- Home

- Microsoft Certifications

- MB6-895 Financial Management in Microsoft Dynamics 365 for Finance and Operations Dumps

Pass Microsoft MB6-895 Exam in First Attempt Guaranteed!

MB6-895 Premium File

- Premium File 71 Questions & Answers. Last Update: Feb 22, 2026

Whats Included:

- Latest Questions

- 100% Accurate Answers

- Fast Exam Updates

Last Week Results!

Files coming soon.

All Microsoft MB6-895 certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the MB6-895 Financial Management in Microsoft Dynamics 365 for Finance and Operations practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

Key Strategies for Passing the MB6-895 Exam

The MB6-895 exam is targeted at professionals who are responsible for implementing, configuring, maintaining, or supporting financial management processes within Dynamics 365 for Finance and Operations. Candidates typically have a moderate understanding of accounting and finance principles and need to understand how these concepts are applied through system functionalities.

The exam is suitable for functional consultants, solution architects, project managers, and other individuals who work with financial processes but may not be advanced finance specialists. It is also relevant for professionals with a background in business software who wish to demonstrate a foundational grasp of financial management features within the system. Understanding the target audience helps candidates focus on the areas of practical application and ensures preparation is aligned with the skills measured by the exam.

Core Financial Module Configuration

A significant portion of the exam assesses the ability to set up and configure core financial modules. Mastery of these modules ensures that business processes function correctly and that data integrity is maintained across the organization. The general ledger module is central to financial operations, and candidates should be able to create charts of accounts, define main accounts, manage fiscal calendars, and configure financial dimensions. They should also understand account structures, set up journals, and define automatic posting parameters. Intercompany accounting knowledge is essential to manage transactions across multiple entities efficiently.

Cash and bank management involves understanding bank accounts, transaction types, bank groups, and check layout configurations. Candidates should be able to manage daily banking operations, set system parameters, and process transactions accurately. Knowledge of reconciliations, voided payments, and deposit processing is necessary for accurate account management.

Accounts receivable and collections management requires an understanding of customer posting profiles, payment processing, and centralized payment structures. Candidates should know how to configure collection letters, interest calculations, aging periods, and customer pools to manage overdue balances efficiently. Daily operational scenarios, including customer invoicing, prepayments, and write-offs, are critical to practice.

Accounts payable management includes vendor posting profiles, invoice matching, payment processing, and centralized vendor management. Candidates should understand how to configure vendor accounts, manage prepayments, and process payment proposals. Knowledge of invoice exceptions, reversals, and accounting impact is vital for ensuring accurate financial reporting.

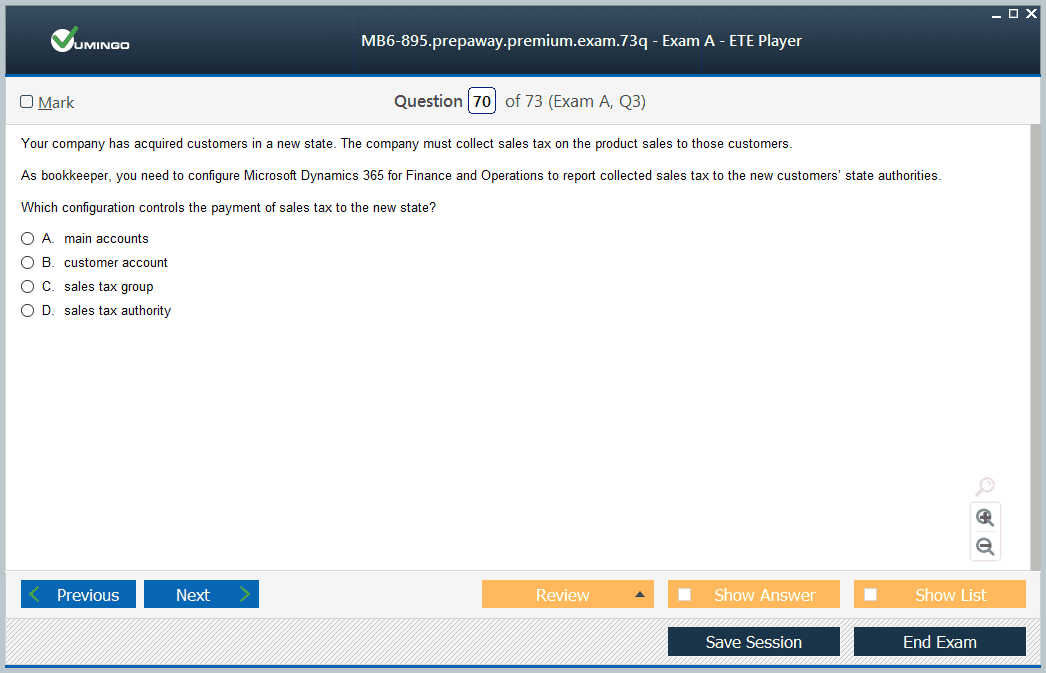

The tax module requires candidates to define ledger posting groups, sales tax codes, item tax groups, and withholding tax setups. Candidates should understand how taxes integrate with other modules, how to apply tax rules in transactions, and how to manage exceptions to maintain compliance and accuracy.

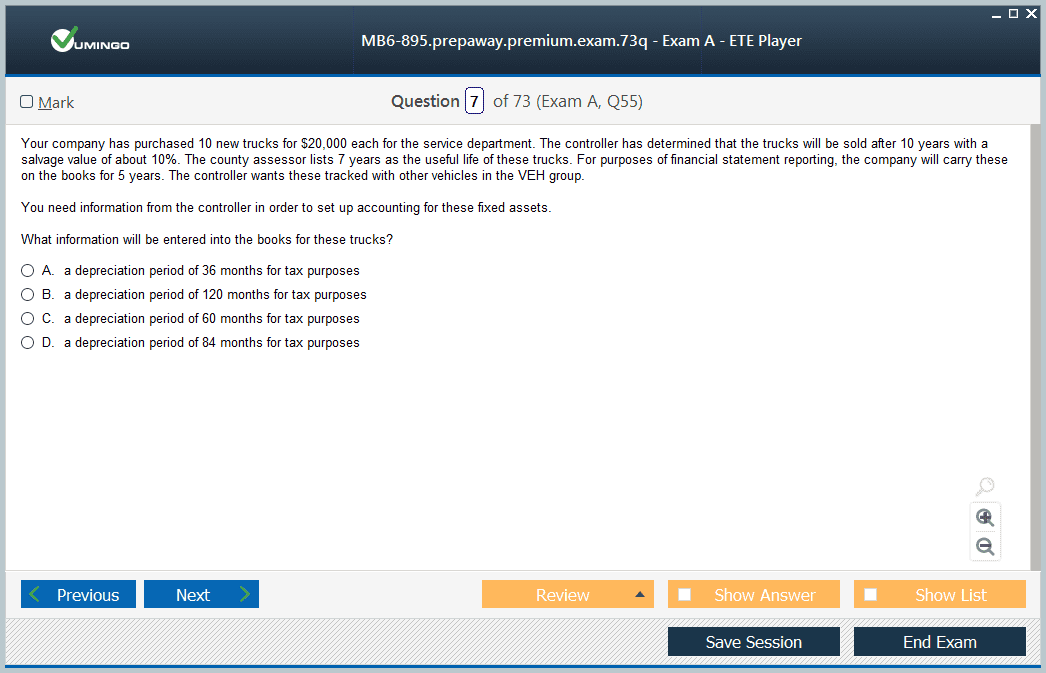

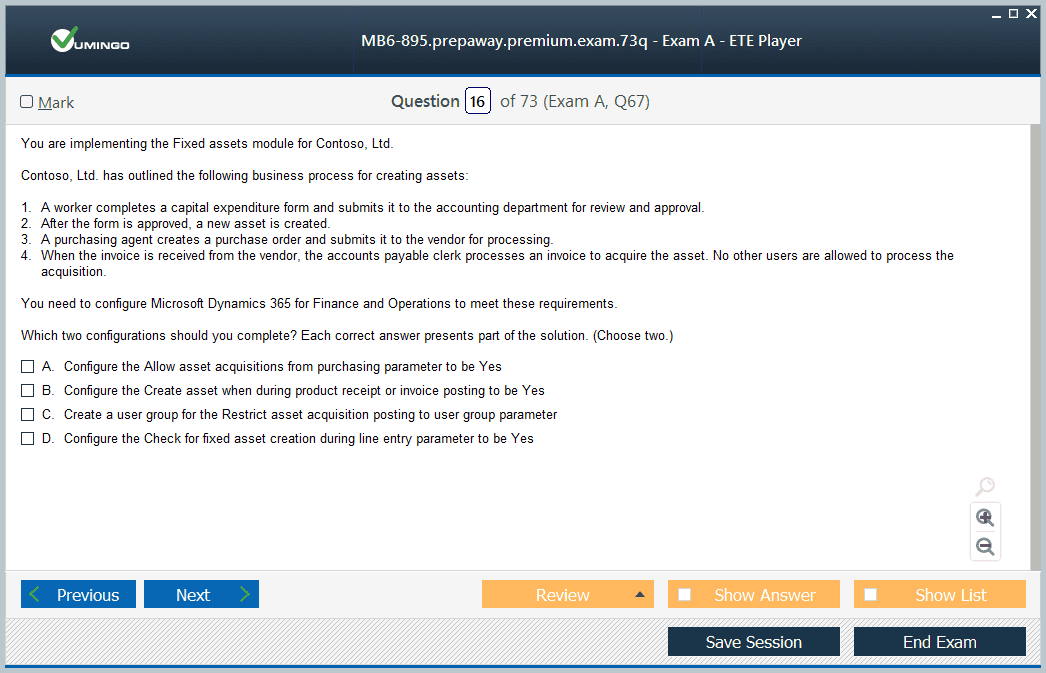

Fixed assets management involves understanding asset lifecycle, depreciation methods, value models, and transaction processing. Candidates should know how to create assets, configure depreciation books, assign barcodes, and manage acquisitions, disposals, and value adjustments. Understanding asset integration with general ledger and budgeting ensures accurate reporting and financial control.

Managing Daily Transactions

Daily transaction management is an essential skill for exam readiness. In the general ledger, candidates must be able to create and post journals, process period allocations, and handle accrual schemes. Skills include reversing transactions, creating reversing entries, and processing intercompany journal entries. Candidates should practice error-handling scenarios and ensure all postings maintain ledger integrity.

Cash and bank management daily tasks include issuing, voiding, and reversing payments, managing deposit slips, and reconciling bank accounts. Hands-on practice ensures that candidates understand both the configuration parameters and the practical steps required for accurate daily operations.

Accounts receivable operations involve creating free text invoices, processing prepayments, managing settlements, and performing customer reimbursements. Candidates should be able to review aged balances, generate account statements, track collection activities, and handle non-sufficient fund scenarios. Daily management requires accurate handling of transaction statuses and application of collection rules.

Accounts payable transactions include invoice journal creation, invoice matching, vendor prepayments, and payment proposal processing. Candidates should understand how to manage recurring payments, handle invoice discrepancies, and ensure that transactions are correctly reflected in the ledger.

Tax transactions require revising sales tax prior to posting, posting taxes on prepayments, and creating conditional tax transactions. Understanding how tax interacts with receivables, payables, and ledger entries is critical for maintaining accurate compliance and reporting.

Fixed asset daily operations involve processing acquisitions, posting depreciations, managing disposals, and performing value adjustments. Candidates should practice acquiring assets from purchase orders, updating asset records, and integrating asset transactions with the general ledger.

Budgeting Configuration and Management

Budgeting knowledge is a major component of the exam. Candidates should understand basic budget concepts, including types of budgets, budget parameters, and configuration options. They must be able to create and modify budget plans, define budget groups, and manage budget control rules. Budget control ensures that transactions adhere to defined limits and supports financial planning.

Budget planning exercises should cover creating budgets for multiple entities, adjusting allocations, and processing budget updates using spreadsheet-based tools. Candidates must understand how budget register entries are created and processed, including transferring balances and updating entries as planning scenarios change. Efficient budget management requires integrating planning, control, and reporting to support financial decision-making.

Periodic and Closing Procedures

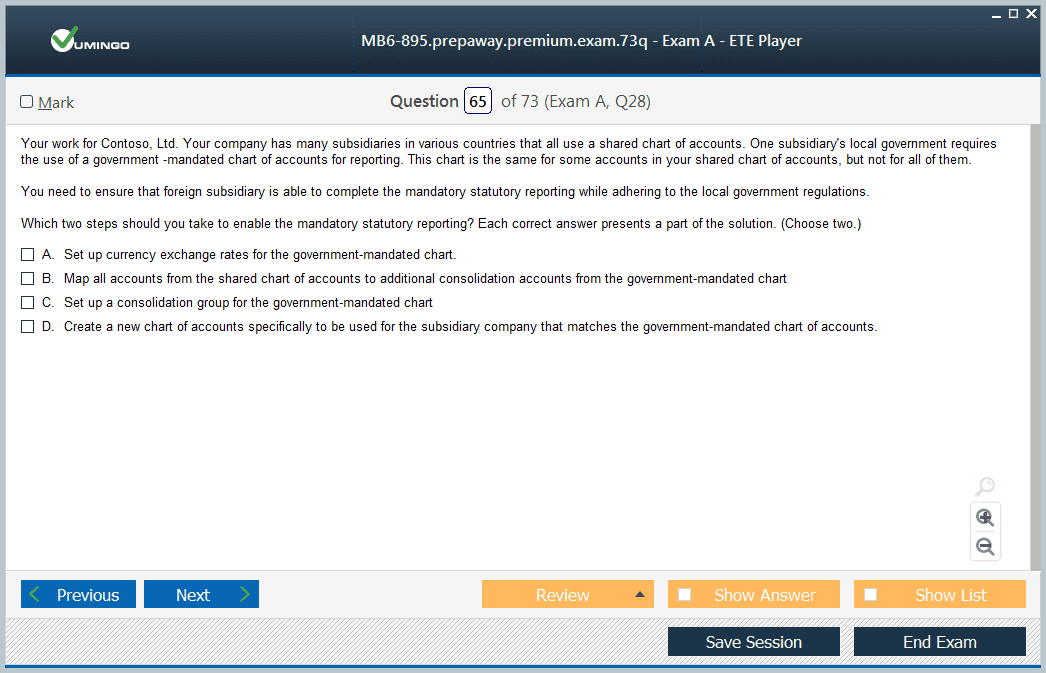

Candidates must be proficient in managing period-end and fiscal year-end processes. Consolidations and eliminations are critical to combine financial data across multiple entities. Candidates should know how to configure consolidation companies, define groups, create elimination rules, and process consolidations efficiently.

Foreign currency revaluations require candidates to define account settings, select revaluation types, and apply currency adjustments to reflect accurate financial positions. Ledger allocations include creating allocation rules, defining allocation bases, and processing allocation requests to ensure accurate distribution of costs and revenues.

The period close workspace provides a structured approach to closing tasks. Candidates should understand how to configure templates, manage closing activities, and use the workspace to streamline the process. Fiscal year-end procedures require setting up parameters, performing year-end close operations, and completing closing sheets. Candidates should practice simulations that integrate multiple modules to ensure readiness for applied exam scenarios.

Interconnected Financial Processes

A key aspect of preparation involves understanding how modules interact within the system. General ledger configurations influence accounts receivable, accounts payable, fixed assets, budgeting, and closing procedures. Candidates must recognize the dependencies between modules to maintain accuracy, consistency, and reliability in financial reporting.

Budgeting, taxation, and currency revaluation processes must be integrated with daily operations to support compliance and financial planning. Candidates should practice scenarios where changes in one module affect other modules, reinforcing the importance of understanding system logic and interconnections.

Practical Workflow Exercises

Scenario-based exercises are crucial for mastering the MB6-895 exam. Candidates should simulate complete financial cycles, including journal creation, bank processing, collections, vendor payments, asset transactions, budgeting, and period-end procedures. Practicing end-to-end workflows ensures familiarity with module interactions, transaction dependencies, and the impact of configuration choices on financial outcomes.

Candidates should also explore exceptional cases, such as high-volume transactions, complex asset acquisitions, multi-step budget adjustments, and currency fluctuations. Handling these scenarios in a controlled practice environment builds confidence, problem-solving skills, and practical understanding of system behavior.

Efficiency and Accuracy in Financial Operations

Efficiency is critical when managing financial operations in Dynamics 365. Candidates must learn to optimize workflows, automate recurring tasks, and maintain accurate records. Time management and prioritization are essential skills, especially when managing multiple journals, payment runs, or reconciliation processes simultaneously.

Scenario-based exercises should focus on completing operations accurately and efficiently while maintaining compliance with internal controls and system configuration rules. Candidates should also practice error detection, corrections, and reconciliation tasks to ensure the integrity of financial records.

Advanced Reporting and Analytics

Candidates should develop the ability to use reporting and analytics tools to monitor financial performance, support decision-making, and evaluate operational effectiveness. This includes generating reports on account balances, transaction details, budget performance, and consolidation outcomes. Visualization of data through dashboards and interactive reports helps in identifying trends, anomalies, and areas for improvement.

Scenario-based exercises should cover monitoring aged accounts receivable, evaluating vendor payments, tracking budget compliance, and analyzing asset performance. Understanding how reporting integrates with workflows, transactions, and system configurations is critical for providing actionable insights and demonstrating proficiency in managing Dynamics 365 financial processes.

Strategic Decision-Making Using System Insights

Candidates should leverage system insights for strategic decision-making. Analyzing financial data allows prioritization of resources, optimization of workflows, and adjustment of operational strategies. Scenario-based exercises can simulate decision-making challenges such as reallocating budgets, addressing overdue collections, or adjusting asset depreciation methods based on performance analytics.

Understanding how to interpret insights, combine data from multiple modules, and apply findings to improve efficiency and compliance ensures candidates can demonstrate both practical skills and strategic thinking during the exam.

Continuous Skill Development

Preparation for the MB6-895 exam is not limited to theory; continuous hands-on practice is essential. Candidates should explore all functional areas repeatedly, focusing on configuration, transaction processing, budget management, and closing operations. Practicing scenario-based exercises, simulating multi-module workflows, and reviewing potential exceptions ensures readiness for exam questions that test applied understanding rather than memorization.

Developing familiarity with the system interface, navigation, and available tools strengthens operational confidence. Candidates who integrate conceptual knowledge with hands-on exercises gain a comprehensive understanding of financial processes, module interactions, and best practices for Dynamics 365 for Finance and Operations.

Budgeting Configuration and Practical Application

Budgeting in Dynamics 365 requires a strong understanding of fundamental concepts, configurations, and controls. Candidates must know how to define budgets, categorize them by type, and configure the system to ensure that budgets align with organizational requirements. This includes creating budget groups, configuring control rules, and enabling transaction checks against budget limits.

Hands-on practice should involve setting up budgets for multiple departments or cost centers, defining allocation rules, and processing budget register entries. Candidates should be able to adjust budgets dynamically, transfer balances between periods, and monitor budget performance against actual financial activity. Understanding how budget plans integrate with journals, transactions, and reporting ensures that candidates can apply knowledge in realistic scenarios.

Budget control exercises should cover enabling budget checks for source documents and journal entries. Candidates should explore scenarios where transactions exceed budget limits, ensuring that they can handle exceptions, approve overrides, and maintain compliance with internal policies. The ability to use system-generated results to guide financial decisions is essential for both exam readiness and real-world application.

Candidates should also practice generating budget plans, processing updates, and reviewing results. Creating multi-year budget plans and simulating reallocations across entities or departments enhances understanding of advanced planning processes. Excel-based adjustments, integration with financial data, and scenario planning are key areas to master for practical application.

Periodic Procedures and Ledger Management

Managing period-end procedures is a critical component of the MB6-895 exam. Candidates should be able to configure and execute period allocations, accruals, and reversals effectively. This includes understanding various allocation bases, processing requests, and ensuring that entries reflect accurately in the general ledger. Candidates should simulate workflows that include recurring allocations, multiple currencies, and complex cost distribution scenarios.

The period close workspace is designed to streamline end-of-period activities. Candidates must understand how to configure templates, assign tasks, and monitor completion. Simulating a complete period close using this workspace allows candidates to see interdependencies between journals, budget adjustments, and financial reporting.

Ledger allocations require candidates to define allocation rules, determine applicable accounts, and execute processing efficiently. Practice exercises should include scenarios where costs are distributed across multiple departments, projects, or business units. Candidates should also explore the impact of allocations on budgeting and reporting to ensure an integrated understanding of system operations.

Foreign currency revaluations are another essential skill. Candidates should know how to define revaluation types, configure accounts, and process adjustments to reflect accurate financial positions. Exercises should include scenarios involving multiple currencies, transaction timing differences, and the impact of revaluations on consolidated financial statements.

Consolidation and Elimination Practices

Consolidations and eliminations ensure that financial data from multiple entities is combined accurately. Candidates must be able to configure consolidation companies, define consolidation groups, and establish elimination rules. Practical exercises should involve processing consolidations, adjusting intercompany transactions, and validating that results are consistent with accounting standards.

Candidates should also practice elimination scenarios, including handling intercompany balances, transferring costs, and adjusting for non-reciprocal transactions. Understanding the sequence of consolidation and elimination processes ensures that candidates can manage both local and consolidated financial statements effectively. Advanced exercises should simulate multi-entity reporting with adjustments, revaluations, and allocations integrated into the workflow.

Managing Fixed Asset Transactions

Candidates must be proficient in handling fixed asset processes within the system. This includes creating assets, configuring depreciation methods, managing value models, and processing acquisitions, disposals, and adjustments. Hands-on exercises should include acquiring assets from purchase orders, recording capital expenditures, and assigning asset identifiers such as barcodes.

Depreciation processing requires understanding methods, conventions, and profiles. Candidates should simulate scenarios involving different asset classes, calculation methods, and reporting periods. Adjustments to asset values, disposals, and transfers between entities should also be practiced to ensure a comprehensive understanding of lifecycle management.

Integration with the general ledger is critical for asset transactions. Candidates should explore how asset postings affect ledger accounts, budgeting, and reporting. Practice scenarios should include multiple assets, complex acquisition methods, and varying depreciation schedules to simulate real-world conditions.

Accounts Receivable and Accounts Payable Advanced Scenarios

Candidates should demonstrate proficiency in processing complex transactions within accounts receivable and accounts payable modules. Accounts receivable exercises should include creating invoices, managing prepayments, tracking collections, and handling write-offs. Candidates should practice reviewing aging reports, processing non-sufficient fund scenarios, and managing customer disputes.

Accounts payable exercises should involve invoice matching, payment proposal creation, prepayment handling, and exception management. Candidates should explore scenarios where multiple vendors, currencies, and payment terms interact to understand the impact on cash flow, ledger accounts, and reporting.

Both modules require understanding integration with budgeting, general ledger, and taxation. Candidates should simulate workflows where errors or exceptions must be resolved while maintaining financial accuracy and compliance. Practice should include reconciliations, reversals, and reporting to reinforce the connection between operational activities and system data.

Tax Management and Compliance

Candidates must be able to configure and manage tax processes in Dynamics 365. This includes setting up ledger posting groups, tax codes, item tax groups, and withholding tax configurations. Candidates should understand how taxes interact with sales and purchase transactions, as well as the impact on general ledger accounts.

Scenario-based exercises should involve posting transactions with multiple tax codes, adjusting tax calculations, and processing conditional taxes. Candidates should practice correcting errors, revising transactions before posting, and ensuring that all tax-related postings comply with system rules. Understanding integration with accounts receivable, accounts payable, and general ledger ensures accuracy and audit readiness.

Integration of Modules and Workflow Dependencies

A deep understanding of module interconnections is critical for exam preparation. Changes in general ledger accounts can impact accounts receivable, accounts payable, fixed assets, and budgeting. Candidates should simulate scenarios where transactions in one module affect multiple others, observing the ripple effect on reporting, reconciliation, and analysis.

Scenario-based exercises should cover end-to-end workflows, including journal postings, bank transactions, asset management, budgeting, period-end closing, and tax calculations. Candidates should practice resolving conflicts, ensuring data consistency, and validating results across modules. Mastery of integration ensures that candidates can apply knowledge holistically rather than as isolated processes.

Advanced Budgeting Exercises

Candidates should focus on multi-step budget management, including creating budget plans for multiple entities, adjusting allocations, and integrating budget updates with general ledger and journal entries. Scenario-based exercises should include reallocating funds across departments, handling over-budget exceptions, and processing budget register entries from updated plans.

Candidates should practice monitoring budget performance against actual expenditures, reviewing budget check results on transactions, and generating reports for management review. Understanding how budgeting interacts with period-end and year-end processes is crucial for comprehensive exam readiness.

Consolidation, Revaluation, and Allocation Workflows

Candidates must understand the end-to-end process for consolidation, foreign currency revaluation, and ledger allocations. Exercises should involve creating consolidation groups, applying elimination rules, processing currency adjustments, and validating results in reports.

Ledger allocation exercises should include distributing costs across departments, projects, or business units, creating allocation rules, and processing requests efficiently. Candidates should practice managing exceptions, reconciling allocations, and verifying the impact on budgeting and reporting.

Foreign currency revaluation exercises should include processing adjustments for multiple currencies, reflecting accurate values in general ledger accounts, and integrating results with consolidation processes. Understanding how these activities affect overall financial reporting is essential for advanced exam scenarios.

Candidates should practice full period-end and year-end closing procedures. This includes using the period close workspace, processing ledger allocations, completing accrual entries, and performing reconciliations. Exercises should involve checking for unposted transactions, verifying balances, and preparing closing sheets.

Year-end closing scenarios should include configuring parameters, running closing processes, and validating financial statements. Candidates should also practice generating reports for management review, analyzing variances, and ensuring that all closing activities maintain system integrity.

Advanced reporting exercises should cover generating dashboards, visualizing trends, and extracting insights from integrated financial data. Candidates should simulate real-world analysis, including budget vs. actual comparisons, aging reports, and consolidated financial statements.

Hands-On Practice and Scenario-Based Learning

For the MB6-895 exam, hands-on practice is crucial to translate theoretical knowledge into practical skills. Candidates should simulate complete financial processes, including general ledger management, bank transactions, accounts receivable and payable, fixed assets, budgeting, and period-end closing. Practicing end-to-end workflows helps candidates understand module interdependencies and develop confidence in applying system configurations to realistic scenarios.

Scenario-based exercises should cover common and complex transactions. For instance, candidates should process high-volume journal entries, reconcile bank accounts with multiple payment types, handle prepayments, and execute partial settlements. This approach ensures familiarity with operational workflows and helps candidates anticipate challenges that may arise during the exam.

Practicing with multiple entities and business units is important to understand intercompany transactions, consolidation, and elimination processes. Candidates should simulate postings across entities, manage currency revaluations, and validate consolidated financial statements. Exercises should include error detection, correction, and reconciliation to ensure accurate and reliable reporting.

Efficiency in Transaction Management

Efficiency is a critical skill for financial management. Candidates should focus on streamlining workflows, reducing manual effort, and ensuring timely completion of financial tasks. Practicing recurring journal entries, automated bank reconciliations, and standardized invoice processing improves operational speed while maintaining accuracy.

Candidates should explore features that support efficiency, such as template journals, batch processing, and integration between modules. For example, automated postings from accounts payable to general ledger or fixed asset acquisitions ensure that data flows seamlessly without manual intervention. Understanding these features allows candidates to demonstrate practical knowledge during the exam.

Monitoring transaction status and managing exceptions efficiently is also vital. Candidates should practice identifying unposted transactions, failed allocations, or over-budget entries and applying corrective actions systematically. Familiarity with workflow approvals, posting errors, and adjustment procedures ensures candidates can maintain accuracy and compliance under realistic conditions.

Exception Handling and Troubleshooting

Exception handling is a significant aspect of exam preparation. Candidates must be able to identify, investigate, and resolve issues that occur during financial operations. This includes resolving discrepancies in accounts receivable and payable, addressing misposted transactions, handling failed allocations, and correcting budget control violations.

Practical exercises should simulate real-world exceptions. For example, candidates can practice resolving issues related to incorrect account allocations, misapplied payments, missing intercompany entries, or inaccurate currency revaluations. They should also explore the impact of exceptions on reports, period-end closing, and consolidated financial statements.

Developing a systematic approach to troubleshooting is essential. Candidates should understand the sequence of module dependencies, identify root causes, apply corrective actions, and validate results. Exercises should also include scenario analysis to ensure that candidates can anticipate potential issues and implement preventive measures.

Strategic Financial Decision-Making

Understanding how to use Dynamics 365 to support strategic decision-making is an advanced skill evaluated indirectly in the MB6-895 exam. Candidates should practice using system insights, reports, and analytics to guide financial decisions. This includes evaluating budget performance, monitoring cash flow, analyzing customer and vendor balances, and assessing fixed asset utilization.

Candidates should practice creating dashboards and visual reports that consolidate data from multiple modules. This allows them to identify trends, detect anomalies, and make informed decisions. Scenario-based exercises can include planning resource allocations, adjusting budgets based on performance, or simulating multi-entity financial planning.

Strategic exercises should also incorporate the evaluation of period-end and year-end outcomes. Candidates should analyze closing results, verify intercompany reconciliations, assess foreign currency impacts, and review consolidated statements. This approach reinforces the connection between operational activities and high-level financial decision-making.

Integration of Financial Modules

A thorough understanding of module interconnections is essential for effective exam preparation. Candidates should simulate workflows that demonstrate the integration between general ledger, accounts receivable, accounts payable, fixed assets, budgeting, and tax management. Understanding these interdependencies ensures accurate reporting and compliance with organizational financial policies.

Exercises should include scenarios where a single transaction impacts multiple modules. For example, an asset acquisition affects fixed assets, general ledger accounts, and budgeting. Vendor payments influence accounts payable, cash balances, and ledger postings. Candidates should practice tracing the impact of such transactions across all relevant modules to develop a holistic understanding.

Advanced Budgeting Practices

Candidates should focus on advanced budgeting scenarios that involve multi-step allocations, adjustments, and integration with transaction processing. Exercises should include creating budget plans for multiple entities or departments, reallocating funds, processing budget register entries, and monitoring results against actual expenditures.

Practical exercises should also simulate exceptions, such as over-budget transactions, budget control rule violations, and adjustments to previously recorded entries. Candidates should practice resolving these issues while maintaining accurate records and ensuring compliance with system controls. Understanding how budgeting interacts with period-end and consolidation processes reinforces readiness for advanced exam scenarios.

Period-End and Year-End Closing Exercises

Comprehensive practice in period-end and year-end procedures is critical. Candidates should simulate all closing activities, including posting accruals, performing ledger allocations, reconciling accounts, and validating balances. Using the period close workspace allows candidates to organize tasks, monitor completion, and ensure a smooth closing process.

Year-end closing exercises should include configuring closing parameters, running the fiscal year-end close, and generating closing sheets. Candidates should also practice reconciling foreign currency adjustments, completing intercompany eliminations, and preparing consolidated statements. Simulating a full closing cycle reinforces understanding of operational dependencies and system workflows.

Reporting and Analytics Proficiency

Candidates should develop proficiency in reporting and analytics to demonstrate operational and strategic understanding. Exercises should include generating detailed financial reports, analyzing customer and vendor activity, evaluating budget compliance, and reviewing asset performance. Candidates should practice creating visual dashboards that consolidate multiple data points for decision-making.

Scenario-based reporting exercises should include comparing actual results to budgeted amounts, identifying variances, and recommending corrective actions. Candidates should practice extracting insights from integrated module data, including general ledger postings, accounts receivable and payable activity, fixed asset transactions, and budget outcomes.

Advanced reporting exercises also involve reviewing consolidated statements, analyzing intercompany transactions, and evaluating the impact of foreign currency adjustments. Candidates should ensure that reports reflect accurate, reconciled data and provide actionable insights for management.

Real-World Workflow Simulations

Practical preparation should emphasize simulating real-world workflows that integrate multiple modules. Exercises should cover end-to-end processes, including journal creation, customer invoicing, vendor payments, asset management, budget planning, period-end closing, and reporting. Candidates should practice scenarios involving multiple entities, complex transactions, and multi-step workflows.

Simulation exercises should also include exception handling, corrective actions, and validation of results. This ensures that candidates are not only familiar with standard procedures but can also respond to operational challenges and maintain accurate financial records. Hands-on simulation reinforces theoretical knowledge and develops confidence in using Dynamics 365 to manage complex financial operations.

Efficiency and Automation in Practice

Candidates should explore efficiency and automation features within Dynamics 365 to improve transaction processing and reduce manual effort. Exercises should include using journal templates, batch processing, recurring entries, and automated posting of transactions across modules. Candidates should understand how automation integrates with general ledger, budgeting, and asset management.

Practical exercises should also emphasize monitoring automated processes, resolving exceptions, and ensuring that automation aligns with organizational policies. Candidates should practice balancing efficiency with accuracy, demonstrating that they can leverage system capabilities while maintaining compliance and data integrity.

Scenario-Based Problem Solving

Candidates should practice problem-solving exercises that simulate complex financial scenarios. Examples include reconciling intercompany transactions with currency fluctuations, managing vendor payments with multiple terms, adjusting budgets mid-period, or handling fixed asset disposals with partial depreciation.

These exercises develop critical thinking, analytical skills, and operational proficiency. Candidates should practice identifying root causes, applying corrections, and validating outcomes across all relevant modules. Scenario-based problem solving ensures readiness for exam questions that require applied knowledge rather than memorized steps.

Continuous Review and Knowledge Reinforcement

Exam readiness requires continuous review and reinforcement of financial management concepts. Candidates should revisit module configurations, daily transaction procedures, budgeting processes, period-end and year-end operations, and reporting practices regularly.

Practical review should include hands-on exercises, simulations, scenario analysis, and reporting practice. Candidates should also assess their understanding of module interactions, transaction dependencies, and the impact of configuration choices on financial outcomes. Consistent review ensures that knowledge is retained, workflows are internalized, and candidates are prepared for applied exam scenarios.

Integration of Technical and Functional Skills

The MB6-895 exam evaluates both technical configuration skills and functional understanding of financial processes. Candidates should practice configuring system parameters, defining accounts, and setting up modules while also applying functional knowledge to manage transactions, budgets, and reporting.

Scenario exercises should integrate technical setup with functional workflows. For example, configuring a depreciation profile and then processing asset acquisitions demonstrates both understanding of system capabilities and practical application. Similarly, defining budget control rules and applying them in transactions illustrates how configuration supports operational management.

Consolidation and Multi-Entity Management

Understanding consolidation processes is crucial for candidates preparing for the MB6-895 exam. Candidates must know how to configure consolidation companies, define consolidation groups, and establish rules for eliminations. This ensures that financial data from multiple entities is combined accurately and reflects a true view of organizational performance.

Practice exercises should include simulating multi-entity scenarios, where transactions in one entity impact consolidation results. Candidates should create elimination entries for intercompany balances, handle adjustments for intra-group transactions, and validate consolidated financial statements. Scenario-based learning reinforces understanding of how consolidation rules interact with ledger postings, allocations, and reporting outcomes.

Candidates should also explore configuring consolidation schedules, including periodic updates, adjustments, and final reporting. Understanding the sequence of steps in consolidation ensures that data integrity is maintained across entities and that results are compliant with accounting standards.

Intercompany Transaction Management

Intercompany transactions are an essential component of the exam. Candidates should understand how to define intercompany relationships, create intercompany journal entries, and process reconciliations between entities. Exercises should include both standard and complex scenarios, such as cross-entity asset transfers, intercompany invoices, and multi-currency transactions.

Candidates should practice resolving discrepancies in intercompany balances, including missing postings, duplicate entries, and currency conversion differences. Understanding the impact of these transactions on general ledger accounts, budgeting, and reporting is critical. Scenario exercises should also simulate error handling and corrective actions to prepare for practical exam questions.

Advanced Fixed Asset Management

Candidates must demonstrate a deep understanding of fixed asset lifecycle management. This includes acquiring assets, setting up depreciation methods, adjusting asset values, transferring assets between entities, and managing disposals. Practice exercises should involve complex acquisition scenarios, such as assets purchased through multiple vendors or funded by various cost centers.

Depreciation exercises should include processing scheduled depreciation, handling mid-period adjustments, and analyzing depreciation impact on financial statements. Candidates should also practice adjusting asset values due to revaluation, impairment, or partial disposals. Integrating fixed asset transactions with general ledger postings and budget allocations ensures a comprehensive understanding of financial operations.

Integrated Budgeting and Control

Advanced budgeting exercises are crucial for exam readiness. Candidates should simulate creating multi-level budgets, adjusting allocations across departments, and processing budget register entries from updated plans. Practical exercises should also include over-budget scenarios, budget control violations, and approval workflows to reinforce system understanding.

Candidates should practice monitoring budget compliance in real time, analyzing budget vs. actual performance, and using insights to support decision-making. Exercises should include linking budget checks to journal entries, transaction postings, and automated alerts to demonstrate practical application of system controls. Understanding the integration between budgeting and other financial modules ensures accuracy and consistency across operations.

Tax Configuration and Compliance Scenarios

Candidates must be able to configure and manage tax processes across multiple modules. This includes setting up sales tax codes, item tax groups, withholding tax rules, and posting groups. Scenario exercises should involve processing transactions with multiple tax rates, adjusting tax calculations, and handling conditional tax situations.

Candidates should also practice reconciling tax reports, correcting tax posting errors, and analyzing the impact of tax adjustments on general ledger balances. Understanding integration with accounts receivable, accounts payable, and consolidated reporting ensures that tax compliance is maintained throughout the organization.

Period-End and Year-End Advanced Workflows

Mastery of period-end and year-end procedures is essential. Candidates should simulate completing all closing activities, including accruals, allocations, intercompany reconciliations, and adjustments for multi-entity operations. Using the period close workspace, candidates should practice task assignment, monitoring completion, and validating results.

Year-end closing exercises should include preparing closing sheets, executing fiscal year-end close, and handling foreign currency revaluations. Candidates should also explore scenarios involving multi-entity consolidations, elimination adjustments, and final reporting. These exercises reinforce understanding of module interdependencies, process sequence, and accurate financial reporting.

Integrated Reporting and Analysis

Candidates should focus on advanced reporting techniques to demonstrate both operational and strategic proficiency. Exercises should include generating consolidated financial statements, intercompany reports, budget performance dashboards, and variance analyses. Candidates should practice combining data from multiple modules to create comprehensive insights.

Scenario-based reporting exercises should involve comparing actual results to budgets, analyzing trends across entities, and evaluating the impact of currency adjustments. Candidates should also practice identifying anomalies, generating visual dashboards, and interpreting results to support decision-making. Integrated reporting ensures a holistic understanding of financial performance.

Audit Readiness and Compliance Practices

Candidates should prepare for audit-related scenarios by practicing transaction review, reconciliation, and documentation. Exercises should include tracing journal entries, verifying account balances, and ensuring that all postings comply with configured controls. Candidates should simulate internal audit procedures, including cross-checking intercompany transactions, verifying consolidation entries, and reviewing budget adherence.

Understanding how to maintain audit trails, manage exception reporting, and validate corrections is crucial for both exam readiness and real-world financial management. Candidates should practice generating reports and documentation that demonstrate accuracy, transparency, and compliance with organizational standards.

Exception Management and Troubleshooting

Advanced exception management is essential for exam success. Candidates should practice identifying, analyzing, and correcting errors across all financial modules. Scenarios may include misposted intercompany transactions, incorrect budget allocations, foreign currency discrepancies, and fixed asset adjustments.

Candidates should develop systematic troubleshooting approaches, including verifying system configurations, analyzing transaction flows, and validating corrective actions. Scenario exercises should reinforce the impact of corrections on multiple modules, ensuring that candidates can manage complex operational challenges efficiently and accurately.

Strategic Scenario Planning

Candidates should develop skills in strategic scenario planning using system data. Exercises should include evaluating budget adjustments, forecasting cash flow, simulating intercompany transactions, and assessing the impact of asset acquisitions or disposals. Scenario planning helps candidates connect operational activities with broader organizational objectives.

Candidates should practice creating reports, visual dashboards, and integrated summaries to support strategic decisions. Exercises should also include evaluating alternative scenarios, analyzing outcomes, and implementing adjustments based on insights. Mastery of scenario planning demonstrates both applied knowledge and strategic thinking, which are crucial for practical exam success.

Multi-Module Workflow Simulations

Effective preparation involves simulating multi-module workflows that integrate all core financial operations. Candidates should practice end-to-end processes, including journal creation, cash management, accounts receivable and payable, fixed assets, budgeting, period-end closing, and consolidated reporting.

Simulation exercises should include complex multi-entity operations, currency revaluations, intercompany eliminations, and exception handling. Candidates should practice verifying results across modules, ensuring data consistency, and validating the impact of transactions on financial statements. Comprehensive workflow simulations reinforce understanding of system functionality and exam readiness.

Leveraging Automation for Efficiency

Candidates should explore automation features to enhance efficiency and reduce manual effort. Exercises should include using batch processing for journals, automated payment runs, recurring entries, and integration between modules. Candidates should also practice monitoring automated workflows, resolving exceptions, and validating results.

Understanding how automation integrates with general ledger, budgeting, and asset management ensures that candidates can manage complex operations efficiently while maintaining accuracy and compliance. Scenario exercises should include both standard processes and exceptional conditions to demonstrate practical application of system capabilities.

Integrated Hands-On and Conceptual Review

Candidates should combine hands-on exercises with conceptual review to reinforce understanding. Reviewing module configurations, transaction procedures, budgeting principles, period-end and year-end operations, and reporting processes ensures that knowledge is internalized.

Practical exercises should include scenario simulations, exception management, workflow validation, and integrated reporting. Conceptual review should focus on the rationale behind configurations, interdependencies between modules, and the impact of operational decisions on financial outcomes. This dual approach ensures comprehensive exam preparation.

Preparing for Applied Exam Scenarios

The MB6-895 exam emphasizes applied understanding rather than memorization. Candidates should practice scenarios that simulate real-world financial operations, including multi-entity management, intercompany transactions, asset management, budget control, period-end and year-end closing, and reporting.

Exercises should involve identifying issues, applying corrections, validating results, and analyzing outcomes across multiple modules. Scenario-based practice ensures candidates are prepared to tackle exam questions that test both functional and technical knowledge in integrated workflows.

Continuous Skill Enhancement

Ongoing practice and review are key to exam success. Candidates should revisit system configurations, transaction management procedures, budgeting, period-end workflows, and reporting practices regularly. Practical exercises, scenario simulations, and integrated workflows should be repeated to reinforce skills.

Candidates should focus on improving efficiency, accuracy, problem-solving abilities, and strategic decision-making. Continuous skill enhancement ensures readiness for applied scenarios in the exam and demonstrates mastery of Dynamics 365 financial management processes.

Final Exam Preparation Strategy

Preparing for the MB6-895 exam requires a structured approach that balances theoretical knowledge with practical application. Candidates should start by reviewing all core financial modules, including general ledger, accounts receivable, accounts payable, cash and bank management, fixed assets, budgeting, taxation, consolidation, and period-end closing processes. A comprehensive understanding of how these modules integrate ensures readiness for scenario-based exam questions.

Candidates should organize study time by allocating focused sessions for each module. Reviewing module configurations, daily procedures, transaction workflows, and reporting capabilities helps reinforce key concepts. Hands-on practice should be integrated into each session, allowing candidates to apply configurations to real-world scenarios and understand the impact on overall financial management.

Advanced Scenario Simulations

Scenario simulations are critical for mastering the MB6-895 exam content. Candidates should design scenarios that reflect complex operational workflows, including multi-entity operations, intercompany transactions, foreign currency revaluations, and asset lifecycle management. These simulations should also include error handling, corrective actions, and reconciliation processes.

For example, a scenario could involve processing intercompany sales, posting related entries to the general ledger, managing budget implications, and generating consolidated reports. Candidates should practice tracing the flow of transactions across modules, analyzing the impact of adjustments, and validating results. Scenario simulations reinforce integrated thinking and help candidates prepare for applied questions in the exam.

Efficiency in Financial Operations

Candidates should focus on improving efficiency within financial processes. Understanding features such as batch processing, recurring journals, automated allocations, and integration between modules is essential. Exercises should involve automating repetitive tasks, monitoring workflows, and resolving exceptions effectively.

Practical exercises should also include evaluating system-generated alerts, managing approvals, and verifying transaction accuracy. Efficiency-focused practice ensures candidates can demonstrate both operational proficiency and strategic decision-making during the exam.

Budgeting and Control Optimization

Advanced budgeting exercises are important for final preparation. Candidates should simulate creating, adjusting, and monitoring budgets across multiple departments or entities. Exercises should include handling over-budget exceptions, budget control violations, and realigning allocations to meet organizational goals.

Candidates should practice linking budget checks to journals and transactions, generating reports for management review, and analyzing budget versus actual performance. Understanding the interaction between budgeting, period-end closing, and consolidated reporting ensures candidates can apply their knowledge effectively under exam conditions.

Intercompany and Multi-Currency Management

Managing intercompany transactions and multi-currency scenarios is essential for exam success. Candidates should practice defining intercompany relationships, processing journal entries, and reconciling intercompany balances. Exercises should include scenarios with foreign currency revaluations, adjustments for exchange rate differences, and validation of consolidated results.

Candidates should also simulate error resolution for intercompany discrepancies, such as missing or duplicate entries, misaligned balances, or incorrect allocations. Understanding the impact of these transactions on budgeting, reporting, and compliance ensures that candidates can address complex real-world financial situations confidently.

Fixed Asset Lifecycle Management

Advanced fixed asset exercises should include acquiring assets, setting depreciation methods, performing mid-period adjustments, transferring assets, and processing disposals. Candidates should simulate scenarios involving multiple asset classes, complex acquisition sources, and integration with general ledger and budget accounts.

Depreciation processing should include scheduled depreciation, adjustments due to revaluation or impairment, and reporting of asset performance. Candidates should also practice reconciling fixed asset transactions with general ledger accounts and budget allocations to ensure consistency and accuracy.

Tax Management and Compliance

Candidates should focus on complex tax scenarios, including multi-rate taxes, item tax groups, withholding taxes, and conditional tax rules. Exercises should include posting transactions with multiple tax codes, adjusting calculations, and reconciling tax reports. Candidates should also simulate error handling, such as correcting misapplied taxes or revising transactions before posting.

Integration of tax processes with accounts receivable, accounts payable, and general ledger postings should be practiced extensively. Candidates should understand how tax adjustments affect consolidated reporting and ensure that all postings comply with organizational and regulatory requirements.

Period-End and Year-End Procedures

Mastery of period-end and year-end procedures is a key component of exam readiness. Candidates should simulate completing all closing activities, including accruals, allocations, reconciliations, and adjustments for multi-entity operations. Using the period close workspace, candidates should practice assigning tasks, monitoring completion, and validating results.

Year-end closing exercises should include preparing closing sheets, executing fiscal year-end close, handling foreign currency adjustments, and validating consolidated statements. Practicing these procedures ensures candidates can manage complex operational workflows and demonstrate proficiency in exam scenarios.

Integrated Reporting and Analysis

Candidates should develop skills in integrated reporting and financial analysis. Exercises should include generating consolidated statements, intercompany reports, budget performance dashboards, and variance analyses. Candidates should practice consolidating data from multiple modules to create comprehensive insights.

Scenario-based reporting exercises should include comparing actual results to budgets, analyzing trends across entities, and evaluating the impact of currency adjustments. Candidates should also simulate anomaly detection, generating visual dashboards, and interpreting results to support strategic decision-making.

Exception Handling and Troubleshooting

Candidates should practice advanced exception handling across all financial modules. Exercises should include identifying, analyzing, and resolving errors in journal postings, intercompany transactions, budgets, asset transactions, and tax postings. Candidates should develop systematic approaches to troubleshoot, validate corrective actions, and reconcile results across modules.

Scenario-based exercises should reinforce problem-solving skills, including managing recurring issues, validating adjustments, and understanding the interdependencies of module workflows. Effective exception handling demonstrates operational proficiency and ensures candidates are prepared for applied exam questions.

Strategic Financial Scenario Planning

Strategic scenario planning involves using system data to evaluate financial decisions, assess risks, and plan for organizational goals. Candidates should practice forecasting cash flow, simulating budget adjustments, managing intercompany transactions, and assessing the impact of fixed asset acquisitions or disposals.

Exercises should include creating reports, dashboards, and integrated summaries to support strategic decisions. Candidates should simulate alternative scenarios, analyze outcomes, and implement corrective measures. Scenario planning ensures candidates can apply system knowledge to real-world financial challenges and complex exam questions.

Multi-Module Workflow Integration

Candidates should practice simulating integrated workflows across multiple modules. Exercises should include journal creation, cash management, accounts receivable and payable, fixed assets, budgeting, period-end closing, intercompany transactions, and consolidated reporting.

Simulation exercises should involve complex multi-entity scenarios, currency revaluations, elimination adjustments, and exception management. Candidates should validate results across modules, ensuring data consistency and accuracy. Comprehensive workflow simulations reinforce understanding of system functionality and exam readiness.

Efficiency and Automation Techniques

Candidates should explore automation features to optimize efficiency and reduce manual effort. Exercises should include batch processing, recurring journals, automated payment runs, and system integrations. Candidates should monitor automated processes, resolve exceptions, and verify results for accuracy and compliance.

Practical exercises should balance efficiency with control, ensuring that automated processes maintain data integrity and adhere to organizational policies. Candidates should practice applying automation in multi-module scenarios to demonstrate operational proficiency.

Integrated Review and Knowledge Reinforcement

Continuous review and practical application are essential for exam success. Candidates should revisit module configurations, transaction workflows, budgeting, period-end and year-end processes, intercompany management, and reporting capabilities regularly.

Hands-on practice should include scenario simulations, exception management, workflow validation, and integrated reporting. Conceptual review should focus on module interdependencies, system configuration rationale, and the impact of operational decisions on financial outcomes. Reinforcing knowledge through practice ensures exam readiness and operational confidence.

Final Exam Simulation and Practice

Candidates should conduct full-scale exam simulations to consolidate preparation. Simulations should include multi-module transactions, intercompany postings, foreign currency adjustments, budget planning, asset management, period-end closing, and reporting exercises.

Candidates should practice solving applied scenarios under time constraints, validating results, managing exceptions, and producing integrated reports. Simulated exams help candidates identify gaps, improve efficiency, and build confidence in navigating complex system workflows.

Applied Knowledge Assessment

Candidates should assess their readiness by reviewing their ability to apply knowledge in integrated, scenario-based situations. Exercises should cover configuration setup, transaction processing, budgeting, asset management, period-end procedures, consolidation, reporting, and exception handling.

Assessment should focus on accuracy, workflow efficiency, troubleshooting skills, and strategic decision-making. Candidates should ensure that they can handle applied scenarios that reflect real-world operational challenges and exam expectations.

Continuous Improvement and Skill Refinement

Final preparation involves continuous improvement through targeted practice and skill refinement. Candidates should identify areas of weakness, revisit complex scenarios, and practice advanced workflows to ensure proficiency. Exercises should include integrated transaction simulations, reporting validation, and exception management across modules.

Candidates should also practice optimizing efficiency, applying automation, and validating outcomes for accuracy. Continuous skill refinement ensures comprehensive readiness for the MB6-895 exam and the ability to apply knowledge effectively in real-world financial operations.

Advanced Transaction Workflows

Candidates should focus on mastering advanced transaction workflows that integrate multiple financial modules. Exercises should include processing complex journal entries that affect general ledger, budgeting, accounts receivable, and accounts payable simultaneously. Practicing interdependent workflows ensures candidates understand the ripple effects of transactions across modules.

Simulations should cover scenarios such as multi-department expense allocations, intercompany sales postings, and cross-module adjustments. Candidates should verify each step of the transaction lifecycle, including validation, posting, exception handling, and reporting. This prepares them for exam scenarios that test applied knowledge rather than rote memorization.

Integrated Budget Planning and Execution

Effective budgeting exercises are critical for exam readiness. Candidates should practice creating comprehensive budgets for multiple departments or entities, processing adjustments, and monitoring budget adherence in real time. Exercises should also include handling budget exceptions and applying corrective measures.

Candidates should simulate transactions that interact with budgets, such as journal entries, vendor payments, and revenue postings, and then assess their impact on budget balances. This approach reinforces the understanding of budgeting as an operational tool and ensures candidates are ready to apply these skills in the exam.

Intercompany Transaction Challenges

Handling intercompany transactions requires precision and a deep understanding of system dependencies. Candidates should simulate posting transactions between entities, including invoices, payments, and intercompany journal entries. Exercises should cover reconciliation of intercompany balances, adjustments for discrepancies, and validation of consolidated reporting.

Candidates should also practice handling currency conversion, ensuring correct application of exchange rates, and resolving differences between entities. Scenario-based exercises prepare candidates for exam questions that involve multi-entity financial management and intercompany operations.

Fixed Asset Advanced Management

Candidates should master the complete lifecycle of fixed assets, including acquisition, depreciation, transfer, revaluation, impairment, and disposal. Exercises should cover multiple asset classes, complex acquisition scenarios, and integration with general ledger and budgeting modules.

Depreciation exercises should simulate adjustments mid-period, valuation changes, and impact on financial statements. Candidates should practice reconciliation of asset postings with ledger accounts and budget allocations. Scenario exercises should also include cross-entity asset transfers and evaluating asset performance in reports.

Tax Configuration and Real-World Application

Candidates should focus on advanced tax configuration and compliance exercises. Simulated scenarios should involve complex sales tax, item tax groups, withholding taxes, and conditional tax rules. Candidates should practice posting transactions with multiple tax codes, adjusting tax amounts, and reconciling reports to ensure compliance.

Exercises should also include resolving misapplied tax postings, adjusting prior-period transactions, and analyzing the impact of tax changes on consolidated financial statements. Integration exercises should demonstrate the effect of tax adjustments across accounts receivable, accounts payable, and general ledger.

Period-End Process Mastery

Mastering period-end workflows is essential for exam success. Candidates should simulate completing all required closing activities, including accrual postings, intercompany reconciliations, ledger allocations, and budget review. Exercises should include using the period close workspace to organize tasks, monitor progress, and validate results.

Candidates should practice error detection and resolution, handling unposted transactions, and ensuring that period-end reports accurately reflect organizational financial status. Scenario exercises should also include validating data consistency across modules and confirming compliance with accounting policies.

Year-End Closing and Consolidation Exercises

Candidates should practice comprehensive year-end closing procedures, including fiscal year-end adjustments, foreign currency revaluations, and consolidated reporting. Exercises should simulate adjustments for multiple entities, elimination of intercompany balances, and preparation of closing sheets.

Candidates should also practice reconciling subsidiary and parent entity data, validating ledger accounts, and generating consolidated statements. These exercises reinforce understanding of multi-entity operations, intercompany transactions, and end-of-year reporting requirements.

Reporting and Financial Analysis Skills

Candidates should develop advanced reporting and financial analysis skills. Exercises should include generating consolidated statements, budget variance reports, intercompany reconciliations, and operational dashboards. Candidates should practice analyzing trends, identifying anomalies, and generating actionable insights.

Scenario-based exercises should integrate multiple modules, combining data from general ledger, accounts receivable, accounts payable, fixed assets, budgeting, and intercompany transactions. Candidates should also practice visualizing financial results through charts and dashboards to support strategic decision-making.

Exception Handling and Problem Resolution

Advanced exception management is critical for both exam success and real-world financial management. Candidates should practice identifying errors in transactions, budgets, intercompany postings, and fixed assets. Exercises should include investigating discrepancies, applying corrective actions, and validating results across multiple modules.

Candidates should develop systematic troubleshooting approaches, including tracing the flow of transactions, checking system configurations, and confirming compliance with financial policies. Scenario exercises should focus on resolving recurring issues, validating corrections, and ensuring data integrity.

Automation and Process Optimization

Candidates should practice using automation tools to optimize workflows and reduce manual effort. Exercises should include batch processing of journals, automated payment runs, recurring entries, and integration between modules. Candidates should monitor automated processes, resolve exceptions, and verify that results meet accuracy standards.

Simulation exercises should also cover the impact of automation on budgeting, intercompany transactions, fixed asset management, and reporting. Candidates should practice balancing efficiency with control, ensuring automated processes comply with organizational policies.

Strategic Scenario Planning and Forecasting

Candidates should practice using system data for strategic planning and financial forecasting. Exercises should include evaluating cash flow, projecting budgets, simulating multi-entity operations, and assessing the financial impact of asset acquisitions or disposals. Candidates should also practice preparing integrated reports to support decision-making.

Scenario exercises should include comparing alternative strategies, analyzing results, and implementing adjustments based on forecasted outcomes. Practicing scenario planning enhances applied knowledge and prepares candidates to answer complex exam questions effectively.

Multi-Module Integration Exercises

Candidates should focus on integrating multiple modules in simulated workflows. Exercises should include end-to-end processes involving general ledger, accounts receivable, accounts payable, cash management, fixed assets, budgeting, intercompany transactions, and reporting. Candidates should validate results, manage exceptions, and ensure data consistency.

Simulation exercises should cover complex scenarios, such as multi-entity operations, currency adjustments, budget reallocations, and period-end closing activities. Integrated workflow practice reinforces the interconnected nature of modules and develops practical proficiency.

Continuous Knowledge Review

Ongoing review and reinforcement are essential for exam readiness. Candidates should revisit system configurations, daily transaction workflows, budgeting processes, period-end and year-end procedures, intercompany transactions, and reporting capabilities.

Review exercises should include scenario simulations, troubleshooting exercises, workflow validation, and integrated reporting. Candidates should assess understanding of module interdependencies, system configuration rationale, and the operational impact of financial decisions. Continuous review ensures comprehensive readiness for the exam.

Applied Exam Simulation

Candidates should conduct full-scale exam simulations to consolidate preparation. Simulations should include multi-module workflows, complex intercompany transactions, currency adjustments, budget planning, asset management, period-end and year-end closing, and reporting exercises.

Candidates should practice solving applied scenarios under time constraints, validating results, managing exceptions, and generating integrated reports. Simulated exams help candidates identify knowledge gaps, improve workflow efficiency, and build confidence for the actual exam.

Assessment of Applied Knowledge

Candidates should evaluate their readiness by testing the ability to apply knowledge across integrated scenarios. Exercises should cover configuration setup, transaction processing, budgeting, fixed assets, intercompany transactions, period-end procedures, consolidation, reporting, and exception management.

Assessment should focus on accuracy, operational efficiency, problem-solving skills, and strategic decision-making. Candidates should practice applying knowledge in real-world scenarios to ensure readiness for applied questions in the exam.

Continuous Skill Refinement

Final preparation requires continuous refinement of skills through targeted practice. Candidates should identify weak areas, revisit complex workflows, and practice advanced scenarios to reinforce proficiency. Exercises should include integrated transaction simulations, exception handling, reporting validation, and workflow optimization.

Candidates should focus on efficiency, automation, and accuracy, ensuring that every step of financial operations is understood and can be executed correctly. Continuous skill refinement solidifies knowledge, prepares candidates for complex exam scenarios, and ensures practical proficiency in Dynamics 365 financial management processes.

Comprehensive Review and Integration

Candidates should conclude preparation with a comprehensive review of all modules and their interconnections. Exercises should integrate general ledger, accounts receivable, accounts payable, budgeting, cash management, fixed assets, intercompany transactions, period-end and year-end closing, consolidation, and reporting.

Review should emphasize understanding the operational impact of configurations, identifying dependencies, validating integrated workflows, and ensuring data accuracy across all financial operations. Comprehensive review reinforces knowledge retention, operational confidence, and exam readiness.

Confidence Building and Exam Mindset

Candidates should practice exam-like scenarios to build confidence in applying skills under time constraints. Exercises should include multi-step transaction processing, exception handling, consolidated reporting, and strategic financial planning. Practicing in an exam mindset ensures candidates can think critically, solve problems efficiently, and apply knowledge accurately during the actual MB6-895 exam.

Simulation exercises should replicate exam conditions, including time pressure, integrated workflows, and applied problem-solving. Candidates should practice pacing themselves, prioritizing tasks, and verifying results to develop a systematic approach to handling complex exam questions.

Final Practical Integration

Candidates should finalize preparation by combining all aspects of practical exercises, scenario simulations, automation techniques, exception handling, and reporting practice. Exercises should simulate real-world workflows that encompass all financial modules, including multi-entity and intercompany operations.

Candidates should validate every step, analyze results, and ensure consistency across modules. Integrated practice consolidates knowledge, enhances operational proficiency, and prepares candidates to handle complex applied questions confidently in the exam.

Mastery of Multi-Entity Operations

Mastery of multi-entity operations is essential for exam success. Candidates should practice end-to-end processes that involve transactions across multiple entities, including intercompany postings, currency revaluations, consolidation, and reporting. Exercises should ensure accuracy, data consistency, and compliance with organizational financial rules.

Scenario exercises should also include multi-step reconciliations, intercompany adjustments, and review of consolidated financial statements. Mastery of these workflows demonstrates practical proficiency and ensures readiness for applied exam questions.

Monitoring and Validation of Transactions

Candidates should focus on continuous monitoring and validation of transactions across all financial modules. Exercises should include tracking journal entries, reconciling accounts, and verifying that transactions comply with financial policies. Candidates should simulate error detection and resolution, ensuring that adjustments are properly applied and results are consistent across modules.

Monitoring exercises should also include analyzing cash flow impacts, assessing budget implications, and validating intercompany postings. Candidates should practice reviewing transaction histories, confirming approval workflows, and ensuring that automated processes are functioning as expected.

Intercompany Reconciliation and Adjustments

Intercompany reconciliation is a critical aspect of financial management. Candidates should practice reviewing intercompany balances, identifying discrepancies, and applying corrective adjustments. Exercises should cover multi-step reconciliation processes, including adjusting journal entries, updating intercompany accounts, and validating consolidation reports.

Candidates should also simulate handling complex scenarios such as cross-entity payments, currency conversions, and elimination entries. These exercises reinforce understanding of multi-entity operations and prepare candidates for applied questions in the exam.

Advanced Budget Management

Candidates should practice advanced budget management techniques, including scenario planning, reallocation of funds, and monitoring budget compliance across departments or entities. Exercises should simulate over-budget alerts, budget control checks, and adjustments to allocations. Candidates should practice using reports to track budget performance and apply corrective measures to maintain alignment with organizational goals.

Advanced exercises should also include integrating budget management with accounts payable, accounts receivable, and general ledger workflows. Candidates should assess the impact of financial transactions on budget balances and simulate real-world decision-making scenarios.

Fixed Asset Strategic Management

Candidates should practice strategic management of fixed assets, including acquisition planning, depreciation scheduling, impairment handling, and disposal processing. Exercises should cover multiple asset classes, complex acquisition sources, and integration with budgeting and general ledger.

Candidates should simulate mid-period adjustments, asset transfers, and valuation changes. Exercises should include reconciling asset postings with ledger accounts, monitoring depreciation schedules, and evaluating asset performance for reporting. This ensures candidates understand the full lifecycle and financial impact of fixed assets.

Tax Scenario Simulations

Candidates should practice advanced tax scenarios that test understanding of complex tax configurations. Exercises should include posting transactions with multiple tax codes, applying withholding taxes, and reconciling tax reports. Candidates should simulate correcting misapplied tax entries, adjusting prior-period transactions, and analyzing tax impacts on consolidated statements.

Simulation exercises should also integrate tax with accounts receivable, accounts payable, and general ledger workflows. Candidates should validate the effect of tax adjustments on financial reports, ensuring compliance and accuracy across all transactions.

Period-End Closing Excellence

Period-end closing exercises should cover all module interactions, including journal postings, allocations, reconciliations, and budget validation. Candidates should practice using the period close workspace to monitor tasks, validate transaction completion, and detect errors.

Exercises should simulate complex period-end scenarios, including unposted journals, intercompany discrepancies, and adjustments to fixed assets and budgets. Candidates should also practice reconciling general ledger accounts and validating reports before closing periods to ensure accuracy.

Year-End Closing Mastery

Candidates should practice comprehensive year-end closing procedures, including fiscal year-end adjustments, intercompany eliminations, foreign currency revaluations, and consolidated reporting. Exercises should include preparation of closing sheets, validation of ledger balances, and reconciliation of subsidiary and parent entities.

Simulation exercises should also cover adjustments for asset revaluations, budget carryovers, and tax reconciliations. Candidates should ensure that all entries are accurately posted and consolidated, reinforcing applied understanding of multi-entity year-end processes.

Consolidation and Reporting Accuracy

Candidates should practice advanced consolidation exercises, including preparation of consolidated financial statements, intercompany eliminations, and variance analysis. Exercises should integrate data from multiple modules, including general ledger, budgeting, accounts receivable, accounts payable, and fixed assets.

Candidates should simulate scenarios requiring analysis of discrepancies, adjustments for intercompany transactions, and validation of final reports. Exercises should include preparation of executive summaries, dashboard views, and detailed reports to demonstrate applied knowledge and reporting proficiency.

Workflow Integration Challenges

Candidates should focus on integrated workflow exercises that span multiple financial modules. Exercises should include end-to-end transaction processing, intercompany postings, budget adjustments, asset management, and reporting. Candidates should validate each step of the workflow, ensuring accuracy and consistency across all modules.