- Home

- Microsoft Certifications

- MB-310 Microsoft Dynamics 365 Finance Functional Consultant Dumps

Pass Microsoft Dynamics 365 MB-310 Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

MB-310 Premium Bundle

- Premium File 425 Questions & Answers. Last update: Jan 20, 2026

- Training Course 25 Video Lectures

Last Week Results!

Includes question types found on the actual exam such as drag and drop, simulation, type-in and fill-in-the-blank.

Based on real-life scenarios similar to those encountered in the exam, allowing you to learn by working with real equipment.

All Microsoft Dynamics 365 MB-310 certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the MB-310 Microsoft Dynamics 365 Finance Functional Consultant practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

The Hidden Advantage of Practice Tests for Microsoft MB-310

The MB-310 exam is designed to evaluate the knowledge and skills required to effectively manage financial processes using Dynamics 365 Finance. It emphasizes the practical application of financial concepts, ensuring candidates can configure, operate, and monitor key financial functions. The exam covers multiple areas including general ledger management, accounts receivable, accounts payable, budgeting, fixed assets, and collections. Success in this exam demonstrates the ability to manage financial operations in an integrated enterprise environment and to make informed decisions based on accurate financial data.

Candidates are expected to understand not only how to navigate the system but also how financial processes interact across various modules. This includes the impact of accounting entries, transaction flows, and reporting outcomes. A strong foundation in finance principles combined with practical exposure to Dynamics 365 Finance features is essential for performing well.

Structure and Format

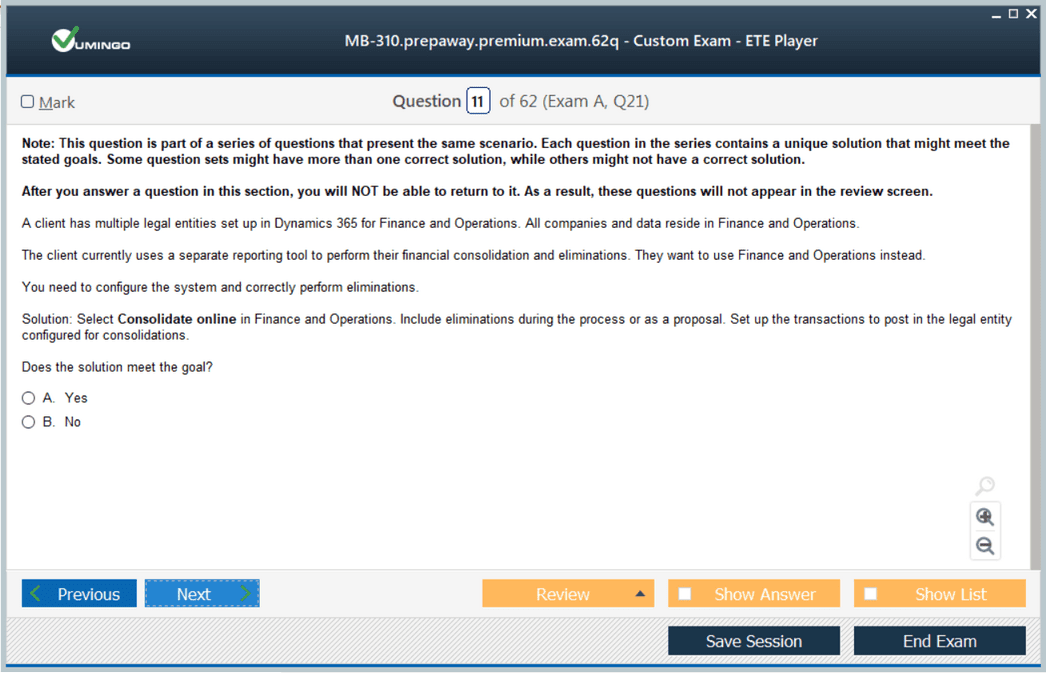

The exam generally includes between 40 to 60 questions, with a variety of question types such as multiple-choice, scenario-based, and case studies. Each question evaluates a candidate's understanding of both theoretical knowledge and practical application. The exam has a set duration, requiring candidates to manage their time efficiently while addressing complex financial scenarios. The scoring is structured to assess comprehensive knowledge across all topic areas, with candidates needing to demonstrate competency in each domain to achieve a passing result.

Understanding the format of the exam is critical for preparation. Candidates must familiarize themselves with the question types, practice interpreting case studies, and apply their knowledge to simulated scenarios. This approach helps in building confidence and reduces the likelihood of misinterpreting questions during the actual assessment.

Core Competencies Required

Candidates are expected to have an in-depth understanding of financial operations within Dynamics 365 Finance. Key areas include general ledger management, where understanding the setup of charts of accounts, journal entries, and financial reporting is essential. Knowledge of accounts receivable involves managing invoices, payments, collections, and customer credit. Accounts payable requires managing vendor invoices, payment processing, and expense reporting.

Budgeting is another critical area, requiring candidates to understand budget creation, control, and analysis processes. Fixed assets management involves asset acquisition, depreciation, revaluation, and disposal, requiring both theoretical knowledge and practical application within the system. Understanding how these modules interact ensures accurate reporting and decision-making, which is vital for finance professionals.

Financial Management and Reporting

A significant portion of the exam focuses on implementing financial management and reporting capabilities within Dynamics 365 Finance. Candidates must understand how to configure financial parameters, set up ledgers, and define fiscal calendars. They should be able to generate accurate financial statements, perform reconciliations, and analyze financial performance using built-in reporting tools.

Understanding financial reporting tools involves interpreting data from multiple modules, recognizing the impact of transactions on financial statements, and using system features to customize reports for management needs. Candidates must demonstrate the ability to provide actionable insights based on the financial data available, ensuring that organizations can make informed strategic decisions.

Accounts Receivable and Collections

Managing accounts receivable is a core component of financial operations. Candidates must be proficient in invoice processing, customer credit management, payment application, and monitoring overdue accounts. The exam assesses the ability to configure and execute automated collection processes, ensuring that outstanding payments are managed efficiently.

Understanding subscription billing and recurring transactions is also part of this area. Candidates should know how to set up periodic billing schedules, apply adjustments, and reconcile accounts. Proficiency in these tasks ensures that organizations maintain healthy cash flows and minimize risk associated with delayed payments.

Accounts Payable and Expense Management

Accounts payable management involves handling vendor invoices, processing payments, and maintaining accurate records of liabilities. Candidates should understand workflows for invoice approvals, vendor settlements, and expense reimbursements. Effective accounts payable management reduces errors, ensures compliance with company policies, and maintains strong supplier relationships.

Expense management includes tracking employee expenses, applying policies for reimbursement, and integrating expense data with general ledger entries. Candidates must demonstrate the ability to configure expense categories, approval workflows, and reporting mechanisms to provide visibility into organizational spending.

Budgeting Processes

Budgeting is a critical aspect of financial management, requiring candidates to understand planning, monitoring, and controlling organizational resources. The exam evaluates the ability to set up budget models, define control thresholds, and analyze variances between actual and planned performance.

Candidates should be capable of creating budgets for departments, projects, or cost centers and adjusting allocations based on financial performance. This ensures that resources are utilized effectively and that financial goals are aligned with organizational objectives. Proficiency in budgeting also supports decision-making by providing insight into potential financial risks and opportunities.

Fixed Assets Management

Managing fixed assets involves the entire lifecycle of assets, from acquisition to disposal. Candidates must understand how to record acquisitions, calculate depreciation, perform revaluations, and process asset disposals. The exam assesses knowledge of configuring asset types, defining depreciation methods, and ensuring compliance with accounting standards.

Practical knowledge of fixed asset management is essential for maintaining accurate financial records, optimizing asset utilization, and reporting asset values correctly. Candidates should also be able to analyze asset performance, plan for replacements or upgrades, and integrate asset management with overall financial operations.

Practical Experience and Application

Hands-on experience is essential for mastering the concepts tested in the exam. Candidates benefit from working with Dynamics 365 Finance in real-world scenarios, applying financial processes, and troubleshooting common issues. Practical exercises help reinforce theoretical knowledge and improve confidence in using system features efficiently.

Simulating business processes, such as invoicing, payment processing, budgeting cycles, and asset management, enables candidates to see how transactions flow through the system. This understanding helps in anticipating the effects of decisions on overall financial reporting and operational outcomes.

Preparation Strategy

A well-structured preparation strategy enhances the likelihood of success. Candidates should begin by reviewing all relevant topics and ensuring a clear understanding of financial processes within Dynamics 365 Finance. Breaking down study sessions into manageable segments focused on each module allows for systematic learning.

Integrating practice scenarios and case studies into preparation provides practical context. Regularly assessing performance using practice exercises helps identify areas requiring additional focus. Consistent review of processes and workflows ensures that knowledge is retained and can be applied effectively during the exam.

Time Management and Exam Readiness

Managing time during the exam is critical. Candidates must practice answering questions efficiently while maintaining accuracy. Understanding how to approach different question types, particularly scenario-based and case study questions, helps optimize performance.

Time management also involves prioritizing questions based on complexity, ensuring that sufficient attention is given to higher-weighted topics. Familiarity with the exam interface and question navigation reduces stress and allows candidates to focus on applying their knowledge accurately.

Integration of Modules

A key component of the exam is understanding how financial modules interact within Dynamics 365 Finance. Transactions in one module, such as accounts payable or receivable, can affect general ledger balances, budgeting, and reporting. Candidates must comprehend these interactions to ensure accurate financial management.

Integration knowledge includes recognizing how journal entries propagate through the system, how automated workflows affect balances, and how reporting tools aggregate data from multiple sources. This holistic understanding is essential for accurate decision-making and financial analysis.

Analyzing Financial Data

Candidates are expected to demonstrate the ability to analyze financial data effectively. This includes evaluating reports, identifying discrepancies, monitoring cash flows, and assessing organizational performance. Understanding key financial ratios, variance analysis, and trend assessment supports informed decision-making.

Proficiency in data analysis also involves using Dynamics 365 Finance tools to extract insights from large volumes of transaction data. Candidates should be able to generate customized reports, interpret results, and make recommendations based on findings. This capability is essential for roles that require strategic financial planning and management.

Maintaining Compliance and Controls

Financial management within an organization requires adherence to policies, regulations, and internal controls. Candidates must understand how to implement approval workflows, control mechanisms, and audit processes to maintain compliance.

This includes configuring system settings to enforce financial policies, monitoring transactions for anomalies, and ensuring that all entries are accurately recorded. Understanding internal control processes also supports risk management and ensures the integrity of financial information.

Continuous Learning and Skill Development

Preparing for the exam is not limited to memorizing processes; it also involves developing critical thinking and problem-solving skills. Candidates should cultivate the ability to analyze financial situations, evaluate alternatives, and implement solutions using Dynamics 365 Finance functionalities.

Continuous practice and exposure to different scenarios enhance adaptability and confidence. Candidates who develop a strong conceptual understanding along with practical skills are better equipped to handle the complexities presented in the exam.

Benefits of Exam Mastery

Achieving success in the exam signifies proficiency in managing financial processes using Dynamics 365 Finance. This mastery enables professionals to execute daily tasks efficiently, contribute to financial planning and decision-making, and ensure accurate reporting.

Understanding integrated financial workflows enhances the ability to monitor performance, optimize resources, and implement improvements across financial operations. This competency is valuable not only for exam purposes but also for effective performance in finance-focused roles.

Long-Term Professional Impact

The skills and knowledge gained while preparing for the exam extend beyond the assessment itself. Candidates develop expertise in financial management systems, analytical capabilities, and process optimization. This foundation supports career growth in roles requiring finance system proficiency, strategic planning, and operational management.

Developing practical experience in managing accounts, budgets, and assets prepares professionals for challenges encountered in daily financial operations. The ability to navigate complex workflows and apply system knowledge ensures effective management of organizational finances.

Practice and Assessment

Engaging in simulated exercises and practice assessments is a critical component of preparation. Candidates can evaluate their understanding of concepts, timing, and exam readiness. Regular practice identifies areas requiring reinforcement, allowing focused study efforts.

Practice exercises also help in familiarizing candidates with common scenarios, ensuring that they can approach similar situations confidently during the exam. Repeated exposure to questions and processes strengthens recall and builds a systematic approach to financial problem-solving.

Consolidating Knowledge

A comprehensive preparation approach includes reviewing all modules, practicing scenario-based exercises, analyzing case studies, and consolidating knowledge across financial processes. Candidates should integrate theoretical understanding with practical application, ensuring that they can handle both conceptual and operational questions effectively.

Holistic preparation ensures that all topics, from accounts management to budgeting and asset control, are covered in sufficient depth. Candidates who adopt this approach can approach the exam with confidence and demonstrate proficiency in managing financial operations.

Building Confidence

Confidence in handling exam questions comes from consistent preparation, practical experience, and familiarity with system features. Candidates should simulate exam conditions, time themselves on practice exercises, and develop strategies for efficiently answering questions.

Building confidence also involves understanding the logical flow of financial processes and being able to anticipate outcomes of transactions. This preparation minimizes errors and allows candidates to approach each question analytically, applying knowledge rather than relying on memorization.

Integrating Practical Skills

Effective exam preparation integrates practical skills with theoretical knowledge. Candidates should be able to perform tasks such as processing invoices, managing budgets, handling payments, and configuring system settings. Practical competence ensures that candidates can apply their learning in real-world scenarios, reinforcing understanding and enhancing exam performance.

Hands-on experience also supports problem-solving abilities, allowing candidates to navigate unexpected situations, troubleshoot errors, and implement solutions efficiently. This integration of skills reflects the real-world application of financial management knowledge.

Strategic Preparation Approach

A strategic approach to preparation involves planning study sessions, prioritizing high-weighted topics, and continuously evaluating progress. Candidates should allocate sufficient time for each module, focusing on areas that require improvement while reinforcing strengths.

Strategic preparation also includes leveraging practice exercises to simulate exam conditions, refining time management, and developing a systematic approach to answering questions. This ensures a balanced preparation that addresses all aspects of the exam comprehensively.

Understanding System Features

Candidates should become proficient in using Dynamics 365 Finance features to complete financial tasks accurately. This includes navigating menus, understanding module interactions, configuring financial settings, and generating reports. Familiarity with system features reduces errors, enhances efficiency, and supports better decision-making.

Understanding system functionality also involves recognizing how automated processes work, how workflows can be customized, and how data integrity is maintained across modules. Mastery of these features is essential for both the exam and practical financial management roles.

Reviewing and Reinforcing Knowledge

Regular review sessions help reinforce learning and solidify understanding of financial processes. Candidates should revisit key topics, analyze case studies, and perform practical exercises repeatedly to ensure retention.

Reinforcement of knowledge also involves connecting theoretical principles with practical applications, ensuring that concepts are not only understood but can be executed effectively. This holistic approach increases readiness for the exam and strengthens long-term retention of skills.

Applying Analytical Thinking

Analytical thinking is essential for managing financial operations and for success in the exam. Candidates should practice evaluating financial data, identifying discrepancies, and interpreting results accurately.

Applying analytical thinking also involves assessing the implications of transactions, understanding cause-and-effect relationships in workflows, and making informed decisions based on available data. This capability ensures that candidates can handle complex scenarios effectively.

Mastery Through Consistent Practice

Consistent practice is a key factor in mastering financial processes and preparing for the exam. Candidates should integrate practical exercises, scenario simulations, and repeated reviews into their study plan.

This consistency develops familiarity with financial operations, builds confidence in applying knowledge, and reduces uncertainty during the exam. Mastery is achieved when candidates can handle all aspects of financial management with accuracy and efficiency.

Evaluating Readiness

Periodic evaluation of readiness allows candidates to identify knowledge gaps and adjust their preparation accordingly. Practice exercises, timed simulations, and scenario-based assessments help in gauging proficiency levels.

Evaluating readiness also supports targeted study efforts, ensuring that time and resources are focused on areas that require improvement. This approach increases efficiency and enhances the likelihood of success on the exam.

Continuous Improvement

Preparation for the exam should emphasize continuous improvement. Candidates should refine workflows, enhance system knowledge, and practice problem-solving consistently.

Continuous improvement also involves reflecting on errors, analyzing why mistakes occur, and implementing strategies to avoid them in the future. This iterative process ensures steady progress and a thorough understanding of all financial processes.

Professional Application

The knowledge and skills acquired through preparation are directly applicable in professional settings. Candidates can apply their understanding of financial processes, system functionality, and reporting to manage organizational finances effectively.

Professional application also includes optimizing processes, implementing best practices, and supporting decision-making with accurate financial data. The combination of theoretical knowledge and practical competence enhances performance in finance-focused roles.

Advanced Financial Management Concepts

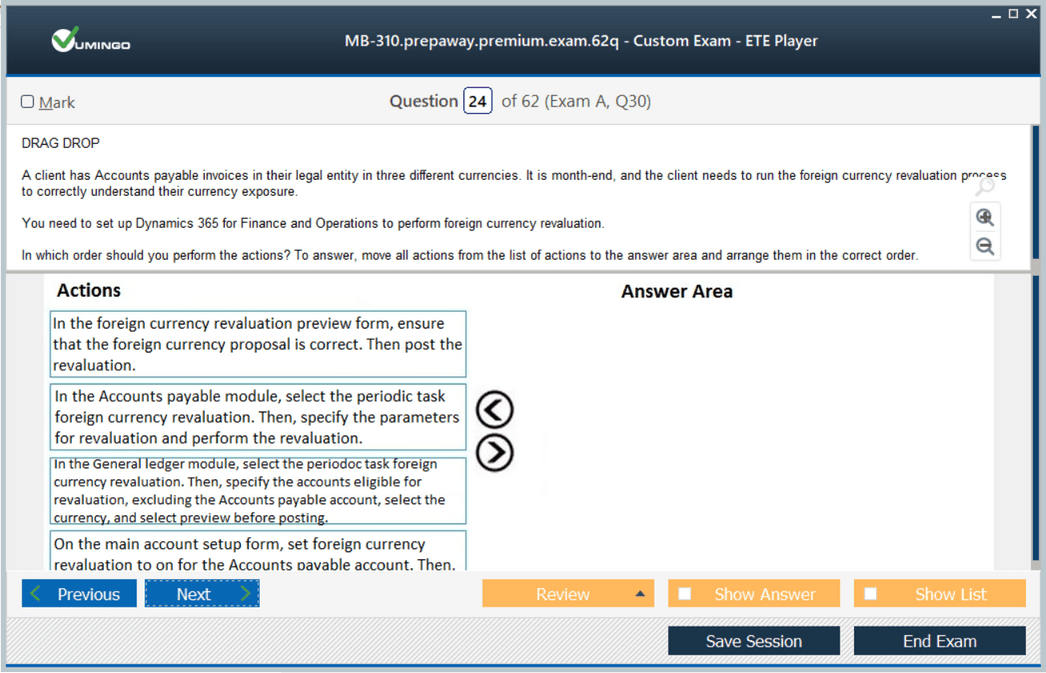

Candidates should be familiar with advanced financial management concepts, such as managing intercompany transactions, handling multi-currency operations, and integrating financial data across departments.

Understanding these advanced concepts ensures accurate reporting, efficient processing, and comprehensive oversight of financial operations. Mastery of such topics supports higher-level decision-making and strategic planning within an organization.

Preparing for Complex Scenarios

The exam often presents complex financial scenarios that require integrated knowledge of multiple modules. Candidates must analyze situations, evaluate alternatives, and apply system features effectively to reach accurate conclusions.

Preparing for complex scenarios involves practicing case studies, understanding process interdependencies, and developing problem-solving strategies. This preparation equips candidates to handle unexpected challenges confidently and efficiently.

Building a Strong Foundation

A strong foundation in financial principles, accounting standards, and system functionalities is crucial for success. Candidates should focus on understanding the underlying concepts that govern financial operations, ensuring that their knowledge is both deep and practical.

This foundation enables candidates to adapt to various situations, apply logical reasoning, and maintain accuracy across all tasks. Strong foundational knowledge supports both exam performance and professional competence.

Optimizing Workflow Efficiency

Candidates should develop the ability to optimize financial workflows within Dynamics 365 Finance. This includes automating repetitive tasks, configuring approvals efficiently, and ensuring smooth transaction flows.

Optimized workflows reduce errors, save time, and enhance reporting accuracy. Candidates who can implement efficient processes demonstrate practical mastery of financial management, which is essential for both the exam and real-world applications.

Monitoring Performance and Reporting

Monitoring performance and generating accurate reports is a central aspect of financial management. Candidates should be able to track key performance indicators, analyze variances, and provide insights to support organizational goals.

Effective monitoring requires integrating data from multiple modules, understanding transaction impacts, and interpreting financial results accurately. Mastery of reporting tools ensures that candidates can provide actionable intelligence to support decision-making.

Integrating Knowledge Across Modules

Success in the exam requires integrating knowledge across multiple financial modules. Candidates should understand how general ledger, accounts receivable, accounts payable, budgeting, and fixed assets interact.

Integration knowledge enables candidates to manage end-to-end processes, identify discrepancies, and ensure accurate financial reporting. This holistic understanding is critical for both exam success and practical application in finance roles.

Enhancing Decision-Making Skills

The ability to make informed decisions is central to financial management. Candidates should practice evaluating options, understanding financial impacts, and applying system features to support optimal outcomes.

Decision-making skills involve analyzing data, predicting results, and implementing solutions that align with organizational objectives. Developing these skills enhances performance on complex exam scenarios and in professional responsibilities.

Leveraging System Capabilities

Candidates should be proficient in leveraging the capabilities of Dynamics 365 Finance to support efficient financial management. This includes configuring settings, generating reports, and automating processes to improve accuracy and efficiency.

Effective use of system capabilities reduces manual errors, streamlines operations, and supports strategic decision-making. Candidates who can utilize these features effectively demonstrate both technical competence and practical expertise.

Continuous Review and Application

Ongoing review and application of knowledge ensure long-term retention and exam readiness. Candidates should integrate regular practice, scenario exercises, and workflow simulations into their study plan.

This continuous approach reinforces learning, builds confidence, and ensures that knowledge can be applied effectively during the exam. Consistent practice also prepares candidates for handling complex financial scenarios accurately.

Preparing for Exam Challenges

Candidates should anticipate challenges such as complex scenarios, interdependent modules, and multi-step processes. Preparation involves practicing these challenges repeatedly and developing strategies to approach them systematically.

Handling exam challenges effectively requires a combination of theoretical understanding, practical experience, and analytical skills. Candidates who prepare strategically are better equipped to navigate difficult questions and achieve high performance.

Applying Knowledge Practically

Practical application is essential for mastering financial processes. Candidates should practice executing tasks such as processing transactions, reconciling accounts, managing budgets, and analyzing performance within the system.

Applying knowledge practically reinforces learning, improves accuracy, and develops problem-solving abilities. Candidates who integrate practice with theory are better prepared to tackle exam scenarios and professional responsibilities effectively.

Reinforcing Analytical Skills

Analytical skills are crucial for interpreting financial data and solving complex problems. Candidates should practice analyzing reports, identifying anomalies, and evaluating the impact of transactions on financial outcomes.

Reinforcing analytical skills enhances decision-making, supports accurate reporting, and ensures that candidates can approach complex exam questions with confidence. Strong analytical capabilities are a key factor in both exam success and professional effectiveness.

Mastering Transaction Flows

Understanding transaction flows across financial modules is essential. Candidates should know how entries in accounts payable, accounts receivable, and other modules impact the general ledger and reporting outcomes.

Mastery of transaction flows ensures accuracy in reporting, effective process management, and the ability to troubleshoot issues efficiently. Candidates who grasp these flows can navigate complex scenarios confidently and demonstrate comprehensive knowledge.

Strategic Review and Practice

A strategic review plan involves revisiting key topics, simulating exam conditions, and practicing complex scenarios. Candidates should prioritize areas of weakness while reinforcing strengths to ensure balanced preparation.

Strategic review and practice improve time management, accuracy, and confidence. This methodical approach allows candidates to handle the breadth of topics in the exam effectively and apply their knowledge in professional contexts.

Advanced Financial Operations

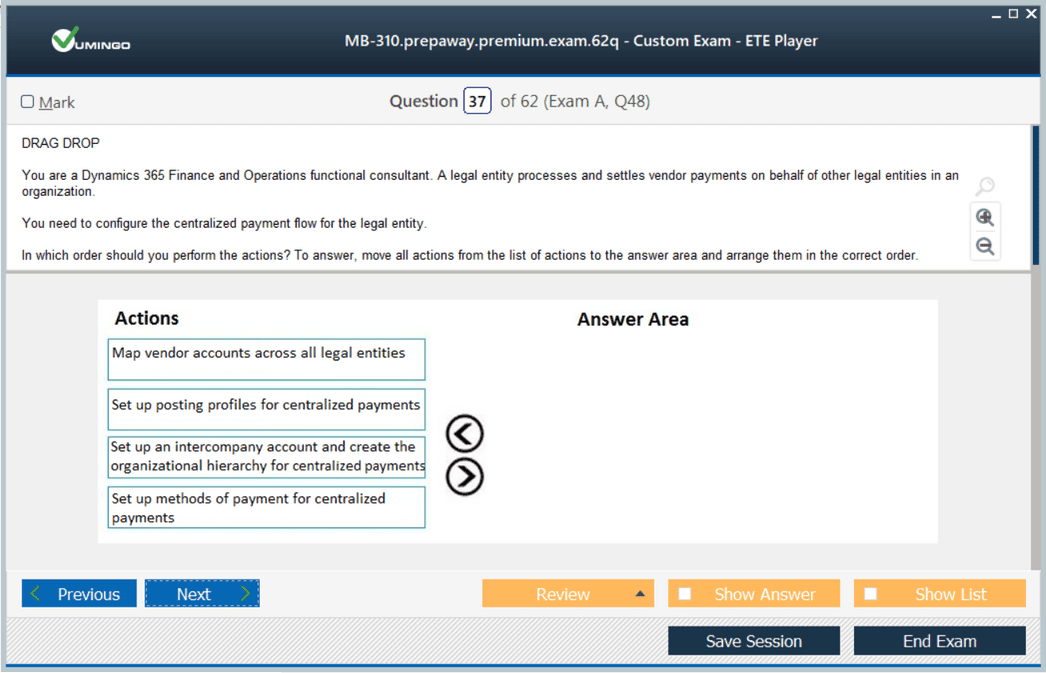

Candidates preparing for the MB-310 exam are expected to have a strong grasp of advanced financial operations within Dynamics 365 Finance. This includes handling intercompany accounting, managing currency conversions, and configuring multi-dimensional financial structures. Understanding these advanced operations enables candidates to ensure accuracy in reporting across multiple departments and operational units. Knowledge of intercompany transactions, including eliminations and reconciliations, is critical for organizations that operate complex financial models.

Advanced financial operations also encompass scenario planning, where candidates analyze the potential impact of financial decisions before execution. This requires both system proficiency and the ability to interpret financial data to make strategic choices. Candidates should be comfortable simulating different financial outcomes and evaluating risks associated with each scenario.

Configuration and System Setup

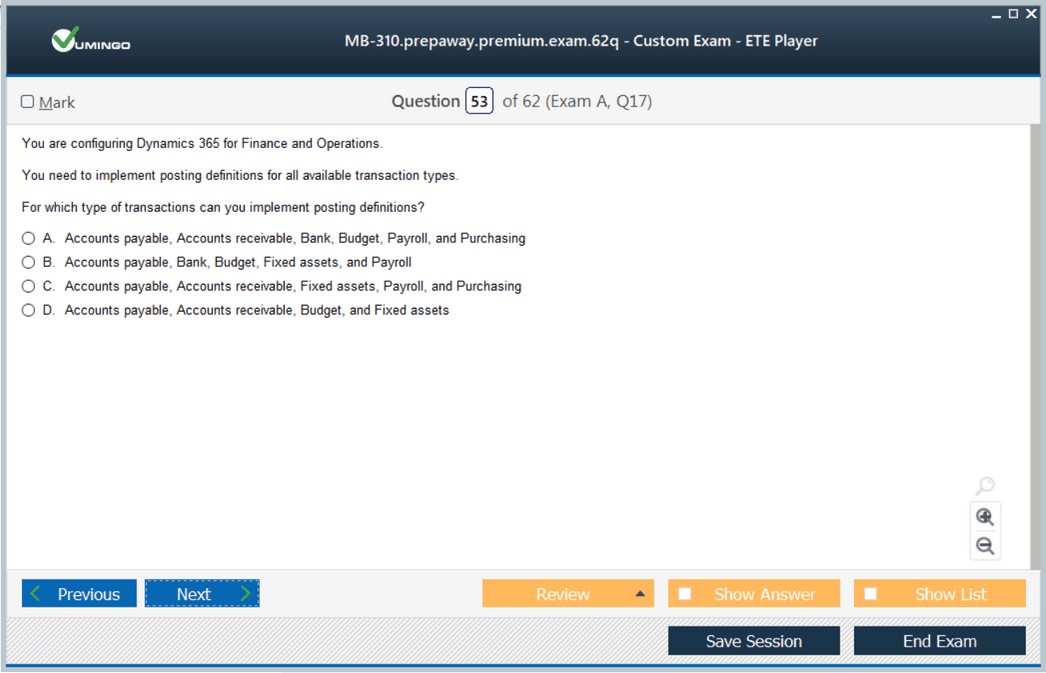

A key element of the MB-310 exam is the ability to configure Dynamics 365 Finance modules effectively. Candidates should understand how to set up the chart of accounts, fiscal calendars, and ledger structures. Proper configuration ensures that financial processes are aligned with organizational requirements and reporting standards.

System setup extends to defining parameters for accounts receivable, accounts payable, fixed assets, and budgeting modules. Candidates must ensure workflows are correctly configured to automate processes while maintaining accuracy. Understanding system options for approvals, notifications, and transaction posting is essential for managing efficient operations.

Financial Data Management

Effective financial data management is a crucial skill for exam candidates. This includes ensuring data integrity, consistency, and accuracy across modules. Candidates should be familiar with validating entries, reconciling accounts, and correcting discrepancies to maintain reliable financial records.

Data management also involves monitoring transaction flows to prevent errors, duplications, or misclassifications. Candidates should be able to audit data effectively, ensuring that financial reporting reflects the actual state of operations. Proficiency in managing financial data supports accurate decision-making and improves confidence in system-generated reports.

Reporting and Analysis

The MB-310 exam emphasizes the ability to generate and analyze financial reports. Candidates should understand how to create standard and customized reports, interpret results, and identify trends or anomalies. Proficiency in using financial reporting tools allows candidates to provide actionable insights and support strategic decision-making.

Analysis skills include performing variance analysis between budgeted and actual figures, monitoring cash flow, and evaluating the performance of departments or projects. Candidates must be able to consolidate information from multiple modules to provide a comprehensive view of the organization’s financial health.

Internal Controls and Compliance

Candidates should demonstrate knowledge of internal controls and compliance measures within Dynamics 365 Finance. This includes configuring approval workflows, monitoring transactions, and maintaining audit trails. Effective internal controls reduce the risk of errors and ensure adherence to organizational policies and financial regulations.

Compliance knowledge also involves understanding how system configurations support legal and regulatory requirements. Candidates should be able to implement control mechanisms to monitor sensitive transactions, prevent unauthorized actions, and maintain accountability across financial operations.

Budget Control and Forecasting

Budget control is a significant area for MB-310 exam candidates. They must understand how to set up budgets, enforce spending limits, and monitor budget adherence throughout operational cycles. Forecasting skills allow candidates to predict future financial performance based on historical data and current trends.

Candidates should be able to create detailed financial models that support resource allocation and planning. This involves adjusting budgets in response to operational changes, ensuring that financial resources are used efficiently, and identifying potential risks to financial stability.

Cash and Treasury Management

Understanding cash and treasury management is another vital aspect of exam preparation. Candidates need to know how to manage cash flow, monitor liquidity, and optimize the use of funds. Proficiency in cash management ensures that organizations can meet obligations, plan investments, and respond to financial challenges effectively.

Treasury management also includes handling bank accounts, performing reconciliations, and managing payment schedules. Candidates should be familiar with automating cash flow processes to reduce manual effort and increase accuracy in reporting.

Accounts Receivable Strategies

Beyond basic accounts receivable management, the exam assesses candidates on advanced collection strategies. This includes managing overdue accounts, establishing credit policies, and applying automated collection routines. Candidates should be able to evaluate customer creditworthiness and implement procedures that reduce risk and improve cash flow.

Candidates are expected to analyze receivable trends and implement strategies for optimizing collections. This requires combining system capabilities with analytical skills to ensure timely payments and effective financial control.

Accounts Payable Efficiency

Effective accounts payable management involves more than processing vendor invoices. Candidates must understand how to streamline payment processes, manage vendor relationships, and ensure compliance with contractual terms. Automation features in Dynamics 365 Finance can improve efficiency, reduce errors, and maintain accurate records of obligations.

Expense management, including employee reimbursements and project-related costs, is also part of this module. Candidates should be able to configure policies, monitor approvals, and reconcile expenses against budgets and financial reports.

Fixed Asset Lifecycle Management

Managing the lifecycle of fixed assets is essential for maintaining accurate financial records. Candidates should know how to record asset acquisition, calculate depreciation, perform revaluations, and handle disposals. Proper asset management ensures compliance with accounting standards and accurate reporting of asset values.

Candidates should be able to analyze asset utilization, plan for replacements, and monitor asset performance over time. This knowledge supports strategic decision-making regarding capital investments and resource allocation.

Integration of Financial Modules

A critical aspect of the MB-310 exam is understanding how financial modules are integrated. Transactions in accounts payable, accounts receivable, and fixed assets impact general ledger balances, budgets, and reports. Candidates should be able to trace these transactions and understand their effects across the system.

Integration knowledge allows candidates to manage end-to-end processes efficiently, identify discrepancies quickly, and ensure consistent reporting. This holistic understanding is necessary for both exam success and practical application in financial roles.

Scenario-Based Problem Solving

Candidates are often assessed on their ability to solve scenario-based problems. These scenarios simulate real-world financial challenges and require candidates to apply their knowledge of multiple modules simultaneously. Problem-solving skills involve analyzing data, evaluating options, and implementing solutions that meet organizational objectives.

Practicing scenario-based questions helps candidates develop critical thinking skills, improves decision-making under pressure, and enhances their ability to navigate complex financial situations. This preparation is essential for demonstrating competence during the exam.

Monitoring Financial Performance

Candidates must be able to monitor organizational financial performance effectively. This includes tracking key performance indicators, analyzing variances, and identifying trends that impact decision-making. Proficiency in monitoring allows candidates to provide accurate insights and recommend improvements in financial operations.

Monitoring involves integrating data from multiple modules to assess overall performance, identify areas of inefficiency, and ensure that resources are allocated appropriately. Candidates should be skilled in using system tools to generate reports that support management decisions.

Workflow Optimization

Optimizing workflows within Dynamics 365 Finance is an essential skill for candidates. This includes automating repetitive tasks, configuring approvals, and ensuring smooth transaction flows. Workflow optimization reduces errors, improves efficiency, and ensures compliance with organizational policies.

Candidates should be able to analyze existing processes, identify bottlenecks, and implement improvements using system features. This capability enhances operational efficiency and supports accurate financial management.

Analytical Skills Development

Developing strong analytical skills is critical for the exam. Candidates should practice interpreting financial data, identifying discrepancies, and evaluating the impact of transactions. Analytical skills enable candidates to make informed decisions and provide actionable insights.

Proficiency in analytics involves using system tools to consolidate data, perform trend analysis, and assess performance against targets. Candidates should be able to communicate findings clearly and use insights to support strategic planning.

Practical Application and Testing

Hands-on practice is essential for mastering the concepts tested in the MB-310 exam. Candidates should simulate business processes such as invoicing, budgeting, payment processing, and asset management. Practical application reinforces theoretical knowledge and develops confidence in system usage.

Simulated exercises allow candidates to experience realistic financial scenarios, troubleshoot issues, and apply solutions effectively. This preparation ensures readiness for both the exam and professional responsibilities.

Evaluating Knowledge and Progress

Regular evaluation of knowledge and progress helps candidates identify areas that require additional focus. Self-assessment through practice exercises and scenario simulations allows for targeted study efforts.

Evaluating progress ensures that candidates allocate time efficiently, reinforce weak areas, and maintain balanced preparation across all topics. This approach improves both exam performance and practical competence.

Strategic Study Approach

Adopting a strategic study approach is key to effective preparation. Candidates should plan study sessions, prioritize high-weighted topics, and integrate practical exercises into their routine. This structured approach ensures comprehensive coverage of all exam topics.

A strategic approach also involves revisiting challenging topics, simulating exam conditions, and analyzing performance trends. This methodical preparation reduces uncertainty and enhances confidence in handling complex exam questions.

Mastering System Navigation

Candidates should be proficient in navigating Dynamics 365 Finance to perform tasks efficiently. This includes accessing modules, configuring settings, and generating reports. Familiarity with system navigation reduces errors and supports accurate task completion.

Understanding system navigation also involves recognizing how modules interact, how automated processes function, and how to troubleshoot issues effectively. Mastery of these skills is essential for both exam success and professional application.

Financial Analysis and Decision Support

Providing decision support through financial analysis is a critical skill. Candidates should practice interpreting reports, evaluating performance, and recommending actions based on data. Proficiency in this area enables candidates to contribute to strategic planning and operational improvements.

Financial analysis includes identifying trends, evaluating cost structures, and assessing the impact of transactions on overall performance. Candidates should be able to communicate insights effectively and support management in decision-making processes.

Continuous Knowledge Enhancement

Continuous enhancement of knowledge ensures readiness for complex exam scenarios. Candidates should regularly review topics, practice scenario exercises, and integrate practical tasks into their study plan.

Enhancing knowledge consistently strengthens retention, builds confidence, and improves the ability to handle advanced financial operations. This approach ensures that candidates can apply their learning effectively during the exam.

Risk Management in Financial Operations

Understanding risk management is an important aspect of preparation. Candidates should be able to identify potential financial risks, implement controls, and develop strategies to mitigate them.

Risk management involves analyzing transaction flows, monitoring compliance, and ensuring that financial processes adhere to policies and standards. Candidates proficient in risk management can prevent errors and support organizational stability.

Practical Problem Resolution

Candidates should develop the ability to resolve practical problems efficiently. This includes identifying discrepancies, applying corrective actions, and ensuring accuracy in financial records.

Practical problem resolution reinforces system knowledge, enhances analytical capabilities, and prepares candidates for handling real-world financial challenges. Mastery of problem-solving is essential for both exam performance and professional competence.

Consolidating Skills Across Modules

Success in the MB-310 exam requires integrating skills across multiple modules. Candidates should understand how financial operations in one area affect other modules, ensuring consistency and accuracy in reporting.

Consolidating skills allows candidates to approach complex scenarios confidently, trace transactions effectively, and provide accurate financial insights. This holistic understanding is vital for achieving a high level of proficiency.

Exam Readiness Assessment

Assessing exam readiness involves evaluating knowledge, practical skills, and confidence levels. Candidates should perform simulated exams, analyze performance, and focus on areas needing improvement.

Readiness assessment ensures that candidates are fully prepared for the range of topics and scenarios presented in the exam. This approach minimizes surprises and allows candidates to demonstrate their capabilities effectively.

Leveraging Insights for Professional Growth

The preparation process for the MB-310 exam equips candidates with valuable skills applicable in professional settings. These skills include process optimization, financial analysis, reporting, and effective use of system features.

Leveraging insights gained through preparation supports career growth, enables efficient financial management, and enhances the ability to contribute strategically to organizational goals. Candidates who integrate these skills are well-positioned for success in finance-focused roles.

Mastery of Reporting Tools

Candidates should be adept at using reporting tools within Dynamics 365 Finance. This includes creating standard and customized reports, interpreting data, and presenting actionable insights.

Mastery of reporting tools allows candidates to monitor performance, track financial metrics, and support strategic decision-making. This skill is essential for both exam performance and practical application in professional finance environments.

Handling Complex Financial Scenarios

Candidates must be prepared to handle complex financial scenarios that require multi-module knowledge and analytical reasoning. This includes evaluating transactions, forecasting impacts, and implementing effective solutions.

Practicing complex scenarios develops problem-solving capabilities, strengthens analytical skills, and ensures that candidates can navigate challenges confidently during the exam and in professional practice.

Enhancing Efficiency Through Automation

Automation within Dynamics 365 Finance streamlines financial processes, reduces errors, and improves accuracy. Candidates should understand how to configure automated workflows, approvals, and posting routines to enhance efficiency.

Proficiency in automation allows candidates to focus on analysis and decision-making rather than repetitive manual tasks. This skill is valuable for both exam preparation and real-world financial management.

Integrating Budgeting and Forecasting

Candidates should be able to integrate budgeting and forecasting processes to support strategic financial planning. This includes monitoring performance against budgets, adjusting allocations, and predicting future financial outcomes.

Integration of budgeting and forecasting ensures effective resource management, supports decision-making, and enhances the ability to respond to operational changes efficiently.

Comprehensive Review and Practice

A comprehensive review involves revisiting all modules, practicing scenario-based tasks, and consolidating knowledge. Candidates should focus on areas requiring additional attention while reinforcing strengths to achieve balanced preparation.

Regular practice and review strengthen retention, build confidence, and ensure that candidates can approach the exam with a thorough understanding of financial operations.

Decision-Making in Dynamic Environments

Candidates should be prepared to make decisions in dynamic financial environments. This involves evaluating data, anticipating impacts, and implementing solutions that align with organizational objectives.

Decision-making skills are critical for successfully handling scenario-based questions and for effective financial management in professional roles. Strong decision-making enhances accuracy, efficiency, and strategic outcomes.

Advanced Asset Management

In addition to basic fixed asset management, candidates should be proficient in advanced asset tracking, revaluation, and performance analysis. This includes understanding asset lifecycle management, integration with accounting processes, and reporting implications.

Advanced asset management ensures accurate financial reporting, supports capital planning, and enables strategic decision-making related to organizational resources.

Optimizing Resource Allocation

Effective resource allocation is essential for managing budgets, expenses, and investments. Candidates should be able to evaluate organizational needs, prioritize expenditures, and allocate resources efficiently using system tools.

Optimized resource allocation improves financial performance, supports strategic planning, and ensures that organizational goals are achieved while maintaining financial control.

Integration of Analytical Insights

Candidates should integrate analytical insights into financial decision-making. This involves interpreting data, evaluating trends, and applying insights to improve operational and strategic outcomes.

Integrating analytical insights strengthens financial planning, enhances reporting accuracy, and supports proactive management of financial processes.

Preparing for Complex Exam Scenarios

Candidates should practice complex exam scenarios that combine multiple modules, workflows, and decision points. This preparation helps develop the ability to analyze situations, apply knowledge, and make informed decisions under time constraints.

Complex scenario practice builds confidence, improves problem-solving skills, and ensures readiness for high-level questions that require comprehensive understanding and integration of financial processes.

Enhancing Operational Oversight

Candidates should focus on enhancing operational oversight by monitoring financial processes, ensuring compliance, and evaluating performance metrics. Effective oversight supports accuracy, efficiency, and strategic alignment across all financial operations.

Operational oversight involves understanding workflow interactions, transaction flows, and reporting mechanisms to maintain control over financial activities and support organizational objectives.

Enhancing Financial Control

In preparing for the MB-310 exam, candidates need to focus on enhancing financial control capabilities within Dynamics 365 Finance. This includes setting up approval hierarchies, defining control limits, and monitoring financial transactions to prevent errors. Effective control measures allow for accurate reporting, timely identification of discrepancies, and assurance that organizational policies are followed. Candidates should understand how system configurations can enforce compliance and provide audit trails for accountability

Enhancing control also involves monitoring financial processes such as budget adherence, expense approvals, and payment processing. By mastering these functions, candidates can ensure that all financial activities are recorded accurately and are aligned with organizational objectives.

Advanced Accounts Receivable Management

Advanced accounts receivable skills go beyond basic invoice processing. Candidates should understand how to manage customer credit limits, automate collections, and handle adjustments. They should also be able to analyze customer payment patterns and implement strategies that reduce overdue balances while maintaining customer relationships

Understanding subscription billing and recurring transactions is crucial for managing ongoing revenue streams. Candidates need to configure billing schedules, monitor subscriptions, and reconcile accounts to ensure accurate receivable balances. This level of expertise demonstrates the ability to manage complex financial operations effectively

Comprehensive Accounts Payable Processes

Managing accounts payable efficiently is a key focus area for the exam. Candidates must understand vendor invoice processing, payment scheduling, and reconciliation. Effective management ensures timely payments, maintains supplier trust, and minimizes errors in recording liabilities

Expense management, including employee reimbursements and operational costs, requires configuring expense categories, approval workflows, and reporting mechanisms. Candidates should be able to monitor spending against budgets and integrate expense data into the general ledger to maintain financial accuracy and operational oversight

Budgeting and Financial Planning

Budgeting is a critical aspect of preparing for the MB-310 exam. Candidates need to understand how to create budgets at multiple levels, monitor adherence, and analyze variances. This includes departmental budgets, project budgets, and organization-wide financial plans

Financial planning extends to forecasting and scenario analysis. Candidates should be able to project financial performance based on historical data, evaluate the impact of potential changes, and adjust budgets accordingly. This ability to integrate budgeting with operational planning ensures effective resource allocation and financial stability

Fixed Asset Management and Reporting

Candidates should be proficient in managing fixed assets, including acquisition, depreciation, revaluation, and disposal. Understanding the lifecycle of assets and their integration with general ledger accounts is essential for maintaining accurate financial statements

Reporting on fixed assets requires candidates to generate summaries, track asset performance, and analyze depreciation impacts. Mastery of these processes supports strategic decision-making and ensures compliance with accounting standards, which is a vital component of the exam assessment

Integration and Transaction Flow

Understanding the integration of financial modules is critical. Candidates should know how transactions in accounts payable, accounts receivable, budgeting, and fixed assets impact the general ledger and financial reporting. This holistic understanding ensures accurate recording and reduces the risk of errors

Candidates should be able to trace transactions across modules, analyze the effects of adjustments, and verify balances. Mastery of transaction flows ensures that all financial operations are synchronized, supporting accuracy in reporting and decision-making

Reporting and Analytical Skills

Effective reporting and analytical skills are essential for success. Candidates should be able to generate financial statements, perform variance analysis, and interpret data to provide actionable insights. This includes monitoring cash flow, analyzing budget adherence, and evaluating performance metrics across departments

Analytical skills also involve scenario modeling, trend analysis, and forecasting. Candidates need to demonstrate the ability to assess the impact of financial decisions, identify potential risks, and provide solutions that support organizational objectives

Compliance and Risk Management

Compliance and risk management are central to the exam. Candidates must be able to configure system controls, monitor transactions, and maintain audit trails to ensure adherence to policies and standards. Effective risk management includes identifying potential financial risks, mitigating issues, and maintaining the integrity of financial data

Candidates should understand how system features support compliance, such as approval workflows, automated checks, and alerts. This knowledge ensures that financial processes are both efficient and secure, reducing the likelihood of errors or fraud

Cash and Treasury Management

Proficiency in cash and treasury management is essential for candidates. They should be able to monitor liquidity, manage cash flow, and optimize the use of funds. This includes reconciling bank accounts, scheduling payments, and forecasting cash requirements to support operational and strategic decisions

Candidates should also understand the implications of cash flow on budgeting, investments, and financial planning. Mastery of cash and treasury processes ensures that organizations maintain financial stability and can respond to emerging financial challenges

Scenario-Based Problem Solving

The MB-310 exam frequently presents scenario-based questions that require integrated knowledge across modules. Candidates must analyze situations, identify solutions, and apply system functionality to achieve accurate outcomes. Practicing scenario-based problems builds critical thinking and decision-making skills

Candidates should simulate real-world scenarios, such as handling complex intercompany transactions, adjusting budgets due to unexpected changes, or managing overdue receivables. This practice ensures that candidates can approach similar challenges confidently during the exam

Optimizing Workflows

Candidates should focus on optimizing financial workflows to increase efficiency and reduce errors. This includes automating approvals, standardizing processes, and ensuring smooth transaction flows across modules. Effective workflow management enhances accuracy, reduces operational bottlenecks, and supports compliance with organizational policies

Candidates should be able to evaluate existing workflows, identify inefficiencies, and implement improvements using system tools. Mastery of workflow optimization reflects practical knowledge and contributes to operational excellence

Advanced Budgeting Techniques

Advanced budgeting techniques are a critical component of the exam. Candidates should be able to create multi-level budgets, perform variance analysis, and integrate forecasting into planning processes. This ensures accurate resource allocation and supports strategic decision-making

Candidates should also be able to analyze financial trends, anticipate potential deviations from planned budgets, and implement corrective actions. Proficiency in advanced budgeting demonstrates the ability to manage organizational finances effectively

Forecasting and Strategic Planning

Candidates must be capable of integrating forecasting with strategic planning. This includes evaluating historical data, projecting future financial outcomes, and aligning forecasts with organizational goals. Forecasting supports resource planning, operational adjustments, and proactive financial management

Strategic planning requires candidates to assess the financial impact of decisions, prioritize initiatives, and ensure alignment between financial performance and organizational objectives. Mastery of these skills demonstrates comprehensive financial management expertise

Practical Application and Hands-On Experience

Hands-on experience is crucial for mastering the exam content. Candidates should practice performing tasks such as processing invoices, managing budgets, handling payments, and reconciling accounts. Practical exercises reinforce theoretical knowledge and improve confidence in system navigation

Candidates should engage in realistic simulations to replicate business processes and resolve potential challenges. This experience ensures familiarity with the functionality of Dynamics 365 Finance and prepares candidates to apply knowledge effectively in the exam context

Analytical Thinking and Data Interpretation

Strong analytical thinking is essential for evaluating financial data accurately. Candidates should practice identifying discrepancies, interpreting trends, and assessing the implications of transactions on financial outcomes. Analytical skills support decision-making, reporting, and risk management

Candidates should also be able to generate insights from integrated data across modules, providing a comprehensive view of financial performance. This capability is critical for addressing complex exam scenarios and real-world financial challenges

Mastering Transaction Reconciliation

Candidates should be proficient in reconciling transactions across accounts and modules. This includes verifying entries, correcting discrepancies, and ensuring that all balances are accurate. Mastery of reconciliation processes ensures reliable financial reporting and supports audit readiness

Candidates should understand how reconciliations impact general ledger balances, budgets, and financial statements. Effective reconciliation practices demonstrate attention to detail and a thorough understanding of financial operations

Resource Allocation and Cost Management

Efficient resource allocation and cost management are integral to the exam. Candidates should be able to evaluate financial needs, allocate resources appropriately, and monitor expenditures against budgets. This ensures that organizational objectives are met while maintaining financial discipline

Candidates should also analyze cost trends, identify areas for optimization, and implement strategies to improve efficiency. Mastery of resource allocation and cost control demonstrates practical financial management skills

Integration of Financial Insights

Candidates should integrate insights from financial data to inform decisions across multiple modules. This includes analyzing performance metrics, forecasting trends, and aligning financial strategies with operational needs. Integration of insights ensures a comprehensive understanding of organizational finances

Candidates should also be able to apply these insights to scenario-based problems, providing solutions that enhance financial performance and operational efficiency

Performance Monitoring and Reporting

Monitoring financial performance is critical for both the exam and practical application. Candidates should be able to track key performance indicators, evaluate budget adherence, and analyze financial trends to support decision-making

Effective reporting involves consolidating data from multiple modules, interpreting results, and presenting actionable information. Mastery of performance monitoring ensures that candidates can provide accurate insights and contribute to strategic financial management

Handling Complex Intercompany Transactions

Candidates should understand the intricacies of intercompany transactions, including eliminations, reconciliations, and reporting impacts. Proficiency in managing these transactions ensures accuracy in consolidated financial statements and compliance with organizational policies

Managing intercompany processes involves configuring system parameters, monitoring transactions, and resolving discrepancies. Mastery of these functions reflects advanced understanding of financial operations within an integrated environment

Optimizing System Utilization

Efficient utilization of system features enhances accuracy, productivity, and reporting capabilities. Candidates should be able to configure automation, manage workflows, and optimize module interactions to support financial processes

Optimizing system utilization reduces manual effort, minimizes errors, and enables candidates to focus on analytical and strategic tasks. Proficiency in using system capabilities effectively is essential for both exam success and professional performance

Continuous Practice and Knowledge Reinforcement

Regular practice and knowledge reinforcement ensure mastery of exam topics. Candidates should simulate realistic financial scenarios, perform practical exercises, and review module functionalities consistently

Continuous reinforcement strengthens retention, builds confidence, and ensures that candidates are prepared for both complex exam scenarios and real-world financial challenges

Developing Decision-Making Competence

Decision-making competence is vital for handling scenario-based questions and professional responsibilities. Candidates should evaluate data, assess alternatives, and implement solutions that align with organizational goals

Developing decision-making skills involves understanding the consequences of financial actions, integrating knowledge across modules, and applying analytical reasoning. Mastery in this area supports effective financial management and exam performance

Advanced Asset Tracking and Reporting

Candidates should be proficient in tracking asset performance, revaluations, and depreciation calculations. Understanding the impact of asset management on financial statements ensures accurate reporting and informed decision-making

Advanced asset tracking also includes monitoring asset utilization, planning replacements, and assessing the financial implications of asset-related decisions. This expertise is critical for comprehensive financial management

Strategic Budget Adjustments

Candidates must be capable of making strategic budget adjustments based on operational needs and financial performance. This includes reallocating resources, adjusting forecasts, and evaluating the impact of changes on overall financial health

Strategic budget adjustments ensure optimal use of resources, support organizational objectives, and demonstrate the candidate’s ability to manage dynamic financial environments effectively

Preparing for Integrated Exam Scenarios

The MB-310 exam often presents integrated scenarios requiring multi-module knowledge. Candidates should practice evaluating transactions, analyzing interdependencies, and applying system functionalities to resolve complex problems

Integrated scenario practice enhances critical thinking, improves problem-solving abilities, and ensures that candidates can approach the exam with confidence and competence

Optimizing Reporting Accuracy

Candidates should focus on ensuring the accuracy of financial reports by verifying data, reconciling discrepancies, and integrating information across modules. Accurate reporting supports decision-making, compliance, and strategic planning

Mastery of reporting accuracy demonstrates attention to detail, comprehensive knowledge of financial processes, and the ability to provide reliable insights for organizational management

Conclusion

Preparing for the MB-310 exam requires a comprehensive understanding of financial operations within Dynamics 365 Finance, including general ledger, accounts receivable, accounts payable, budgeting, fixed assets, and cash management. Candidates must not only master individual modules but also understand how these areas integrate to ensure accurate financial reporting, effective resource allocation, and strategic decision-making. Hands-on experience, scenario-based practice, and familiarity with system functionalities are critical for reinforcing theoretical knowledge and developing practical competence.

Success in the exam demonstrates the ability to configure financial processes, optimize workflows, manage compliance, and provide actionable insights through reporting and analysis. Candidates must also be proficient in advanced concepts such as intercompany transactions, multi-dimensional budgeting, asset lifecycle management, and forecasting. Analytical thinking, problem-solving skills, and the ability to interpret complex financial data are essential for navigating scenario-based questions and real-world applications.

Ultimately, the MB-310 exam validates a professional’s capability to manage and optimize financial operations in a modern enterprise environment. Thorough preparation, continuous practice, and mastery of both practical and strategic financial skills ensure exam success and provide the foundation for professional growth, enabling candidates to contribute effectively to organizational financial performance and decision-making.

Microsoft Dynamics 365 MB-310 practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass MB-310 Microsoft Dynamics 365 Finance Functional Consultant certification exam dumps & practice test questions and answers are to help students.

Exam Comments * The most recent comment are on top

- AZ-104 - Microsoft Azure Administrator

- DP-700 - Implementing Data Engineering Solutions Using Microsoft Fabric

- AI-102 - Designing and Implementing a Microsoft Azure AI Solution

- AZ-305 - Designing Microsoft Azure Infrastructure Solutions

- AI-900 - Microsoft Azure AI Fundamentals

- PL-300 - Microsoft Power BI Data Analyst

- MD-102 - Endpoint Administrator

- AZ-900 - Microsoft Azure Fundamentals

- AZ-500 - Microsoft Azure Security Technologies

- SC-300 - Microsoft Identity and Access Administrator

- SC-200 - Microsoft Security Operations Analyst

- MS-102 - Microsoft 365 Administrator

- SC-401 - Administering Information Security in Microsoft 365

- DP-600 - Implementing Analytics Solutions Using Microsoft Fabric

- AZ-204 - Developing Solutions for Microsoft Azure

- SC-100 - Microsoft Cybersecurity Architect

- AZ-700 - Designing and Implementing Microsoft Azure Networking Solutions

- AZ-400 - Designing and Implementing Microsoft DevOps Solutions

- PL-200 - Microsoft Power Platform Functional Consultant

- MS-900 - Microsoft 365 Fundamentals

- SC-900 - Microsoft Security, Compliance, and Identity Fundamentals

- PL-600 - Microsoft Power Platform Solution Architect

- AZ-140 - Configuring and Operating Microsoft Azure Virtual Desktop

- PL-400 - Microsoft Power Platform Developer

- AZ-800 - Administering Windows Server Hybrid Core Infrastructure

- MS-700 - Managing Microsoft Teams

- AZ-801 - Configuring Windows Server Hybrid Advanced Services

- DP-300 - Administering Microsoft Azure SQL Solutions

- MB-280 - Microsoft Dynamics 365 Customer Experience Analyst

- GH-300 - GitHub Copilot

- PL-900 - Microsoft Power Platform Fundamentals

- MB-800 - Microsoft Dynamics 365 Business Central Functional Consultant

- MB-310 - Microsoft Dynamics 365 Finance Functional Consultant

- DP-100 - Designing and Implementing a Data Science Solution on Azure

- MB-330 - Microsoft Dynamics 365 Supply Chain Management

- DP-900 - Microsoft Azure Data Fundamentals

- MB-820 - Microsoft Dynamics 365 Business Central Developer

- MB-230 - Microsoft Dynamics 365 Customer Service Functional Consultant

- MS-721 - Collaboration Communications Systems Engineer

- PL-500 - Microsoft Power Automate RPA Developer

- MB-920 - Microsoft Dynamics 365 Fundamentals Finance and Operations Apps (ERP)

- MB-700 - Microsoft Dynamics 365: Finance and Operations Apps Solution Architect

- GH-900 - GitHub Foundations

- GH-200 - GitHub Actions

- MB-910 - Microsoft Dynamics 365 Fundamentals Customer Engagement Apps (CRM)

- MB-500 - Microsoft Dynamics 365: Finance and Operations Apps Developer

- MB-335 - Microsoft Dynamics 365 Supply Chain Management Functional Consultant Expert

- GH-500 - GitHub Advanced Security

- MB-240 - Microsoft Dynamics 365 for Field Service

- GH-100 - GitHub Administration

- AZ-120 - Planning and Administering Microsoft Azure for SAP Workloads

- DP-420 - Designing and Implementing Cloud-Native Applications Using Microsoft Azure Cosmos DB

- DP-203 - Data Engineering on Microsoft Azure

- SC-400 - Microsoft Information Protection Administrator

- AZ-303 - Microsoft Azure Architect Technologies

- 98-383 - Introduction to Programming Using HTML and CSS

- MO-201 - Microsoft Excel Expert (Excel and Excel 2019)

- MB-210 - Microsoft Dynamics 365 for Sales

- 98-388 - Introduction to Programming Using Java

- 62-193 - Technology Literacy for Educators

- MB-900 - Microsoft Dynamics 365 Fundamentals

Purchase MB-310 Exam Training Products Individually

Why customers love us?

What do our customers say?

The resources provided for the Microsoft certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the MB-310 test and passed with ease.

Studying for the Microsoft certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the MB-310 exam on my first try!

I was impressed with the quality of the MB-310 preparation materials for the Microsoft certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The MB-310 materials for the Microsoft certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the MB-310 exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my Microsoft certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for MB-310. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the MB-310 stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my MB-310 certification exam. The support and guidance provided were top-notch. I couldn't have obtained my Microsoft certification without these amazing tools!

The materials provided for the MB-310 were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed MB-310 successfully. It was a game-changer for my career in IT!