Pass Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate Certification Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

MB-310 Premium Bundle

- Premium File 425 Questions & Answers. Last update: Jan 31, 2026

- Training Course 25 Video Lectures

MB-310 Premium Bundle

- Premium File 425 Questions & Answers

Last update: Jan 31, 2026 - Training Course 25 Video Lectures

Purchase Individually

Premium File

Training Course

MB-310 Exam - Microsoft Dynamics 365 Finance Functional Consultant

| Download Free MB-310 Exam Questions |

|---|

Microsoft Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate Certification Practice Test Questions and Answers, Microsoft Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate Certification Exam Dumps

All Microsoft Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate certification exam dumps, study guide, training courses are prepared by industry experts. Microsoft Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate certification practice test questions and answers, exam dumps, study guide and training courses help candidates to study and pass hassle-free!

The Foundation of a Microsoft Certified Dynamics 365 Finance Functional Consultant Associate

Becoming a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate signifies a professional's capability to unify global financials and operations for an organization. This certification is a testament to an individual's skills in automating tasks and workflows, which are crucial for modern business efficiency. The role involves streamlining a wide range of processes, including customer ordering, selling, invoicing, and reporting. Essentially, these consultants are the architects of a company's financial system within the Dynamics 365 environment, ensuring that the technology aligns perfectly with business objectives and operational requirements. The certification validates that a consultant has the expertise to leverage the full power of the platform.

A functional consultant's primary responsibility is to translate business needs into functional solutions. They work closely with stakeholders to understand their financial processes and then configure the Dynamics 365 Finance application to meet those specific needs. This involves a deep understanding of both accounting principles and the software's capabilities. They are problem solvers who can identify inefficiencies in a company's financial operations and implement technology-driven improvements. This requires a unique blend of technical acumen, business process knowledge, and excellent communication skills to guide clients through the implementation and adoption process, ensuring a successful digital transformation of their financial landscape.

A High-Level Overview of Exam MB-300

The journey to becoming a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate begins with passing Exam MB-300: Microsoft Dynamics 365 Core Finance and Operations. This exam serves as the foundational stepping stone, validating the core skills required to work with the platform. It is not exclusively focused on finance but covers the essential cross-application functionalities that are relevant to all modules within the Finance and Operations suite. Passing this exam demonstrates that a candidate has a firm grasp of the basic architecture, navigation, and common tools used to implement and manage the solution, which is a prerequisite for specializing in finance.

The exam measures a candidate's ability to accomplish a set of critical technical tasks. These include using common functionality and implementation tools, configuring security and options, performing data migration, and supporting the solution. It is designed to ensure that every consultant, regardless of their area of specialization, understands how to navigate the system, manage user access, move data effectively, and utilize the lifecycle management tools provided by Microsoft. This broad knowledge base is essential for collaborating on large implementation projects and ensuring that the overall solution is coherent, secure, and well-managed from start to finish.

Navigating Dynamics 365 Finance and Operations

A key skill tested in Exam MB-300 is the ability to efficiently navigate and use the common features of the platform. This starts with understanding workspaces, which are central hubs designed to provide users with an overview of specific business functions. A workspace aggregates key information, metrics, and actions related to a process, such as customer invoicing or vendor payments, allowing users to manage their tasks without navigating through complex menu structures. The ability to determine when and how to use these workspaces is fundamental for improving user productivity and is a core competency for any functional consultant.

Beyond standard workspaces, a consultant must be familiar with mobile workspaces, Power Apps, and Power Automate (formerly Flow). Mobile workspaces extend the functionality of Dynamics 365 to devices, allowing users to perform tasks and access data on the go. Identifying use cases for these mobile solutions is crucial. Furthermore, knowing how to leverage Power Apps to create custom applications and Power Automate to build automated workflows can significantly enhance the standard solution. These tools allow consultants to address unique business requirements without extensive custom development, providing immense value to clients by delivering tailored and integrated solutions.

Data management is another critical aspect of navigation and functionality. A consultant must understand the global address book and how it differs from other address books within the system. The global address book is a centralized repository for contact information for all organizations and people the company interacts with, preventing data duplication. Additionally, understanding tools like the Data Expansion Tool, which helps in managing data across different legal entities, is important. A thorough knowledge of these data structures and tools is essential for maintaining data integrity and ensuring the smooth operation of business processes across an entire organization.

The platform also includes powerful features for managing tasks and accessing information. Work Items functionality, for instance, is used within workflows to represent tasks or approvals that need to be completed. A consultant must be able to demonstrate how to use these work items. Efficient navigation techniques, beyond just using workspaces, are also expected. Finally, identifying the various inquiry and report types available in a standard installation is a key skill. This knowledge allows a consultant to quickly provide stakeholders with the data they need and to design effective reporting strategies that offer valuable insights into business performance.

Understanding Lifecycle Services

Lifecycle Services, commonly known as LCS, is a vital collaboration portal that provides a suite of tools to manage the entire lifecycle of a Dynamics 365 Finance and Operations implementation. A significant part of the MB-300 exam focuses on a candidate's ability to effectively use LCS. One of the core concepts within LCS is the ability to reuse existing assets. This includes business process models, task recordings, and other project artifacts. By identifying opportunities to reuse assets from previous projects or from Microsoft's provided libraries, a consultant can significantly accelerate the implementation process and ensure consistency with best practices.

A powerful tool within LCS is the Business Process Modeler (BPM). The BPM allows consultants to create, view, and modify business process hierarchies for an organization. It helps in documenting the company's workflows and aligning them with the standard processes available in Dynamics 365. An essential skill for a consultant is the ability to analyze the results from the BPM and identify any gaps between the client's requirements and the standard functionality of the system. This gap analysis is a critical early step in any implementation project, as it forms the basis for solution design and determines where configurations or customizations are needed.

Troubleshooting and issue resolution are constant activities throughout a project's lifecycle, and LCS provides tools to support this. The Issue search tool within LCS is a repository of known issues, hotfixes, and resolutions. A proficient consultant must be able to use the Issue search tool to find solutions to problems encountered during implementation or operation. Analyzing the search results to find the most relevant and effective solution is a key competency. This skill helps in reducing downtime and ensures that the system remains stable and reliable, contributing directly to the overall success of the project and client satisfaction.

Key Terminology for Aspiring Consultants

To succeed as a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate, one must master the specific terminology of the platform. A legal entity is a fundamental concept, representing a registered or legislated organization. The ability to set up and configure legal entities is one of the first tasks in any implementation, as it forms the basis of the financial structure. Each legal entity has its own chart of accounts, currency, and financial reporting requirements, making its correct configuration absolutely critical for the integrity of the financial data and for meeting regulatory compliance.

Number sequences are another foundational element. These are used throughout the system to generate unique identifiers for master data records and transactions, such as customer accounts, vendor invoices, and sales orders. Configuring base number sequences is an essential setup task. A consultant must understand how to create and manage these sequences to ensure that all records are uniquely identified and that the numbering scheme aligns with the client's business practices and reporting needs. Improperly configured number sequences can lead to data conflicts and significant issues with transaction processing, so this is a crucial area of knowledge.

Posting profiles are at the heart of the financial module's configuration. They are rules that control how transactions are posted to the general ledger. For example, a customer posting profile dictates which ledger accounts are used when a sales invoice is posted. A deep understanding of how to configure posting profiles and definitions is essential for ensuring that financial transactions are recorded accurately and that the general ledger reflects the true financial position of the company. This is a complex area that requires a solid grasp of both accounting principles and the system's architecture, making it a key skill for a finance consultant.

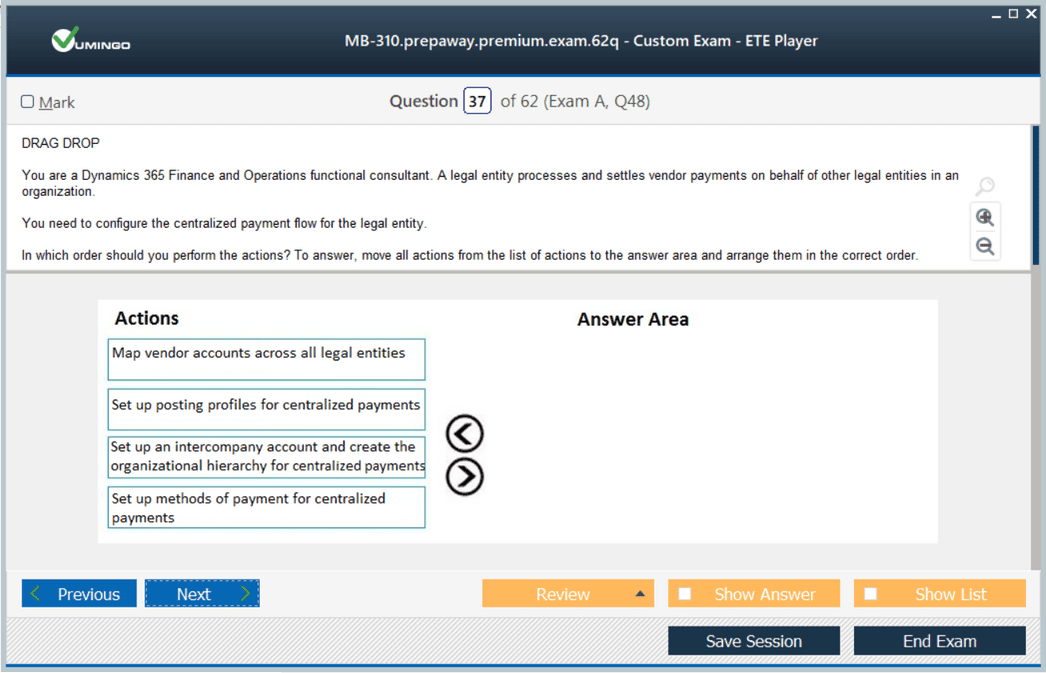

Finally, organizational hierarchies provide a way to model the business and define relationships between different organizational units. They are used for various purposes, including centralized processing and reporting. For example, a hierarchy might be used to define a centralized payments process where one legal entity pays invoices on behalf of several others. A consultant must know how to create these hierarchies and apply purposes and policies to them. This allows for the implementation of sophisticated operational structures and control mechanisms, enabling businesses to manage their complex organizational models effectively within the system.

An Introduction to Security and Configuration

The largest and most critical domain of the MB-300 exam is focused on configuring security, processes, and options. This area carries a weight of forty-five to fifty percent, signaling its importance in the daily life of a consultant. Proper configuration is the bedrock of a successful Dynamics 365 implementation. It ensures that the system is secure, that business processes are accurately modeled and automated, and that the foundational options are set correctly to support all subsequent transactions. For a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate, mastering this domain is non-negotiable, as it directly impacts the system's integrity, usability, and compliance.

This extensive section of the exam covers three primary areas. The first is implementing security, which involves managing user access and ensuring that individuals can only view and edit the data relevant to their roles. The second is designing and creating workflows, which is key to automating business processes and enforcing internal controls. The third involves configuring a wide range of options, from setting up legal entities to establishing system-wide parameters for email and printing. Each of these areas requires meticulous attention to detail and a deep understanding of how different configurations interact and affect the overall solution.

Implementing Robust Security Measures

Security in Dynamics 365 Finance and Operations is role-based, a concept that is fundamental to its design. A consultant must be able to identify and distinguish between the standard, pre-configured security roles that come with the application. These roles, such as 'Accountant' or 'Accounts payable manager', are designed around common business functions and provide a starting point for security setup. Understanding the scope and limitations of these standard roles is the first step in designing a security model that fits a client's specific organizational structure and internal control requirements. This knowledge is essential for building a secure and compliant system.

The security model is built on a hierarchy of elements: permissions, privileges, and duties. Permissions are the lowest level, granting access to individual elements like a specific form, button, or menu item. Privileges group these permissions together to grant access to perform a specific job, such as maintaining vendor records. Duties, in turn, group privileges together to define a part of a business process, like managing vendor payments. A consultant must be able to distinguish between these components and understand how they combine to form a security role. This granular understanding is crucial for customizing security effectively.

The ultimate goal of security configuration is to assign users to the correct security roles based on their responsibilities within the organization. The exam will test this ability through various scenarios. For example, a candidate might be asked to determine the appropriate role for a user who needs to approve purchase requisitions but should not have access to vendor bank details. This requires applying the principle of least privilege, ensuring users have access only to the information and functions necessary to perform their jobs. Properly assigning roles is critical for preventing fraud, protecting sensitive data, and ensuring operational efficiency.

Designing and Creating Effective Workflows

Workflows are a powerful tool for automating and standardizing business processes. A key skill for a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate is the ability to identify opportunities for automation and control based on a customer's existing processes. This involves analyzing how a business handles tasks like purchase order approvals or vendor invoice processing and then designing a workflow in the system to replicate and improve that process. This not only increases efficiency by routing tasks automatically but also enhances internal controls by enforcing approval limits and segregation of duties within the system.

Once an opportunity for a workflow has been identified, the consultant must be able to configure its properties and elements. The workflow editor is a graphical interface where consultants build the process flow. This involves adding elements like approvals, conditional decisions, and automated tasks. Configuring the properties of each element is crucial. For example, for an approval step, the consultant must define who the approvers are, what the conditions for approval are, and what happens when a document is approved or rejected. This requires a logical mindset and a thorough understanding of the client's business rules.

Inevitably, workflows can sometimes encounter issues. They might stall, route to the wrong person, or fail to execute an automated task. Therefore, the ability to troubleshoot workflows is an essential skill. A consultant must know how to view the workflow history to understand where a process failed, how to interpret error messages, and how to take administrative actions like resuming or recalling a workflow instance. This diagnostic capability is vital for providing ongoing support for the solution and ensuring that critical business processes continue to run smoothly without interruption, maintaining business continuity.

Configuring Organizational Options

The configuration of a Dynamics 365 environment begins with setting up the foundational organizational structures. A consultant must know how to set up and configure legal entities, which represent the distinct business units for which financials will be tracked. This initial setup includes defining the company name, address, and default language. Following this, importing or creating postal data, such as city and county information, is necessary to ensure address accuracy throughout the system. These initial steps are the building blocks upon which the rest of the financial configuration is built, and their accuracy is paramount.

Time and measurement standards also need to be configured. This involves setting up calendars and date intervals, which are used to define fiscal periods for financial reporting and to control transaction posting dates. A consultant must be able to construct fiscal calendars that align with the client's accounting cycle. Additionally, configuring units of measure and their conversions is essential for businesses that handle inventory. For example, a company might purchase items in cases but sell them as individual units. Setting up these conversions ensures that inventory quantities are tracked accurately throughout the procurement and sales processes.

The creation of organization hierarchies is another key configuration task. These hierarchies are used to model the relationships between different parts of the business. For example, a retail company might create a hierarchy that groups individual stores into regions and then into countries. A consultant needs to understand how to build these structures and then apply purposes and policies to them. A purpose might be 'Security' or 'Centralized payments', and the policy defines how the hierarchy is used in that context. This allows for flexible and powerful management of business processes across a complex organization.

User Options and System Integration

Beyond organizational setup, a consultant must be able to describe and apply various user options. These settings allow individual users to personalize their experience, such as changing the color theme, setting a default company to log into, or adjusting notification preferences. While these may seem like minor details, they significantly impact user adoption and satisfaction. A consultant who can guide users in setting up their options helps to create a more comfortable and efficient work environment, which is an important aspect of a successful implementation project.

Integration with other common business tools is a frequent requirement. A consultant must be able to demonstrate how to synchronize Microsoft Office information with Dynamics 365. This includes using the Excel add-in to view, edit, and create data. Furthermore, configuring email settings, whether using SMTP or Exchange, is a critical technical task that enables the system to send notifications, reports, and business documents like invoices. This also involves creating and maintaining email templates and record templates to standardize communication and data entry, improving both consistency and efficiency across the user base.

Modern business intelligence relies on data visualization, and a consultant needs to know how to set up the Power BI connector. This integration allows for the creation of rich, interactive dashboards and reports using data from Dynamics 365, providing deep insights into financial performance. Another common requirement is setting up network printing to allow users to print documents directly from the application to designated printers. These integration and setup tasks are essential for making Dynamics 365 the central, authoritative system for a business's operations and ensuring it works seamlessly with the other tools in their technology stack.

The Importance of a Solid Migration Strategy

Data migration is one of the most challenging and critical phases of any enterprise resource planning implementation. For a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate, mastering the domain of performing data migration, which accounts for fifteen to twenty percent of the MB-300 exam, is essential. A well-executed migration ensures business continuity by making historical and master data available in the new system from day one. Conversely, a poorly planned migration can lead to data corruption, project delays, and a loss of user confidence. Therefore, developing a comprehensive strategy is not just a technical task but a crucial business process.

The strategy begins with identifying common migration scenarios and the tools available within Dynamics 365 Finance and Operations. The primary tool for this is the Data Management Framework, a robust workspace that provides a comprehensive set of capabilities for managing data import, export, and migration. A consultant must understand its features, such as data entities, data projects, and processing groups. The strategy must also consider the source of the data, whether it's a legacy system or a collection of spreadsheets, as this will influence the tools and techniques used for extraction and transformation.

Defining Migration Scope and Data Entities

A key part of the migration strategy is to determine the migration scope. It is rarely feasible or desirable to migrate every piece of data from a legacy system. A consultant must work with business stakeholders to decide what data is essential for the new system to function. This typically includes master data like customers, vendors, and products; open transactional data like outstanding invoices and open purchase orders; and historical data required for reporting and compliance. Establishing this scope early prevents wasted effort and focuses the migration team on what truly matters for the business's go-live success.

Once the scope is defined, the next step is to identify the relevant data entities and elements for the migration. Data entities in Dynamics 365 are an abstraction of the underlying database tables, providing a simplified and logical view of the data. For example, instead of dealing with multiple tables that store customer information, a consultant can use the 'Customers' data entity. An essential skill, tested in various scenarios, is the ability to map the data from the source system to the correct data entities and their corresponding fields in the target system. This mapping is the blueprint for the entire data migration process.

With the scope and entities identified, the consultant can establish the migration strategy processes. This includes defining the sequence of data migration, often starting with foundational data like the chart of accounts and moving on to master data before tackling open transactions. The strategy should also outline the processes for data cleansing and transformation. Data from legacy systems is often inconsistent or incomplete, and it must be cleaned before it can be loaded into the new system. This process ensures that the new Dynamics 365 environment starts with high-quality, reliable data, which is fundamental to its long-term success.

Preparing and Migrating the Data

The execution phase of the migration begins with identifying and extracting the source data. This process can be complex, depending on the nature of the legacy system. It may involve running reports, querying databases directly, or manually exporting data to files. Once extracted, the data needs to be transformed to fit the structure and format required by the Dynamics 365 data entities. This is where the field mapping created earlier becomes critical. The consultant will use tools like Excel or a database staging environment to manipulate the source data, ensuring it aligns perfectly with the target data structures.

After the data is prepared, the consultant performs the actual migration, typically using the Data Management Framework. This involves creating import projects, uploading the data files, and running the import jobs. An important aspect of this process is supporting the transition between the existing and migrated systems. This often requires careful planning of a cutover weekend, during which the legacy system is frozen, final data is extracted and migrated, and the new system is brought online. The consultant plays a key role in coordinating these activities to ensure a smooth and seamless transition for the business.

No migration is complete without rigorous testing. A consultant must perform a test migration, often multiple times in different test environments, to validate the entire process. This involves loading a subset of the data and having business users verify that it is correct and complete in the new system. This validation of the output is a critical quality assurance step. It helps to identify and resolve any issues with the data mapping, transformation logic, or import process before the final production go-live, significantly reducing the risk of data-related problems after the launch.

Validating and Supporting the Solution

Once the system is configured and data has been migrated, the focus shifts to validating the entire solution. This domain makes up the final fifteen to twenty percent of the MB-300 exam. The primary method for this is User Acceptance Testing, or UAT. During UAT, key business users test the system to confirm that it meets their requirements and supports their day-to-day processes. A consultant's role during UAT is to facilitate the testing, answer questions, and document any issues that are discovered. It is the final checkpoint before the system is approved for go-live.

To ensure UAT is structured and thorough, the consultant must build effective test scripts. These scripts should provide step-by-step instructions for users to follow as they test specific business functionalities. For example, a script might guide a user through the process of creating a new customer, entering a sales order, and posting the invoice. A crucial skill is demonstrating the correlation between these test scripts and the original business requirements gathered at the start of the project. This traceability ensures that all requirements have been met and thoroughly tested, leaving no gaps in the solution.

During the validation testing, issues will inevitably be found. These can range from minor cosmetic defects to critical bugs that prevent a process from being completed. The consultant must monitor the validation test progress closely and be prepared to make ad hoc changes to correct identified issues. This might involve adjusting a configuration, fixing a workflow, or escalating a more complex problem to a technical developer. The ability to respond quickly and effectively to issues found during testing is vital for keeping the project on track and ensuring a high-quality solution is delivered.

Application Lifecycle Management with LCS

The role of a consultant extends beyond the initial implementation. They must also support the Application Lifecycle Management (ALM) of the solution, primarily by using the tools within Lifecycle Services (LCS). After go-live, as new business needs arise, a consultant will often perform a solution gap analysis. This process is similar to the initial analysis but focuses on identifying gaps between the current system's functionality and new or evolving business requirements. This analysis helps to plan for future enhancements and continuous improvement of the solution.

When issues are identified, either during UAT or in the production environment, LCS provides tools to manage them. A consultant must know how to use these tools to identify, report, and ultimately resolve issues. This involves searching for existing hotfixes, logging new support incidents with Microsoft if necessary, and tracking the progress of these incidents until a resolution is provided. This systematic approach to issue management is essential for maintaining a stable and reliable system and for providing excellent ongoing support to the client, solidifying the consultant's role as a trusted advisor.

An Introduction to Exam MB-310

After building a strong foundation with the MB-300 core exam, the next step in becoming a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate is to conquer Exam MB-310: Microsoft Dynamics 365 Finance. This exam shifts the focus from broad, cross-application skills to a deep and detailed exploration of the finance-specific modules and functionalities. It is designed to validate a consultant's expertise in setting up, configuring, and managing the core financial components of the system. Success in this exam demonstrates that a professional can handle the complex financial requirements of a modern enterprise.

The exam is structured around several key areas, with the largest and most significant being the setup and configuration of financial management, which accounts for thirty-five to forty percent of the questions. This is followed by sections on managing common processes, implementing accounts payable and receivable, and finally, managing budgeting and fixed assets. This structure mirrors the logical flow of a financial implementation, starting with the foundational setup and moving through to the transactional and specialized processes. A thorough understanding of each of these domains is crucial for any consultant aspiring to specialize in finance.

Setting Up Core Financial Configurations

The journey into financial configuration begins with the core modules. A consultant must be adept at configuring and applying accrual schemes, which are used to automate the deferral of revenues and expenses over a specified period. This ensures that financial statements accurately reflect the matching principle of accounting. Similarly, configuring cash flow reports is a key task. This involves mapping ledger accounts to the appropriate sections of the cash flow statement to provide management with a clear view of the company's liquidity and solvency. These configurations are fundamental to sound financial reporting within the system.

For businesses engaged in international trade, a consultant needs to know how to configure letters of credit and letter of guarantee templates. These are critical financial instruments that mitigate risk in transactions between importers and exporters. The system provides functionality to manage the entire lifecycle of these documents, and proper configuration is essential for their effective use. Another crucial area is setting up intercompany accounting. This functionality allows for the seamless recording of transactions between different legal entities within the same organization, automating the creation of due-to and due-from entries to keep intercompany balances aligned.

Building the Chart of Accounts

The heart of any financial system is the chart of accounts. A primary responsibility for a finance consultant is to create and configure the account structures that govern the combination of main accounts and financial dimensions used for transaction posting. This structure is the backbone of financial reporting and control, and its design requires careful planning. The consultant must define the rules that determine which dimensions are required for which main accounts, ensuring data entry is both accurate and consistent across the organization. This foundational setup dictates the level of detail and analysis possible in financial reporting.

Defining and configuring financial dimensions and dimension sets is a related and equally important task. Financial dimensions are data classifiers, such as Department, Business Unit, or Cost Center, that are used to add context to financial transactions. A consultant must work with the business to identify the necessary dimensions and then configure them in the system. Dimension sets are then used to define how these dimensions are displayed on reports and inquiries, allowing for flexible and powerful analysis of financial data. A well-designed dimensional structure is key to unlocking deep insights from the general ledger.

Leveraging Advanced Financial Features

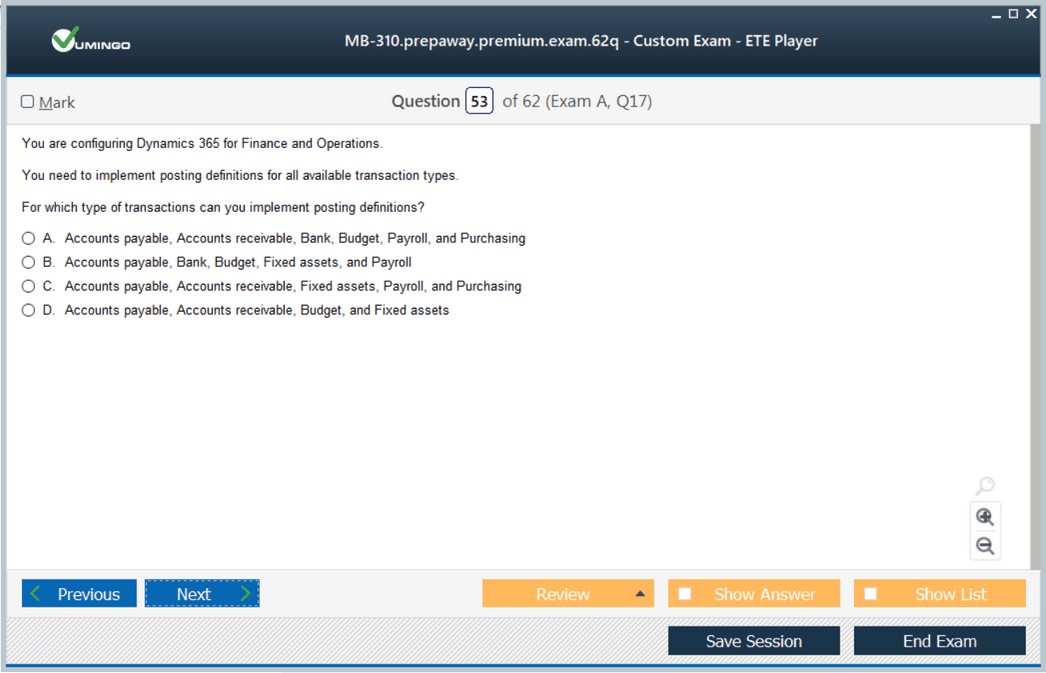

Beyond the basic setup, a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate must be proficient in the system's advanced features. This includes implementing posting definitions, which offer a more sophisticated alternative to posting profiles for controlling ledger entries, especially in public sector or encumbrance accounting scenarios. Another advanced area is the implementation and testing of cost and allocation policies. These policies are used in cost accounting to distribute shared costs, like rent or utilities, across different cost centers based on defined allocation bases, such as square footage or headcount.

Implementing cost accounting processes is a major undertaking that provides management with detailed insights into the costs of products, services, and operations. This involves setting up the cost accounting module, defining cost elements and cost objects, and processing cost data. A consultant must also be able to implement inventory costing versions and item groups, which are critical for accurately valuing inventory and calculating the cost of goods sold. Understanding and demonstrating the use of cost accounting terminology is also a key expectation, showing a deep conceptual grasp of the subject.

The system also provides powerful tools for ledger allocations. A consultant must be able to create and process ledger allocation rules. These rules are used to periodically distribute amounts from one set of ledger account and dimension combinations to others. For example, a company might allocate its corporate marketing expenses to its different business units based on their respective sales revenue. The ability to construct these rules allows for sophisticated financial modeling and reporting, providing a more accurate picture of the profitability of different parts of the business.

Mastering Periodic Financial Processes

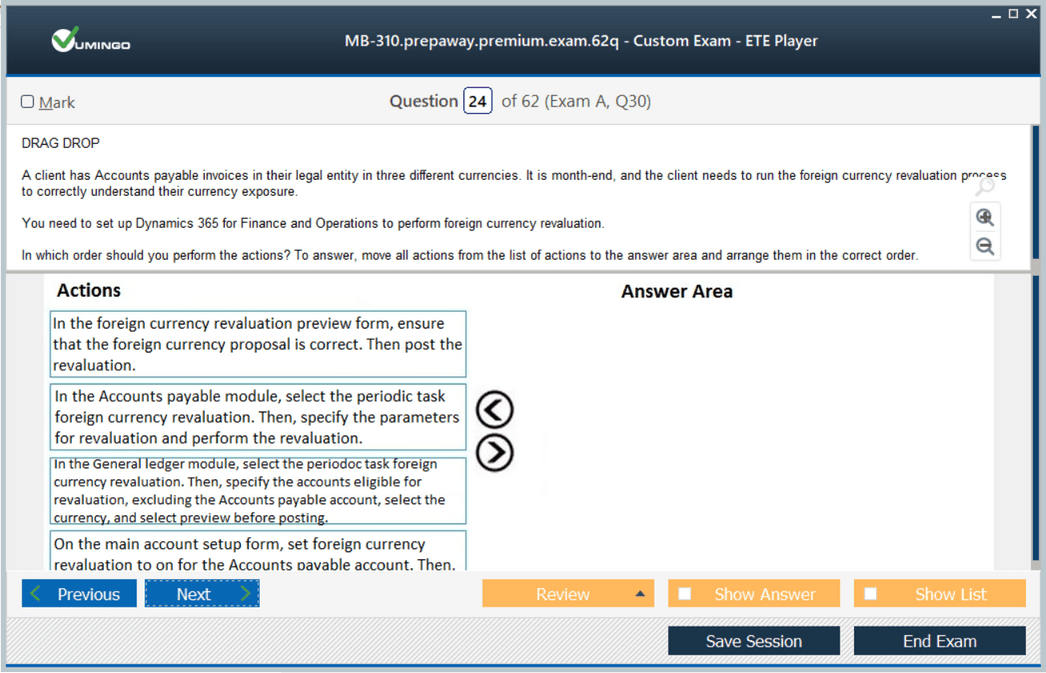

A significant part of a finance department's work revolves around periodic processes, especially the month-end and year-end close. A consultant must know how to configure the financial period close workspace and how to define and demonstrate the periodic closing processes and end-of-year processes in the system. This includes tasks like running foreign currency revaluations, processing allocations, and ultimately closing the fiscal periods to prevent further transactions. A smooth and efficient period-end close is a key measure of success for any financial system implementation.

Regional compliance is another critical consideration. A consultant must be able to demonstrate the system's regional tax reporting capabilities. This involves understanding the specific tax regulations of the countries where the business operates and configuring the system to generate the required reports and electronic filings. This could include reports for Value Added Tax (VAT), Goods and Services Tax (GST), or other local tax regimes. Ensuring compliance with these regulations is a major responsibility and a key value proposition of using a global ERP system like Dynamics 365.

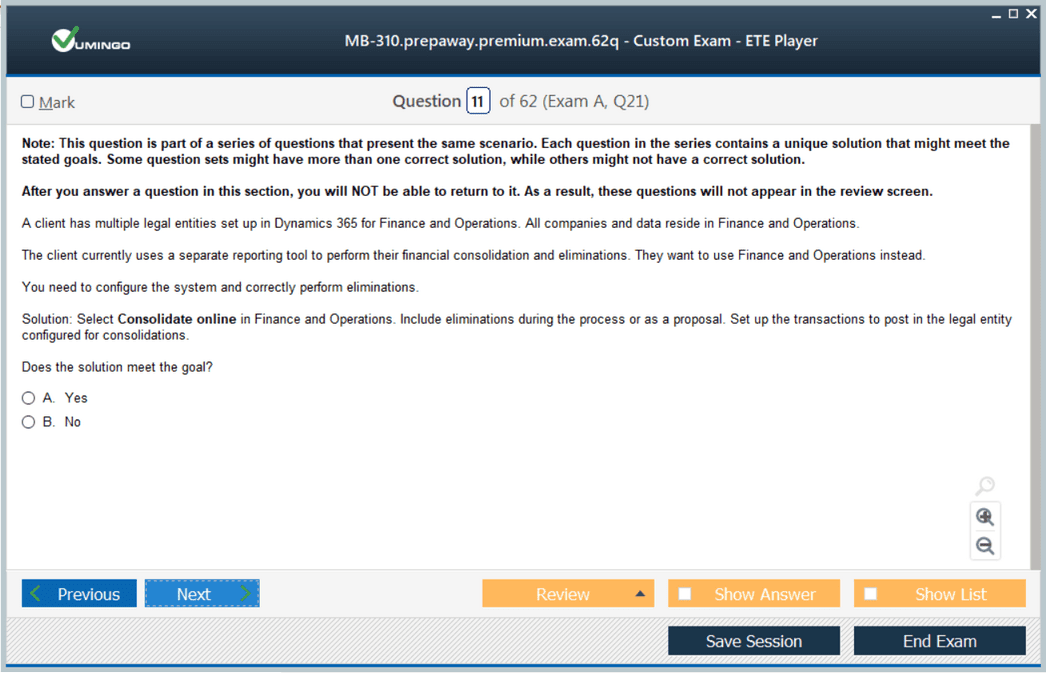

Finally, performing bank reconciliation is a routine but essential financial task. The consultant must be able to configure and execute the bank reconciliation process, matching bank statement transactions with the transactions recorded in the system's cash and bank management module. The system offers advanced features for automatic reconciliation by importing electronic bank statements. Furthermore, the ability to perform financial consolidation is a requirement for organizations with multiple legal entities. This involves combining the financial results of subsidiaries into a single set of consolidated financial statements for the parent company, a complex process that the system is designed to streamline.

Managing Common Financial Processes

The domain covering common processes, which accounts for twenty to twenty-five percent of the MB-310 exam, focuses on the daily and periodic activities that form the core of financial operations. A Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate must be proficient in managing these routine yet critical tasks. This includes a deep understanding of journals, which are the primary mechanism for entering manual accounting transactions. A consultant must be able to identify the different types of journals available, such as general journals and vendor payment journals, and configure their setup, including names and voucher series.

To maintain control over financial postings, a consultant must know how to set up journal controls and configure journal posting restriction rules. Journal controls can be used to mandate that certain financial dimensions are entered or to restrict which users or groups can post to specific journals. Posting restrictions add another layer of control, preventing users from posting to certain accounts or modules. Furthermore, configuring approval processes for journals using the workflow engine is a common requirement to ensure that significant financial entries are reviewed and approved before they are posted to the general ledger.

Efficiency in data entry is also important. Consultants are expected to know how to create voucher templates, which allow users to quickly create recurring journal entries by saving a template of the accounts, dimensions, and amounts. Finally, a consultant must be able to perform the daily procedures using journals, which involves entering, validating, and posting various types of financial transactions. This hands-on knowledge is crucial for training users and troubleshooting any issues that may arise during daily operations, ensuring the smooth functioning of the finance department.

Implementing Accounts Receivable

The accounts receivable module is critical for managing a company's revenue cycle and cash flow. A consultant's expertise in this area, which is part of the twenty to twenty-five percent domain covering payables and receivables, is vital. The setup begins with configuring customer posting profiles, which, much like their vendor counterparts, control the posting of customer transactions to the general ledger. Correctly setting up these profiles is essential for ensuring that revenue, cash receipts, and receivables are recorded accurately in the financial statements.

Managing delinquent customers and the collections process is a key business function supported by the system. A consultant must be able to configure and process credit and collection functionalities. This includes setting up collection letters, managing customer aging data, and tracking collection activities. The system provides a dedicated workspace for collections managers to help them prioritize their work and manage their interactions with customers. Effectively implementing these tools can significantly reduce the number of days sales are outstanding and improve a company's cash position.

The module also handles the entire invoicing and payment process. A consultant needs to know how to configure billing codes for free text invoices, which are invoices that are not linked to a sales order. They must also be able to process customer orders, post invoices, and record customer payments. This includes configuring customer payment setup options, such as methods of payment and cash discount terms. Additionally, the ability to prepare and send customer account statements and configure accounts receivable charges, for things like late fees or freight, is also a required skill for managing the end-to-end receivables process.

Implementing Accounts Payable

On the other side of the ledger is accounts payable, which involves managing the company's obligations to its vendors. A consultant must know how to set up the vendor posting profile to ensure that purchases, invoices, and payments are correctly reflected in the general ledger. A key area of focus is configuring invoice validation policies. These policies allow for the automated matching of vendor invoices against purchase orders and product receipts, helping to prevent overpayments and ensure that the company only pays for goods and services it has actually received. This is a critical internal control feature.

The consultant must be able to process vendor orders, invoices, and payments. This includes managing the entire procure-to-pay cycle. A specialized feature that requires configuration is the Vendor collaboration module. This provides a portal where vendors can view their purchase orders, submit invoices electronically, and check the status of their payments. Implementing this module can greatly improve efficiency and communication with suppliers. Configuring vendor payments, including setting up methods of payment and managing payment proposals for batch processing, is another core competency. Finally, configuring accounts payable charges for costs like freight is also essential.

Configuring Budgeting Processes

Budgeting and fixed assets management constitute the final domain of the MB-310 exam, accounting for fifteen to twenty percent of the content. For budgeting, a consultant must be able to configure the various budgeting components, including budget models, codes, and allocation terms. A key task is creating a budget plan template, which defines the structure and layout of the budget entry sheets. This is followed by using the budget plan wizard to generate the actual budget plans where departments can enter their budget figures for the upcoming fiscal year.

The consultant must be able to perform the entire budget planning process, which involves consolidating departmental budget plans, making adjustments at a higher level, and ultimately finalizing and activating the budget. A crucial part of this is configuring budget controls. These controls are rules that prevent transactions from being posted if they would exceed the available budget balance. This is a proactive control that helps organizations adhere to their financial plans. A consultant must also be able to create and demonstrate registry entries and implement budget workflows to manage the review and approval of the budget plans.

Implementing Fixed Assets

The final area of expertise for a Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate is the management of fixed assets. This begins with creating fixed assets and fixed asset groups. Groups are used to categorize assets and assign default depreciation settings. A consultant must be able to configure the various fixed asset parameters, which control how assets are managed and depreciated across the entire organization. An important consideration is identifying when to enable integration with the purchasing and sales modules, which allows for the automatic creation and disposal of assets directly from purchase orders and sales invoices.

A consultant must be able to demonstrate the entire lifecycle of a fixed asset within the system. This includes performing the acquisition of an asset, either through a purchase or by creating it manually. It also involves running the periodic depreciation process, which calculates and posts the depreciation expense for all assets based on their configured depreciation profiles. Finally, the consultant must be able to perform the disposal of fixed assets, whether through a sale or by scrapping the asset, and ensure that the correct accounting entries for the gain or loss on disposal are generated.

Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate certification practice test questions and answers, training course, study guide are uploaded in ETE files format by real users. Study and pass Microsoft Microsoft Certified: Dynamics 365 Finance Functional Consultant Associate certification exam dumps & practice test questions and answers are the best available resource to help students pass at the first attempt.