- Home

- ISC Certifications

- CAP Certified Authorization Professional Dumps

Pass ISC CAP Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

CAP Premium File

- Premium File 395 Questions & Answers. Last Update: Feb 15, 2026

Whats Included:

- Latest Questions

- 100% Accurate Answers

- Fast Exam Updates

Last Week Results!

All ISC CAP certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the CAP Certified Authorization Professional practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

From Beginner to Pro: The ISC CPA Exam Guide

The Information Systems and Controls section of the CPA Exam is a specialized area that evaluates candidates’ knowledge of accounting information systems, technology frameworks, internal controls, and data management practices. It is one of the discipline sections that candidates can select after completing the core CPA Exam requirements, which cover auditing, financial accounting, and taxation. This section is particularly designed for candidates who wish to focus on the intersection of accounting, finance, and technology, reflecting the growing importance of IT in the accounting profession. Candidates taking this section are expected to demonstrate an understanding of how information systems support business processes, manage data, maintain security and privacy, and ensure compliance with internal and external standards.

The section examines the integration of technology and accounting principles, emphasizing how professionals can leverage IT frameworks to improve organizational efficiency and audit effectiveness. The ISC section also delves into governance structures, risk assessment, and security protocols, which are essential for auditors, data analysts, and IT professionals working in financial environments. Mastery of these concepts ensures that candidates are capable of identifying system vulnerabilities, recommending process improvements, and implementing secure and effective financial information systems.

Exam Structure and Content Areas

The ISC section is structured as a four-hour exam comprising multiple-choice questions and task-based simulations, reflecting both theoretical understanding and practical application of accounting technology. The exam is divided into three primary content areas: information systems and data management, security and privacy, and System and Organization Controls engagements. Candidates are expected to demonstrate knowledge in designing, implementing, and evaluating controls over accounting information systems while addressing issues such as data integrity, system reliability, and compliance with regulations.

Information systems and data management focus on topics such as enterprise resource planning systems, IT infrastructure, system availability, data governance, and change management. Candidates must understand how data flows through an organization and how systems interact to support financial reporting and operational decision-making. This includes the ability to evaluate risks associated with data storage, processing, and transfer, as well as ensuring that accounting systems are aligned with organizational goals.

The security and privacy content area examines the standards, regulations, and frameworks that govern the protection of financial and operational data. Candidates are tested on their ability to identify potential threats, implement mitigation strategies, respond to security incidents, and maintain confidentiality and privacy in organizational processes. This section reflects the increasing responsibility of accountants to oversee not only financial data but also the systems that store and transmit sensitive information.

System and Organization Controls engagements require candidates to apply auditing concepts to evaluate the design and effectiveness of internal controls in IT environments. This includes understanding the planning, performance, and reporting phases of SOC engagements, interpreting audit findings, and providing actionable recommendations for improving system reliability and compliance. Candidates must demonstrate the ability to analyze data and identify errors, inefficiencies, or security gaps within complex accounting systems.

Skills and Competencies Required

The ISC section tests a combination of conceptual knowledge, applied skills, and analytical reasoning. Candidates are evaluated on their ability to understand and recall essential principles, apply best practices in real-world scenarios, and analyze situations to identify errors or propose solutions. This skill framework aligns with professional standards for accounting certification and ensures that candidates are prepared to handle the responsibilities of modern accounting roles that require both financial and technological expertise.

Candidates must be proficient in evaluating business processes, understanding the flow of financial information, and implementing controls that ensure data accuracy, integrity, and compliance. They must also be capable of interpreting complex IT environments and integrating accounting knowledge with technology management practices. This combination of skills ensures that professionals are not only competent in traditional accounting tasks but also equipped to contribute to organizational decision-making, risk assessment, and data governance initiatives.

Strategic Preparation and Exam Planning

Planning the sequence in which CPA Exam sections are taken can significantly impact performance, particularly when choosing a discipline section like ISC. Many candidates benefit from completing the auditing section prior to ISC, as the foundational auditing principles provide a strong base for understanding controls, risk assessment, and compliance considerations. Additionally, completing financial accounting and reporting early can reinforce the accounting concepts that underpin much of the ISC content.

Effective preparation for the ISC section involves creating a structured study plan that integrates both conceptual learning and practical exercises. Candidates should allocate sufficient time to practice task-based simulations and multiple-choice questions to develop proficiency in applying knowledge to real-world scenarios. Understanding the latest technology standards, regulatory frameworks, and industry best practices is essential for success in this section, as it emphasizes practical skills as much as theoretical knowledge.

Candidates should also focus on understanding IT governance, enterprise systems, and internal control frameworks, as these areas are critical for evaluating and improving business processes. Familiarity with audit standards and frameworks for system assessments ensures that candidates can effectively evaluate internal controls, identify weaknesses, and recommend improvements that enhance both financial reporting and operational efficiency.

Career Implications of ISC Certification

Successfully completing the ISC section of the CPA Exam positions candidates for advanced career opportunities in areas where accounting intersects with technology. Professionals with expertise in information systems and controls are increasingly sought after for roles that involve financial data management, IT auditing, system evaluation, and risk assessment. The knowledge gained through ISC prepares candidates for responsibilities such as overseeing financial systems, managing data integrity, ensuring compliance with regulatory requirements, and supporting organizational decision-making.

Careers for candidates who complete this discipline section include financial data analyst, IT auditor, systems accountant, and roles in corporate finance or information security leadership. The skills developed in this section are highly transferable across industries, reflecting the growing demand for accounting professionals who can navigate complex IT environments while maintaining compliance, security, and efficiency. The ISC section demonstrates a candidate’s ability to integrate financial and technological expertise, an increasingly valuable competency in the evolving landscape of accounting and finance.

Exam Scoring and Evaluation

The ISC section is scored on a scale from 0 to 99, with a passing score set at 75. The evaluation incorporates both multiple-choice questions and task-based simulations, with different weightings assigned to each component to reflect their significance in assessing candidate competencies. Multiple-choice questions account for a larger portion of the score, emphasizing the importance of understanding key concepts and principles, while simulations assess practical application and analytical skills.

The exam scoring methodology rewards accuracy and completeness in demonstrating knowledge and skills. Candidates are encouraged to answer all questions to maximize potential scoring, as partial credit can be awarded for task-based simulations where multiple components are involved. This scoring structure ensures that candidates are evaluated on both their theoretical knowledge and their ability to apply concepts in realistic accounting and IT scenarios.

Study Considerations and Best Practices

Preparing for the ISC section requires a balance of theoretical study, practical exercises, and analytical skill development. Candidates should prioritize understanding the interaction between accounting processes and IT systems, focusing on areas such as internal control design, system security, data integrity, and regulatory compliance. Practice with simulations is particularly valuable, as it mirrors real-world challenges where accountants must apply knowledge to complex scenarios involving financial data and IT environments.

Consistency in study routines and accountability are key factors for successful preparation. Candidates should create structured schedules, allocate sufficient time for each content area, and ensure regular review of complex concepts. Developing familiarity with IT frameworks, data management practices, and auditing standards enhances readiness for both the multiple-choice and simulation portions of the exam.

Additionally, staying updated on changes in technology, regulatory requirements, and professional standards ensures that candidates are prepared to apply relevant knowledge in practical contexts. The ISC section reflects the evolving nature of the accounting profession, where technology, data security, and information systems play a central role in supporting accurate financial reporting, risk management, and organizational decision-making.

Integration of Technology and Accounting Expertise

The ISC section exemplifies the integration of accounting knowledge with information technology skills, reflecting the modern demands of the profession. Candidates are expected to understand the principles of enterprise systems, IT infrastructure, system availability, and change management while ensuring that internal controls and data management practices are effective. This integration ensures that accounting professionals can provide insights into business processes, identify operational inefficiencies, and recommend improvements that support organizational objectives.

In addition to technical knowledge, candidates must demonstrate critical thinking, problem-solving, and analytical skills. The ISC section evaluates the ability to interpret financial and operational data, assess risks, and develop solutions that enhance system reliability and compliance. This combination of skills prepares candidates for dynamic roles in accounting and finance, where the ability to bridge the gap between technology and financial management is increasingly important.

Importance of ISC in CPA Certification

The ISC section represents a forward-looking approach to CPA certification, emphasizing the skills necessary for modern accounting roles that extend beyond traditional financial reporting. Candidates who complete this section gain specialized expertise in IT audit, data management, security, and controls, positioning them for career advancement and leadership roles in finance and technology. The knowledge and skills acquired through ISC complement the core CPA competencies, providing a comprehensive foundation for professional growth in a rapidly evolving industry.

Accounting professionals with ISC expertise are equipped to address complex challenges, ensure data integrity, maintain compliance, and support strategic decision-making. This specialization aligns with the demands of organizations seeking professionals who can navigate technological environments while applying accounting principles to achieve operational excellence. By demonstrating proficiency in information systems and controls, candidates enhance their credibility and value in the field of accounting and finance.

Strategic Planning for the CPA Certification Exam

Successfully navigating the CPA Certification Exam requires careful planning, particularly when selecting discipline sections like the information systems and controls area. Candidates must consider the sequence in which they attempt the exam sections to maximize retention, build confidence, and establish a solid foundation across accounting and technology domains. Many candidates choose to complete core sections such as auditing and financial accounting before attempting the discipline section, as this provides essential knowledge for understanding internal controls, risk management, and the integration of accounting systems with organizational processes. Strategic planning also involves evaluating personal strengths, prior experience, and career objectives, allowing candidates to prioritize sections that align with their expertise and professional goals. Proper sequencing helps in building momentum and reducing the cognitive load when approaching more specialized content areas within the CPA Certification Exam.

Time management is another crucial element in planning for the CPA Certification Exam. Allocating sufficient study periods for each content area ensures comprehensive coverage of essential topics and minimizes the risk of knowledge gaps. Candidates are encouraged to divide their preparation into manageable segments, combining conceptual review with practical exercises. Effective planning includes setting milestones, monitoring progress, and adjusting the study schedule as needed to accommodate the complexity of different sections. The discipline section requires in-depth understanding of information systems, data governance, and internal controls, which demands consistent and focused study routines. Planning ahead enables candidates to balance preparation for multiple sections while maintaining high performance across the exam.

In-Depth Understanding of Exam Content

The CPA Certification Exam assesses candidates’ abilities to apply theoretical knowledge to practical scenarios in accounting, auditing, and finance. Within the discipline section focused on information systems and controls, candidates must demonstrate proficiency in analyzing complex IT environments, evaluating the design and implementation of internal controls, and managing financial data with accuracy and security. Mastery of content areas such as enterprise systems, IT infrastructure, system availability, and change management is crucial for ensuring reliable financial reporting and operational efficiency. Candidates also need to understand the interplay between technology and regulatory requirements, including the implications for audit engagements and data privacy considerations.

Information systems and controls expertise extends beyond basic technical knowledge, requiring candidates to integrate IT principles with core accounting concepts. This involves evaluating risk, designing control frameworks, implementing security measures, and assessing the effectiveness of organizational processes. Candidates must demonstrate the ability to identify potential vulnerabilities, recommend improvements, and support decision-making processes through accurate and secure data management. Understanding system dependencies, transaction flows, and data lifecycle management is fundamental for professionals preparing for this section of the CPA Certification Exam.

Security, confidentiality, and privacy form another critical content area, where candidates must apply knowledge of regulatory standards, threat mitigation strategies, and incident response protocols. Professionals in accounting and finance increasingly encounter scenarios that involve safeguarding sensitive financial information, making it imperative to understand the frameworks that govern data protection. Candidates must also be capable of evaluating internal and external risks, designing controls to address vulnerabilities, and implementing monitoring mechanisms that maintain compliance and integrity across organizational systems.

System and organization controls are assessed through practical scenarios that simulate real-world audit and advisory engagements. Candidates are expected to plan, execute, and report on evaluations of internal controls, interpreting findings, and providing actionable recommendations. This requires analytical thinking, problem-solving, and the ability to synthesize information from multiple sources. Candidates who successfully navigate these tasks demonstrate a high level of competence in bridging the gap between accounting principles and information technology applications, a skill increasingly demanded in the modern finance industry.

Skills Development for Certification Success

The CPA Certification Exam evaluates a combination of technical knowledge, analytical reasoning, and applied skills. Candidates are required to recall essential accounting principles, apply best practices in real-world scenarios, and analyze complex situations to identify errors or propose solutions. These skills are particularly relevant to the discipline section on information systems and controls, where technology and accounting intersect. Candidates must be able to integrate financial expertise with IT governance, risk assessment, and data management, demonstrating the competencies necessary for modern accounting roles.

Developing proficiency in this area involves focusing on core skills such as evaluating internal controls, assessing IT systems for reliability, and ensuring compliance with regulatory standards. Candidates should also cultivate the ability to analyze data flows, detect irregularities, and implement process improvements that support financial integrity. Understanding enterprise systems, accounting software, and data security protocols enhances candidates’ capabilities to navigate complex organizational environments, making them effective contributors to auditing, financial reporting, and advisory functions.

Analytical skills are especially important for interpreting simulation-based tasks, where candidates must apply theoretical knowledge to practical problems. This requires attention to detail, critical thinking, and the ability to consider multiple perspectives when evaluating organizational processes. Candidates who develop these competencies are better equipped to manage the responsibilities of accounting roles that involve oversight of technology systems, data governance, and compliance with evolving industry standards.

Exam Preparation Strategies

Effective preparation for the CPA Certification Exam involves a structured and disciplined approach that balances theoretical review with practical exercises. Candidates are advised to create a study plan that covers all relevant content areas, including accounting principles, auditing concepts, IT systems, data management, and internal controls. Consistent study routines, milestone tracking, and self-assessment are critical components of preparation, ensuring comprehensive coverage and retention of essential knowledge.

Task-based simulations and scenario exercises are particularly valuable for candidates preparing for the information systems and controls section. These exercises mimic real-world challenges, requiring the integration of accounting knowledge with IT processes, risk evaluation, and compliance considerations. Practicing simulations helps candidates develop problem-solving skills, analytical reasoning, and the ability to make informed decisions under time constraints, all of which are crucial for success in the CPA Certification Exam.

Understanding the latest standards, frameworks, and regulations is another essential aspect of preparation. Candidates must stay informed about developments in information security, data privacy, and internal control systems, as these topics form the foundation for practical tasks in the discipline section. Familiarity with these areas ensures that candidates can apply current best practices in evaluating organizational processes, implementing controls, and providing recommendations for improvement.

Career Relevance of the Discipline Section

Completing the discipline section of the CPA Certification Exam demonstrates specialized expertise that is highly relevant to modern accounting and finance careers. Professionals with knowledge of information systems, data management, and internal controls are increasingly sought after for roles that require oversight of financial technology systems, auditing of IT processes, and management of organizational data. Candidates who successfully navigate this section demonstrate the ability to integrate financial knowledge with technology applications, a skill set that enhances both employability and career advancement opportunities.

Roles suited for candidates with this specialization include financial data analyst, IT auditor, systems accountant, and positions in corporate finance, risk management, and information security leadership. The knowledge acquired through the discipline section enables candidates to evaluate business processes, manage data integrity, implement controls, and support strategic decision-making within organizations. This expertise is particularly valuable in industries that rely heavily on technology for financial reporting, operational efficiency, and compliance with regulatory standards.

Candidates who demonstrate proficiency in information systems and controls can contribute to organizational success by identifying operational risks, recommending process improvements, and ensuring that financial systems operate securely and efficiently. This specialization positions professionals to take on leadership responsibilities, oversee complex auditing projects, and support organizations in achieving both financial and technological objectives.

Practical Application of Skills

The practical application of skills is a central focus of the discipline section of the CPA Certification Exam. Candidates are expected to apply knowledge of accounting, auditing, and information systems to evaluate real-world scenarios, assess risks, and implement solutions that enhance operational efficiency and compliance. This requires the ability to interpret complex data, identify system vulnerabilities, and design controls that safeguard financial information.

Candidates must also be capable of performing evaluations of organizational systems, planning audits, and preparing reports that provide actionable recommendations. These tasks demand a combination of technical proficiency, analytical thinking, and communication skills, reflecting the multifaceted nature of modern accounting roles. Successfully applying these skills demonstrates readiness for professional responsibilities that extend beyond traditional financial reporting and into the realm of IT governance, data management, and internal control oversight.

Integrating Technology and Accounting Knowledge

The CPA Certification Exam discipline section on information systems and controls emphasizes the integration of accounting principles with technology expertise. Candidates are required to understand how IT systems support business operations, financial reporting, and risk management. This includes evaluating system availability, data governance, security protocols, and internal control frameworks. The ability to integrate these areas ensures that candidates can provide valuable insights into business processes, improve operational efficiency, and support organizational decision-making.

Understanding the interaction between accounting and technology also involves evaluating compliance with regulatory standards, assessing cybersecurity risks, and implementing best practices for data management. Candidates must be able to navigate complex IT environments while applying accounting knowledge to identify gaps, recommend improvements, and support organizational objectives. This combination of skills reflects the evolving requirements of the accounting profession, where technology plays a central role in financial reporting, auditing, and advisory functions.

Importance of the Discipline Section for CPA Certification

The discipline section of the CPA Certification Exam represents a critical component of professional development, equipping candidates with specialized knowledge that is increasingly relevant in the modern accounting landscape. Successfully completing this section demonstrates the ability to apply accounting expertise to technology-driven environments, manage financial data securely, and evaluate internal controls effectively.

Professionals with this expertise are well-positioned for advanced roles that require oversight of accounting systems, IT audits, and data management initiatives. The skills acquired through this section enhance employability, career growth, and the ability to contribute to organizational success. By integrating financial and technological competencies, candidates demonstrate a comprehensive understanding of modern accounting practices, preparing them to meet the demands of complex, data-driven business environments.

Preparation for the CPA Certification Exam, particularly the discipline section on information systems and controls, requires a strategic, focused, and comprehensive approach. Candidates must develop a deep understanding of accounting principles, auditing practices, IT systems, internal controls, and data management. Success in this section demonstrates the ability to integrate financial knowledge with technology expertise, apply practical solutions to real-world challenges, and support organizational efficiency and compliance. Mastery of these skills positions candidates for rewarding careers in accounting, finance, and technology-focused roles, reflecting the evolving nature of the profession and the increasing importance of IT in financial management and audit practices

Advanced Strategies for CPA Certification Exam Preparation

Effective preparation for the CPA Certification Exam, particularly for the discipline section focused on information systems and controls, requires a comprehensive strategy that combines conceptual understanding with practical application. Candidates should develop a study plan that balances review of core accounting and auditing concepts with in-depth exploration of IT systems, internal controls, and data governance practices. A key component of advanced preparation involves identifying personal strengths and weaknesses, prioritizing topics that require additional focus, and integrating scenario-based exercises that simulate real-world challenges encountered by accounting professionals. Consistent and structured study routines ensure that candidates maintain a high level of readiness for all sections of the exam, particularly the discipline portion which demands both technical and analytical skills.

Candidates are advised to engage with practice simulations that replicate real-world accounting and IT environments. These exercises enhance the ability to apply theoretical knowledge to practical scenarios, evaluate internal control systems, and analyze financial data for accuracy and compliance. Understanding the flow of information through enterprise systems, including how transactions are recorded, processed, and reported, is critical for success. Advanced strategies also include integrating knowledge of regulatory standards and frameworks with practical auditing techniques, allowing candidates to effectively assess risks, identify vulnerabilities, and recommend improvements.

Time management plays a crucial role in advanced exam preparation. Allocating sufficient time for each content area, including information systems, auditing processes, security and privacy, and system and organization controls, ensures comprehensive coverage and retention. Candidates should set clear milestones for study progress, regularly assess their understanding, and adjust their plan to address areas where additional focus is needed. Efficient use of time allows for repeated review of complex concepts, practice with simulations, and reinforcement of key skills, all of which are essential for achieving success in the CPA Certification Exam.

Deepening Knowledge of Exam Content

The discipline section on information systems and controls requires candidates to develop expertise in evaluating IT environments within accounting and finance contexts. Understanding the architecture of accounting systems, including transaction processing, data management, and system reliability, is essential for identifying potential risks and recommending controls. Candidates must also analyze the effectiveness of internal controls, ensuring that financial reporting is accurate, secure, and compliant with regulatory requirements. This content area reflects the evolving nature of the accounting profession, where technology increasingly underpins business operations and financial oversight.

Security and privacy considerations are central to the discipline section. Candidates need to understand the standards, frameworks, and regulations governing data protection, including confidentiality requirements and incident response protocols. The ability to anticipate potential threats, evaluate mitigation strategies, and implement effective controls is critical for professionals tasked with safeguarding sensitive financial information. These skills not only support exam success but also prepare candidates for real-world responsibilities in auditing, financial management, and IT governance roles.

System and organization controls assessments require candidates to integrate their knowledge of auditing principles with technology expertise. Planning and executing evaluations of internal controls, interpreting audit findings, and providing recommendations for process improvements are core skills tested in this section. Candidates must demonstrate analytical reasoning, problem-solving abilities, and the capacity to synthesize information from multiple sources. The discipline section thus bridges the gap between traditional accounting skills and modern technological requirements, emphasizing the application of knowledge in complex, dynamic environments.

Analytical and Applied Skills

The CPA Certification Exam emphasizes both theoretical understanding and practical application, particularly in the discipline section focused on information systems and controls. Candidates must demonstrate their ability to analyze financial data, evaluate system reliability, and design controls that enhance organizational efficiency. This requires attention to detail, critical thinking, and the ability to interpret complex scenarios involving data flows, transaction processing, and compliance considerations. Analytical skills are particularly important for task-based simulations, where candidates must apply knowledge to real-world problems and provide well-reasoned solutions.

Developing applied skills involves practice with scenario-based exercises, case studies, and simulations that replicate the challenges faced by accounting professionals in modern organizations. Candidates learn to evaluate IT systems, assess internal controls, and implement solutions that address operational inefficiencies, data vulnerabilities, and compliance risks. These experiences enhance problem-solving capabilities and reinforce the integration of accounting knowledge with technology expertise. Applied skills also enable candidates to contribute effectively to auditing, financial reporting, and advisory functions within organizations, reflecting the professional competencies expected of CPA-certified individuals.

Candidates should also focus on improving decision-making abilities and prioritization skills. Evaluating multiple potential solutions, determining the most effective course of action, and justifying recommendations are essential competencies for the discipline section. These abilities are directly transferable to professional roles in finance and accounting, where critical thinking and strategic planning are necessary for managing complex systems, mitigating risks, and ensuring regulatory compliance.

Exam Simulation and Practice Techniques

Simulating the exam environment is a key strategy for successful preparation. Candidates should complete timed practice exams that reflect the structure, format, and difficulty of the CPA Certification Exam. This approach helps build familiarity with the pacing required for both multiple-choice questions and task-based simulations. It also reinforces the application of knowledge under exam conditions, improving confidence and performance. Simulations allow candidates to identify gaps in understanding, refine problem-solving approaches, and develop strategies for efficiently navigating complex scenarios.

Practice techniques should focus on integrating knowledge across multiple content areas. Candidates need to evaluate IT systems, assess internal controls, and consider security and privacy requirements in conjunction with core accounting and auditing principles. By practicing comprehensive, scenario-based exercises, candidates develop the ability to synthesize information, analyze risks, and provide solutions that align with professional standards. This holistic approach ensures readiness for the diverse challenges presented in the discipline section of the CPA Certification Exam.

Additionally, candidates should review their performance on practice exercises to identify recurring mistakes and areas needing improvement. Developing a feedback loop that incorporates self-assessment, corrective action, and repeated practice enhances skill retention and reinforces the ability to apply knowledge accurately under exam conditions. Focused practice not only prepares candidates for the exam but also builds competencies essential for professional roles in auditing, data management, and internal control evaluation.

Integrating Professional Knowledge with Technology

The discipline section emphasizes the integration of professional accounting knowledge with information technology expertise. Candidates must understand how enterprise systems, accounting software, and data management practices support financial reporting, operational efficiency, and compliance. Evaluating system availability, monitoring transaction flows, and ensuring data integrity are critical responsibilities tested in this section. Candidates are also expected to assess control environments, implement risk mitigation strategies, and provide recommendations that enhance organizational performance.

This integration reflects the evolving demands of the accounting profession, where technology is increasingly central to financial management, auditing, and advisory services. Candidates who demonstrate the ability to bridge accounting and IT competencies are well-positioned for advanced roles in finance and technology-focused positions. These professionals can contribute to decision-making, support regulatory compliance, and enhance operational effectiveness within organizations, showcasing the value of CPA certification in the modern business environment.

Understanding emerging technologies and regulatory developments is also important for candidates preparing for the CPA Certification Exam. Knowledge of cloud computing, data analytics, cybersecurity, and governance frameworks enhances the ability to evaluate system controls, assess risks, and implement solutions that align with professional standards. Staying informed about industry trends ensures that candidates can apply current best practices in evaluating financial systems and safeguarding organizational data.

Professional Implications of the Discipline Section

Completing the discipline section focused on information systems and controls provides candidates with a competitive advantage in the accounting and finance job market. Professionals with expertise in this area are equipped to manage complex IT systems, evaluate internal controls, oversee auditing processes, and ensure compliance with regulatory standards. The skills developed through this section enhance employability, career advancement, and the ability to contribute strategically to organizational objectives.

Roles for candidates who specialize in information systems and controls include IT auditor, financial data analyst, systems accountant, and positions in corporate finance, risk management, and information security. The knowledge gained through the discipline section enables professionals to assess business processes, manage data integrity, implement controls, and support decision-making, demonstrating the practical value of CPA certification in modern organizations.

Candidates who succeed in this section are recognized for their ability to integrate accounting expertise with technology management, a competency that is increasingly sought after in finance, consulting, and auditing roles. This specialization demonstrates the capacity to navigate complex organizational environments, identify risks, and implement effective controls, positioning candidates for leadership and advisory responsibilities in the accounting profession.

Application of Knowledge in Professional Contexts

The discipline section emphasizes the practical application of knowledge in real-world professional contexts. Candidates are expected to evaluate IT systems, assess internal controls, and apply auditing and accounting principles to ensure accurate financial reporting and operational efficiency. This requires the ability to synthesize information, analyze risks, and provide actionable recommendations, reflecting the multifaceted nature of modern accounting roles.

Candidates must also be capable of planning and executing audits, interpreting findings, and developing solutions that address deficiencies in internal controls, security, and data management. These competencies are directly transferable to professional practice, enabling CPA-certified individuals to contribute effectively to organizational decision-making, compliance initiatives, and risk mitigation strategies. The ability to apply knowledge in practical contexts distinguishes successful candidates and demonstrates the value of CPA certification in advancing professional expertise.

Enhancing Critical Thinking and Decision-Making Skills

Critical thinking and decision-making are central to success in the CPA Certification Exam, particularly in the discipline section. Candidates must evaluate complex scenarios, consider multiple potential outcomes, and determine the most effective course of action. These skills are essential for assessing risks, recommending improvements, and ensuring that accounting systems operate securely and efficiently.

Developing these competencies involves analyzing case studies, performing simulation exercises, and reflecting on the outcomes of various strategies. Candidates who cultivate strong critical thinking and decision-making abilities are better prepared for professional roles that require oversight of financial systems, risk management, and compliance with regulatory standards. These skills also enhance the ability to support strategic decision-making and contribute to organizational objectives in a meaningful way.

Long-Term Value of CPA Certification

The discipline section focused on information systems and controls enhances the long-term value of CPA certification by equipping candidates with specialized expertise that is increasingly relevant in the modern accounting landscape. Professionals who complete this section demonstrate the ability to integrate accounting knowledge with technology, evaluate complex systems, and provide solutions that improve organizational performance.

This expertise opens doors to advanced roles in auditing, financial analysis, IT governance, and advisory services. It also prepares candidates to navigate the evolving demands of the profession, where technology, data integrity, and internal controls play a central role in financial management and decision-making. By mastering the skills tested in this section, candidates strengthen their professional credibility, expand career opportunities, and contribute to organizational success.

Candidates who excel in the discipline section are recognized for their capacity to manage financial systems, evaluate internal controls, ensure regulatory compliance, and support strategic decision-making. This specialization enhances professional growth, positions individuals for leadership responsibilities, and underscores the value of CPA certification in a technology-driven accounting environment

Advanced Exam Readiness for the CPA Certification Exam

Preparing for the CPA Certification Exam requires a multi-layered approach that combines comprehensive study, practical application, and mastery of time management. Candidates should adopt a systematic study routine that addresses all sections of the exam while placing particular emphasis on the discipline section focused on information systems and controls. This section requires candidates to integrate accounting knowledge with technology expertise, analyze complex organizational processes, and evaluate internal controls. Advanced exam readiness begins with understanding the exam structure, the types of questions, and the weighting of multiple-choice and simulation-based assessments.

Candidates should approach preparation by breaking the content into manageable segments and allocating sufficient time for review and practice. Understanding foundational accounting principles, auditing concepts, IT systems, and data management is crucial for achieving high performance. Advanced readiness involves practicing scenario-based tasks that simulate real-world challenges, reinforcing analytical skills, decision-making abilities, and the application of knowledge to complex situations. By mastering both conceptual understanding and practical skills, candidates can approach the CPA Certification Exam with confidence and competence.

Time management strategies are critical for balancing the extensive content covered in the exam. Candidates should develop a detailed study plan that includes specific goals, deadlines, and regular self-assessment to track progress. Allocating time for repeated review of challenging topics ensures retention and reinforces understanding of critical concepts. Practicing under timed conditions simulates the pressure of the actual exam environment, helping candidates develop pacing strategies and reduce anxiety. Advanced exam readiness also involves identifying personal strengths and weaknesses and adapting study methods to target areas that require additional focus.

Mastery of Discipline Section Content

The discipline section on information systems and controls is designed to assess candidates’ ability to apply accounting principles in technology-driven environments. Candidates must demonstrate proficiency in evaluating enterprise systems, assessing internal controls, managing financial data, and ensuring compliance with regulatory standards. This requires a deep understanding of IT infrastructure, system availability, change management, and data governance. The integration of these concepts ensures that candidates are prepared to handle the complexities of modern accounting and auditing practices.

Security and privacy are central themes in the discipline section. Candidates need to understand frameworks, regulations, and best practices for protecting sensitive financial information. This includes evaluating threats, implementing controls, responding to security incidents, and maintaining confidentiality. Professionals with expertise in these areas can contribute to organizational decision-making, support compliance initiatives, and enhance overall operational efficiency. Developing mastery in security and privacy ensures that candidates are equipped to manage risks associated with increasingly complex IT and accounting environments.

System and organization controls require candidates to plan, execute, and evaluate audit engagements, interpreting findings and providing recommendations for improvements. This component emphasizes applied skills, analytical reasoning, and problem-solving abilities. Candidates must be able to synthesize information from multiple sources, evaluate risks, and recommend solutions that strengthen internal controls and improve data integrity. Mastery of these areas demonstrates the ability to bridge traditional accounting knowledge with technological expertise, reflecting the evolving demands of the CPA profession.

Integrating Analytical Skills and Practical Application

Analytical skills are crucial for success in the CPA Certification Exam, particularly in the discipline section. Candidates are expected to assess complex financial and IT scenarios, identify risks, and propose solutions that address system vulnerabilities, operational inefficiencies, and compliance gaps. Developing strong analytical abilities involves practicing simulations, case studies, and scenario-based exercises that mimic real-world challenges. These exercises require the integration of accounting knowledge with technology management, enhancing the ability to make informed decisions and provide actionable recommendations.

Practical application is reinforced through repeated exposure to task-based simulations that test candidates’ ability to evaluate systems, implement controls, and analyze data flows. Candidates must demonstrate proficiency in interpreting information, detecting discrepancies, and applying professional judgment to resolve issues. By consistently practicing applied scenarios, candidates build confidence in their decision-making abilities and develop skills that are directly transferable to professional accounting and auditing roles. This integration of analytical reasoning and practical application is essential for achieving success in both the exam and professional practice.

Developing advanced problem-solving skills requires understanding the interconnections between accounting processes and IT systems. Candidates must evaluate the impact of control deficiencies, assess operational risks, and design solutions that enhance data integrity and system reliability. This approach ensures that candidates can address real-world challenges, contribute to organizational efficiency, and provide value through informed decision-making and robust control assessments.

Study Techniques for Advanced Preparation

Candidates preparing for the CPA Certification Exam should adopt study techniques that combine conceptual review with active problem-solving. Creating detailed study schedules, setting specific learning objectives, and incorporating self-assessment are key strategies for ensuring comprehensive preparation. Reviewing foundational accounting and auditing principles alongside IT and system controls content enhances understanding and reinforces critical knowledge areas.

Engaging with scenario-based exercises and practice simulations is particularly effective for developing applied skills. These exercises simulate real-world tasks that accountants and auditors encounter, requiring candidates to evaluate data, implement controls, and provide recommendations. By practicing in a controlled environment, candidates can refine analytical skills, decision-making abilities, and proficiency in applying knowledge to practical situations. This approach not only prepares candidates for the exam but also strengthens professional competencies essential for CPA-certified roles.

Advanced preparation also involves integrating regulatory knowledge, best practices, and emerging technology trends into the study process. Understanding the latest frameworks for data security, system controls, and IT governance ensures that candidates can apply current standards in evaluating organizational processes. This knowledge supports both exam success and professional effectiveness, reflecting the increasing role of technology in accounting and finance.

Career Impact and Professional Growth

Successfully completing the discipline section of the CPA Certification Exam demonstrates specialized expertise that is highly valued in accounting and finance careers. Candidates with proficiency in information systems and controls are equipped to manage complex financial systems, assess risks, and ensure compliance with regulatory standards. This expertise enhances employability, career advancement, and the ability to contribute strategically to organizational objectives.

Professionals with this specialization can pursue roles such as IT auditor, financial data analyst, systems accountant, and positions in corporate finance, risk management, and information security. The knowledge and skills gained through the discipline section enable candidates to evaluate business processes, manage data integrity, implement controls, and support decision-making. These capabilities are increasingly important in organizations that rely on technology for financial reporting, operational efficiency, and regulatory compliance.

Candidates who excel in this section are recognized for their ability to integrate accounting expertise with technological understanding. This combination of skills positions professionals for leadership responsibilities, oversight of financial systems, and advisory roles that support organizational success. Mastery of information systems and controls reflects the evolving demands of the accounting profession, where technology, data integrity, and internal controls play a central role in operational effectiveness.

Long-Term Value of CPA Certification

The discipline section focused on information systems and controls enhances the long-term value of CPA certification by equipping candidates with specialized knowledge relevant to modern accounting environments. Professionals who complete this section demonstrate the ability to integrate accounting knowledge with technology expertise, evaluate complex systems, and provide solutions that improve organizational performance. This expertise is increasingly important in a profession where technological proficiency is critical for auditing, financial reporting, and data governance.

The knowledge acquired through the discipline section opens doors to advanced roles in finance, auditing, IT governance, and advisory services. It prepares candidates to navigate complex organizational environments, assess operational risks, implement controls, and support strategic decision-making. By demonstrating proficiency in these areas, candidates strengthen their professional credibility, expand career opportunities, and contribute to organizational success in roles that require both accounting and technology expertise.

CPA certification also provides a platform for continuous professional growth, enabling candidates to pursue advanced responsibilities and leadership positions. Mastery of the discipline section demonstrates a commitment to professional excellence, adaptability to emerging industry trends, and the ability to apply integrated knowledge in practical contexts. This positions candidates as valuable contributors to organizations seeking professionals capable of managing technology-driven accounting systems while ensuring financial accuracy and compliance.

Applying Knowledge to Real-World Scenarios

The practical application of knowledge is a defining feature of the discipline section. Candidates are expected to analyze IT systems, evaluate internal controls, and apply auditing and accounting principles to ensure accurate financial reporting. Real-world scenarios often involve complex data flows, system vulnerabilities, and compliance considerations. Candidates must demonstrate the ability to synthesize information, assess risks, and implement solutions that enhance operational efficiency and data integrity.

This application extends to planning and executing audit engagements, interpreting findings, and developing recommendations for improvement. Candidates who develop these applied skills are prepared to navigate professional challenges, support organizational decision-making, and contribute to effective financial management. The discipline section thus bridges theoretical knowledge and practical expertise, reflecting the demands of modern CPA-certified professionals.

Enhancing Professional Competencies

Preparing for the CPA Certification Exam, and particularly the discipline section, enhances a range of professional competencies. Candidates develop analytical thinking, problem-solving abilities, decision-making skills, and the capacity to integrate accounting knowledge with technology. These competencies are essential for performing audits, evaluating financial systems, managing data integrity, and ensuring compliance with regulatory standards.

Candidates also cultivate the ability to communicate findings effectively, provide actionable recommendations, and contribute strategically to organizational goals. These skills are directly transferable to professional roles in accounting, auditing, finance, and technology management. The discipline section emphasizes the application of knowledge in practical contexts, ensuring that CPA-certified professionals are equipped to handle the complexities of modern business environments.

Advanced preparation for the CPA Certification Exam requires an integrated approach that combines theoretical understanding, applied skills, analytical reasoning, and strategic planning. The discipline section on information systems and controls prepares candidates for professional responsibilities that bridge accounting expertise with technology management. By mastering these skills, candidates enhance their professional credibility, expand career opportunities, and contribute effectively to organizational success. Success in this section demonstrates readiness for complex auditing, financial management, and advisory roles, reflecting the evolving demands of the accounting profession and the long-term value of CPA certification.

Exam Day Strategies for the CPA Certification Exam

Proper exam day preparation is critical for achieving success on the CPA Certification Exam, particularly for the discipline section focused on information systems and controls. Candidates should approach the exam with a clear plan that includes time management, stress reduction techniques, and familiarity with the exam format. Understanding the structure of the exam, including the distribution of multiple-choice questions and task-based simulations, allows candidates to allocate time efficiently and prioritize questions based on difficulty and familiarity. Preparing for exam day also involves mental and physical readiness, including adequate rest, nutrition, and strategies to maintain focus and concentration throughout the testing period.

Candidates are encouraged to simulate exam conditions during practice sessions to become comfortable with the pacing and pressure of the actual exam environment. Timed practice tests help in developing strategies for allocating time to different sections, identifying questions that require deeper analysis, and managing fatigue. Familiarity with the computer interface and navigation tools used in the exam can reduce anxiety and ensure smoother execution on test day. Candidates should also plan logistics in advance, including transportation, check-in procedures, and materials allowed during the exam, to minimize distractions and unexpected delays.

Review Techniques and Knowledge Reinforcement

Effective review techniques are essential for consolidating knowledge before the CPA Certification Exam. Candidates should focus on reinforcing core concepts, revisiting challenging topics, and applying knowledge to practical scenarios. Review should involve both conceptual understanding and applied practice, integrating multiple-choice questions with simulations that test problem-solving, analytical thinking, and decision-making skills. Organizing review sessions by content areas such as accounting processes, auditing principles, IT systems, data governance, and internal controls ensures comprehensive coverage and retention of essential material.

Active learning strategies, such as summarizing information, creating flowcharts, and discussing complex topics with peers or mentors, enhance understanding and memory retention. Candidates can also use scenario-based exercises to apply theoretical knowledge to real-world situations, improving their ability to analyze data, assess risks, and implement solutions. Reviewing previous errors and understanding the reasoning behind correct answers reinforces learning and helps candidates avoid repeating mistakes during the actual exam. Focused review sessions in the final weeks before the exam maximize retention and ensure readiness for the diverse challenges presented in the discipline section.

Integration of Knowledge Across Exam Sections

The CPA Certification Exam requires candidates to integrate knowledge from multiple areas, including auditing, financial accounting, regulatory standards, and information systems. Successful candidates demonstrate the ability to connect concepts across disciplines, apply analytical skills to complex scenarios, and evaluate organizational processes from both accounting and technology perspectives. This integration ensures that candidates can address real-world challenges, assess risks, and recommend solutions that enhance operational efficiency, data integrity, and regulatory compliance.

For the discipline section on information systems and controls, integration involves evaluating IT systems alongside internal controls, auditing standards, and financial reporting requirements. Candidates must consider how technology supports business processes, manages data, and mitigates risks. Applying this integrated knowledge in practice enhances problem-solving abilities, improves decision-making, and demonstrates readiness for professional responsibilities that require a comprehensive understanding of both accounting and technology. Integration also helps candidates recognize interdependencies between processes, identify systemic weaknesses, and implement effective improvements in organizational operations.

Application of Analytical and Decision-Making Skills

Analytical and decision-making skills are central to the CPA Certification Exam, particularly in the discipline section. Candidates are expected to evaluate complex scenarios, assess risks, and determine appropriate courses of action. Developing these skills requires consistent practice with simulations, case studies, and scenario-based exercises that reflect real-world challenges in accounting and technology management. Candidates must analyze data flows, assess internal controls, identify vulnerabilities, and recommend improvements that align with professional standards.

Effective decision-making involves considering multiple factors, weighing potential outcomes, and prioritizing solutions that maximize efficiency, accuracy, and compliance. Candidates who excel in analytical thinking can interpret complex information, evaluate risk scenarios, and provide recommendations that enhance organizational performance. This skill set is highly valuable in professional practice, equipping CPA-certified individuals to manage auditing engagements, oversee financial systems, and support strategic decision-making in finance and technology roles.

Post-Exam Reflection and Continuous Improvement

After completing the CPA Certification Exam, candidates should engage in post-exam reflection to evaluate performance, identify areas of strength, and recognize opportunities for improvement. Reviewing exam experiences, analyzing challenging questions, and assessing study methods provide insights that inform future professional development. Continuous improvement ensures that candidates build on their knowledge, refine analytical and problem-solving skills, and remain current with evolving industry standards and practices.

Post-exam reflection also contributes to long-term professional growth by reinforcing concepts learned during preparation and highlighting areas that require further attention. Candidates who adopt a mindset of continuous learning are better equipped to adapt to changes in accounting regulations, auditing standards, and technology applications. This approach fosters professional resilience, enhances career development, and ensures ongoing competence in accounting and finance roles.

Professional Implications and Career Applications

The CPA Certification Exam, particularly the discipline section on information systems and controls, prepares candidates for a range of advanced career opportunities. Professionals with expertise in this area are equipped to manage complex IT systems, evaluate internal controls, assess risks, and support strategic decision-making. The skills developed through this section enhance employability, career progression, and the ability to contribute to organizational success in roles that integrate accounting and technology expertise.

Careers for candidates who complete this discipline section include IT auditor, financial data analyst, systems accountant, and positions in corporate finance, risk management, and information security. The knowledge gained enables professionals to evaluate business processes, implement controls, ensure compliance, and support organizational objectives. Candidates who demonstrate proficiency in integrating accounting and technology are positioned for leadership roles, advisory functions, and responsibilities that require oversight of financial systems and operational efficiency.

The discipline section also emphasizes the importance of staying current with emerging technologies, regulatory developments, and industry best practices. Professionals who maintain up-to-date knowledge can anticipate risks, implement effective controls, and provide guidance that enhances organizational performance. This ongoing learning reinforces the long-term value of CPA certification, ensuring that candidates remain competitive and capable in a dynamic business environment.

Long-Term Professional Growth Through CPA Certification

Achieving CPA certification provides a foundation for continuous professional growth and career advancement. The discipline section on information systems and controls equips candidates with specialized expertise that is increasingly relevant in modern accounting and finance. Professionals who complete this section can bridge accounting knowledge with technology management, evaluate organizational processes, and implement improvements that enhance efficiency and compliance.

The long-term benefits of CPA certification include expanded career opportunities, recognition of expertise, and the ability to assume leadership and advisory roles within organizations. Candidates with proficiency in information systems and controls can contribute strategically to financial management, auditing, risk assessment, and decision-making processes. This specialization reflects the evolving demands of the accounting profession and demonstrates a commitment to maintaining professional excellence, adaptability, and technical competence.

Candidates who excel in the discipline section demonstrate the ability to navigate complex organizational environments, integrate accounting and technology knowledge, and provide solutions that strengthen internal controls, data integrity, and operational effectiveness. These competencies are valuable for organizations seeking professionals capable of managing technology-driven financial systems, mitigating risks, and supporting strategic initiatives. CPA certification serves as a benchmark of professional competence, credibility, and readiness to meet the challenges of modern accounting roles.

Integrating Exam Preparation With Career Planning

Advanced CPA candidates recognize that exam preparation and career planning are closely interconnected. Mastering the discipline section requires developing skills that are directly applicable to professional responsibilities, including auditing, financial management, IT governance, and advisory services. Integrating exam preparation with career objectives ensures that candidates are not only ready to pass the CPA Certification Exam but also prepared to apply knowledge effectively in professional contexts.

Candidates should align study efforts with career goals by focusing on areas of accounting and technology that are most relevant to their intended professional path. This approach enhances both exam performance and readiness for roles that require specialized expertise in information systems, internal controls, and data management. By linking preparation to career objectives, candidates can maximize the return on investment in their CPA certification, ensuring that the knowledge and skills gained translate into tangible professional benefits.

Continuous Learning and Adaptability in Professional Practice

The CPA Certification Exam emphasizes the importance of continuous learning and adaptability. Candidates must develop the ability to apply knowledge in evolving business environments, stay current with emerging standards, and respond to technological advancements. The discipline section on information systems and controls reinforces the need for accountants to be proficient in both financial principles and IT management. Professionals who maintain a commitment to ongoing education and skill development are better prepared to meet the demands of modern accounting, auditing, and finance roles.

Continuous learning enhances the ability to anticipate risks, evaluate organizational processes, and implement effective controls. Adaptability ensures that CPA-certified professionals can respond to changes in regulations, industry trends, and technological innovations. These qualities are essential for maintaining professional competence, supporting organizational objectives, and sustaining long-term career growth in accounting and finance.

Conclusion

The CPA Certification Exam, particularly the discipline section focused on information systems and controls, requires advanced preparation, analytical skills, practical application, and strategic exam readiness. Candidates must integrate accounting knowledge with technology expertise, evaluate internal controls, manage data integrity, and apply regulatory standards to real-world scenarios. Success in this section demonstrates professional competence, enhances career opportunities, and positions candidates for leadership and advisory roles.

Exam day strategies, comprehensive review techniques, integration of knowledge across sections, and post-exam reflection contribute to overall exam success. The skills developed through the discipline section provide long-term value by preparing candidates to navigate complex organizational environments, support decision-making, and maintain compliance in technology-driven accounting roles. CPA certification reflects a commitment to professional excellence, continuous learning, and the ability to apply integrated knowledge in practical, high-impact contexts

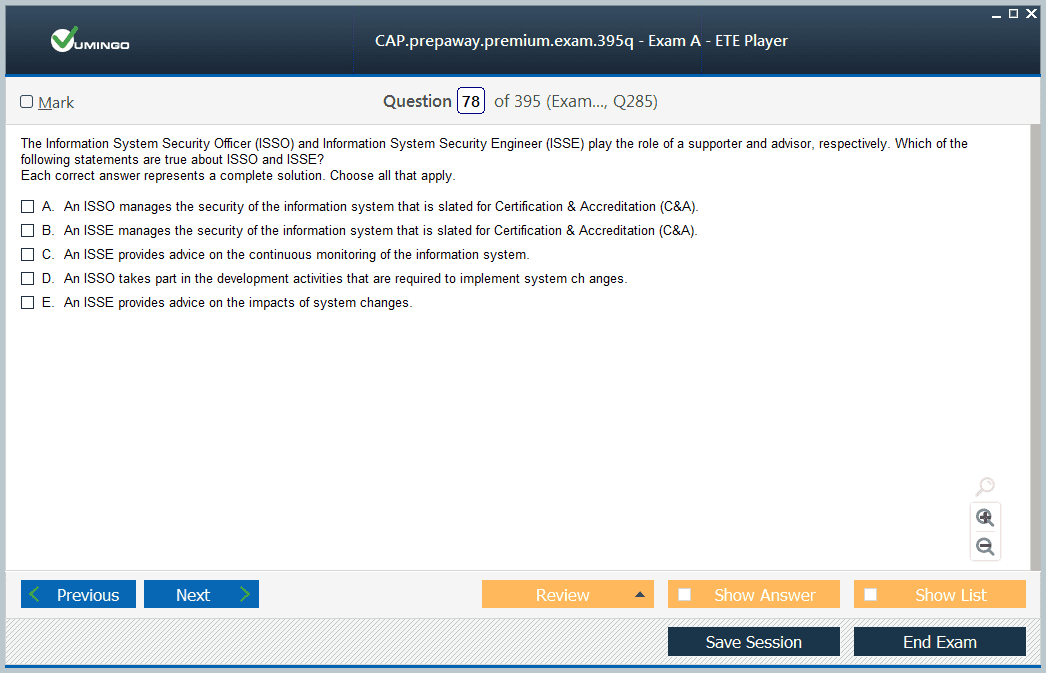

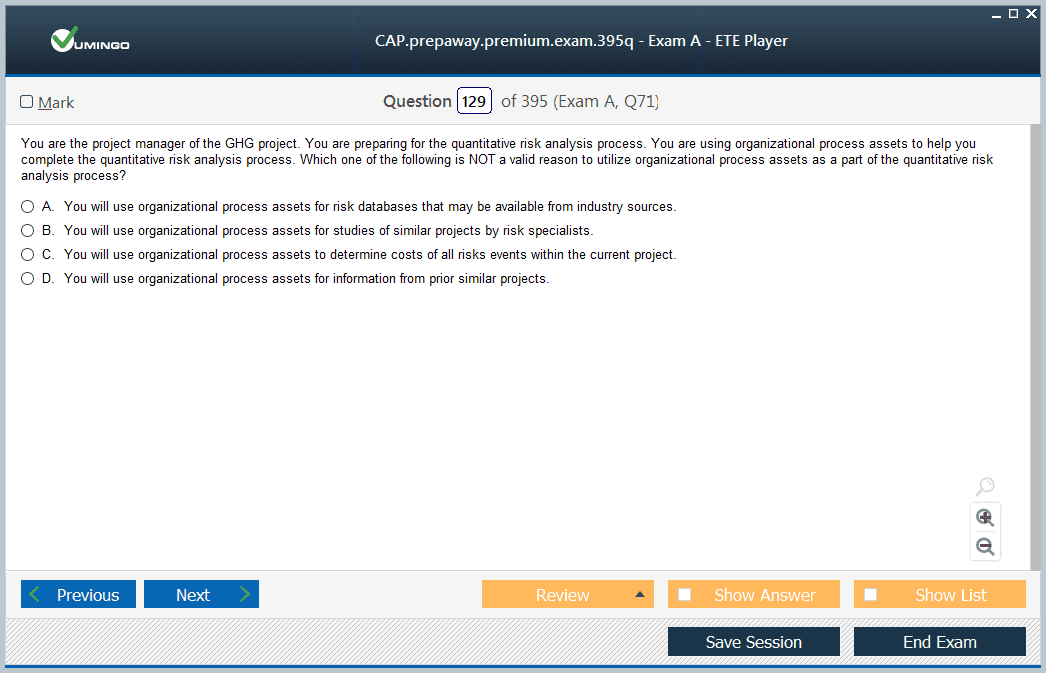

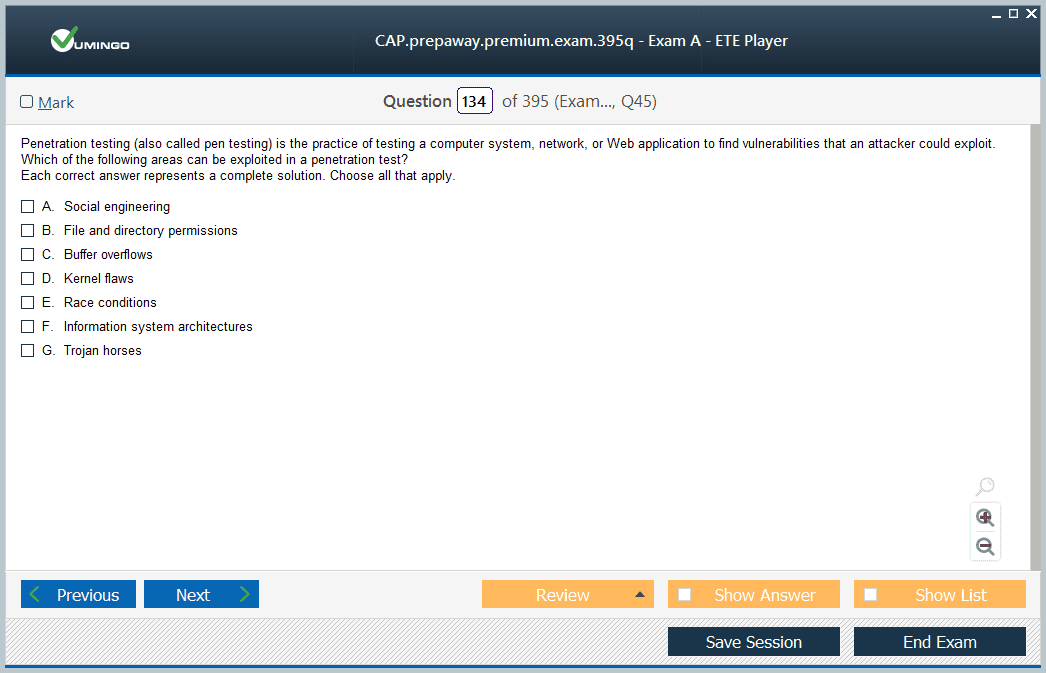

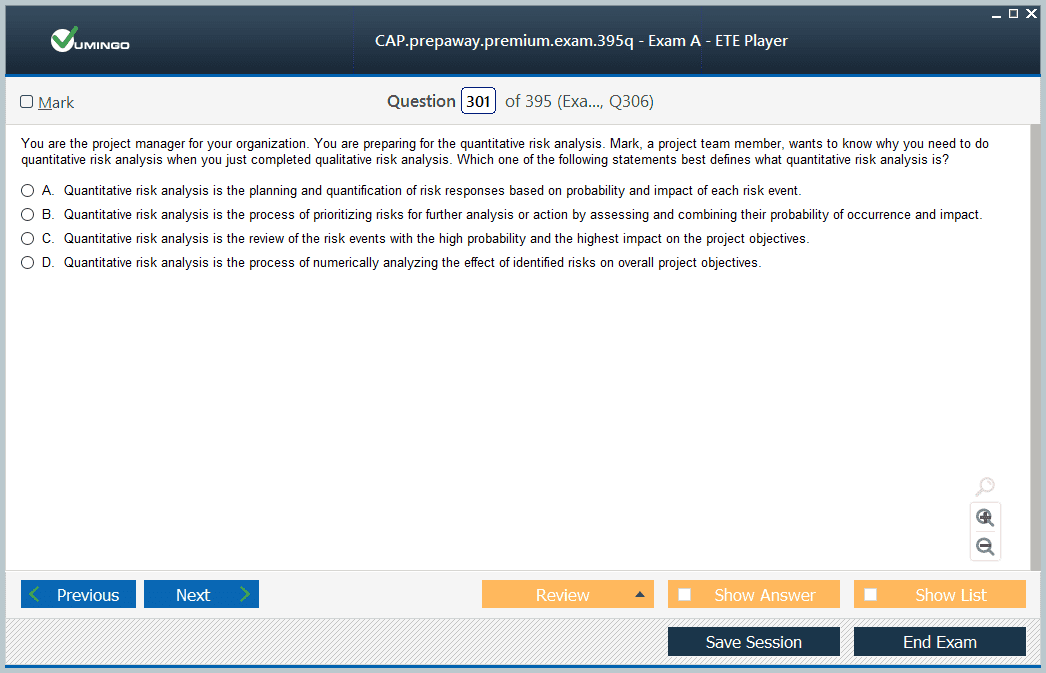

ISC CAP practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass CAP Certified Authorization Professional certification exam dumps & practice test questions and answers are to help students.

Exam Comments * The most recent comment are on top

- CISSP - Certified Information Systems Security Professional

- CCSP - Certified Cloud Security Professional (CCSP)

- SSCP - System Security Certified Practitioner (SSCP)

- CISSP-ISSAP - Information Systems Security Architecture Professional

- CISSP-ISSEP - Information Systems Security Engineering Professional

- CISSP-ISSMP - Information Systems Security Management Professional

- CAP - Certified Authorization Professional

- CSSLP - Certified Secure Software Lifecycle Professional

Why customers love us?

What do our customers say?

The resources provided for the ISC certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the CAP test and passed with ease.

Studying for the ISC certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the CAP exam on my first try!

I was impressed with the quality of the CAP preparation materials for the ISC certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The CAP materials for the ISC certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the CAP exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my ISC certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for CAP. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the CAP stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my CAP certification exam. The support and guidance provided were top-notch. I couldn't have obtained my ISC certification without these amazing tools!

The materials provided for the CAP were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed CAP successfully. It was a game-changer for my career in IT!

I want to know if I qualify for the ISC2 CAP exam in case I don’t have any work experience. Maybe someone had the same situation? What did you do?

Thanks in Advance