- Home

- IIA Certifications

- IIA-CFSA Certified Financial Services Auditor Dumps

Pass IIA IIA-CFSA Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

IIA-CFSA Premium File

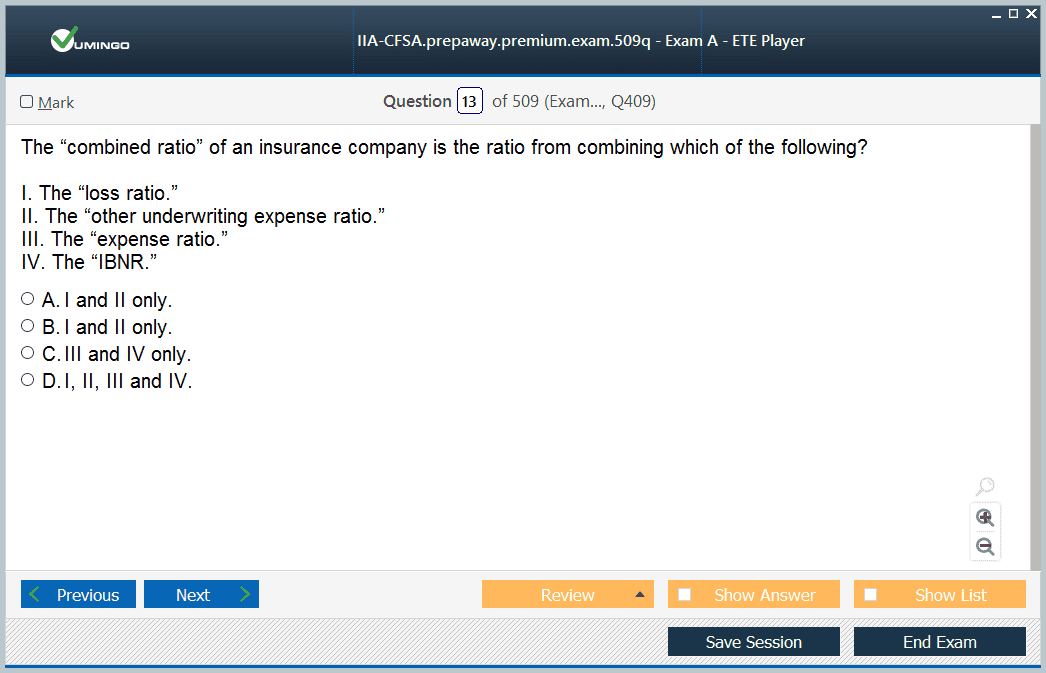

- Premium File 509 Questions & Answers. Last Update: Jan 31, 2026

Whats Included:

- Latest Questions

- 100% Accurate Answers

- Fast Exam Updates

Last Week Results!

All IIA IIA-CFSA certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the IIA-CFSA Certified Financial Services Auditor practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

IIA-CFSA: Elevate Your Career in Financial Services Auditing

The IIA Certified Financial Services Auditor certification represents a specialized qualification for professionals engaged in auditing within the financial sector. It is designed for individuals working across a variety of financial institutions, including banking, insurance, investment firms, mutual funds, brokerage houses, regulatory agencies, and security or commodity companies. This certification equips auditors with in-depth knowledge and practical skills essential for evaluating financial operations, processes, and compliance frameworks, enabling them to navigate complex financial environments effectively.

The value of this certification lies in its alignment with the dynamic nature of the financial services industry. It is structured to reflect current industry expectations, regulatory trends, and emerging risks, ensuring that certified professionals are well-prepared to address challenges in auditing, risk management, and governance. By acquiring this credential, auditors demonstrate their expertise in both technical auditing principles and the broader operational context of financial services, providing a distinct competitive advantage.

Eligibility Requirements for IIA-CFSA

To pursue the IIA-CFSA certification, candidates must meet specific eligibility criteria that ensure readiness for the rigorous examination process. Candidates are required to hold a four-year post-secondary degree from an accredited institution or, alternatively, possess three years of professional experience combined with two years of post-secondary education.

Additionally, applicants must provide a character reference that confirms their professional conduct and suitability for certification. This reference is typically completed by a senior professional in the auditing or financial sector or the candidate’s immediate supervisor. The eligibility period for completing the certification process is four years from the date of application approval, giving candidates adequate time to prepare and fulfill all requirements.

Core Domains of the IIA-CFSA Curriculum

The certification curriculum is divided into four primary domains, each addressing critical aspects of financial services auditing. The first domain, auditing financial services products, focuses on evaluating the design, functionality, and risk profiles of various financial instruments. This includes the ability to identify inherent risks, assess compliance with industry standards, and determine the effectiveness of control measures applied to these products.

The second domain, financial services auditing, emphasizes comprehensive auditing practices across the three major financial sectors: banking, insurance, and securities. It covers audit planning, evidence collection, risk assessment, and reporting methodologies that enable auditors to conduct thorough evaluations of financial institutions.

The third domain, auditing financial services processes, addresses operational and procedural auditing within organizations. This involves examining internal workflows, control mechanisms, and process efficiency to identify vulnerabilities, improve operational effectiveness, and ensure adherence to organizational policies.

The fourth domain, the regulatory environment, explores compliance requirements and legal frameworks that govern financial activities. Auditors must understand applicable laws, standards, and regulatory expectations to ensure that institutions operate within defined parameters and maintain accountability to stakeholders.

Exam Format and Structure

The IIA-CFSA examination is delivered through computer-based testing and is accessible in multiple languages. Candidates can schedule the exam at approved testing centers. The examination comprises 115 multiple-choice questions, with a total duration of two hours and fifty-five minutes.

The exam is designed to evaluate both general and specialized knowledge. Approximately 80% of the questions cover the three main sectors—banking, insurance, and securities—providing a broad assessment of industry expertise. The remaining 20% focus on the candidate’s selected specialization, allowing for deeper evaluation in a particular area of interest and reflecting the candidate’s proficiency in their chosen field.

Preparation Strategies for IIA-CFSA

Effective preparation for the IIA-CFSA requires a comprehensive approach combining theoretical study and practical application. Candidates should begin by reviewing the official study guide, which outlines the topics, learning objectives, and essential auditing principles. Complementary resources, such as textbooks, reference materials, and training kits, offer additional context, practice questions, and exercises to reinforce understanding.

Preparation should emphasize the development of key competencies, including risk assessment, internal control evaluation, regulatory compliance, and auditing of financial processes. Practicing exam-style questions under timed conditions is recommended to simulate the actual testing environment, improve time management, and enhance accuracy. Candidates are encouraged to integrate case studies and real-world scenarios to bridge theoretical knowledge with practical application.

Developing Core Auditing Competencies

The IIA-CFSA certification fosters several critical competencies required for effective auditing in financial services. These include the ability to analyze complex financial instruments, interpret financial statements, assess operational risks, and evaluate compliance with regulatory frameworks.

Auditors also develop skills in identifying control weaknesses, recommending improvements, and ensuring organizational governance. The certification emphasizes analytical thinking, problem-solving, and decision-making, enabling professionals to address challenges proactively and contribute to the financial integrity of institutions.

Practical Application and Career Impact

Beyond exam preparation, IIA-CFSA candidates are expected to apply their knowledge in professional contexts. Engaging with real-world auditing scenarios helps consolidate learning, refine judgment, and improve practical skills. Exposure to financial operations, compliance audits, and risk assessments enhances the auditor’s ability to evaluate processes, detect inefficiencies, and provide actionable recommendations.

The certification significantly influences career development. Professionals holding IIA-CFSA credentials are positioned for advancement into senior auditing roles, risk management, and leadership positions within financial organizations. It demonstrates advanced expertise, ethical standards, and readiness to manage complex auditing responsibilities, thereby enhancing professional credibility and employability.

Maintaining Certification and Professional Growth

Certified professionals must maintain their credential by engaging in continuous professional development. Ongoing education, training, and staying informed of industry changes ensure that auditors remain current with evolving financial regulations, emerging risks, and best practices in auditing.

Maintaining certification reflects a commitment to excellence and lifelong learning, reinforcing the auditor’s role as a trusted professional. It also supports sustained career growth by enhancing the auditor’s ability to adapt to changes in financial markets, regulatory frameworks, and organizational practices.

Advanced Skills and Specialization

The IIA-CFSA encourages specialization and mastery of advanced auditing techniques. Professionals develop expertise in sector-specific regulations, risk assessment methodologies, and auditing strategies tailored to banking, insurance, or securities. This specialization allows auditors to provide targeted insights, enhance organizational decision-making, and ensure compliance with both internal and external requirements.

Advanced skills also include evaluating emerging financial products, monitoring systemic risks, and integrating technology into auditing processes. Certified auditors are trained to interpret complex data, assess financial performance, and identify potential vulnerabilities within institutions, supporting informed and strategic decision-making.

Integration with Organizational Objectives

Certified auditors play a pivotal role in aligning auditing activities with organizational goals. Their insights support risk management, compliance, and operational efficiency, contributing to the overall stability and success of financial institutions. The IIA-CFSA equips professionals with the ability to evaluate processes critically, ensure regulatory adherence, and provide recommendations that enhance organizational governance.

Auditors with this certification are also better equipped to communicate findings effectively, collaborate with management teams, and support strategic planning. Their expertise ensures that auditing processes are not only thorough but also aligned with the institution’s objectives and regulatory expectations.

Long-Term Value of Certification

The IIA-CFSA credential offers long-term professional value. It enhances recognition within the financial industry, signaling expertise, integrity, and a commitment to professional standards. Certified auditors are viewed as capable of managing complex audits, addressing sector-specific risks, and contributing to sound financial management practices.

The certification also fosters continuous professional growth. It encourages auditors to stay updated on regulatory changes, industry trends, and technological advancements, ensuring that their skills remain relevant and valuable throughout their careers.

Building Confidence and Professional Authority

Achieving the IIA-CFSA designation instills confidence in auditors by validating their knowledge, skills, and professional judgment. It establishes authority in financial services auditing, allowing professionals to influence organizational practices, improve risk management, and enhance compliance frameworks.

Certified auditors are equipped to lead audit engagements, mentor junior professionals, and provide strategic guidance to management. Their expertise strengthens institutional integrity, supports regulatory compliance, and promotes operational excellence.

Exam Readiness and Strategic Study

Successful completion of the IIA-CFSA exam requires strategic study and thorough understanding of all domains. Candidates should focus on mastering the principles of auditing, financial analysis, and regulatory compliance while integrating practical applications through case studies and practice exercises.

Developing a structured study plan, prioritizing areas of complexity, and applying problem-solving techniques are essential to exam readiness. Consistent review, self-assessment, and engagement with practice scenarios help reinforce knowledge and enhance the ability to perform under exam conditions.

Applying Knowledge in Dynamic Environments

The certification emphasizes the application of auditing knowledge in dynamic financial environments. Professionals are trained to assess evolving risks, evaluate process changes, and ensure compliance amidst regulatory updates. This practical approach prepares auditors to handle real-world challenges and make informed decisions that support organizational objectives.

Certified auditors gain experience in evaluating complex financial transactions, interpreting performance metrics, and assessing operational effectiveness. Their ability to apply knowledge strategically enhances institutional governance, strengthens internal controls, and supports sustainable financial practices.

Continuous Learning and Adaptation

The IIA-CFSA promotes continuous learning, encouraging auditors to adapt to emerging financial instruments, technological advancements, and changing regulatory frameworks. Ongoing education ensures that certified professionals remain proficient in contemporary auditing practices and capable of addressing new challenges effectively.

Adaptation skills are critical for auditors who must respond to evolving market conditions, manage emerging risks, and provide recommendations that maintain organizational resilience. The certification fosters a mindset of proactive learning and professional growth, ensuring long-term relevance in the auditing field.

Enhancing Organizational Governance

Certified financial services auditors contribute to robust governance structures within organizations. Their expertise supports risk mitigation, ensures compliance, and strengthens operational processes. By applying auditing principles strategically, these professionals help organizations achieve regulatory adherence, operational efficiency, and financial transparency.

The certification equips auditors with the analytical tools and judgment required to identify deficiencies, recommend improvements, and monitor implementation of corrective measures. Their role in governance extends beyond compliance, influencing strategic decision-making and promoting organizational accountability.

The IIA Certified Financial Services Auditor certification represents a comprehensive pathway for auditing professionals seeking specialized expertise in financial services. It encompasses knowledge of products, processes, auditing techniques, regulatory frameworks, and sector-specific risks essential for effective practice.

Through eligibility verification, structured preparation, and practical application, candidates develop the competencies necessary to excel in financial services auditing. Achieving this certification signifies mastery of specialized auditing skills, adherence to professional standards, and readiness to enhance organizational accountability and governance.

Professionals holding this credential benefit from career advancement, increased recognition, and the ability to influence organizational performance. The IIA-CFSA supports ongoing professional development, ensuring auditors remain effective, knowledgeable, and adaptable in a rapidly evolving financial environment.

Preparing for the IIA-CFSA Exam

Effective preparation for the IIA-CFSA exam begins with a clear understanding of its objectives and the competencies it evaluates. The certification assesses knowledge across multiple dimensions of financial services auditing, including product assessment, process evaluation, regulatory compliance, and sector-specific risk analysis. To succeed, candidates must integrate theoretical knowledge with practical application, developing an ability to analyze complex scenarios and make informed audit judgments.

Candidates should start by studying the core domains of the exam thoroughly. Understanding auditing financial services products involves analyzing the structure and functionality of banking instruments, insurance policies, investment products, and securities. This domain emphasizes risk identification, control evaluation, and compliance verification to ensure that financial products operate effectively and adhere to relevant standards.

The domain covering financial services auditing focuses on the methodology and principles underlying audit engagements. Candidates must master audit planning, testing procedures, evidence collection, and reporting techniques. This ensures that auditors can conduct comprehensive assessments of financial operations and identify control weaknesses that could impact organizational integrity.

Auditing financial services processes requires a detailed examination of operational workflows within institutions. Candidates must learn to evaluate internal controls, assess efficiency, and detect process gaps. Mastery of this domain enables auditors to recommend process improvements, enhance organizational performance, and ensure that internal controls operate effectively across diverse business units.

The regulatory environment domain is crucial for understanding the legal and compliance framework governing financial institutions. Candidates need to be familiar with laws, regulations, and industry standards, and must develop the ability to assess institutional adherence to these requirements. Knowledge in this area ensures that auditors can navigate complex compliance challenges and support organizational accountability.

Study Materials and Resources

The official study guide provided by the certifying body is a fundamental resource for exam preparation. It outlines exam objectives, details key concepts, and provides guidance on the application of auditing principles in financial contexts. Supplementary resources, including textbooks and training materials, can enhance understanding by offering practical examples, case studies, and sample exercises.

Practice is a critical component of preparation. Candidates should simulate exam conditions by answering practice questions under timed scenarios to build familiarity with the exam structure, improve time management, and enhance accuracy. Practicing with sector-specific case studies helps candidates bridge theoretical knowledge with real-world auditing scenarios, developing critical thinking and problem-solving skills essential for the exam and professional practice.

Developing a structured study schedule is recommended. Dividing preparation into focused sessions for each domain ensures comprehensive coverage. Emphasis should be placed on areas of complexity or lesser familiarity to reinforce understanding and minimize gaps in knowledge. Combining review of theoretical content with practical application supports deeper learning and strengthens the ability to analyze complex auditing situations effectively.

Exam Format and Question Types

The IIA-CFSA exam employs a computer-based format with multiple-choice questions designed to evaluate both general and specialized auditing knowledge. The exam consists of 115 questions, with a duration of nearly three hours. Questions are distributed across general financial services sectors and the candidate’s chosen area of specialization, requiring a balanced understanding of broad concepts and sector-specific details.

Understanding the structure of questions is essential for success. Candidates should focus on interpreting scenarios accurately, identifying relevant risk factors, and applying appropriate auditing techniques. Developing skills in analyzing question prompts and distinguishing critical information ensures efficient and accurate responses. Time management strategies are crucial to ensure that all questions are addressed within the allotted exam period.

Enhancing Analytical and Critical Thinking

A key component of success in the IIA-CFSA exam is the ability to apply analytical and critical thinking skills to audit scenarios. Candidates must evaluate complex financial transactions, assess risk exposure, and determine the adequacy of controls. Analytical skills allow auditors to identify patterns, anomalies, and potential areas of concern within financial data and institutional processes.

Critical thinking supports decision-making by enabling auditors to weigh evidence, consider alternative perspectives, and draw reasoned conclusions. By integrating analytical and critical thinking abilities, candidates enhance their capacity to interpret financial information, assess operational effectiveness, and provide recommendations that support organizational objectives.

Practical Applications and Scenario-Based Learning

The IIA-CFSA exam emphasizes practical application through scenario-based questions. Candidates are expected to apply auditing principles to realistic situations, simulating challenges encountered in financial institutions. This approach reinforces the connection between theoretical knowledge and professional practice, preparing candidates to navigate real-world auditing scenarios.

Scenario-based learning develops problem-solving skills by requiring candidates to analyze situations, identify risks, and recommend corrective actions. It also enhances judgment and decision-making capabilities, enabling auditors to respond effectively to diverse challenges across banking, insurance, and securities sectors.

Risk Assessment and Internal Controls

An essential aspect of financial services auditing is evaluating risk and internal controls. Candidates must be proficient in identifying operational, financial, and compliance risks, and in assessing the effectiveness of control mechanisms implemented to mitigate these risks.

Understanding control frameworks, such as segregation of duties, transaction monitoring, and regulatory compliance checks, enables auditors to detect vulnerabilities and recommend enhancements. Mastery of risk assessment techniques ensures that auditors can provide comprehensive evaluations that safeguard organizational integrity and promote accountability.

Sector-Specific Knowledge

The IIA-CFSA requires candidates to demonstrate knowledge of sector-specific regulations, practices, and challenges. Banking, insurance, and securities sectors each have unique operational structures, compliance requirements, and risk profiles.

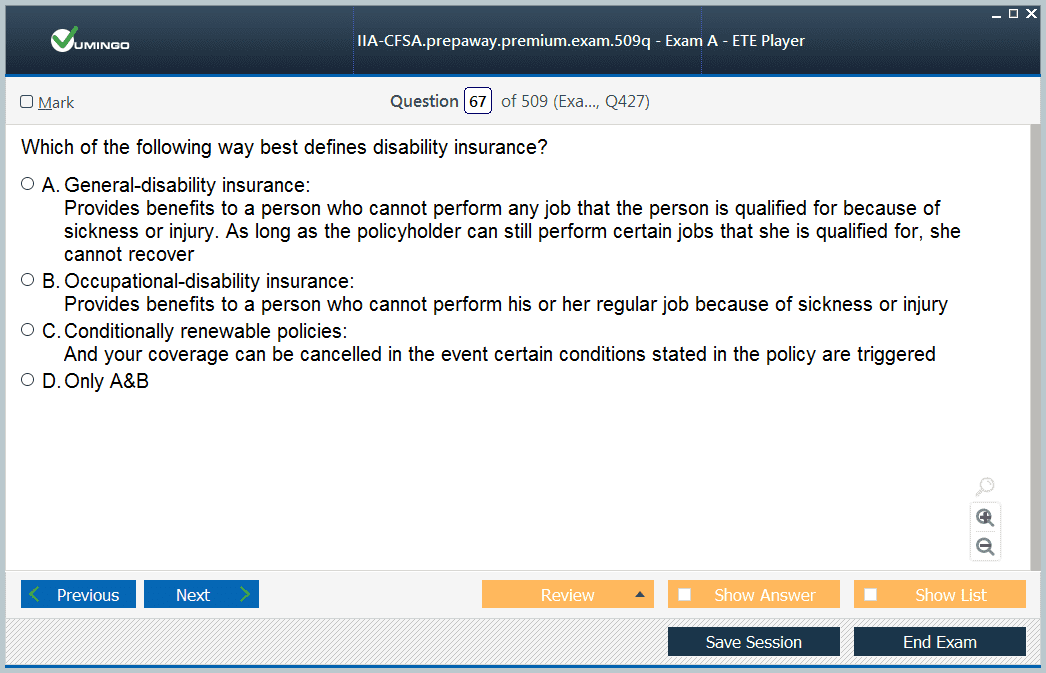

In banking, auditors must understand lending practices, deposit management, and capital adequacy requirements. Insurance auditing emphasizes policy administration, claims processing, underwriting, and regulatory compliance. Securities auditing involves investment management, trade processing, and risk evaluation associated with market activities.

Developing expertise in a chosen sector allows auditors to provide in-depth evaluations and tailored recommendations. Candidates should focus on understanding sector-specific risk indicators, operational procedures, and regulatory frameworks to ensure comprehensive audit coverage.

Developing Professional Judgment

The IIA-CFSA certification emphasizes the development of professional judgment. Auditors are required to assess situations, prioritize issues, and determine appropriate audit responses. Professional judgment is cultivated through study, practice, and exposure to real-world scenarios, allowing auditors to make decisions that balance risk, compliance, and operational efficiency.

Professional judgment also involves interpreting complex regulations, evaluating financial information, and making recommendations that align with organizational objectives. By developing this skill, auditors enhance their effectiveness in providing assurance, improving controls, and supporting governance frameworks within financial institutions.

Ethical Considerations in Financial Services Auditing

Ethics play a critical role in financial services auditing. Candidates are expected to understand ethical principles, integrity standards, and professional responsibilities that guide auditing practice. Maintaining objectivity, confidentiality, and accountability ensures that auditors uphold the trust placed in them by stakeholders.

Ethical awareness enables auditors to navigate conflicts of interest, identify potential misconduct, and ensure compliance with professional standards. Integrating ethical principles into auditing practice enhances credibility, supports regulatory adherence, and promotes responsible financial management.

Integrating Technology in Auditing

Technology increasingly influences financial services auditing. Candidates should be familiar with auditing software, data analytics tools, and risk management systems that facilitate comprehensive evaluation of financial operations. Technology integration enhances efficiency, accuracy, and the ability to analyze large volumes of data.

Auditors trained in technology applications can identify trends, detect anomalies, and perform predictive analysis to assess risk exposure. Understanding the role of technology in auditing supports informed decision-making, strengthens control evaluations, and improves reporting accuracy.

Exam Strategy and Time Management

Strategic preparation for the IIA-CFSA exam involves both knowledge acquisition and effective exam techniques. Candidates should allocate time to review all core domains, practice scenario-based questions, and identify areas requiring additional focus.

Time management is critical during the exam. Candidates should develop the ability to read questions carefully, prioritize responses, and maintain a steady pace to ensure completion within the allotted time. Practicing under timed conditions simulates the exam environment, reduces stress, and enhances performance.

The IIA-CFSA certification is a comprehensive qualification that equips auditors with specialized skills in financial services auditing. It encompasses product evaluation, process auditing, regulatory compliance, and sector-specific expertise, ensuring that certified professionals are well-prepared to address challenges in complex financial environments.

Through structured preparation, practical application, and development of analytical, judgmental, and ethical competencies, candidates can achieve mastery in auditing. The certification enhances career prospects, professional recognition, and the ability to contribute effectively to organizational governance and risk management.

Certified auditors benefit from ongoing professional growth, continuous learning, and the ability to adapt to evolving industry practices, positioning them as trusted advisors and key contributors to the integrity of financial institutions.

Mastering Risk-Based Auditing in Financial Services

A core component of the IIA-CFSA certification is mastering risk-based auditing. This approach focuses on identifying and assessing the risks that could affect the objectives of financial institutions. Candidates must develop skills to prioritize audit efforts based on risk significance, ensuring that high-risk areas receive the most scrutiny while maintaining a comprehensive view of the institution's operations.

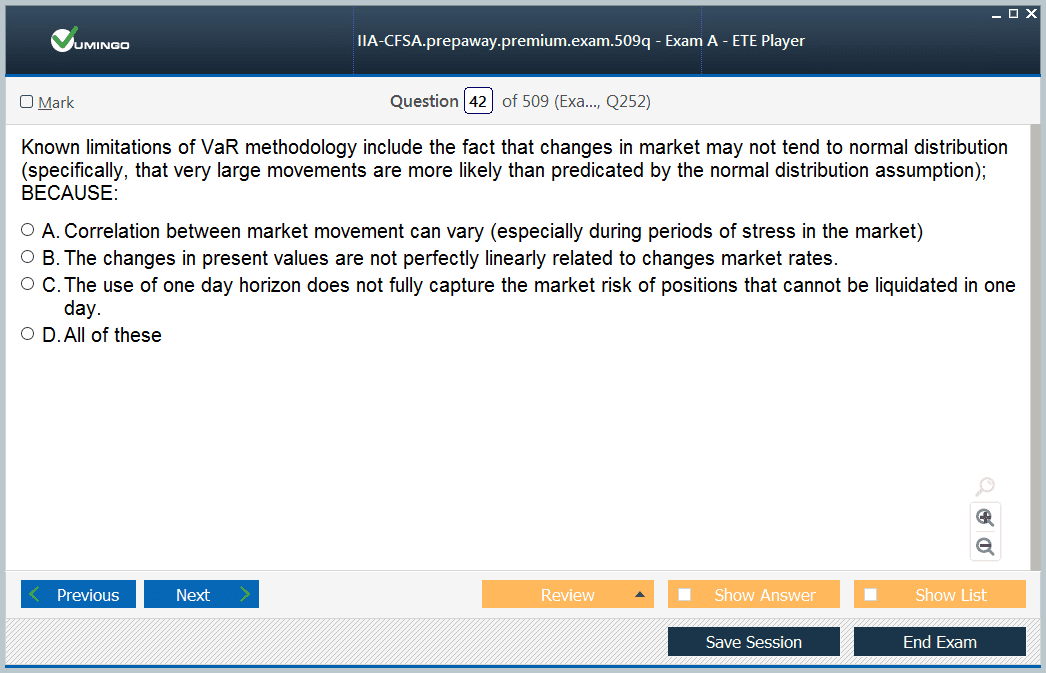

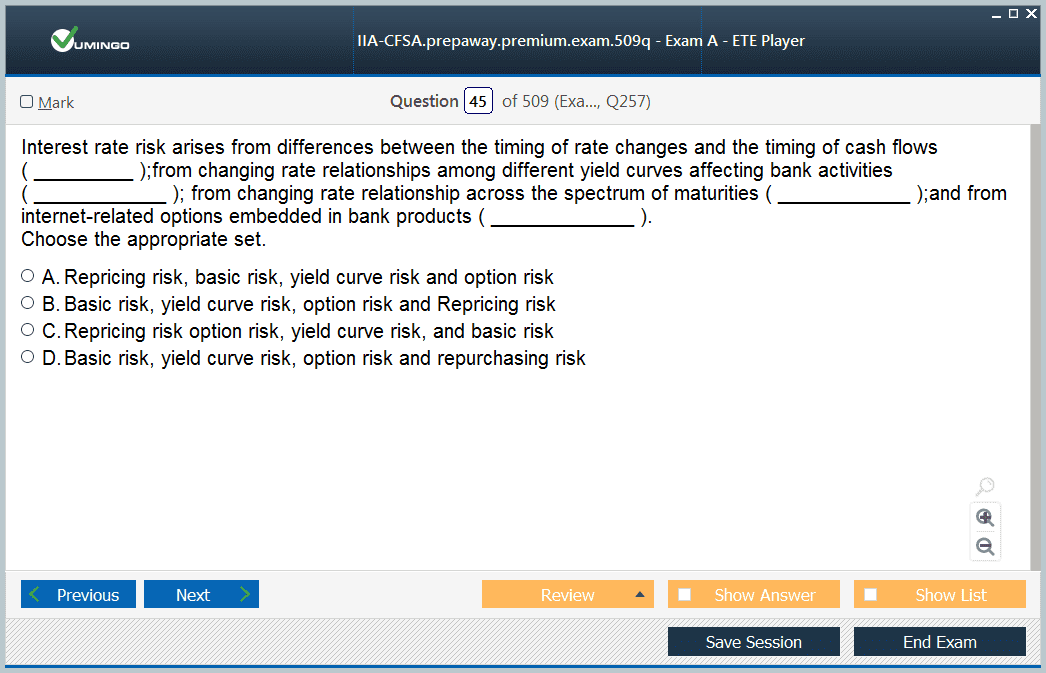

Risk-based auditing involves a thorough understanding of operational, financial, and compliance risks. Operational risks include failures in processes, people, or systems that could result in financial loss or reputational damage. Financial risks cover exposures related to credit, market fluctuations, liquidity, and capital adequacy. Compliance risks relate to the potential for violations of laws, regulations, and internal policies. Auditors must be able to evaluate these risks and determine the sufficiency of controls in mitigating them.

The practice of risk-based auditing requires integrating analytical techniques, professional judgment, and sector-specific knowledge. Candidates must learn to assess the probability and impact of risks, develop audit plans that target critical areas, and document findings in a structured manner. This methodology ensures efficient allocation of audit resources and strengthens the institution's overall risk management framework.

Regulatory Compliance and Governance

Understanding regulatory compliance and governance structures is a critical aspect of the IIA-CFSA certification. Auditors are expected to assess whether financial institutions adhere to applicable laws, regulatory standards, and internal policies. Familiarity with governance structures allows auditors to evaluate decision-making processes, accountability mechanisms, and oversight functions.

Candidates should focus on interpreting regulatory requirements, monitoring compliance activities, and evaluating reporting mechanisms. Auditors play a key role in ensuring that institutions maintain transparency, adhere to ethical standards, and manage risks effectively. Strong knowledge of governance principles supports the identification of control gaps and the provision of actionable recommendations to management and boards.

Auditing Financial Services Products

Auditing financial services products requires an in-depth understanding of the instruments offered by banking, insurance, and securities organizations. Each product carries unique risks, regulatory considerations, and operational procedures. Candidates must analyze product features, transaction flows, and associated controls to determine compliance and performance effectiveness.

In banking, auditors review loan portfolios, deposit schemes, and investment offerings. They assess credit evaluation procedures, interest calculations, and reporting accuracy. In insurance, auditors examine policy issuance, claims management, underwriting practices, and premium calculations. In securities, auditing focuses on trading activities, investment valuations, settlement processes, and regulatory reporting.

Competency in product auditing ensures that auditors can identify errors, fraud risks, and inefficiencies while providing recommendations to enhance control frameworks. Candidates must develop an ability to evaluate complex product structures and understand their implications on institutional risk profiles.

Evaluating Financial Services Processes

The audit of processes in financial services requires analyzing workflows, control mechanisms, and operational efficiency. Candidates must develop skills to review end-to-end processes, identify weaknesses, and recommend improvements. Process auditing encompasses transaction processing, data integrity, reconciliation procedures, and operational compliance.

Auditors evaluate segregation of duties, approval hierarchies, monitoring systems, and reporting mechanisms to ensure that processes function as intended. Understanding how processes interconnect allows auditors to identify systemic risks and propose corrective actions that enhance operational reliability.

The ability to evaluate processes across banking, insurance, and securities sectors equips auditors with the expertise to manage complex audits that span multiple business units and functions. This competency supports continuous improvement, risk mitigation, and alignment with strategic objectives.

Integrating Audit Methodology and Tools

The IIA-CFSA emphasizes the integration of auditing methodology with practical tools. Candidates must be proficient in audit planning, evidence collection, testing procedures, and reporting techniques. Utilizing technology, such as data analytics software and automated control testing tools, enhances audit efficiency and accuracy.

Data-driven auditing enables auditors to analyze large volumes of transactions, identify patterns, and detect anomalies. Proficiency in these tools allows candidates to perform audits that are both comprehensive and precise, ensuring that findings are supported by quantitative evidence and actionable insights.

Understanding audit methodology also involves documentation practices. Auditors must prepare reports that clearly communicate findings, recommendations, and risk implications. Effective reporting supports management decision-making and reinforces the institution's control environment.

Sector-Specific Expertise

Sector-specific expertise is essential for success in the IIA-CFSA exam. Banking, insurance, and securities each have distinct operational characteristics, regulatory frameworks, and risk exposures. Candidates must develop a deep understanding of sector-specific practices to evaluate risks accurately and provide relevant audit recommendations.

In banking, knowledge of lending policies, liquidity management, and interest rate risk is critical. In insurance, understanding claim processing, risk underwriting, and policy compliance ensures thorough auditing. In securities, expertise in market operations, investment compliance, and trade settlement is necessary.

Developing sector-specific knowledge allows auditors to address nuanced challenges, apply appropriate controls, and support regulatory compliance. It ensures that audit findings are meaningful and aligned with the operational realities of the chosen sector.

Advanced Risk Assessment Techniques

The IIA-CFSA certification emphasizes advanced risk assessment techniques to enhance audit effectiveness. Candidates must be adept at evaluating risk exposure, estimating potential impact, and prioritizing audit activities. Techniques such as scenario analysis, stress testing, and risk modeling support informed decision-making.

Scenario analysis allows auditors to anticipate potential adverse events and evaluate control responses. Stress testing examines the resilience of processes under extreme conditions. Risk modeling quantifies exposure and helps prioritize areas requiring attention. Mastery of these techniques enables auditors to deliver assessments that are both precise and actionable.

Professional Judgment and Decision-Making

Professional judgment is a cornerstone of financial services auditing. Candidates must integrate knowledge, experience, and analytical skills to make informed decisions regarding audit scope, findings, and recommendations. Exercising professional judgment ensures that audits are conducted efficiently, risks are accurately assessed, and controls are effectively evaluated.

Decision-making involves evaluating alternative courses of action, considering risk implications, and providing management with recommendations that enhance institutional performance. Developing this competency prepares candidates for leadership roles in auditing and risk management.

Ethical Standards and Integrity

Adherence to ethical standards is essential in financial services auditing. Candidates must understand principles of integrity, objectivity, confidentiality, and professional behavior. Auditors are entrusted with sensitive financial information, and maintaining ethical standards ensures credibility, compliance, and trustworthiness.

Ethical awareness supports the identification of conflicts of interest, fraudulent activities, and regulatory breaches. Integrating ethics into auditing practice strengthens professional reputation and reinforces stakeholder confidence in audit outcomes.

Continuous Learning and Professional Development

The dynamic nature of financial services requires auditors to engage in continuous learning and professional development. Staying updated on regulatory changes, emerging risks, and technological advancements ensures that auditors maintain relevance and effectiveness.

Continuous professional development allows auditors to refine skills, expand knowledge, and adapt methodologies to evolving industry practices. This commitment to learning enhances career growth and reinforces the value of the IIA-CFSA certification in supporting long-term professional success.

Exam Strategy and Preparation

Effective exam preparation involves a structured approach that combines theoretical study, practical application, and simulated testing. Candidates should focus on understanding core domains, practicing scenario-based questions, and reviewing sector-specific knowledge.

Developing a study schedule that allocates dedicated time for each domain ensures comprehensive preparation. Emphasizing challenging topics and reinforcing weak areas improves confidence and readiness. Practicing under timed conditions simulates the exam environment, enhancing performance and time management skills.

The IIA-CFSA certification equips auditors with the expertise required to navigate complex financial environments. Mastery of auditing principles, risk assessment techniques, sector-specific knowledge, professional judgment, and ethical standards ensures that certified professionals are prepared to address operational and regulatory challenges effectively.

By integrating practical skills, advanced methodologies, and continuous learning, candidates can achieve excellence in financial services auditing. The certification enhances career prospects, strengthens professional credibility, and positions auditors as key contributors to the integrity and governance of financial institutions.

Audit Planning and Risk Prioritization

Audit planning is a fundamental component of the IIA-CFSA certification process. Candidates must develop the ability to design comprehensive audit plans that focus on high-risk areas within financial institutions. Effective planning begins with understanding the organizational structure, key processes, and potential risk exposures. Auditors are expected to identify significant operational, financial, and compliance risks and allocate resources accordingly.

Prioritizing audit activities based on risk severity ensures that audits are both efficient and effective. Techniques such as risk scoring, control mapping, and process analysis help determine which areas require immediate attention and which can be addressed later. A structured approach to planning allows auditors to cover critical areas while maintaining a holistic perspective on the institution’s operations and objectives.

Regulatory Analysis and Compliance Evaluation

A deep understanding of regulatory frameworks is critical for financial services auditors. The IIA-CFSA emphasizes evaluating whether institutions adhere to applicable regulations, internal policies, and ethical standards. Candidates must be proficient in analyzing regulatory requirements, identifying compliance gaps, and recommending corrective measures.

Auditors must evaluate governance structures to ensure that decision-making processes, reporting lines, and oversight functions align with regulatory expectations. This includes reviewing documentation, monitoring reports, and operational practices to verify compliance. By integrating regulatory analysis with practical auditing skills, candidates can provide valuable insights that strengthen institutional governance and risk management frameworks.

Financial Products Auditing

Auditing financial products is a core aspect of the IIA-CFSA exam. Candidates are required to understand the structures, risk profiles, and operational requirements of products offered by banking, insurance, and securities organizations. Auditors assess product-related risks, operational processes, and compliance with regulatory standards.

In banking, auditors review loan origination, credit evaluation, deposit management, and investment instruments. In insurance, the focus is on policy issuance, claims processing, underwriting procedures, and premium calculations. In securities, auditing encompasses trading activities, investment management, portfolio valuation, and settlement processes. Proficiency in product auditing ensures that auditors can detect inefficiencies, errors, and compliance violations while recommending control improvements.

Process Review and Operational Control

Auditing processes within financial services institutions requires examining workflows, internal controls, and operational efficiency. Candidates must develop skills to assess end-to-end processes, identify control gaps, and suggest improvements. Process auditing includes reviewing transaction flows, reconciliations, data integrity, and approval hierarchies.

Understanding the interconnections between processes allows auditors to detect systemic risks and implement corrective measures. Effective process reviews support operational reliability, strengthen internal controls, and reduce the likelihood of errors or fraud. Knowledge of sector-specific processes ensures that audit recommendations are relevant and actionable.

Technology Integration in Auditing

The use of technology in auditing is increasingly important in modern financial services. IIA-CFSA candidates are expected to leverage data analytics, automated testing tools, and audit management software to enhance audit efficiency and accuracy. Technology facilitates the analysis of large datasets, identification of anomalies, and evaluation of control effectiveness.

Data-driven auditing enables auditors to focus on critical risk areas, detect irregularities, and provide evidence-based recommendations. Understanding how to integrate technology into audit methodology is essential for conducting comprehensive audits and delivering actionable insights.

Sector-Specific Knowledge Development

A key aspect of the IIA-CFSA certification is the development of sector-specific expertise. Banking, insurance, and securities each have unique operational characteristics, regulatory requirements, and risk exposures. Candidates must understand these nuances to evaluate risks accurately and provide informed audit recommendations.

In banking, auditors examine credit risk, liquidity risk, and operational controls. In insurance, they focus on claims management, underwriting, and policy compliance. In securities, auditors review market operations, trade settlements, and investment compliance. Mastery of sector-specific knowledge allows auditors to identify potential risks, assess controls effectively, and contribute to institutional resilience.

Risk Assessment and Analytical Techniques

Advanced risk assessment techniques are central to financial services auditing. IIA-CFSA candidates must be skilled in evaluating potential risk exposure, determining impact, and prioritizing audit efforts. Techniques such as scenario analysis, stress testing, and risk modeling help auditors anticipate challenges and assess control effectiveness.

Scenario analysis enables auditors to forecast potential adverse events and evaluate institutional responses. Stress testing examines processes under extreme conditions to identify vulnerabilities. Risk modeling quantifies exposures and supports resource allocation for high-priority audit areas. Mastery of these analytical techniques ensures that auditors can deliver precise and actionable assessments.

Ethical Considerations and Professional Conduct

Ethical standards are integral to the practice of financial services auditing. IIA-CFSA candidates must adhere to principles of integrity, objectivity, confidentiality, and professional behavior. Auditors handle sensitive financial information and must maintain ethical conduct to ensure credibility and trustworthiness.

Ethical awareness helps auditors identify conflicts of interest, detect fraudulent activity, and maintain compliance with regulatory requirements. Integrating ethics into auditing practices reinforces stakeholder confidence and strengthens the overall governance framework of financial institutions.

Exam Preparation and Strategy

Successful completion of the IIA-CFSA exam requires a structured preparation strategy. Candidates should focus on understanding the four main domains, practicing scenario-based questions, and developing sector-specific expertise. A balanced study plan that allocates time to each domain ensures comprehensive coverage of the syllabus.

Engaging in practical exercises and simulated exams helps candidates build familiarity with the question format and time management. Reviewing areas of weakness and reinforcing difficult concepts enhances confidence and readiness for the exam. Applying theoretical knowledge to real-world scenarios ensures that candidates are well-prepared for both the exam and professional practice.

Continuous Learning and Career Advancement

The dynamic nature of financial services auditing necessitates ongoing professional development. IIA-CFSA candidates are encouraged to stay current with emerging risks, regulatory changes, and technological advancements. Continuous learning enhances auditing competencies and supports long-term career growth.

Regularly updating knowledge allows auditors to refine methodologies, strengthen risk assessment capabilities, and adapt to evolving industry practices. Commitment to professional growth reinforces the value of the certification and ensures sustained relevance in the financial services sector.

Certification and Professional Recognition

Upon successful completion of the exam and fulfillment of eligibility requirements, candidates receive formal recognition as Certified Financial Services Auditors. This credential demonstrates expertise in auditing financial services, risk assessment, and regulatory compliance. It distinguishes professionals in the field and enhances credibility with employers and clients.

Certification signifies that the auditor possesses the knowledge, skills, and judgment required to evaluate complex financial operations effectively. It positions professionals to take on advanced roles in auditing, risk management, and governance within financial institutions.

The IIA-CFSA certification equips auditors with comprehensive knowledge and practical skills necessary for financial services auditing. Candidates gain expertise in risk-based auditing, sector-specific processes, regulatory compliance, and ethical standards. Mastery of these areas enables auditors to assess risks effectively, strengthen controls, and contribute to the resilience of financial institutions.

Integration of audit methodology, analytical techniques, and continuous learning ensures that certified professionals are prepared to navigate the complexities of modern financial services. The certification enhances career prospects, professional credibility, and positions auditors as key contributors to organizational integrity and governance.

Advanced Audit Methodologies

In financial services auditing, advanced methodologies are essential for assessing complex operations. IIA-CFSA candidates are expected to understand and apply techniques that address the intricate nature of banking, insurance, and securities functions. This involves evaluating transaction flows, internal control systems, and organizational processes to identify risks and inefficiencies. Candidates must be skilled in selecting appropriate audit techniques for different scenarios, including sampling methods, analytical procedures, and substantive testing. Advanced methodologies help auditors to provide a more accurate assessment of institutional performance and risk exposure.

Data Analytics and Audit Tools

The role of data analytics in financial auditing continues to expand. Auditors pursuing IIA-CFSA certification must develop proficiency in using technology-driven tools to enhance audit effectiveness. This includes analyzing large datasets to detect anomalies, trends, and potential control weaknesses. Familiarity with audit management software, automated testing tools, and data visualization techniques allows auditors to interpret complex information efficiently. Integrating technology into audit processes improves accuracy, reduces manual errors, and enables auditors to focus on high-risk areas, thus enhancing the overall value of the audit function.

Risk Management Integration

A significant aspect of IIA-CFSA preparation involves integrating risk management principles into audit practice. Candidates are expected to identify, assess, and prioritize risks within financial institutions. This includes operational, credit, market, liquidity, and compliance risks across banking, insurance, and securities sectors. Auditors must evaluate the effectiveness of risk mitigation measures, internal controls, and monitoring systems. Risk-based auditing ensures that audit efforts are focused on areas with the highest potential impact, providing meaningful recommendations to improve institutional resilience and governance practices.

Sector-Specific Case Studies

Exam preparation for IIA-CFSA requires a deep understanding of sector-specific issues through the study of case studies. Banking case studies often focus on loan management, credit assessment, and regulatory reporting. Insurance case studies cover claims processing, policy administration, underwriting, and compliance with insurance regulations. Securities case studies highlight trade settlements, investment risk management, and compliance with securities laws. Reviewing real-world scenarios enables candidates to apply theoretical knowledge to practical situations, improving problem-solving skills and decision-making during audits.

Audit Reporting and Communication

Effective communication is a critical skill for financial services auditors. Candidates must be able to document findings clearly, provide actionable recommendations, and communicate results to management and stakeholders. Audit reports should convey key risks, control gaps, and improvement opportunities in a concise and understandable manner. IIA-CFSA candidates are expected to develop proficiency in both written and verbal reporting, ensuring that stakeholders can act on audit insights efficiently. Clear communication also supports transparency, accountability, and organizational learning.

Internal Controls Evaluation

Evaluating internal controls is a core function of the IIA-CFSA certification. Auditors must assess the design, implementation, and effectiveness of controls within financial services organizations. This includes controls over financial reporting, operational processes, compliance, and IT systems. Effective internal control evaluation requires understanding how control mechanisms interact across different processes and identifying weaknesses that could lead to errors, fraud, or regulatory breaches. Candidates are trained to recommend improvements that enhance control reliability and institutional governance.

Ethical and Professional Standards

Adherence to ethical and professional standards is fundamental in financial services auditing. IIA-CFSA candidates must demonstrate integrity, objectivity, confidentiality, and professional behavior. Ethical awareness ensures auditors can identify conflicts of interest, maintain impartiality, and uphold regulatory and organizational standards. Emphasis on professional conduct helps auditors establish credibility, reinforce stakeholder trust, and contribute to a culture of accountability within financial institutions.

Exam Structure and Question Types

Understanding the structure of the IIA-CFSA exam is essential for effective preparation. The exam consists of 115 multiple-choice questions and is administered via computer-based testing. The duration is approximately two hours and fifty-five minutes. The exam content is divided into a weighted focus, with 80% covering banking, insurance, and securities sectors collectively, and 20% focusing on the candidate’s chosen specialization. Familiarity with the format allows candidates to manage time efficiently, approach different question types strategically, and ensure thorough coverage of all domains.

Strategic Study Approaches

Preparation for the IIA-CFSA exam benefits from a structured and strategic approach. Candidates should create study plans that cover all domains, allocate sufficient time to challenging topics, and incorporate regular practice assessments. Utilizing study guides, practice questions, and scenario-based exercises enhances understanding of complex concepts and application skills. Reviewing sector-specific risks, control frameworks, and regulatory expectations ensures readiness for both the exam and practical auditing tasks. Effective study strategies include active learning, self-assessment, and targeted review of weak areas.

Continuous Professional Development

Continuous professional development is a cornerstone of career advancement in financial services auditing. IIA-CFSA candidates are encouraged to stay updated on evolving industry practices, regulatory changes, and emerging risks. Engaging in professional learning activities, attending seminars, and reviewing industry publications strengthens audit competencies and supports long-term career growth. Maintaining professional development ensures auditors remain relevant, enhance their skill set, and contribute effectively to organizational risk management and governance initiatives.

Comprehensive Risk Assessment

A comprehensive approach to risk assessment is crucial for IIA-CFSA certified professionals. This involves identifying potential risks, evaluating their likelihood and impact, and prioritizing audit interventions. Techniques such as scenario planning, stress testing, and quantitative risk modeling allow auditors to analyze complex situations and anticipate potential operational, financial, and regulatory challenges. By integrating these assessments into audit planning, candidates ensure a systematic and thorough evaluation of organizational resilience and control effectiveness.

Governance and Oversight

Governance structures play a significant role in financial services auditing. IIA-CFSA candidates must understand how boards, committees, and executive management oversee risk management, compliance, and operational performance. Auditors evaluate the effectiveness of governance mechanisms, decision-making processes, and accountability frameworks. This includes assessing reporting lines, supervisory responsibilities, and policy enforcement. Strong governance oversight supports organizational integrity, enhances transparency, and mitigates the likelihood of control failures or regulatory breaches.

Practical Application of Audit Knowledge

The IIA-CFSA certification emphasizes the application of audit knowledge to real-world financial services scenarios. Candidates must demonstrate the ability to integrate auditing principles, risk assessment, regulatory compliance, and sector-specific knowledge into actionable recommendations. Practical exercises, case studies, and simulation tests provide opportunities to practice decision-making, problem-solving, and analytical reasoning. Applying theoretical understanding to complex situations ensures auditors are capable of delivering value through their assessments and recommendations.

Integration of Technology in Financial Audits

Technology is integral to modern financial services auditing. IIA-CFSA candidates are expected to leverage audit software, data analytics, and automated testing tools to enhance audit quality and efficiency. Technology supports detailed data examination, anomaly detection, and validation of control effectiveness. Familiarity with technological applications allows auditors to manage large datasets, monitor trends, and provide evidence-based insights. Integration of technology ensures comprehensive audits and enhances the reliability and timeliness of audit findings.

Career Implications of Certification

Achieving the IIA-CFSA certification provides significant professional recognition and career advancement opportunities. Certified auditors are distinguished by their expertise in financial services auditing, risk management, and compliance evaluation. The certification signals to employers and stakeholders that the auditor possesses the knowledge, skills, and judgment required to navigate complex financial operations. IIA-CFSA professionals are positioned for leadership roles, specialized audit functions, and strategic contributions to organizational risk management and governance initiatives.

Ethical Judgment and Decision-Making

Ethical judgment is critical for auditors handling sensitive financial information. IIA-CFSA candidates are trained to identify ethical dilemmas, assess potential conflicts of interest, and make decisions that uphold professional standards. This includes evaluating transactions, reporting discrepancies, and ensuring compliance with regulatory requirements. Ethical decision-making strengthens trust, supports organizational integrity, and fosters accountability throughout financial institutions.

Post-Certification Responsibilities

After earning the IIA-CFSA certification, professionals are expected to maintain ongoing competence through continuous education and professional development activities. This includes updating knowledge on emerging risks, sector-specific innovations, and regulatory amendments. Maintaining certification reinforces expertise, enhances professional credibility, and ensures auditors remain effective contributors to financial services governance and risk management frameworks.

Strategic Audit Planning

Strategic audit planning involves aligning audit objectives with organizational goals, risk priorities, and compliance requirements. IIA-CFSA candidates must develop plans that incorporate sector-specific considerations, regulatory expectations, and operational priorities. Effective planning includes resource allocation, scheduling, and risk-based focus areas. Strategic planning ensures audits are conducted efficiently, risks are addressed proactively, and the audit function delivers maximum value to the organization.

Professional Competency and Recognition

Certification as an IIA-CFSA professional demonstrates mastery of auditing principles, risk management, and financial services operations. Professionals are recognized for their ability to conduct thorough evaluations, recommend control improvements, and contribute to organizational governance. Recognition enhances career opportunities, establishes credibility with employers and clients, and affirms the auditor’s role as a trusted advisor in financial services.

The IIA-CFSA certification equips professionals with advanced skills in auditing financial services, assessing risks, evaluating controls, and ensuring regulatory compliance. Mastery of sector-specific knowledge, risk assessment techniques, audit methodologies, and ethical standards enables auditors to perform their duties effectively and provide actionable insights. The certification supports career advancement, professional recognition, and ongoing competency development in the dynamic field of financial services auditing.

Conclusion

The IIA-CFSA certification represents a benchmark of expertise and professional competence for auditors in the financial services sector. By achieving this certification, professionals demonstrate mastery over the complexities of banking, insurance, and securities auditing. The rigorous requirements of the certification ensure that candidates are not only well-versed in auditing principles but also capable of applying them in practical, high-stakes environments. This combination of theoretical knowledge and practical application makes the certification particularly valuable for those seeking to advance in their careers or take on specialized audit responsibilities.

A key benefit of the certification lies in its focus on sector-specific knowledge. Candidates gain a deep understanding of the unique operational, regulatory, and financial challenges that affect banking institutions, insurance providers, and securities firms. This expertise allows auditors to identify control weaknesses, evaluate risk management practices, and provide recommendations that enhance the efficiency and resilience of financial operations. The ability to navigate these sector-specific complexities distinguishes certified professionals from their peers and increases their value to employers and stakeholders.

The preparation process for the IIA-CFSA exam itself contributes significantly to professional development. The structured study of auditing processes, regulatory frameworks, and risk assessment methodologies equips candidates with skills that are directly applicable in real-world auditing scenarios. Through practice exercises, case studies, and application of auditing principles, candidates refine their analytical abilities and judgment, preparing them to make informed decisions under pressure. This process also emphasizes ethical conduct and professional integrity, ensuring that certified auditors uphold the highest standards of accountability and transparency.

Another critical aspect of the certification is its emphasis on risk-based auditing. Candidates learn to prioritize areas of high risk and focus audit efforts on processes and functions that have the most significant potential impact on the organization. This approach improves the efficiency and effectiveness of audits while enabling auditors to provide actionable insights that support strategic decision-making. Risk-based auditing also prepares professionals to anticipate emerging risks, adapt to changes in regulatory environments, and respond proactively to challenges in the financial services industry.

The use of technology in auditing is another area where IIA-CFSA certification adds value. Auditors are trained to utilize data analytics, automated testing tools, and audit software to evaluate controls and detect anomalies in complex datasets. Integrating technology into the audit process not only improves accuracy and efficiency but also enables auditors to provide a more comprehensive assessment of organizational operations. This technological proficiency is increasingly critical in a rapidly evolving financial landscape where digital transactions, automated systems, and data-driven decision-making are prevalent.

Post-certification, professionals are encouraged to continue developing their skills through ongoing education and professional development activities. Maintaining currency in industry practices, regulatory changes, and emerging risks ensures that auditors remain effective and relevant throughout their careers. Continuous learning reinforces the credibility of certified auditors and strengthens their ability to contribute meaningfully to organizational governance and risk management efforts.

Ultimately, the IIA-CFSA certification equips financial services auditors with a combination of technical expertise, sector-specific knowledge, ethical awareness, and strategic insight. Certified professionals are capable of conducting thorough audits, evaluating risks comprehensively, and communicating findings effectively. The certification fosters confidence in the auditor’s ability to safeguard organizational integrity, support regulatory compliance, and enhance operational efficiency. By achieving IIA-CFSA, auditors gain not only recognition and career opportunities but also the skills and judgment necessary to excel in a complex and demanding financial environment. The value of the certification extends beyond exam success, shaping professionals who can navigate evolving challenges, contribute to organizational resilience, and uphold the highest standards of financial services auditing.

IIA IIA-CFSA practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass IIA-CFSA Certified Financial Services Auditor certification exam dumps & practice test questions and answers are to help students.

- IIA-CIA-Part1 - CIA Part 1 - Essentials of Internal Auditing

- IIA-CIA-Part2 - Certified Internal Auditor - Part 2, Practice of Internal Auditing

- IIA-CIA-Part3 - Certified Internal Auditor - Part 3, Business Analysis and Information Technology

- IIA-CHAL-QISA - Qualified Info Systems Auditor CIA Challenge

- IIA-CFSA - Certified Financial Services Auditor

Why customers love us?

What do our customers say?

The resources provided for the IIA certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the IIA-CFSA test and passed with ease.

Studying for the IIA certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the IIA-CFSA exam on my first try!

I was impressed with the quality of the IIA-CFSA preparation materials for the IIA certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The IIA-CFSA materials for the IIA certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the IIA-CFSA exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my IIA certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for IIA-CFSA. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the IIA-CFSA stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my IIA-CFSA certification exam. The support and guidance provided were top-notch. I couldn't have obtained my IIA certification without these amazing tools!

The materials provided for the IIA-CFSA were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed IIA-CFSA successfully. It was a game-changer for my career in IT!