- Home

- ABA Certifications

- CRCM Certified Regulatory Compliance Manager Dumps

Pass ABA CRCM Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

CRCM Premium File

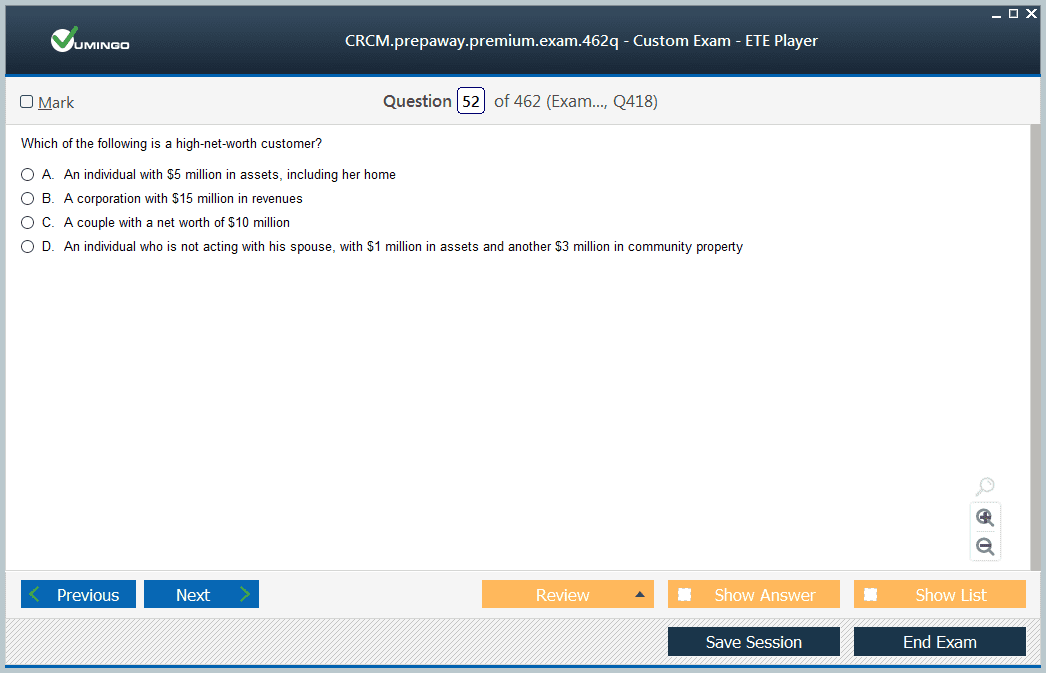

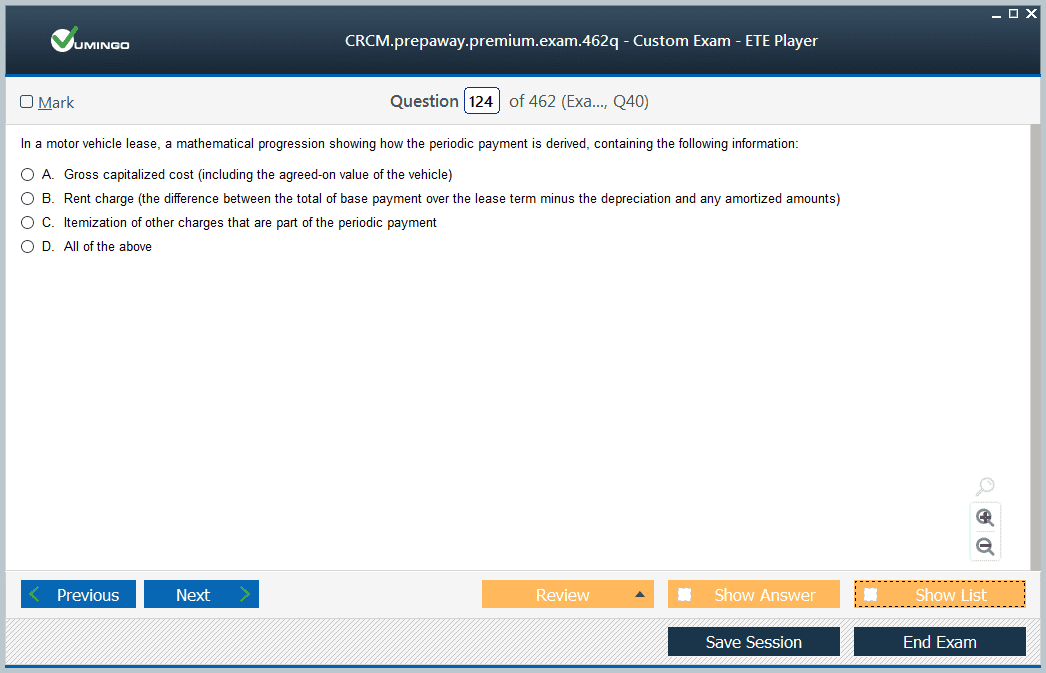

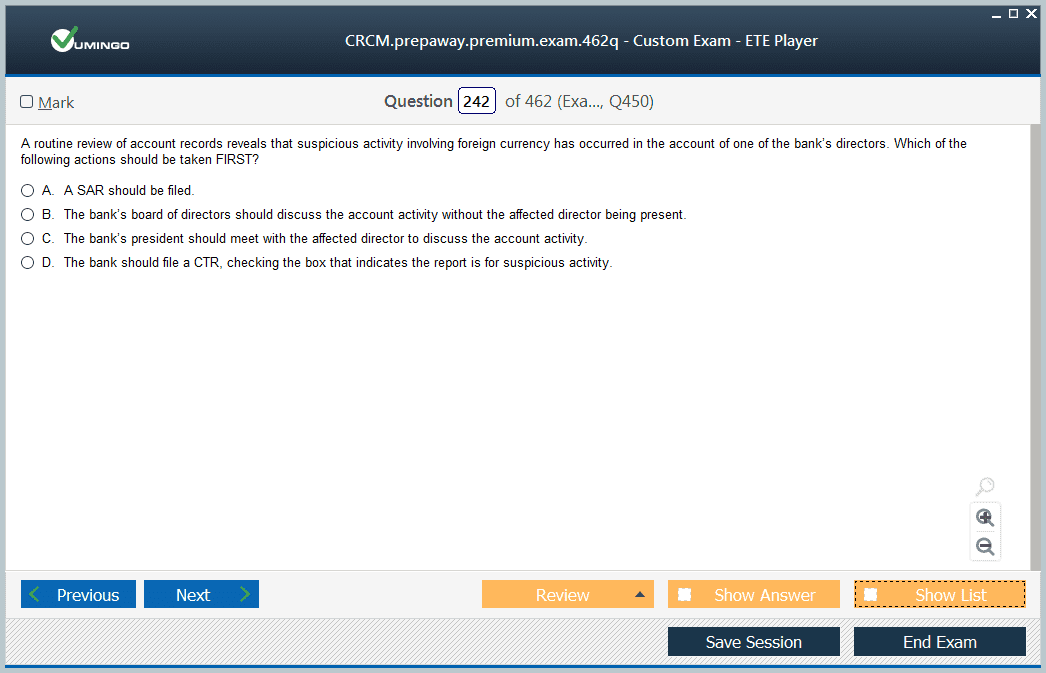

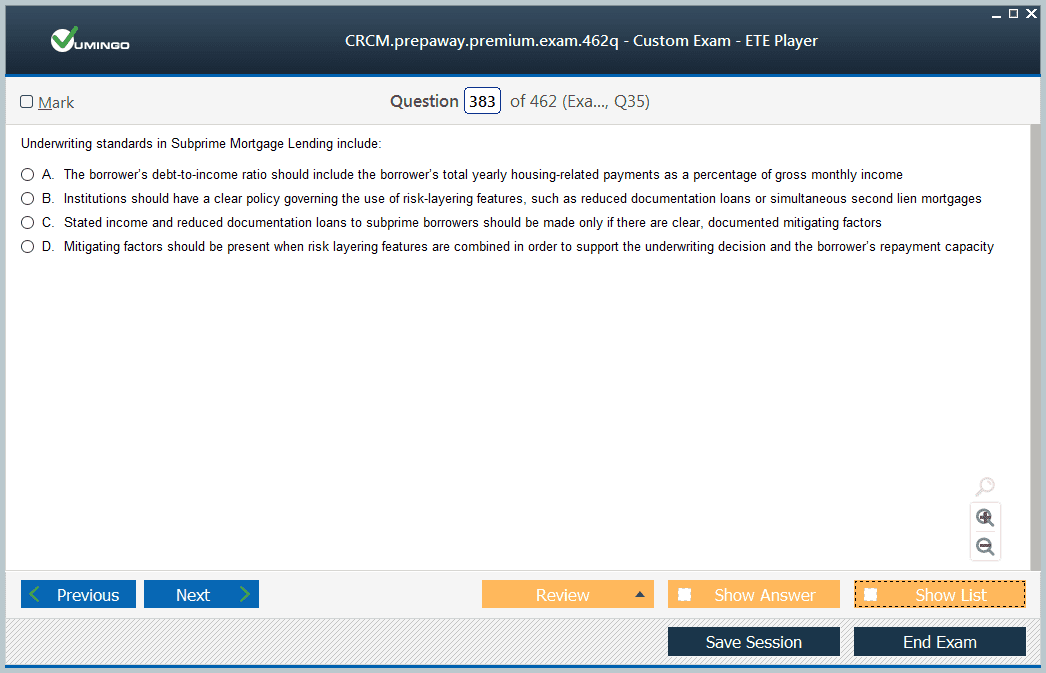

- Premium File 462 Questions & Answers. Last Update: Feb 04, 2026

Whats Included:

- Latest Questions

- 100% Accurate Answers

- Fast Exam Updates

Last Week Results!

All ABA CRCM certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the CRCM Certified Regulatory Compliance Manager practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

Essential Preparation Tips for the ABA CRCM Certification Exam

The Certified Regulatory Compliance Manager credential is a professional certification designed for individuals in the banking and financial services sector who specialize in regulatory compliance and risk management. Professionals who pursue this certification are typically responsible for developing, implementing, and overseeing compliance programs, ensuring that financial institutions operate within legal and regulatory frameworks. The certification signifies a comprehensive understanding of compliance principles, regulatory requirements, risk assessment, and internal controls. Holding this credential demonstrates the ability to manage compliance risk programs effectively and implement controls that mitigate potential regulatory and operational risks

Eligibility requirements for the CRCM certification emphasize both experience and professional responsibility. Candidates generally need at least six years of experience as a compliance professional, with at least three years in the most recent five years. An alternative path allows candidates with three years of experience to qualify if they meet specific criteria demonstrating managerial oversight over compliance operations. This ensures that all certified professionals have not only theoretical knowledge but also practical experience in managing compliance functions and regulatory risk

The CRCM certification is recognized for its prestige and rigor, as it demands a combination of knowledge, experience, and managerial competency. It is valued across financial institutions because it validates a professional’s capability to interpret regulatory requirements, monitor compliance programs, manage risk effectively, and contribute to a culture of ethical and legal adherence. Professionals with this certification are often entrusted with high-level compliance responsibilities, including overseeing audits, implementing internal controls, and ensuring that regulatory expectations are met consistently

Understanding the CRCM Exam Structure

A successful CRCM candidate must first understand the structure and content of the certification exam. The exam typically consists of multiple-choice questions designed to assess a candidate’s knowledge across various regulatory compliance and risk management areas. The topics cover regulatory frameworks, compliance monitoring, risk assessment, internal controls, and operational policies that financial institutions must follow. Familiarity with the exam syllabus allows candidates to identify high-priority areas and allocate study time efficiently

The exam evaluates both conceptual knowledge and practical application. Candidates may encounter scenario-based questions that simulate real-world compliance challenges, requiring them to apply regulatory knowledge to assess risk, recommend controls, or interpret policies. Understanding how questions are framed, the type of reasoning required, and the expected depth of analysis is critical for effective preparation

Preparation should include analyzing each domain of the exam content. Regulatory frameworks are a major component, requiring knowledge of federal and state regulations, banking laws, and supervisory guidance. Candidates should understand how these regulations impact operations, compliance procedures, and reporting requirements. Risk assessment and internal control topics focus on identifying vulnerabilities, designing controls, and ensuring effectiveness through monitoring and evaluation

Developing an Effective Study Plan

A structured study plan is vital for CRCM exam success. Candidates should allocate time for each domain based on its weight in the exam and personal familiarity with the content. Breaking down topics into manageable sections allows for systematic review and prevents last-minute cramming. Consistency in study routines, regular progress checks, and periodic revisions help reinforce knowledge and improve retention

High-priority topics, such as regulatory frameworks, compliance monitoring, and risk assessment, should receive focused attention. Candidates should review case studies, real-world compliance scenarios, and historical examples of regulatory enforcement actions to contextualize their understanding. Using visual aids, flowcharts, and summary notes can enhance comprehension of complex regulations and operational processes

Regular review of previous study material is crucial. Revisiting core concepts periodically ensures that knowledge is retained and can be applied effectively to scenario-based questions. Integrating self-assessment methods into the study plan, such as timed quizzes or practice tests, helps identify areas that require additional focus and reinforces test-taking strategies

Leveraging Official Resources and Reference Materials

Utilizing authoritative resources is essential for accurate and current knowledge. Official reference materials, regulatory guidance, and textbooks provide a comprehensive foundation for exam preparation. These resources ensure that candidates are studying content aligned with the expectations of the certification body and that they are familiar with the most recent regulatory updates

Study materials should be used actively rather than passively. Candidates should highlight key concepts, summarize chapters in their own words, and create outlines of regulatory frameworks and compliance processes. Practicing with sample questions or exercises from these materials helps familiarize candidates with exam formats, question phrasing, and the level of analytical reasoning required

Practical exercises based on real-life scenarios strengthen the ability to apply knowledge. For example, reviewing case studies where compliance failures occurred allows candidates to understand how internal controls could have mitigated risks. Understanding the decision-making process behind regulatory compliance actions helps develop the analytical skills necessary for the CRCM exam

Collaborative Learning and Peer Engagement

Engaging in collaborative study approaches can enhance comprehension and provide alternative perspectives. Study groups, professional forums, and discussion networks allow candidates to exchange ideas, clarify complex topics, and gain insights from peers’ experiences. Discussing compliance scenarios collectively helps candidates develop critical thinking and problem-solving skills while reinforcing their understanding of regulations and operational practices

Peer engagement also exposes candidates to diverse interpretations of compliance challenges, which is valuable for scenario-based exam questions. Sharing insights on risk assessment methods, internal controls, and monitoring procedures helps candidates refine their analytical approach and prepares them for the application-focused nature of the exam

Professional Mentorship and Guidance

Seeking guidance from experienced compliance professionals can accelerate exam readiness. Mentors provide practical advice, share strategies for studying efficiently, and clarify challenging concepts. Learning from professionals who have successfully managed compliance programs equips candidates with techniques for evaluating regulatory risks, implementing controls, and ensuring adherence to internal policies and regulatory expectations

Mentorship can also provide insights into exam strategy, such as prioritizing study topics, understanding common pitfalls, and practicing analytical reasoning for scenario-based questions. Candidates benefit from understanding how theoretical knowledge translates into real-world compliance management, which directly aligns with the application-focused structure of the exam

Time Management and Practice Exercises

Time management is critical during both preparation and exam execution. Practicing under timed conditions allows candidates to develop pacing strategies and ensure completion of all questions within the allocated time. Regularly taking practice exercises and simulated exams reinforces familiarity with question types, difficulty levels, and time constraints

Scenario-based exercises help candidates apply knowledge systematically. By analyzing hypothetical compliance issues, recommending actions, and justifying decisions based on regulatory guidance, candidates develop the practical reasoning skills needed for the exam. Reviewing results from practice exercises identifies areas of weakness and allows targeted study, enhancing overall readiness

Stress Management and Exam Confidence

Maintaining focus and confidence is essential for effective performance. Stress and anxiety can impede recall and analytical thinking, so candidates should adopt strategies to remain calm, such as practicing relaxation techniques and maintaining consistent study habits. Adequate rest and avoiding last-minute intensive study sessions ensure mental clarity and readiness

Confidence stems from comprehensive preparation and familiarity with the exam content. Trusting in structured study plans, peer discussions, mentorship insights, and practice exercises allows candidates to approach the exam with a strategic mindset. Confidence supports clear thinking, efficient time use, and effective application of knowledge during the examination

Applying CRCM Knowledge Professionally

The skills developed during CRCM exam preparation extend beyond the test itself. Certified professionals are capable of designing, implementing, and monitoring compliance programs effectively. They can evaluate regulatory risks, recommend controls, and ensure adherence to policies across an organization. The practical application of this knowledge enhances operational efficiency, mitigates risks, and maintains regulatory alignment

Certified individuals are also equipped to manage teams, guide junior staff, and foster a culture of compliance. By understanding regulatory frameworks and internal control mechanisms, they contribute strategically to organizational objectives and maintain ethical and legal standards in operations

Long-Term Career Benefits

Earning the CRCM certification provides significant professional advantages. Certified professionals gain recognition for their expertise, which can lead to career advancement opportunities, managerial responsibilities, and leadership roles within compliance departments. The certification demonstrates a commitment to professional excellence, regulatory understanding, and operational integrity

The credential also serves as a foundation for ongoing professional development. Certified individuals can apply advanced knowledge to increasingly complex compliance challenges, mentor others, and contribute strategically to risk management initiatives. The combination of analytical skills, regulatory knowledge, and practical experience positions CRCM-certified professionals as valuable assets in financial institutions

Strategic Use of Knowledge

CRCM-certified professionals are able to integrate regulatory compliance knowledge into organizational strategy. They assess processes, identify gaps, and implement improvements that align with business objectives. This strategic application ensures that compliance initiatives support operational efficiency, mitigate risks, and enhance overall organizational performance

Understanding how compliance frameworks interact with operational functions allows professionals to make informed decisions, optimize resources, and achieve measurable outcomes. Integrating this knowledge into strategic planning ensures that quality and regulatory standards are maintained while supporting business growth

Preparing for Complex Scenarios

The CRCM exam includes questions that simulate multifaceted compliance challenges. Candidates should practice analyzing scenarios that require synthesis of knowledge across multiple domains, including regulatory frameworks, risk management, internal controls, and operational policies. Developing structured problem-solving approaches helps candidates identify critical issues, evaluate alternatives, and propose practical solutions based on regulatory principles

Preparing for complex scenarios strengthens the ability to think analytically and apply knowledge in practical contexts. Candidates who practice integrated exercises are better equipped to tackle scenario-based questions and demonstrate competency in addressing real-world compliance issues

Success in the CRCM exam requires a combination of comprehensive knowledge, practical application, and effective exam strategies. Candidates must master regulatory frameworks, compliance monitoring, risk assessment, and internal controls while practicing scenario-based exercises that integrate knowledge across domains. Structured study plans, peer collaboration, mentorship, time management, and stress control are critical for exam readiness

Achieving CRCM certification validates professional competence, enhances career opportunities, and equips individuals to lead compliance initiatives effectively. The skills acquired through preparation enable candidates to manage regulatory risks, implement effective controls, and contribute strategically to organizational goals. Certification prepares professionals to excel in compliance management, strengthen operational integrity, and achieve long-term career success

Detailed CRCM Exam Preparation Strategies

Preparing for the Certified Regulatory Compliance Manager exam requires a multifaceted approach that combines theoretical understanding, practical application, and strategic test-taking skills. The first step is to gain a thorough understanding of the regulatory environment in which financial institutions operate. This includes studying federal and state banking regulations, supervisory guidance, risk management frameworks, and compliance program requirements. Candidates should focus on how these regulations influence operational procedures, reporting standards, and internal controls within organizations

Developing a comprehensive study plan is critical. Candidates should break down the exam syllabus into distinct sections such as regulatory frameworks, compliance monitoring, internal controls, risk assessment, and ethical practices. Allocating time based on the weightage of each section ensures efficient study. A structured schedule that incorporates daily or weekly goals allows for consistent progress and reduces the likelihood of overlooking critical topics

Understanding Key Regulatory Domains

A deep comprehension of key regulatory domains is essential for exam success. Candidates must be familiar with laws such as the Bank Secrecy Act, Anti-Money Laundering regulations, Consumer Financial Protection guidelines, and other compliance mandates. Understanding the purpose, scope, and application of these regulations enables candidates to evaluate compliance programs and assess risk effectively

Internal controls and risk management are central to the CRCM certification. Candidates should learn how to design and evaluate internal controls to mitigate risks, ensure compliance with laws, and prevent operational failures. This involves understanding control frameworks, monitoring techniques, and assessment methodologies. Scenario-based practice that applies these concepts to organizational processes enhances analytical skills and reinforces knowledge retention

Practice Through Scenario-Based Exercises

Scenario-based exercises are a critical component of CRCM exam preparation. These exercises mimic real-world challenges faced by compliance professionals, such as identifying gaps in internal controls, addressing regulatory violations, and evaluating risk exposure across departments. Practicing these exercises allows candidates to develop problem-solving skills, prioritize corrective actions, and apply compliance principles effectively

Candidates should simulate comprehensive scenarios that require integration of multiple domains, such as regulatory requirements, internal controls, and risk assessment. This approach develops the ability to analyze complex situations, identify root causes, recommend solutions, and justify decisions based on regulatory standards and organizational policies

Utilizing Reference Materials Effectively

Using authoritative reference materials ensures that study efforts are aligned with current regulatory requirements and industry practices. Candidates should focus on official regulatory publications, compliance manuals, and professional guides that provide comprehensive coverage of the exam content. Active engagement with these resources, such as summarizing key points, creating flowcharts, and highlighting relationships between regulations, supports understanding and retention

Practice questions derived from reference materials help candidates familiarize themselves with the format and depth of exam questions. Regular review of these exercises identifies areas of strength and weakness, allowing targeted study and reinforcing key concepts. Candidates benefit from repeated exposure to regulatory scenarios, which enhances their ability to apply knowledge under exam conditions

Time Management and Exam Simulation

Effective time management is crucial for both preparation and examination. Candidates should practice completing questions under timed conditions to develop pacing strategies and ensure all questions can be addressed within the allocated timeframe. Regular simulation of exam conditions helps reduce anxiety, improves decision-making speed, and reinforces familiarity with question formats

Candidates should adopt a systematic approach when answering scenario-based questions. Analyzing the situation, identifying key issues, applying regulatory knowledge, and proposing corrective actions should be done logically and efficiently. Practicing this methodology during study sessions ensures a structured thought process during the actual exam

Engaging in Peer Discussions

Collaborating with peers in study groups or professional forums provides opportunities to explore different perspectives, clarify doubts, and deepen understanding. Discussing complex regulatory scenarios helps candidates develop critical thinking skills, refine reasoning, and strengthen the ability to apply knowledge to real-world situations

Peer engagement also exposes candidates to diverse experiences in compliance management, such as approaches to risk assessment, monitoring practices, and policy implementation. This diversity enhances problem-solving capabilities and prepares candidates to handle complex, multi-faceted questions on the exam

Mentorship and Professional Guidance

Guidance from experienced compliance professionals can provide valuable insights into exam preparation. Mentors can advise on prioritizing study topics, interpreting complex regulatory requirements, and applying compliance principles effectively. Learning from professionals who have managed compliance programs enhances understanding of real-world applications and bridges the gap between theory and practice

Mentorship also provides strategies for approaching scenario-based questions, identifying potential pitfalls, and applying analytical reasoning. Insights into how regulatory knowledge translates into decision-making in organizational settings help candidates develop a practical approach to the exam

Reinforcing Knowledge Through Repetition

Repetition is an essential strategy for retaining complex regulatory concepts. Candidates should review study materials regularly, revisit key frameworks, and practice scenario-based exercises consistently. Repetition reinforces understanding, strengthens memory retention, and builds confidence in applying concepts to diverse situations

Candidates should also engage in self-testing to evaluate retention and application skills. This practice highlights knowledge gaps and allows for targeted review, ensuring comprehensive coverage of the exam syllabus and preparation for scenario-based challenges

Stress Management and Focus

Maintaining focus and managing stress are critical for optimal exam performance. Candidates should incorporate relaxation techniques, adequate rest, and structured study routines into their preparation plan. Reducing anxiety ensures clear thinking, effective time management, and accurate application of knowledge during the exam

Building confidence through thorough preparation, practice exercises, and understanding of regulatory frameworks supports a positive mindset. Candidates who trust in their preparation are more likely to approach complex questions strategically, analyze scenarios accurately, and make informed decisions

Application of Knowledge in Professional Contexts

The knowledge and skills developed through CRCM exam preparation have direct application in professional settings. Certified individuals are equipped to design, implement, and monitor compliance programs effectively. They can assess regulatory risks, recommend internal controls, and ensure adherence to laws and organizational policies

Professionals with CRCM certification also demonstrate the ability to manage compliance teams, guide junior staff, and foster a culture of regulatory adherence within organizations. The application of these skills enhances operational efficiency, mitigates risks, and strengthens overall organizational governance

Strategic Integration of Compliance Knowledge

CRCM-certified professionals are capable of integrating compliance knowledge into strategic organizational planning. They can assess processes, identify gaps, and implement improvements that align with business objectives. Strategic integration ensures that compliance initiatives support operational efficiency, mitigate risks, and enhance overall organizational performance

Understanding how regulatory frameworks, risk management practices, and internal controls interact with operational functions allows professionals to make informed decisions, optimize resources, and achieve measurable outcomes. Integrating compliance knowledge strategically ensures sustainable improvements and long-term organizational success

Advanced Scenario Analysis

Preparing for complex scenarios is a key aspect of CRCM exam readiness. Candidates should practice analyzing situations that require synthesis of knowledge across regulatory, risk, and operational domains. Developing structured problem-solving techniques helps candidates identify critical issues, evaluate alternatives, and propose practical solutions based on compliance principles

Scenario practice enhances analytical thinking and prepares candidates for multi-faceted questions. Candidates who practice integrating regulatory knowledge with risk assessment and operational considerations develop a methodical approach to addressing complex compliance challenges

Career Impact of CRCM Certification

Earning the CRCM credential provides significant professional benefits. Certified professionals gain recognition for expertise in regulatory compliance, increasing eligibility for leadership roles, managerial responsibilities, and advanced positions within financial institutions. The certification demonstrates a high level of competency in risk management, internal controls, and compliance oversight

CRCM certification also serves as a foundation for ongoing professional growth. Professionals are prepared to handle increasingly complex compliance challenges, contribute strategically to risk management initiatives, and mentor other staff. The combination of analytical skills, regulatory knowledge, and practical experience positions CRCM-certified individuals as highly valuable assets within financial organizations

Continuous Professional Development

CRCM-certified individuals are encouraged to engage in continuous professional development to stay current with evolving regulatory standards and industry best practices. Maintaining updated knowledge ensures that compliance programs remain effective, risks are managed proactively, and organizational processes align with changing regulatory requirements

Continuous development enhances leadership capabilities, analytical skills, and strategic thinking. Professionals who pursue ongoing learning are better prepared to implement innovative compliance solutions, address emerging risks, and support the long-term success of their organizations

Exam Day Preparedness

Effective preparation for exam day involves both mental and logistical readiness. Candidates should review key concepts, practice time management, and maintain a calm mindset. Familiarity with exam protocols, question formats, and timing reduces stress and allows candidates to focus on applying knowledge accurately

Developing a structured approach to answering questions, managing time efficiently, and analyzing complex scenarios ensures optimal performance. Confidence gained through thorough preparation supports clear thinking, accurate decision-making, and strategic application of regulatory knowledge

Achieving success in the CRCM exam requires a combination of comprehensive knowledge, practical application, and strategic preparation. Candidates must master regulatory frameworks, compliance monitoring, risk assessment, internal controls, and scenario analysis while practicing exercises that integrate these domains. Structured study, mentorship, peer engagement, repetition, time management, and stress control are essential for readiness

CRCM certification validates professional competence, enhances career opportunities, and equips individuals to lead compliance initiatives effectively. The skills developed through preparation enable professionals to manage regulatory risks, implement robust internal controls, and contribute strategically to organizational goals, ensuring long-term success in compliance management

Advanced CRCM Exam Preparation Techniques

Preparing for the Certified Regulatory Compliance Manager exam requires a deep understanding of regulatory frameworks, risk management, and internal controls, coupled with the ability to apply this knowledge in complex scenarios. Candidates must focus on integrating their theoretical knowledge with practical applications in financial institutions. This includes analyzing compliance programs, identifying risk exposures, and implementing effective monitoring strategies. The CRCM exam evaluates not only knowledge of regulations but also the ability to make informed decisions in real-world contexts

Scenario-Based Learning and Application

Scenario-based exercises are essential in mastering the CRCM exam. These exercises replicate real-world challenges that compliance professionals encounter, such as gaps in internal controls, regulatory violations, or operational risk exposures. Practicing these scenarios develops critical thinking, analytical reasoning, and decision-making skills. Candidates should work through exercises that require evaluating compliance risks, recommending corrective actions, and explaining decisions based on regulatory standards and organizational policies

Integrated scenarios that combine regulatory knowledge, risk assessment, and operational processes enhance understanding. For instance, candidates may need to determine how a new regulation impacts existing procedures, evaluate controls for compliance effectiveness, and recommend adjustments to mitigate potential risks. Practicing such exercises strengthens problem-solving abilities and prepares candidates for complex exam questions

Using Authoritative Reference Materials

A crucial aspect of CRCM exam preparation is engaging with authoritative reference materials. Candidates should use regulatory manuals, compliance guides, and professional publications to gain accurate, up-to-date knowledge. Active engagement, such as highlighting key points, summarizing concepts, and creating diagrams of regulatory processes, reinforces learning and helps retain complex information

Regular practice using sample questions derived from reference materials is highly effective. These exercises familiarize candidates with the types of questions on the exam and the level of analytical reasoning required. Reviewing performance on practice exercises allows candidates to identify weak areas, refine their study approach, and focus on topics that need more attention

Developing Time Management Skills

Time management is essential for both preparation and exam performance. Candidates should practice answering questions under timed conditions to develop pacing strategies and ensure completion of all questions within the allocated timeframe. This practice helps build confidence, reduces anxiety, and improves accuracy during the actual exam

Candidates should adopt a structured approach when tackling scenario-based questions. Breaking down problems into identifiable components, analyzing information systematically, and applying regulatory principles efficiently ensures that all aspects of a scenario are addressed thoroughly. Practicing this method during preparation builds a reliable strategy for approaching the CRCM exam

Collaborative Learning for Enhanced Understanding

Studying in a collaborative environment strengthens comprehension and exposes candidates to diverse perspectives. Participating in study groups or professional forums allows for discussion of regulatory challenges, sharing insights, and clarifying complex topics. This interaction helps reinforce learning and encourages critical thinking about compliance strategies

Collaborative learning also prepares candidates for scenario-based questions by providing exposure to multiple approaches in addressing compliance issues. Discussing real-world applications and analyzing peer solutions enhances problem-solving skills and deepens understanding of regulatory frameworks and risk management practices

Mentorship and Expert Guidance

Mentorship from experienced compliance professionals provides valuable insights into effective exam preparation. Mentors can offer guidance on prioritizing study topics, interpreting regulatory requirements, and applying compliance principles in practice. Learning from professionals who have successfully managed compliance programs helps candidates connect theoretical knowledge with practical decision-making

Mentors can also provide strategies for approaching complex scenario-based questions, avoiding common mistakes, and applying analytical reasoning effectively. Insights into the practical implications of regulatory knowledge support candidates in developing a methodical approach to exam challenges

Reinforcing Knowledge Through Repetition and Practice

Repetition is a key strategy in preparing for the CRCM exam. Candidates should regularly review core concepts, revisit previously studied topics, and engage in scenario-based exercises consistently. This continuous reinforcement strengthens retention and builds confidence in applying knowledge across different scenarios

Self-assessment through practice exercises helps identify areas of strength and weakness. By evaluating performance on these exercises, candidates can target gaps in knowledge, adjust study plans, and focus on developing skills required for scenario-based analysis and decision-making during the exam

Stress Management and Focused Preparation

Maintaining focus and managing stress are critical to successful exam performance. Candidates should incorporate structured study routines, relaxation techniques, and adequate rest to ensure mental clarity and readiness. Reducing anxiety supports clear thinking, efficient time management, and accurate application of knowledge during the exam

Building confidence through thorough preparation, practice exercises, and familiarity with exam scenarios allows candidates to approach complex questions with a strategic mindset. Confidence helps maintain focus, enhances analytical reasoning, and ensures the effective application of compliance knowledge

Practical Application of CRCM Knowledge

The skills developed through CRCM exam preparation extend directly to professional practice. Certified professionals are capable of designing, implementing, and monitoring compliance programs, assessing regulatory risks, and ensuring adherence to internal controls and regulatory requirements. This practical application enhances operational efficiency, mitigates risk, and strengthens organizational governance

Professionals can also guide teams, mentor junior staff, and foster a culture of compliance throughout the organization. Applying regulatory knowledge strategically ensures that compliance initiatives are effective, sustainable, and aligned with organizational objectives

Strategic Integration of Compliance Skills

CRCM-certified professionals are equipped to integrate compliance knowledge into broader organizational strategy. They can assess operational processes, identify gaps in controls, and implement improvements that align with business objectives. Strategic integration ensures that compliance initiatives contribute to risk mitigation, operational efficiency, and organizational performance

Understanding the interactions between regulatory frameworks, risk assessment, and internal controls enables professionals to make informed decisions, optimize resources, and achieve measurable outcomes. This strategic perspective ensures that compliance programs support long-term organizational goals

Advanced Scenario Analysis

Mastering complex scenario analysis is crucial for the CRCM exam. Candidates should practice evaluating multifaceted situations that require synthesis of regulatory knowledge, risk management, and operational oversight. Developing structured problem-solving methods allows candidates to identify key issues, evaluate alternatives, and recommend solutions based on regulatory principles

Scenario practice enhances analytical thinking and prepares candidates for challenging exam questions. Candidates who engage in integrated exercises that combine multiple domains develop a methodical approach to addressing complex compliance challenges and demonstrate practical competence

Career Impact of CRCM Certification

Earning the CRCM credential provides substantial career advantages. Certified professionals gain recognition for their expertise in regulatory compliance, increasing eligibility for leadership roles, managerial responsibilities, and strategic positions within financial institutions. The certification validates the ability to manage compliance programs, assess risks, and ensure adherence to regulatory requirements

CRCM certification also supports continuous professional growth. Professionals are prepared to handle complex compliance challenges, mentor colleagues, and contribute strategically to organizational objectives. The combination of analytical skills, regulatory knowledge, and practical experience positions certified individuals as valuable contributors within financial organizations

Continuous Professional Development

Ongoing professional development is essential for CRCM-certified individuals. Staying current with evolving regulations, industry best practices, and emerging compliance challenges ensures that compliance programs remain effective, risks are proactively managed, and organizational processes align with regulatory expectations

Continuous development enhances leadership abilities, analytical capabilities, and strategic thinking. Professionals who engage in ongoing learning are better prepared to implement innovative compliance solutions, address emerging risks, and maintain organizational integrity

Exam Simulation and Readiness

Simulating the exam environment is an effective strategy for preparing candidates. Practicing under conditions that replicate the time constraints, question format, and scenario complexity of the actual CRCM exam builds familiarity and reduces anxiety. Exam simulations reinforce pacing strategies, analytical reasoning, and decision-making skills

Candidates should focus on structured approaches during simulations, including identifying key issues, applying regulatory knowledge systematically, and proposing well-supported solutions. Regular simulation builds confidence and ensures candidates are prepared to handle real-world scenarios efficiently

Effective Problem-Solving Techniques

CRCM exam questions often require a structured problem-solving approach. Candidates should practice identifying root causes, evaluating control measures, and proposing solutions that adhere to regulatory requirements. Developing a consistent methodology for analyzing scenarios enhances accuracy, efficiency, and strategic thinking during the exam

Practicing problem-solving across multiple domains helps candidates apply knowledge in integrated ways. This approach mirrors professional responsibilities, ensuring that certified individuals are prepared to manage complex compliance challenges effectively

Long-Term Professional Advantages

CRCM certification offers long-term benefits for career growth and professional recognition. Certified professionals are equipped to manage compliance teams, oversee risk assessment, and ensure regulatory adherence across organizational functions. The credential demonstrates competence, enhances credibility, and supports advancement in regulatory compliance roles

Professionals can leverage CRCM certification to assume leadership positions, influence organizational compliance strategies, and mentor future compliance managers. The knowledge and skills gained through preparation enable certified individuals to contribute strategically to organizational success

Strategic Decision-Making Skills

CRCM-certified professionals are trained to make informed strategic decisions. By integrating regulatory knowledge, risk assessment techniques, and operational insights, they can recommend actions that support compliance, mitigate risk, and align with organizational goals. Strategic decision-making ensures that compliance initiatives are effective, measurable, and sustainable

Developing these skills during exam preparation prepares candidates to handle high-level responsibilities in professional settings. Analytical reasoning, scenario evaluation, and regulatory knowledge are applied systematically to ensure optimal outcomes

Success in the CRCM exam requires mastery of regulatory frameworks, internal controls, risk assessment, scenario analysis, and practical application of compliance knowledge. Candidates should focus on structured study, mentorship, peer collaboration, scenario practice, time management, and stress control. Advanced preparation techniques enhance problem-solving skills, analytical reasoning, and strategic decision-making

CRCM certification validates professional competence, supports career advancement, and equips individuals to manage compliance programs effectively. The knowledge and skills developed through preparation ensure that certified professionals can evaluate risks, implement robust controls, and contribute strategically to organizational objectives, achieving long-term success in regulatory compliance

Mastering CRCM Mock Exams

A crucial component of preparing for the Certified Regulatory Compliance Manager exam is engaging with mock exams that simulate the real test environment. Mock exams provide candidates with the opportunity to assess their understanding of regulatory frameworks, internal controls, and compliance procedures under timed conditions. They also help familiarize candidates with the structure, format, and complexity of actual exam questions. Regular practice with these simulated exams improves accuracy, enhances decision-making skills, and builds confidence in applying knowledge to real-world scenarios

Mock exams allow candidates to identify gaps in knowledge and understand areas that require additional focus. By reviewing results and analyzing incorrect answers, candidates can refine their study plans, reinforce weak areas, and ensure a comprehensive understanding of all exam topics. This targeted approach ensures that preparation is both efficient and effective, allowing candidates to maximize their performance on exam day

Developing Exam-Taking Strategies

Beyond content knowledge, success in the CRCM exam relies on strategic exam-taking skills. Candidates should develop methods to approach multiple-choice and scenario-based questions systematically. Techniques such as eliminating obviously incorrect options, prioritizing questions based on difficulty, and managing time efficiently are essential for completing the exam within the allotted timeframe

Scenario-based questions require careful analysis and logical application of regulatory principles. Candidates should practice breaking down complex situations into key components, identifying compliance risks, and recommending practical solutions. Developing a structured approach for analyzing scenarios enhances critical thinking and ensures that all relevant factors are considered before selecting an answer

Integrating Practical Knowledge with Exam Content

The CRCM exam emphasizes the application of regulatory knowledge to practical situations. Candidates should focus on integrating theoretical understanding with real-world compliance experience. This includes evaluating risk exposures, designing internal controls, monitoring compliance programs, and addressing operational gaps. Preparing for questions that combine multiple domains develops the ability to synthesize information and make informed decisions under pressure

Practical integration also includes understanding how regulations impact day-to-day operations within financial institutions. Candidates should study case studies, regulatory enforcement actions, and organizational compliance procedures to connect theoretical knowledge with operational realities. This approach enhances problem-solving capabilities and ensures readiness for scenario-based exam questions

Time Management During Mock Exams

Practicing time management is a vital aspect of mock exam preparation. Candidates should simulate the exact timing conditions of the actual exam to develop pacing strategies. Allocating time appropriately across different sections ensures that all questions are addressed and reduces the risk of incomplete responses. Time management practice also helps candidates maintain focus and reduce stress during the actual exam

Candidates should develop strategies for handling challenging questions without losing valuable time. Techniques include marking difficult questions for review, answering easier questions first, and maintaining a steady pace throughout the exam. Practicing these strategies during mock exams builds confidence and improves overall performance on test day

Analyzing Performance and Refining Study Plans

After completing mock exams, candidates should conduct a thorough analysis of their performance. Identifying patterns in incorrect responses helps pinpoint specific knowledge gaps or areas requiring additional review. This analysis allows for the adjustment of study plans, prioritization of weak topics, and reinforcement of critical regulatory concepts

Regular analysis of mock exam results also helps candidates track progress over time. By comparing scores and evaluating improvements, candidates can measure the effectiveness of their preparation methods. This iterative process of practice, analysis, and refinement ensures comprehensive readiness for the actual CRCM exam

Leveraging Peer Discussions in Mock Exam Preparation

Engaging with peers during mock exam preparation can enhance understanding and retention. Study groups and professional forums provide opportunities to discuss challenging questions, share insights, and explore alternative approaches to complex scenarios. Collaborative analysis of mock exam questions helps candidates develop a deeper understanding of regulatory concepts and practical applications

Peer discussions also expose candidates to diverse problem-solving strategies and analytical techniques. Learning from others’ approaches to scenario-based questions broadens perspectives and strengthens the ability to tackle unfamiliar challenges effectively during the exam

Mentorship in Mock Exam Strategy

Guidance from experienced compliance professionals is valuable during mock exam preparation. Mentors can provide insights into common pitfalls, recommend effective study techniques, and advise on prioritizing topics for review. Learning from mentors who have successfully passed the CRCM exam helps candidates understand how to approach complex questions strategically and apply regulatory knowledge efficiently

Mentorship also supports the development of exam strategies tailored to individual strengths and weaknesses. By analyzing performance on mock exams with a mentor, candidates gain practical advice on refining their approach, managing time, and improving accuracy in scenario-based questions

Stress Management During Exam Simulations

Managing stress is critical when practicing with mock exams. Simulating exam conditions can be challenging, and candidates may experience pressure similar to the actual test environment. Incorporating relaxation techniques, maintaining a structured study schedule, and taking regular breaks during practice sessions help manage stress and maintain mental clarity

Practicing under controlled stress conditions prepares candidates for the pressures of the actual exam. By becoming accustomed to the timing, question complexity, and analytical demands, candidates build resilience and confidence, ensuring that they can perform effectively on test day

Application of Knowledge to Complex Scenarios

The CRCM exam includes questions that require integration of multiple compliance and regulatory domains. Candidates should practice complex scenarios that involve assessing risk exposure, evaluating internal controls, and recommending regulatory-compliant solutions. Developing structured problem-solving methods ensures that all relevant factors are considered and that answers are well-reasoned

Scenario practice also helps candidates develop strategic thinking skills. By analyzing multifaceted situations, identifying compliance gaps, and proposing solutions based on regulatory principles, candidates enhance their ability to apply knowledge practically and effectively

Professional Relevance of Exam Preparation

Preparation for the CRCM exam extends beyond test-taking and contributes directly to professional competency. Candidates develop skills in regulatory analysis, risk assessment, compliance monitoring, and internal control evaluation. These skills are applicable in real-world banking environments, enabling professionals to manage compliance programs effectively, mitigate risk, and ensure organizational adherence to regulatory standards

Certified professionals are equipped to lead teams, guide junior staff, and implement comprehensive compliance programs. The knowledge and experience gained through mock exam preparation provide a foundation for strategic decision-making, problem-solving, and operational oversight in regulatory compliance roles

Enhancing Analytical and Critical Thinking Skills

Advanced exam preparation emphasizes analytical and critical thinking. Candidates should practice interpreting complex regulatory documents, analyzing operational processes, and assessing potential risks. Developing the ability to evaluate scenarios systematically and propose informed solutions strengthens reasoning skills and prepares candidates for high-complexity questions

Critical thinking skills also support decision-making in professional contexts. By practicing scenario analysis, candidates learn to balance regulatory requirements with operational constraints, ensuring practical and compliant solutions in real-world situations

Long-Term Career Impact of CRCM Certification

Earning the CRCM credential enhances professional credibility, career advancement, and leadership potential. Certified professionals are recognized for their expertise in regulatory compliance, risk management, and internal controls. The certification opens opportunities for managerial positions, strategic roles, and involvement in organizational decision-making processes

The knowledge and skills developed through exam preparation enable certified individuals to contribute effectively to compliance programs, guide teams, and influence organizational policies. CRCM certification establishes a professional as a trusted expert in regulatory compliance and risk management, providing long-term career benefits

Strategic Decision-Making and Risk Assessment

CRCM-certified professionals are trained to make informed strategic decisions based on comprehensive regulatory knowledge and operational insights. Candidates should practice evaluating risk scenarios, analyzing controls, and proposing regulatory-compliant solutions. Strategic decision-making ensures that compliance initiatives support organizational objectives and mitigate operational and regulatory risks

Integrating knowledge from multiple regulatory domains allows professionals to approach challenges holistically. Effective decision-making requires balancing compliance requirements with business objectives, optimizing processes, and implementing controls that maintain organizational integrity

Continuous Professional Growth Through Exam Preparation

Preparation for the CRCM exam fosters continuous professional development. Candidates acquire skills in regulatory analysis, scenario evaluation, risk assessment, and internal control monitoring. These competencies are essential for managing complex compliance programs and supporting organizational goals effectively

Ongoing application of knowledge gained during preparation enhances expertise, improves professional judgment, and ensures readiness to address emerging regulatory challenges. Continuous growth reinforces credibility, leadership capability, and strategic influence within compliance roles

Mastering mock exams is a critical aspect of CRCM exam preparation. Candidates should focus on scenario-based exercises, time management, analytical reasoning, and strategic problem-solving. Engaging with peers, seeking mentorship, and practicing under simulated conditions enhances readiness and builds confidence

Mock exam preparation strengthens practical skills, reinforces regulatory knowledge, and develops strategic thinking. Candidates who effectively integrate preparation techniques are well-equipped to excel in the CRCM exam, demonstrate professional competence, and advance their careers in regulatory compliance and risk management

Advanced Scenario Simulation for CRCM Exam

Preparing for the Certified Regulatory Compliance Manager exam requires mastery of complex regulatory environments and the ability to apply knowledge practically under exam conditions. Advanced scenario simulations are essential to develop this skill. These simulations recreate real-world compliance challenges, including risk assessment, regulatory enforcement, internal control evaluation, and decision-making processes. Practicing with integrated scenarios ensures candidates are ready to handle multi-faceted questions and apply theoretical knowledge to practical situations

Scenario simulations allow candidates to analyze detailed regulatory situations, identify compliance gaps, and propose actionable solutions. By repeatedly practicing scenarios that combine multiple regulatory areas, candidates improve analytical reasoning, critical thinking, and problem-solving skills. This approach ensures that knowledge is not only memorized but also applied effectively under the pressures of an exam environment

Time Optimization Strategies

Efficient time management is critical in the CRCM exam. Candidates must practice answering complex scenario-based questions within the allocated timeframe. Developing strategies such as prioritizing questions based on difficulty, allocating time proportionally to question weight, and maintaining a steady pace helps ensure that all questions are addressed

Practicing under timed conditions during simulations builds speed and accuracy. Candidates learn to quickly identify key issues, apply regulatory knowledge, and make informed decisions without getting stuck on particularly challenging questions. This training enhances confidence and ensures optimal performance during the actual exam

Integrating Multi-Domain Knowledge

The CRCM exam often requires synthesis of knowledge across multiple regulatory domains. Candidates should practice scenarios that integrate areas such as banking regulations, risk assessment, internal controls, compliance monitoring, and ethical decision-making. This integration ensures a holistic approach to problem-solving, reflecting the responsibilities of a compliance professional in a real-world setting

By combining knowledge from different regulatory areas, candidates develop the ability to assess the broader impact of compliance decisions, evaluate operational risks, and recommend solutions that align with organizational objectives and regulatory standards

Enhancing Analytical Thinking

Advanced scenario practice enhances analytical thinking skills. Candidates learn to break down complex regulatory situations into identifiable components, evaluate potential risks, consider regulatory requirements, and recommend corrective actions. This structured approach ensures thorough analysis and well-supported decision-making

Analytical thinking also improves the ability to anticipate potential challenges and assess the consequences of compliance decisions. Practicing scenarios that require detailed analysis strengthens the candidate's capacity to handle intricate exam questions efficiently

Mock Exam Integration

Integrating mock exams with advanced scenario simulations provides a comprehensive preparation strategy. Mock exams replicate the format, timing, and question complexity of the actual CRCM exam, while scenario simulations deepen understanding and practical application of knowledge. Together, these strategies ensure candidates are well-prepared to tackle both knowledge-based and analytical questions

Regularly reviewing mock exam performance helps candidates identify weaknesses, refine study strategies, and adjust their preparation plans. Analysis of incorrect answers provides insight into knowledge gaps and allows targeted practice, ensuring readiness for the full scope of exam content

Developing Strategic Problem-Solving Skills

Candidates must cultivate strategic problem-solving skills to excel in the CRCM exam. This involves evaluating compliance scenarios from multiple perspectives, prioritizing risks, and proposing solutions that are both practical and regulatory-compliant. Practicing such approaches during preparation ensures that candidates are capable of handling the nuanced questions commonly presented on the exam

Strategic problem-solving also involves anticipating potential regulatory challenges and considering the impact of decisions on organizational operations. Candidates trained in these methods are better equipped to navigate complex compliance issues and demonstrate professional judgment under pressure

Real-World Application and Professional Relevance

The knowledge and skills gained through advanced scenario simulations are directly applicable to professional roles in regulatory compliance. Candidates learn to assess risks, evaluate internal controls, monitor compliance programs, and recommend corrective actions effectively. These competencies are essential for managing compliance programs, mitigating risks, and ensuring adherence to regulatory standards within financial institutions

CRCM-certified professionals are equipped to lead compliance teams, guide junior staff, and implement organizational policies aligned with regulatory requirements. The ability to apply scenario-based knowledge strategically enhances operational efficiency, risk mitigation, and overall governance

Developing Decision-Making Confidence

Confidence in decision-making is critical for success in the CRCM exam and professional practice. Advanced scenario simulations train candidates to make informed, timely decisions under pressure. Practicing multiple complex scenarios enables candidates to trust their analytical reasoning, prioritize actions appropriately, and provide well-supported recommendations

Confidence also reduces exam anxiety and improves performance under timed conditions. Candidates who regularly engage with advanced simulations develop a clear understanding of how to approach questions systematically and are better prepared to handle unexpected challenges

Continuous Knowledge Reinforcement

Ongoing practice with scenario simulations and mock exams reinforces knowledge and enhances retention. Repeated exposure to regulatory concepts, risk management principles, and internal control frameworks ensures that candidates internalize critical information and can apply it effectively during the exam

Reinforcement through practical application also strengthens the ability to synthesize knowledge across multiple domains. Candidates develop a comprehensive understanding of how regulations, operational procedures, and risk mitigation strategies interact in real-world situations

Evaluating and Adjusting Study Plans

Regular evaluation of performance in scenario simulations and mock exams allows candidates to adjust study plans strategically. Identifying areas of strength and weakness enables targeted review, ensuring efficient use of preparation time. Continuous assessment ensures that candidates are progressing and are well-prepared for all aspects of the exam

Adjusting study plans based on performance also promotes adaptive learning. Candidates can focus on challenging regulatory areas, refine analytical approaches, and enhance problem-solving skills, ensuring comprehensive readiness for the CRCM exam

Advanced Integration of Compliance Principles

Candidates should practice integrating compliance principles across various operational functions. This includes applying regulatory knowledge to risk assessment, monitoring, internal controls, and ethical decision-making. Advanced integration ensures that candidates can address complex scenarios holistically, considering all relevant factors and potential outcomes

Integration also strengthens the ability to prioritize actions and implement solutions that balance regulatory compliance with operational effectiveness. Candidates who master this approach are better equipped to demonstrate professional competence and strategic thinking during the exam

Stress Management During High-Complexity Scenarios

Practicing advanced scenarios under simulated exam conditions helps candidates manage stress effectively. Exposure to complex, multi-faceted questions trains candidates to maintain focus, analyze information systematically, and make decisions under pressure. Stress management techniques, such as structured analysis, time allocation, and relaxation strategies, enhance performance and decision-making accuracy

Stress management is equally important for professional practice. Candidates who are adept at handling pressure are better prepared to manage compliance challenges, respond to regulatory audits, and lead teams in high-stakes environments

Applying Knowledge in Leadership Roles

CRCM-certified professionals often take on leadership responsibilities, guiding compliance teams and overseeing organizational risk management. Advanced scenario simulations prepare candidates to make strategic decisions, implement policies, and evaluate compliance initiatives from a leadership perspective. This application of knowledge demonstrates the value of certification in professional growth

Leadership application also includes mentoring junior staff, fostering a culture of compliance, and ensuring that organizational processes adhere to regulatory standards. Candidates who practice decision-making in simulated scenarios develop the skills necessary to lead effectively in professional environments

Ethical Decision-Making and Regulatory Compliance

Ethical considerations are central to the CRCM exam and professional practice. Candidates should practice scenarios that require balancing regulatory requirements with ethical decision-making. Developing the ability to identify ethical dilemmas, assess consequences, and recommend compliant actions is crucial for exam success and professional credibility

Ethical decision-making also strengthens organizational governance. Candidates trained in evaluating compliance scenarios from an ethical perspective contribute to a culture of integrity and accountability within financial institutions

Long-Term Professional Benefits

Advanced scenario preparation ensures that candidates gain skills beyond exam performance. CRCM certification enhances credibility, career advancement, and leadership opportunities. Professionals are equipped to manage complex compliance programs, guide teams, and implement strategic solutions aligned with regulatory standards

The skills developed through rigorous scenario practice support long-term professional growth. Certified individuals are capable of navigating emerging regulatory challenges, contributing strategically to organizational goals, and maintaining operational and regulatory integrity

Continuous Professional Development

Ongoing engagement with advanced scenarios supports continuous professional development. Candidates who consistently apply regulatory knowledge to complex problems develop analytical, decision-making, and strategic skills essential for maintaining compliance programs and managing risk effectively

Continuous learning ensures that CRCM-certified professionals remain current with evolving regulations, industry standards, and operational best practices. This ongoing development enhances expertise, leadership capabilities, and the ability to implement effective compliance strategies

Conclusion

Mastering advanced scenario simulations and integrating strategic exam preparation techniques are essential for CRCM exam success. Candidates should focus on complex scenario analysis, time management, analytical reasoning, strategic problem-solving, and ethical decision-making. Regular practice, evaluation, and targeted study reinforce knowledge and build confidence

CRCM certification validates professional competence, enhances career opportunities, and equips individuals to lead compliance initiatives effectively. Candidates who excel in advanced scenario simulations are well-prepared to apply knowledge in real-world settings, manage risks, and contribute strategically to organizational success

ABA CRCM practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass CRCM Certified Regulatory Compliance Manager certification exam dumps & practice test questions and answers are to help students.

Why customers love us?

What do our customers say?

The resources provided for the ABA certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the CRCM test and passed with ease.

Studying for the ABA certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the CRCM exam on my first try!

I was impressed with the quality of the CRCM preparation materials for the ABA certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The CRCM materials for the ABA certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the CRCM exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my ABA certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for CRCM. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the CRCM stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my CRCM certification exam. The support and guidance provided were top-notch. I couldn't have obtained my ABA certification without these amazing tools!

The materials provided for the CRCM were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed CRCM successfully. It was a game-changer for my career in IT!