- Home

- AIWMI Certifications

- CCRA Certified Credit Research Analyst Dumps

Pass AIWMI CCRA Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

CCRA Premium Bundle

- Premium File 84 Questions & Answers. Last update: Feb 15, 2026

- Study Guide 743 Pages

Last Week Results!

Includes question types found on the actual exam such as drag and drop, simulation, type-in and fill-in-the-blank.

Developed by IT experts who have passed the exam in the past. Covers in-depth knowledge required for exam preparation.

All AIWMI CCRA certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the CCRA Certified Credit Research Analyst practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

CCRA Certification: Unlocking Opportunities in Credit Research and Financial Analysis

The Certified Credit Research Analyst certification not only focuses on technical expertise but also emphasizes the application of these skills in practical, real-world situations. Candidates are trained to interpret complex financial statements, assess debt obligations, and understand the implications of leverage, liquidity, and solvency ratios on a company’s overall financial health. This allows professionals to make informed decisions that reduce risk and enhance value for their organizations or clients. Moreover, the program highlights the importance of understanding macroeconomic and industry-specific factors that influence credit quality, such as interest rate trends, regulatory changes, market cycles, and sector-specific risks. By combining macro and micro-level analyses, certified professionals are better equipped to anticipate potential credit events and adapt their strategies accordingly.

In addition to financial analysis, the certification enhances the ability to conduct comprehensive credit risk assessments. Candidates learn to evaluate both qualitative and quantitative factors that contribute to credit risk, including management quality, corporate governance, market positioning, and competitive landscape. They also gain proficiency in quantitative modeling, including scenario analysis, stress testing, and portfolio risk simulations. This holistic approach ensures that professionals can assess not only the probability of default but also the potential financial impact on an organization’s portfolio. The ability to synthesize these insights into actionable recommendations is critical for maintaining the financial stability of institutions and supporting strategic decision-making processes.

The program also stresses the importance of ethical and regulatory compliance. Certified professionals are trained to ensure that their analyses and recommendations conform to global best practices, legal frameworks, and industry regulations. This includes understanding disclosure requirements, reporting standards, and fiduciary responsibilities that protect investors, stakeholders, and the integrity of financial markets. The adherence to professional ethics further reinforces credibility and trust, making CCRA-certified individuals highly respected in their organizations and among industry peers.

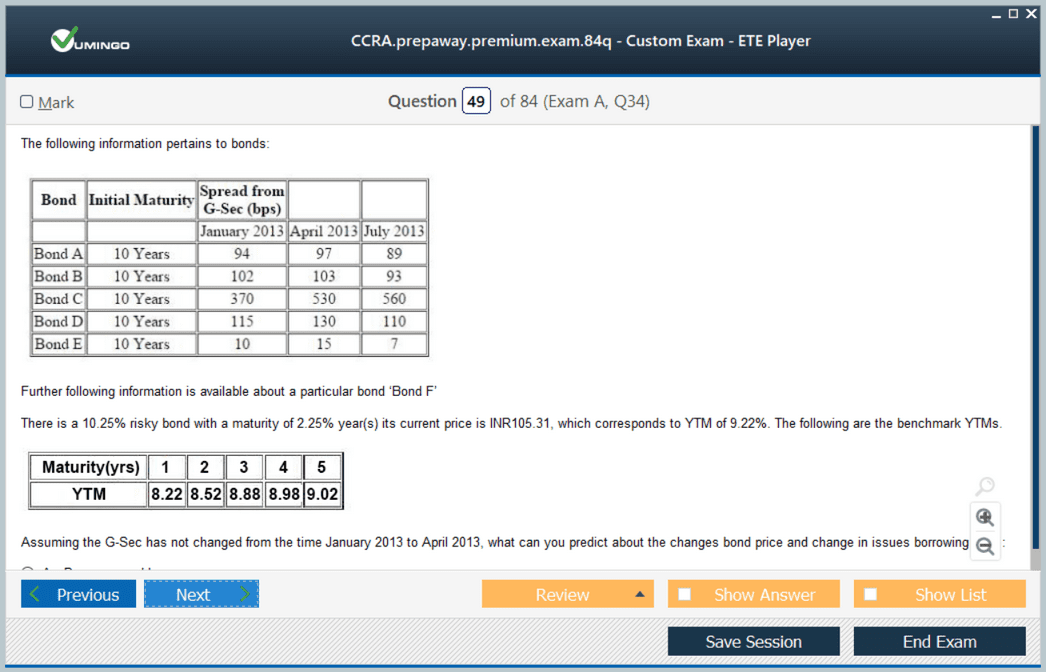

Another key component of the certification is the focus on credit ratings and rating methodologies. Candidates gain an understanding of how credit ratings are assigned, the criteria used by rating agencies, and the implications of ratings on investment decisions and borrowing costs. They learn to apply these methodologies independently to assess creditworthiness, providing organizations with critical insights for lending decisions, debt issuance, and portfolio management. This expertise is especially valuable for professionals working in investment banking, credit rating agencies, corporate finance, and private equity, where accurate credit evaluation directly influences financial outcomes.

The certification further develops a professional’s ability to communicate complex financial information effectively. Candidates are trained to present their analyses clearly and concisely to stakeholders, including senior management, investors, and clients. This skill is essential for ensuring that credit assessments are understood and acted upon appropriately. Professionals learn to create detailed credit reports, prepare risk assessments, and provide recommendations that support strategic decision-making. Strong communication skills complement technical expertise and enhance a professional’s ability to influence outcomes and drive organizational success.

In addition to analytical and communication skills, the CCRA certification emphasizes strategic thinking and portfolio management. Candidates learn to design credit strategies that balance risk and return, optimize portfolio performance, and align with organizational goals. They are trained to evaluate diverse debt instruments, understand their interrelationships, and implement strategies that mitigate risk while maximizing returns. This strategic perspective enables certified professionals to contribute to both short-term operational decisions and long-term financial planning.

The program also exposes candidates to advanced tools and models for credit research. These include software platforms, databases, and analytical frameworks used by industry professionals to monitor financial markets, evaluate securities, and track credit performance over time. Familiarity with these tools enhances efficiency and accuracy, allowing professionals to conduct in-depth research, generate insights, and respond to market changes proactively. The ability to leverage technology in credit analysis further strengthens a professional’s capacity to deliver high-quality research and informed recommendations.

Finally, the Certified Credit Research Analyst certification enhances career prospects and professional recognition. Candidates who complete the program are positioned to take on senior roles in credit research, investment management, banking, and financial advisory services. The certification signals expertise, commitment, and readiness to handle complex financial responsibilities. It provides a competitive edge in the job market, supports career advancement, and opens opportunities for leadership positions. By combining technical knowledge, practical skills, regulatory understanding, and strategic insight, the CCRA certification prepares professionals to excel in the dynamic and challenging field of credit analysis.

In summary, the certification provides a comprehensive learning experience that integrates financial, analytical, and strategic competencies. It equips professionals with the expertise needed to assess credit risk accurately, manage debt portfolios effectively, and contribute to the financial stability and growth of their organizations. By fostering a combination of technical proficiency, ethical standards, and strategic thinking, the CCRA certification ensures that candidates are well-prepared to navigate the complexities of credit research and deliver meaningful value in the financial sector.

The certification serves as a benchmark for credit research proficiency and prepares professionals to make informed decisions in lending, investment, and risk management. Participants develop a strong foundation in interpreting financial metrics, evaluating business performance, and identifying potential risks within industries. By the end of the program, candidates are capable of analyzing complex credit structures, evaluating market trends, and preparing detailed research reports for decision-making purposes.

Benefits of CCRA Certification

The curriculum of the Certified Credit Research Analyst program is structured to meet the needs of global financial institutions and credit rating agencies. It provides candidates with the knowledge to navigate regulatory frameworks, analyze company financials, and evaluate credit risk effectively. One of the key advantages of the certification is that it aligns with industry best practices, helping candidates gain credibility in roles requiring advanced analytical skills and decision-making capabilities.

This certification offers professionals a competitive advantage in the financial industry by demonstrating their expertise in credit research. Certified individuals gain recognition for their ability to evaluate company performance, understand market dynamics, and apply structured analytical methods. It prepares candidates for positions in corporate credit departments, rating agencies, investment firms, and banking institutions, where their skills can directly influence credit decisions and risk management strategies.

In addition, candidates gain access to a structured framework for analyzing financial data and developing actionable insights. They learn to assess market conditions, industry risks, and macroeconomic factors that influence credit quality. This practical knowledge is essential for professionals who need to make informed decisions about lending, investing, or structuring debt instruments. The certification emphasizes both theoretical concepts and practical applications, ensuring candidates are prepared for real-world challenges in credit research.

Skill Development Through the Certification

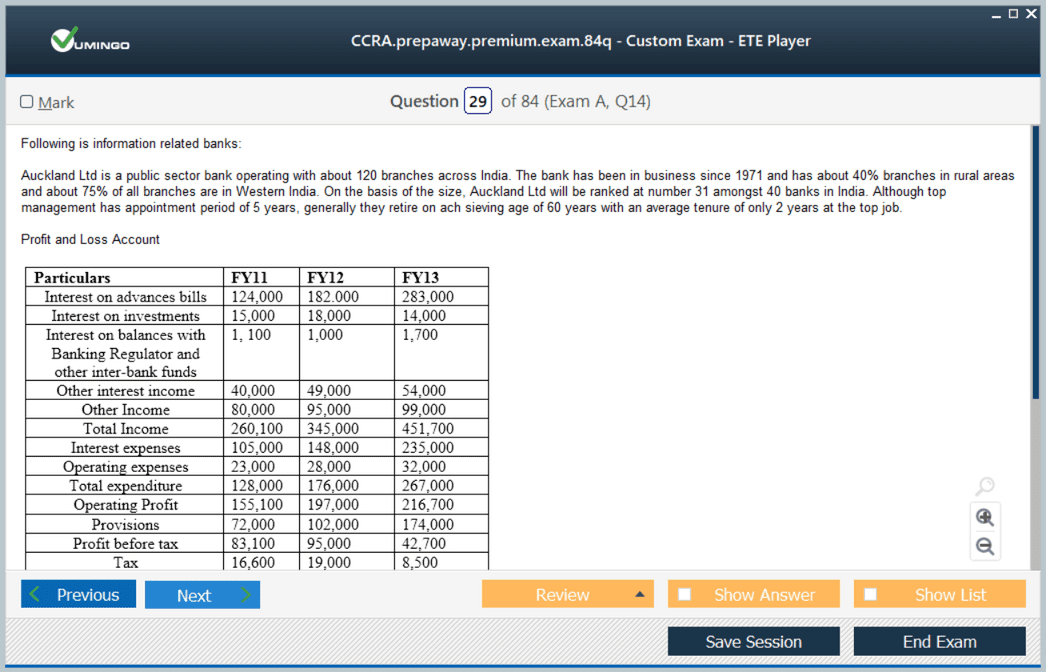

The Certified Credit Research Analyst program emphasizes practical skills that are crucial for analyzing credit risk and structuring financial solutions. Candidates develop expertise in interpreting financial statements, analyzing cash flows, assessing leverage, and understanding key ratios used in credit assessment. The program also covers advanced analytical models and quantitative techniques used to evaluate the credit quality of companies and portfolios.

Participants gain insights into multiple perspectives of credit evaluation, combining qualitative and quantitative analysis to provide a comprehensive view of a company’s financial health. The curriculum includes risk assessment models, market-based evaluations, and fundamental credit analysis techniques. Candidates learn to apply these methods in monitoring debt instruments, assessing counterparty risk, and structuring credit solutions tailored to specific business needs.

Another important aspect of the certification is exposure to tools and methodologies used by industry professionals. Candidates learn to analyze data sets, create detailed reports, and present findings to stakeholders in a clear and concise manner. This training equips them to provide actionable recommendations in lending decisions, investment analysis, and credit risk monitoring. By developing these skills, candidates enhance their ability to perform effectively in high-pressure financial environments where accurate and timely credit analysis is critical.

Examination Structure and Candidate Responsibilities

The CCRA certification exam is conducted on a remote-proctored platform, providing flexibility for candidates to schedule the test within a one-year window. The exam evaluates knowledge across all aspects of credit research, including financial analysis, credit assessment, rating methodologies, and portfolio management. Candidates are tested on their ability to interpret financial data, assess risk, and apply analytical techniques to real-world scenarios.

Candidates must demonstrate a comprehensive understanding of both foundational and advanced credit concepts. The exam ensures that certified professionals can evaluate company performance, analyze industry trends, and develop actionable credit recommendations. Compliance and integrity are essential, and candidates may be subject to audits to verify their educational background and professional experience. Those selected for audit are required to provide supporting documentation to confirm the accuracy of their registration information. Failure to comply with audit requests can result in the cancellation of exam registration and forfeiture of certification eligibility.

The examination measures both theoretical knowledge and practical application, ensuring that candidates are equipped to perform effectively in professional settings. By passing the exam, candidates confirm their ability to analyze complex financial data, monitor portfolio performance, and provide strategic credit recommendations in accordance with industry standards. This combination of assessment methods guarantees that certified professionals are prepared to take on critical roles in credit research and risk management.

Career Opportunities and Professional Growth

Earning the Certified Credit Research Analyst certification opens up a wide array of career opportunities in banking, investment, corporate finance, and credit rating sectors. Professionals with this certification are recognized for their advanced skills in credit assessment and research, making them highly valuable to organizations that rely on accurate and informed financial decision-making.

The program equips candidates to pursue senior roles in credit research, risk analysis, portfolio management, and investment strategy. Professionals gain the technical knowledge and analytical capabilities necessary to evaluate credit risk, structure debt solutions, and make strategic recommendations. They are prepared to handle complex financial data, assess market trends, and provide insights that drive organizational growth and stability.

In addition to immediate career benefits, the certification supports long-term professional development. Candidates gain a deep understanding of global credit markets, analytical frameworks, and risk evaluation techniques. These skills enhance decision-making capabilities, allowing professionals to identify potential risks, develop mitigation strategies, and contribute to sustainable financial practices. Certified individuals are well-positioned to navigate competitive markets, take on leadership responsibilities, and influence strategic decisions within their organizations.

By completing the CCRA certification, professionals demonstrate their commitment to excellence in credit research. They gain credibility, practical expertise, and a strong foundation to advance in the financial sector. The program prepares candidates to tackle complex credit challenges, evaluate market opportunities, and contribute to high-level financial decision-making processes, ensuring their continued growth and success in the field of credit research.

Practical Applications of CCRA Certification

The Certified Credit Research Analyst certification equips professionals with practical knowledge and tools that are immediately applicable in the workplace. Candidates learn to evaluate credit quality across industries, monitor financial health of companies, and conduct comprehensive risk assessments. This practical orientation ensures that individuals can directly apply their learning to roles in corporate finance, investment banking, and credit rating agencies.

Professionals trained under the CCRA framework are adept at analyzing balance sheets, income statements, and cash flow reports to understand liquidity, solvency, and profitability. They are also capable of identifying credit risks, potential default scenarios, and evaluating mitigation strategies. By integrating theoretical knowledge with hands-on analytical tools, the program ensures that candidates can confidently make decisions that influence lending practices, portfolio management, and investment strategies.Global Relevance of the Certification

The CCRA certification holds international recognition, making it suitable for professionals seeking global career opportunities. With a curriculum aligned with international credit rating and banking standards, it provides a common framework for understanding credit markets worldwide. This global relevance allows professionals to navigate cross-border transactions, evaluate multinational corporations, and understand diverse regulatory environments.

Candidates gain insight into global credit trends, macroeconomic indicators, and industry-specific risks. The certification emphasizes the importance of market intelligence and data-driven decision-making, which are critical in global finance. Professionals are prepared to analyze international debt instruments, evaluate corporate creditworthiness across jurisdictions, and contribute to multinational investment strategies.

Advanced Analytical Techniques in Credit Research

A core focus of the CCRA certification is advanced credit analysis techniques. Candidates learn to use quantitative models, ratio analysis, and financial forecasting to assess credit quality. The program also covers scenario analysis, stress testing, and portfolio risk management, allowing professionals to anticipate potential vulnerabilities and prepare risk mitigation strategies.

Analytical skills gained through this certification enable professionals to compare credit metrics across companies, sectors, and regions. They can develop scoring models to rate companies’ creditworthiness and identify investment opportunities. By combining quantitative tools with qualitative insights, candidates gain a comprehensive perspective on market dynamics, enabling precise decision-making in lending, investment, and risk management processes.

Strategic Decision-Making and Risk Management

CCRA-certified professionals are trained to make informed strategic decisions that balance risk and reward. The program emphasizes the importance of aligning credit strategies with organizational objectives and market conditions. Professionals learn to design credit policies, evaluate lending frameworks, and develop strategies for portfolio diversification.

Risk management is a central component of the certification, focusing on identifying potential defaults, assessing counterparty risks, and creating actionable strategies to mitigate losses. Professionals are taught to integrate data from multiple sources, including financial reports, industry trends, and market signals, to develop holistic risk assessments. This strategic approach ensures that decisions are both well-informed and aligned with long-term organizational goals.

Career Pathways and Professional Advancement

Completing the CCRA certification opens doors to a wide range of career paths in finance, banking, and investment sectors. Professionals can pursue roles in credit analysis, portfolio management, investment research, and corporate finance. Organizations value CCRA-certified individuals for their ability to deliver accurate credit assessments and implement risk mitigation strategies.

The certification also supports career progression by equipping candidates with skills that are essential for leadership roles. Professionals can take on responsibilities in credit strategy development, risk management, and high-level financial decision-making. By demonstrating advanced analytical capabilities and comprehensive market knowledge, candidates position themselves as strategic assets within their organizations.

Integration with Organizational Objectives

CCRA-certified professionals are trained to align credit research with broader organizational objectives. They understand how credit strategies impact profitability, operational efficiency, and market positioning. This alignment ensures that financial decisions contribute to sustainable growth and competitive advantage.

Professionals can communicate insights effectively to stakeholders, including management, investors, and regulatory authorities. By providing clear, actionable recommendations, they influence decision-making processes and enhance the organization’s ability to respond to market fluctuations and credit challenges. The certification equips candidates to serve as trusted advisors in financial strategy and risk management initiatives.

Continuous Professional Development

The CCRA certification encourages ongoing professional development by exposing candidates to current trends, industry best practices, and emerging analytical techniques. Professionals are expected to stay informed about changes in market conditions, regulatory frameworks, and credit methodologies. This commitment to continuous learning ensures that certified individuals maintain relevance and competence in an evolving financial landscape.

The program also fosters a network of professionals and access to insights from industry leaders, webinars, and analytical reports. These resources support knowledge expansion and practical application, allowing candidates to refine their skills and adapt to new challenges. The focus on lifelong learning ensures that CCRA-certified professionals remain competitive and capable of contributing effectively to their organizations over time.

Ethical Standards and Regulatory Awareness

CCRA-certified professionals are trained to adhere to high ethical standards in credit research and analysis. The certification emphasizes integrity, transparency, and compliance with regulatory requirements. Professionals are expected to provide accurate assessments, avoid conflicts of interest, and ensure that their recommendations are based on objective analysis.

Understanding regulatory frameworks is crucial for effective credit evaluation. Candidates learn about relevant laws, banking guidelines, and reporting standards that impact credit decisions. This regulatory awareness ensures that professionals operate within legal boundaries and maintain the credibility of their assessments. Ethical conduct and compliance with standards strengthen trust in financial decisions and protect both organizations and stakeholders from undue risk.

Tools and Resources for Credit Analysis

The CCRA program equips candidates with a comprehensive set of tools and resources for conducting effective credit research. Professionals learn to use databases, financial models, and analytical software to collect and interpret data. They gain the ability to evaluate company performance, industry trends, and macroeconomic factors, applying these insights to make informed credit decisions.

Candidates also develop skills in preparing detailed credit reports, presenting findings, and advising management on risk management strategies. The practical use of analytical tools ensures that professionals can handle real-world data efficiently, identify credit opportunities, and assess potential risks with accuracy. These competencies are essential for roles in investment analysis, corporate finance, and credit rating agencies.

Exam Structure and Content Overview

The CCRA Certification exam is designed to test both foundational and advanced knowledge of credit research and analysis. It integrates a wide range of topics, ensuring that candidates possess a holistic understanding of credit markets, corporate finance, and risk management practices. The exam is structured to evaluate analytical thinking, financial acumen, and practical application skills, making it suitable for both fresh graduates and experienced professionals. Candidates are assessed on their ability to interpret complex financial statements, evaluate credit quality, and apply credit risk mitigation strategies effectively.

The certification consolidates learning into a single comprehensive exam that covers the core principles of credit research. This includes modules on financial analysis, credit strategy, corporate rating methodology, and structured finance. By combining multiple levels of learning into one assessment, candidates are encouraged to develop an integrated understanding of credit markets, rather than isolated knowledge areas.

Study Preparation and Learning Approach

Preparing for the CCRA exam requires a strategic approach, combining theoretical knowledge with practical applications. Candidates are encouraged to study case studies that reflect real-world credit evaluation scenarios. This practical focus ensures that the certification is not only about understanding concepts but also about applying them to live market situations. Candidates often review financial statements, industry reports, and credit rating methodologies to develop a well-rounded analytical perspective.

Structured study plans, including self-paced modules and scheduled practice sessions, help candidates manage the breadth of material effectively. The use of analytical tools and market data during preparation equips candidates with the skills needed for precise evaluation of corporate and industry-specific credit risks. A disciplined study schedule, coupled with the practice of interpreting diverse financial scenarios, enhances problem-solving abilities and prepares candidates for real-time decision-making in professional settings.

Candidate Responsibilities and Examination Protocol

Candidates undertaking the CCRA Certification exam are expected to comply with specific examination protocols. The exam is remote-proctored, ensuring integrity and fairness across all candidates. To participate, candidates must have a reliable internet connection and a functioning camera on their device. The remote setup allows flexibility, enabling candidates to schedule the exam at their convenience while maintaining rigorous standards of evaluation.

In addition to technical requirements, candidates must provide accurate information regarding their education and professional background. Periodic audits ensure the authenticity of candidate profiles, with candidates required to submit supporting documentation when requested. Non-compliance with audit requirements or falsification of information may result in disqualification or revocation of the certification. This rigorous approach ensures that the credential maintains credibility and reflects true professional competence.

Exam Topics and Skill Development

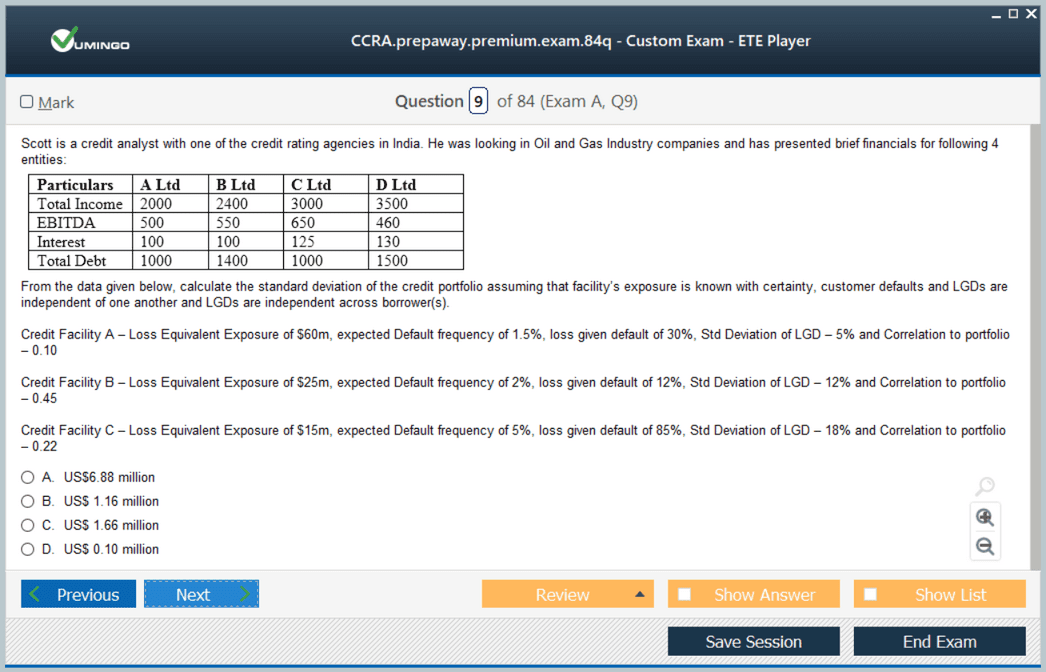

The CCRA exam covers a broad spectrum of topics essential for mastering credit research. Candidates study financial statement analysis, focusing on liquidity, solvency, profitability, and cash flow evaluation. They also learn to assess credit risks using quantitative models, scenario planning, and stress testing. Understanding market trends, economic indicators, and industry-specific dynamics is a crucial component of the curriculum, enabling candidates to make informed decisions.

Strategic components of the exam emphasize portfolio management, structured finance, and credit rating processes. Candidates develop skills in assessing default probabilities, estimating recovery rates, and analyzing credit exposure across diverse sectors. The curriculum also includes communication and reporting skills, preparing candidates to convey complex credit insights clearly to stakeholders, including management, investors, and regulatory bodies.

Career Advantages of Certification

CCRA Certification enhances career prospects by equipping professionals with specialized expertise in credit analysis. Certified individuals are positioned to take on critical roles in corporate finance, banking, investment management, and credit rating agencies. The certification signals to employers that candidates possess both the knowledge and practical capabilities required to assess creditworthiness and implement risk mitigation strategies effectively.

In addition to entry-level opportunities, the CCRA Certification supports advancement into senior positions. Professionals with the credential can oversee credit portfolios, lead risk assessment teams, and contribute to strategic decision-making processes. Organizations value certified individuals for their ability to analyze complex financial data, anticipate market risks, and provide actionable insights that protect and optimize organizational assets.

Strategic Importance for Financial Institutions

Financial institutions benefit significantly from employing CCRA-certified professionals. These individuals bring expertise in evaluating credit exposure, optimizing lending strategies, and maintaining portfolio quality. By applying rigorous credit assessment methodologies, certified analysts help institutions minimize default risks and enhance profitability. Their comprehensive understanding of credit markets allows institutions to make informed lending decisions and design structured finance solutions that meet both regulatory and strategic objectives.

CCRA professionals also provide insights into emerging market trends and potential risks, enabling proactive management of credit portfolios. Their ability to integrate qualitative and quantitative analysis ensures a balanced approach to risk evaluation. This strategic contribution enhances institutional resilience, supports sustainable growth, and strengthens the institution's competitive position in global financial markets.

Practical Application in Investment Analysis

Beyond corporate lending, the skills gained through CCRA Certification are directly applicable to investment analysis. Professionals can evaluate bonds, loans, and other fixed income instruments with precision, identifying opportunities and risks. The certification emphasizes the use of market data, financial ratios, and credit metrics to make investment recommendations that balance return and risk.

Candidates trained in CCRA methods are capable of constructing credit portfolios, analyzing industry trends, and performing scenario-based risk assessments. Their proficiency in using credit models and analytical tools enhances decision-making in both corporate and institutional investment settings. This practical orientation ensures that the certification translates into tangible value in professional practice.

Integrating Quantitative and Qualitative Analysis

A distinguishing feature of the CCRA Certification is its emphasis on integrating quantitative and qualitative evaluation methods. Candidates learn to combine financial modeling, statistical analysis, and scenario testing with qualitative insights into market behavior, corporate governance, and industry dynamics. This dual approach provides a comprehensive framework for credit assessment, enabling professionals to form nuanced judgments that reflect both numerical data and broader market context.

This skill is particularly valuable in situations where data alone may not provide a complete picture. By considering factors such as management quality, competitive positioning, and regulatory environment, certified analysts deliver more accurate and actionable credit evaluations. This integrated approach enhances risk management, portfolio monitoring, and strategic financial decision-making across organizations.

Global Perspectives in Credit Research

The CCRA Certification emphasizes a global understanding of credit markets, preparing candidates to analyze credit quality across different geographies. Financial systems, regulatory frameworks, and market practices vary from country to country, making it essential for credit analysts to understand local contexts as well as international trends. Candidates learn to evaluate credit risk by integrating global economic indicators, interest rate environments, and geopolitical factors into their assessments.

Exposure to international credit analysis practices helps candidates understand how global events, such as economic downturns, trade tensions, and changes in monetary policy, influence the creditworthiness of corporations and sovereign entities. This global perspective equips professionals to advise multinational organizations, investment funds, and global banks on risk management strategies and portfolio allocation decisions.

Advanced Applications in Corporate Credit Evaluation

CCRA-certified professionals gain the ability to conduct in-depth corporate credit evaluations. This involves assessing balance sheets, cash flow statements, and income statements to understand liquidity, solvency, and profitability trends. Analysts examine debt structures, covenant compliance, and capital allocation strategies to evaluate a company’s ability to meet its financial obligations.

Candidates also learn to analyze complex credit instruments, including structured products, syndicated loans, and hybrid securities. The curriculum trains professionals to understand the nuances of credit enhancements, collateral structures, and default scenarios. This advanced application of credit research principles ensures that certified individuals can provide comprehensive recommendations that mitigate risk while maximizing returns.

Ethical Considerations in Credit Analysis

The CCRA Certification places significant emphasis on ethical practices in credit research. Candidates are trained to maintain transparency, accuracy, and integrity when evaluating financial information and reporting their findings. Ethical conduct is critical in ensuring that credit ratings, lending decisions, and investment advice are trustworthy and unbiased.

Analysts are guided on how to avoid conflicts of interest, manage confidential information responsibly, and adhere to regulatory standards across jurisdictions. Ethical training ensures that CCRA-certified professionals uphold the credibility of the credit research profession and protect stakeholders from misleading or incomplete analyses.

Continuous Professional Development

Achieving CCRA Certification is a milestone, but ongoing professional development is essential to maintain expertise in the rapidly evolving field of credit research. Certified analysts are encouraged to stay informed about emerging trends, regulatory changes, and market innovations. This includes attending webinars, reviewing industry reports, and engaging with professional networks that focus on credit analysis and financial risk management.

Continuous learning allows CCRA-certified professionals to refine their skills, adapt to new analytical tools, and remain competitive in the job market. Employers value individuals who proactively update their knowledge, as it translates into better risk assessment, decision-making, and strategic planning capabilities.

Strategic Decision-Making and Portfolio Management

CCRA Certification prepares candidates to contribute meaningfully to strategic decision-making processes within organizations. Certified analysts can assess the risk-reward profile of credit exposures, recommend adjustments to portfolios, and design credit strategies aligned with organizational objectives. They are skilled at identifying early warning signs of default, evaluating market trends, and assessing the impact of macroeconomic changes on credit portfolios.

In portfolio management, CCRA-certified professionals apply both quantitative and qualitative methodologies. They use financial models, scenario simulations, and market data analysis to evaluate credit risk and optimize portfolio performance. This strategic approach ensures that organizations can balance growth objectives with prudent risk management practices.

Integration of Technology in Credit Analysis

The modern credit analyst leverages technology to enhance analytical accuracy and efficiency. CCRA-certified candidates are trained to use advanced software, databases, and financial modeling tools to support their assessments. Technology integration allows analysts to process large volumes of data, identify patterns, and perform predictive analysis on potential credit risks.

Automation and data analytics enable professionals to monitor credit exposures in real time, enhancing decision-making capabilities. The certification emphasizes the importance of combining technological tools with expert judgment to provide well-informed, actionable insights. Candidates develop the ability to interpret complex datasets and translate them into strategic recommendations for management and stakeholders.

Market Risk and Stress Testing

An essential component of the CCRA Certification is the evaluation of market risk and the implementation of stress testing methodologies. Certified analysts are trained to assess how economic downturns, interest rate volatility, or industry-specific shocks impact the creditworthiness of entities within a portfolio. Stress testing enables organizations to anticipate potential losses, develop contingency plans, and implement risk mitigation strategies.

By simulating adverse scenarios and analyzing their potential impact, CCRA-certified professionals can provide guidance on capital allocation, risk limits, and strategic adjustments. This ensures that organizations are better prepared to navigate financial uncertainty and maintain stability in their credit operations.

Communication and Reporting Skills

CCRA-certified professionals are also equipped with the ability to communicate complex credit findings effectively. The certification emphasizes structured reporting, clear presentation of data, and actionable insights tailored to various stakeholders, including management, investors, and regulatory bodies.

Effective communication is critical in translating analytical findings into decisions that impact lending, investment, and strategic planning. Candidates learn to present credit risk assessments clearly, justify recommendations with supporting evidence, and articulate potential risks in a comprehensible manner. This skill set enhances organizational confidence in the decisions made by credit analysts and supports informed strategic planning.

Industry Recognition and Career Advancement

Holding a CCRA Certification demonstrates mastery in credit research and analysis, earning recognition from employers and industry peers. Certified professionals are viewed as competent, credible, and capable of contributing to high-stakes decision-making processes. The credential enhances employability in banking, investment management, credit rating agencies, and corporate finance departments.

Career advancement opportunities expand for certified individuals, as they can take on roles with greater responsibility, including senior analyst positions, portfolio management, and credit strategy leadership. The certification provides a competitive edge in a highly specialized field, highlighting both knowledge and practical skills that are directly relevant to industry demands.

Enhancing Analytical Rigor

CCRA-certified analysts develop rigorous analytical thinking and problem-solving abilities. The program emphasizes evaluating multiple perspectives, combining quantitative metrics with qualitative factors, and making reasoned judgments under uncertainty. Analysts learn to scrutinize financial statements, assess industry dynamics, and interpret macroeconomic indicators to form robust credit assessments.

This analytical rigor equips professionals to identify potential risks and opportunities in credit markets, optimize decision-making processes, and support strategic objectives. Organizations benefit from employing analysts capable of delivering thorough, evidence-based insights that contribute to financial stability and informed business strategies

Preparing for Global Credit Challenges

The certification prepares candidates to address the complexities of global credit markets. Professionals learn to analyze cross-border credit exposures, understand currency and interest rate risks, and evaluate sovereign and corporate credit in different regulatory environments. This knowledge is particularly valuable for multinational corporations, global investment funds, and financial institutions operating across diverse markets.

CCRA-certified analysts are trained to adapt their methodologies to local and international contexts, ensuring that credit assessments remain accurate and actionable despite varying market conditions. This global readiness is a key differentiator for professionals seeking to work in international finance and risk management.

Exam Structure and Preparation Strategy

The CCRA Certification is structured to assess both foundational knowledge and practical application in credit research. The examination consolidates Level 1 and Level 2 material into a single comprehensive assessment, which challenges candidates to demonstrate proficiency across multiple domains of credit analysis. The curriculum covers topics such as corporate financial analysis, credit risk assessment, structured credit products, and portfolio management.

Effective preparation involves understanding the theoretical concepts while simultaneously applying them to real-world scenarios. Candidates are encouraged to study case studies, simulate credit evaluations, and practice interpreting financial statements to develop analytical rigor. Time management is essential, as the exam includes a large number of questions to be answered within a defined period.

Accessing Study Materials and Resources

To prepare thoroughly, candidates leverage a range of study materials designed to reflect the demands of the CCRA Certification exam. Textbooks provide detailed explanations of financial concepts, methodologies for analyzing credit quality, and guidance on structuring and monitoring credit portfolios. Supplementary materials, including practice exercises and case analyses, allow candidates to test their understanding and apply concepts in realistic settings.

Professional webinars and interactive sessions enhance comprehension by offering insights from experienced credit analysts. These sessions often explore contemporary issues in credit markets, regulatory updates, and innovations in credit risk assessment. Candidates gain exposure to practical strategies, industry best practices, and evolving analytical tools that reinforce their learning and improve performance on the exam.

Remote Examination and Candidate Flexibility

The CCRA Certification exam is delivered on a remote-proctored platform, offering candidates flexibility to schedule and complete the assessment from any location with a stable internet connection. This system allows professionals and students to integrate exam preparation into their schedules without the need for travel to physical testing centers. Remote proctoring ensures the integrity of the examination through monitoring and verification protocols.

Candidates must ensure their testing environment meets technical requirements, including a functional camera and reliable internet connectivity. The flexible approach allows candidates to choose an optimal time to take the exam, promoting focused performance while accommodating professional or personal obligations.

Practical Application in Professional Roles

Achieving the CCRA Certification equips candidates to apply advanced credit research skills directly in professional roles. Certified analysts can evaluate the creditworthiness of corporate, sovereign, and structured financial instruments. They develop actionable insights for risk mitigation, lending decisions, and investment strategy formulation.

Employers benefit from CCRA-certified professionals who bring structured analytical methods, advanced financial modeling skills, and the ability to integrate qualitative and quantitative data into decision-making processes. This expertise is critical for roles in banks, investment firms, rating agencies, and corporate finance teams. Certified analysts contribute to portfolio optimization, regulatory compliance, and strategic financial planning.

Networking and Industry Exposure

The certification program fosters connections with peers and industry professionals, which is invaluable for career growth. Candidates engage with a global community of analysts, sharing knowledge, methodologies, and market insights. Exposure to industry perspectives enhances understanding of diverse market conditions and strengthens professional judgment.

Networking opportunities include briefings, webinars, and discussion forums where candidates can analyze current market events, discuss challenges, and learn innovative approaches to credit analysis. These interactions support professional development and increase visibility in the field, potentially leading to career advancement and new opportunities.

Risk Management and Portfolio Strategy

CCRA-certified analysts develop advanced skills in risk identification, measurement, and mitigation. They are trained to evaluate potential default scenarios, monitor exposure concentrations, and implement stress-testing frameworks for credit portfolios. By integrating macroeconomic indicators, sectoral trends, and company-specific factors, analysts provide a comprehensive assessment of potential risks.

Portfolio strategy benefits from the ability to balance risk and return objectives. Certified professionals can recommend adjustments to credit exposures, develop contingency plans for adverse scenarios, and optimize investment allocations. This systematic approach ensures organizations maintain financial stability while pursuing growth and strategic objectives.

Regulatory Compliance and Best Practices

Understanding regulatory requirements is a core component of the CCRA Certification. Analysts learn to navigate domestic and international regulations that impact credit analysis, reporting, and risk management. Compliance knowledge ensures that credit decisions align with legal standards and ethical expectations, mitigating the potential for legal or financial penalties.

Best practices in documentation, reporting, and communication are emphasized to ensure that credit assessments are transparent, reproducible, and defensible. Candidates are trained to maintain rigorous standards of accuracy and reliability, which enhances organizational credibility and stakeholder confidence in the financial decision-making process.

Integrating Quantitative and Qualitative Analysis

CCRA-certified professionals master the integration of quantitative and qualitative assessment methods. Quantitative analysis involves financial ratios, cash flow modeling, and statistical evaluation of risk metrics. Qualitative analysis includes management assessment, industry dynamics, market positioning, and strategic considerations.

Combining both approaches provides a holistic view of creditworthiness, ensuring that decisions reflect both numeric rigor and contextual understanding. This dual approach equips analysts to identify early warning signs, assess potential threats, and recommend proactive interventions.

Career Advancement and Professional Impact

Certification enhances a professional’s ability to pursue senior roles in credit research, investment analysis, and corporate finance. Employers recognize CCRA-certified analysts as highly capable, well-trained professionals who can contribute to strategic decision-making and risk mitigation. The certification demonstrates a commitment to specialized expertise, analytical excellence, and adherence to industry standards.

Career growth includes opportunities in corporate credit, fixed income investment, banking, and financial consulting. Certified analysts may take on leadership roles in portfolio management, credit strategy formulation, and risk oversight. Their advanced skill set allows them to influence organizational strategy, optimize financial outcomes, and contribute to long-term stability.

Long-Term Professional Development

Obtaining the CCRA Certification is not the final step in professional development. Continuous learning is essential to remain current with evolving credit markets, emerging risks, and innovative analytical tools. Professionals are encouraged to engage in ongoing education, industry events, and market research to enhance their knowledge base.

Long-term development ensures that CCRA-certified analysts maintain relevance in the field, adapt to changing financial landscapes, and sustain their ability to provide value to employers and clients. It reinforces the principle that mastery in credit research requires ongoing refinement, application, and professional engagement.

Conclusion

The Certified Credit Research Analyst certification represents a significant milestone for professionals seeking to advance in the financial sector, particularly in credit markets, banking, and investment management. It offers an in-depth understanding of the credit lifecycle, from evaluating corporate financial statements and assessing debt instruments to analyzing market trends and credit risk. This knowledge is critical for professionals who aim to make informed, strategic decisions that protect organizational assets and optimize financial performance.

By completing the CCRA program, candidates acquire both theoretical and practical skills that are immediately applicable in the workplace. They develop the ability to assess creditworthiness for individual companies, industries, and broader portfolios, combining qualitative insights with quantitative analysis. This dual approach allows professionals to not only identify potential risks but also to recommend strategies that balance risk and return, which is essential in maintaining the financial health of institutions and clients they serve.

The certification also emphasizes the importance of adhering to regulatory and compliance standards. Professionals trained through CCRA gain the expertise to ensure that their analyses and recommendations align with industry best practices, legal requirements, and risk management frameworks. This focus on governance and compliance adds an additional layer of credibility, making certified individuals highly valued by employers who prioritize responsible financial management and regulatory adherence.

CCRA-certified professionals enjoy a broad scope of career opportunities. They can work in banks, investment firms, credit rating agencies, corporate finance departments, or advisory services. The program equips them with the skills to undertake senior-level responsibilities, such as structuring credit strategies, conducting portfolio risk assessments, and providing actionable insights for mergers and acquisitions. The versatility of this certification allows professionals to navigate complex financial environments, adapting to various market conditions and organizational needs with confidence.

Another notable advantage of the CCRA certification is the enhancement of analytical and decision-making capabilities. Professionals are trained to critically evaluate multiple factors that influence credit risk, including macroeconomic conditions, industry-specific trends, company performance, and market dynamics. This rigorous analytical training empowers them to identify emerging risks, forecast potential defaults, and design effective mitigation strategies. The resulting skill set not only improves the quality of financial decisions but also strengthens an organization’s ability to respond proactively to market changes.

In addition to technical proficiency, CCRA certification fosters professional credibility and recognition. Employers, clients, and colleagues view certified professionals as experts who have undergone a structured, globally recognized program. This recognition enhances career progression, providing pathways to leadership roles, strategic advisory positions, and opportunities to contribute to high-impact financial decisions. The certification signals dedication to continuous learning and mastery of credit research, qualities that are highly valued in competitive financial markets.

Finally, the CCRA certification equips professionals with access to global analytical models, market insights, and a network of industry peers. This exposure ensures that candidates are not only knowledgeable about local markets but also capable of applying best practices and innovative approaches in a global context. Such comprehensive preparation enables professionals to provide nuanced analysis, make informed decisions, and deliver strategic value across diverse financial environments.

Overall, the Certified Credit Research Analyst certification represents a robust combination of knowledge, practical skills, and professional credibility. It prepares candidates to excel in complex financial markets, handle high-stakes credit analysis, and contribute meaningfully to organizational growth and stability. Through this certification, professionals gain a competitive edge, broaden their career prospects, and become capable of navigating the challenges of modern finance with expertise, confidence, and strategic insight.

AIWMI CCRA practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass CCRA Certified Credit Research Analyst certification exam dumps & practice test questions and answers are to help students.

Purchase CCRA Exam Training Products Individually

Why customers love us?

What do our customers say?

The resources provided for the AIWMI certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the CCRA test and passed with ease.

Studying for the AIWMI certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the CCRA exam on my first try!

I was impressed with the quality of the CCRA preparation materials for the AIWMI certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The CCRA materials for the AIWMI certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the CCRA exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my AIWMI certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for CCRA. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the CCRA stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my CCRA certification exam. The support and guidance provided were top-notch. I couldn't have obtained my AIWMI certification without these amazing tools!

The materials provided for the CCRA were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed CCRA successfully. It was a game-changer for my career in IT!