- Home

- ISTQB Certifications

- ATM Advanced Test Manager Dumps

Pass ISTQB ATM Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

ATM Premium Bundle

- Premium File 64 Questions & Answers. Last update: Feb 22, 2026

- Training Course 52 Video Lectures

Last Week Results!

Includes question types found on the actual exam such as drag and drop, simulation, type-in and fill-in-the-blank.

Based on real-life scenarios similar to those encountered in the exam, allowing you to learn by working with real equipment.

All ISTQB ATM certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the ATM Advanced Test Manager practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

Understanding the Scope of ATM Test Certification Exam

The ATM (Asynchronous Transfer Mode) test certification exam represents a specialized credential validating expertise in testing telecommunications network infrastructure, quality assurance methodologies, and protocol verification procedures essential for network professionals. Candidates pursuing ATM testing certification must demonstrate comprehensive understanding of network testing principles, protocol analysis, performance measurement techniques, and troubleshooting methodologies applicable to ATM networks and related telecommunications infrastructure. Modern network testing increasingly intersects with cloud platforms as organizations migrate networking infrastructure to cloud environments requiring testers to possess both traditional networking knowledge and contemporary cloud administration skills. The certification validates abilities to design test cases, execute testing procedures, analyze results, and document findings supporting network deployment and maintenance activities.

Cloud platform expertise has become increasingly relevant for network testing professionals as infrastructure testing extends into Azure cloud administration domains where virtual networking requires validation similar to physical network testing. Network testers working with cloud infrastructure must understand virtual network configurations, cloud-based monitoring tools, and how to validate network performance in cloud environments where traditional testing approaches may require adaptation. Cloud administration knowledge enables testers to provision test environments, configure virtual networks for testing purposes, and leverage cloud-native monitoring capabilities during testing activities. The intersection of network testing and cloud platforms creates opportunities for professionals who combine traditional networking expertise with modern cloud competencies.

Implementing Security Operations for Network Testing Environments

Network testing environments require robust security operations protecting sensitive testing data, preventing unauthorized access to testing infrastructure, and ensuring testing activities don't compromise production systems. Security operations knowledge enables testers to implement appropriate controls protecting testing environments while maintaining isolation from production networks. ATM test certification candidates must understand security principles applicable to testing infrastructure including access controls, network segmentation, and secure communication protocols. Testing activities may involve sensitive network configurations, customer data samples, or proprietary network designs requiring appropriate security controls protecting confidential information during testing procedures.

Security operations expertise particularly security analyst certifications provides valuable knowledge for network testers establishing and maintaining secure testing environments. Security operations skills enable testers to implement logging and monitoring for testing activities, maintain audit trails documenting testing procedures, and ensure testing infrastructure complies with organizational security policies. Network testers with security operations knowledge can better collaborate with security teams, understand security testing requirements, and implement security controls protecting testing environments. Security-conscious testing practices prevent testing activities from introducing vulnerabilities or compromising network security during validation procedures.

Managing Test Endpoint Configurations and Device Administration

ATM network testing requires managing diverse endpoint devices including testing equipment, network analyzers, and protocol testers each requiring proper configuration and administration. Device management expertise enables testers to configure testing equipment appropriately, maintain testing device inventories, and ensure testing infrastructure remains operational and properly calibrated. Certification candidates must demonstrate abilities to configure testing devices, troubleshoot equipment issues, and maintain testing infrastructure supporting ongoing testing activities. Proper device management ensures testing equipment provides accurate measurements and reliable results during network validation procedures.

Modern device administration skills particularly endpoint management competencies translate directly to testing equipment management where testers must configure, monitor, and maintain testing devices. Device management knowledge enables systematic approaches to testing equipment administration including configuration management, inventory tracking, and maintenance scheduling. Network testers benefit from understanding device management principles when administering testing infrastructure comprising diverse equipment types requiring coordinated configuration and management. Effective device administration ensures testing infrastructure remains reliable, properly configured, and capable of supporting required testing activities.

Analyzing Performance Metrics Using Monitoring and Analytics Tools

Network testing generates extensive performance data requiring systematic analysis to identify issues, validate performance, and document network behavior. Performance analysis skills enable testers to collect metrics, analyze trends, and interpret measurements determining whether networks meet performance specifications. ATM test certification validates abilities to use monitoring tools, analyze performance data, and draw conclusions from measurements supporting network validation decisions. Testers must understand statistical analysis, baseline establishment, and anomaly detection identifying performance deviations requiring investigation or remediation.

Analytics expertise similar to digital marketing analytics capabilities demonstrates how data analysis skills apply across domains where professionals must interpret metrics and derive actionable insights. Network testing analytics requires understanding performance indicators, establishing performance baselines, and identifying patterns indicating network issues or performance degradation. Testers with strong analytical skills can more effectively interpret testing data, identify subtle performance issues, and provide detailed analysis supporting network optimization decisions. Performance analysis represents core competency for network testers validating infrastructure performance and identifying optimization opportunities.

Comparing Compensation Expectations Across Geographic Markets

Career planning for network testing professionals requires understanding compensation expectations across different geographic markets where salaries vary based on cost of living, market demand, and regional economic conditions. Network testing specialists command varying compensation depending on specialization, experience level, and geographic location requiring research into market rates for certification planning and career decisions. Understanding salary ranges helps professionals evaluate certification return on investment, plan career progression, and make informed decisions about specialization areas offering optimal compensation for acquired skills and experience.

Geographic salary analysis demonstrated through digital marketing compensation research reveals methodologies applicable to network testing salary research where professionals must understand regional variations. Network testing salaries vary significantly across regions with major technology centers typically offering higher compensation reflecting cost of living and competitive markets for skilled professionals. Certification candidates should research salary expectations in target markets understanding how ATM test certification affects earning potential and career opportunities. Compensation research supports strategic career planning ensuring certification investments align with realistic salary expectations and career advancement potential.

Applying Strategic Planning Principles to Testing Initiatives

Network testing requires strategic planning determining testing scope, resource allocation, timeline development, and success criteria establishment. Strategic planning skills enable testers to design comprehensive testing programs addressing critical validation requirements while managing resource constraints and schedule limitations. ATM test certification validates abilities to plan testing initiatives, prioritize testing activities, and allocate resources effectively achieving testing objectives within project constraints. Testers must balance comprehensive testing against practical limitations developing testing strategies maximizing validation coverage within available resources and timelines.

Strategic planning expertise illustrated through marketing strategy case studies demonstrates systematic planning approaches applicable to network testing initiatives requiring similar strategic thinking. Testing strategy development involves defining objectives, identifying critical test cases, allocating resources, and establishing success metrics measuring testing effectiveness. Network testers with strategic planning capabilities can design more effective testing programs, prioritize high-value testing activities, and manage testing initiatives delivering maximum value within resource constraints. Strategic planning distinguishes comprehensive testing programs from ad-hoc testing approaches lacking systematic planning and prioritization.

Selecting Appropriate Testing Tools and Instrumentation

Network testing success depends significantly on tool selection as testing capabilities, accuracy, and efficiency depend on appropriate instrumentation. Tool selection requires evaluating testing requirements, comparing available equipment, and selecting instruments providing necessary capabilities within budget constraints. ATM test certification candidates must understand available testing tools, instrument capabilities, and selection criteria ensuring appropriate tool choices for specific testing scenarios. Testing tools range from simple handheld analyzers to sophisticated protocol analyzers requiring significant investment and specialized expertise.

Tool selection parallels standardized test calculator choices where appropriate tool selection significantly affects performance and capabilities. Network testing instrumentation must provide required measurement capabilities, appropriate accuracy, and suitable features for intended testing applications. Testers must evaluate instrument specifications, compare alternative options, and select tools balancing capabilities against costs ensuring cost-effective testing infrastructure. Appropriate tool selection enables efficient testing, accurate measurements, and comprehensive validation supporting network deployment and maintenance activities.

Comparing Protocol Testing Approaches and Methodologies

Network testing encompasses diverse methodologies including functional testing, performance testing, stress testing, and protocol compliance testing each requiring different approaches and techniques. Protocol testing methodologies vary based on testing objectives, network characteristics, and specific protocols requiring validation. ATM test certification validates understanding of various testing approaches, ability to select appropriate methodologies for specific scenarios, and expertise implementing chosen testing strategies effectively. Testers must understand when to apply different testing approaches selecting methodologies appropriate for specific validation objectives and network characteristics.

Methodology comparison skills demonstrated through SAT versus ACT analysis reveal how professionals evaluate alternative approaches selecting optimal methods for specific contexts. Network testing methodology selection requires understanding testing approach strengths, limitations, and applicability to specific scenarios ensuring appropriate method selection. Testers must evaluate functional testing, performance testing, security testing, and compliance testing approaches determining which methodologies address specific validation requirements. Methodology expertise enables appropriate testing approach selection ensuring testing activities effectively validate targeted network characteristics.

Implementing Systematic Testing Procedures and Workflows

Effective network testing requires systematic procedures ensuring consistent, repeatable testing activities producing reliable results. Procedure development involves documenting testing steps, establishing validation criteria, and defining result interpretation guidelines enabling consistent testing across different testers and testing sessions. ATM test certification validates abilities to develop testing procedures, execute documented processes, and maintain procedural discipline ensuring testing consistency and reliability. Systematic procedures prevent ad-hoc testing approaches that may overlook critical validation steps or produce inconsistent results.

Systematic approach development illustrated through ACT science strategies demonstrates structured methodologies applicable to network testing requiring similar systematic approaches. Testing procedures should document setup requirements, testing steps, data collection methods, and result interpretation criteria enabling different testers to execute consistent testing. Procedural discipline ensures testing reliability, enables result comparison across testing sessions, and supports troubleshooting when testing results indicate potential issues. Systematic testing procedures represent best practice distinguishing professional testing from informal validation activities.

Executing Comprehensive Reading and Documentation Analysis

Network testing requires extensive documentation review including network specifications, protocol standards, equipment manuals, and test procedures demanding strong reading comprehension and technical document analysis skills. Documentation analysis enables testers to understand network requirements, identify testing objectives, and develop appropriate validation strategies based on specification review. ATM test certification candidates must demonstrate abilities to interpret technical documentation, extract relevant information, and apply documented requirements to testing activities. Technical reading skills enable effective specification analysis, standard interpretation, and procedure development based on documented requirements.

Reading comprehension expertise similar to ACT reading strategies supports technical documentation analysis where testers must efficiently process complex technical information. Network testing documentation includes protocol specifications, network designs, testing standards, and equipment manuals requiring systematic reading and information extraction. Testers must identify relevant requirements, understand technical specifications, and translate documented requirements into testing procedures validating compliance. Strong documentation analysis skills enable efficient requirement identification and comprehensive test case development ensuring testing addresses all relevant specifications.

Applying Mathematical Concepts to Network Performance Calculations

Network testing involves substantial mathematical analysis including bandwidth calculations, latency measurements, throughput analysis, and statistical data interpretation. Mathematical competency enables testers to perform necessary calculations, interpret numerical results, and apply statistical analysis to testing data. ATM test certification validates mathematical skills applicable to network testing including unit conversions, rate calculations, statistical analysis, and performance metric interpretation. Testers must be comfortable with mathematical operations, understand measurement units, and apply quantitative analysis to testing data.

Mathematical preparation approaches illustrated through ASVAB math guidance demonstrate systematic skill development applicable to network testing mathematics. Network testing mathematics includes bandwidth calculations, latency analysis, packet loss percentages, and throughput measurements requiring mathematical proficiency. Testers must understand formulas, perform calculations accurately, and interpret numerical results determining whether measurements indicate acceptable network performance. Mathematical competency represents fundamental skill for network testing professionals validating technical infrastructure through quantitative measurements.

Developing Retake Strategies for Certification Achievement

Certification candidates sometimes require multiple examination attempts achieving passing scores necessitating strategic retake planning. Retake strategies involve analyzing previous performance, identifying knowledge gaps, adjusting preparation approaches, and managing examination anxiety affecting performance. ATM test certification candidates should understand that initial failures don't preclude eventual success with appropriate adjustments to preparation and testing strategies. Systematic retake approaches address identified weaknesses, incorporate additional study, and refine test-taking strategies improving subsequent performance.

Strategic retake planning demonstrated through ASVAB retake strategies reveals systematic approaches applicable to certification retakes requiring similar preparation adjustments. Retake preparation should include comprehensive review of weak areas, additional practice with challenging topics, and potentially alternative study resources providing different explanations. Candidates should analyze score reports identifying specific knowledge gaps, focus remediation on weak domains, and ensure adequate preparation before retake attempts. Strategic retake approaches increase success probability while ensuring certified professionals possess genuine competencies rather than achieving certification through repeated attempts without adequate knowledge development.

Accessing Practice Resources for Examination Preparation

Certification preparation benefits from practice examinations and study materials enabling candidates to assess readiness, identify knowledge gaps, and familiarize themselves with examination formats. Practice resources including sample questions, practice tests, and study guides support preparation by providing exposure to examination content and question formats. ATM test certification candidates should utilize available practice materials, assess performance on practice examinations, and use practice results to guide focused study on weak areas. Quality practice resources simulate actual examination conditions helping candidates develop test-taking strategies and build examination confidence.

Practice resource availability exemplified through free ASVAB resources demonstrates how practice materials support certification preparation across domains. Network testing certification preparation should include hands-on practice with testing equipment, protocol analysis exercises, and practice examinations covering certification content. Practice activities develop practical skills, build confidence, and reveal knowledge gaps requiring additional study before actual examination attempts. Comprehensive preparation incorporating both theoretical study and practical exercises ensures candidates develop genuine competencies validated through certification.

Mastering Protocol-Specific Knowledge and Implementation Details

Network testing requires deep understanding of specific protocols including their operation, parameters, and expected behavior under various conditions. Protocol expertise enables testers to design appropriate test cases, identify protocol violations, and interpret testing results determining whether implementations comply with protocol specifications. ATM protocol knowledge represents core competency for ATM test certification requiring detailed understanding of ATM cell structure, adaptation layers, quality of service mechanisms, and protocol operations. Protocol mastery distinguishes qualified network testers from generalists lacking depth in specific protocol domains.

Protocol knowledge development parallels MCAT protein function mastery where detailed understanding of specific concepts proves essential for examination success. ATM protocol expertise requires understanding cell formats, virtual circuit establishment, adaptation layer operations, and quality of service mechanisms. Testers must recognize correct protocol operation, identify protocol violations, and understand protocol interactions with other network layers. Protocol depth represents critical knowledge differentiating ATM testing specialists from general network testers lacking protocol-specific expertise.

Managing Stress and Maintaining Focus During Testing Activities

Network testing can involve pressure from deadlines, critical infrastructure dependencies, and high-stakes validation where errors could cause network outages or deployment delays. Stress management skills enable testers to maintain focus, execute procedures accurately, and make sound decisions under pressure. ATM test certification preparation should include stress management and focus techniques supporting effective performance during both certification examinations and professional testing activities. Mental preparation enables testers to manage pressure, maintain procedural discipline, and perform effectively when testing activities carry significant consequences.

Stress management techniques illustrated through MCAT emotional preparation demonstrate mental preparation approaches applicable to high-pressure testing scenarios. Network testers must maintain focus during complex testing procedures, manage anxiety when testing critical infrastructure, and make accurate decisions under time pressure. Mental preparation techniques including practice under realistic conditions, stress reduction strategies, and focus enhancement methods support effective performance. Psychological preparation complements technical knowledge ensuring testers perform effectively when conducting critical network validation activities.

Comprehending Wave Propagation and Signal Analysis Concepts

ATM networks operate on physical media where signal propagation, wave characteristics, and transmission physics affect network performance and testing approaches. Understanding wave propagation enables testers to comprehend signal behavior, identify transmission issues, and select appropriate testing methodologies for physical layer validation. Physical layer knowledge including modulation, attenuation, and signal degradation supports comprehensive network testing addressing all protocol layers from physical transmission through application protocols.

Wave and signal concepts covered in MCAT physics preparation demonstrate physical science foundations applicable to network testing where signal propagation affects testing approaches. Network testers must understand how signals propagate through transmission media, recognize signal degradation effects, and account for physical layer characteristics during testing activities. Physical layer knowledge enables comprehensive testing addressing transmission quality, signal integrity, and physical media characteristics affecting network performance. Understanding signal propagation complements protocol knowledge creating comprehensive testing expertise spanning all network layers.

Differentiating Certification Levels and Prerequisites

Network testing certifications exist at various levels from foundational through expert credentials each requiring different prerequisites and validating distinct competency levels. Understanding certification levels helps candidates select appropriate certifications matching current expertise while planning progression toward advanced credentials. ATM test certification positioning within broader certification landscapes determines prerequisite requirements, expected knowledge levels, and relationships to other networking certifications. Candidates should understand how ATM testing certification relates to other credentials planning strategic certification pathways.

Certification level differentiation illustrated through SAT versus PSAT comparisons demonstrates how related certifications serve different purposes and audiences. Foundational network certifications establish baseline knowledge while advanced certifications validate specialized expertise in specific domains like ATM testing. Certification planning should consider prerequisite requirements, knowledge expectations, and career objectives ensuring appropriate credential selection. Understanding certification relationships enables strategic planning building from foundational credentials through specialized certifications like ATM testing.

Allocating Study Time Effectively for Examination Preparation

Certification preparation success requires effective time management allocating adequate study time across examination domains while balancing preparation with professional and personal responsibilities. Time management skills enable systematic preparation ensuring comprehensive coverage without excessive time investment. ATM test certification candidates must allocate study time proportionally across testing topics, prioritize weak areas requiring additional focus, and maintain consistent study schedules supporting knowledge retention. Effective time allocation prevents last-minute cramming ensuring thorough preparation over appropriate timelines.

Time management strategies demonstrated through SAT preparation time allocation reveal systematic approaches applicable to certification preparation requiring similar planning. Study planning should identify available preparation time, allocate time across content domains, and schedule regular study sessions maintaining momentum. Candidates should balance comprehensive coverage with focused study on weak areas ensuring efficient preparation within time constraints. Time management represents critical success factor enabling thorough preparation while managing competing time demands.

Cultivating Mental Readiness for Examination Performance

Certification examination success requires mental preparation beyond content knowledge including confidence development, anxiety management, and psychological readiness for high-stakes assessment. Mental preparation enables candidates to perform optimally during examinations, manage test anxiety, and demonstrate acquired knowledge under examination conditions. ATM test certification candidates should develop psychological readiness through practice examinations, visualization techniques, and stress management strategies supporting optimal performance. Mental preparation complements content knowledge ensuring candidates can effectively demonstrate competencies during certification examinations.

Psychological preparation approaches illustrated through SAT mental readiness demonstrate mental preparation techniques applicable to certification examinations. Mental preparation includes building confidence through practice, developing coping strategies for examination anxiety, and creating positive mental frameworks supporting success. Candidates should practice under realistic conditions, develop examination strategies, and build confidence through demonstrated practice performance. Psychological preparation represents often-overlooked success factor enabling effective knowledge demonstration during certification examinations.

Recognizing Specialized Testing Challenges and Requirements

Network testing presents unique challenges different from general IT work including specialized equipment, protocol expertise, and systematic methodologies foreign to those without testing backgrounds. Understanding testing-specific challenges helps candidates prepare appropriately recognizing that network testing requires distinct competencies beyond general networking knowledge. ATM test certification validates specialized testing skills differentiating testing professionals from general network administrators or engineers. Testing specialization requires dedicated study of testing methodologies, instrumentation, and systematic validation approaches.

Specialized challenge recognition demonstrated through SAT mathematical challenges reveals how specialized domains require unique preparation approaches. Network testing challenges include interpreting protocol traces, designing comprehensive test cases, and using specialized testing equipment requiring focused skill development. Candidates transitioning into testing from other IT roles must recognize testing's specialized nature requiring dedicated preparation beyond general networking experience. Understanding testing-specific requirements enables appropriate preparation ensuring candidates develop necessary specialized competencies for testing roles.

Acquiring Essential Competencies for Testing Excellence

Network testing excellence requires specific skill sets beyond general networking knowledge including analytical thinking, systematic methodology, attention to detail, and documentation discipline. Testing competencies enable professionals to design comprehensive test cases, execute testing procedures accurately, and document findings supporting network deployment decisions. ATM test certification validates acquisition of testing-specific skills differentiating testing specialists from general network professionals. Skill development for testing roles requires focused effort developing competencies essential for systematic network validation activities.

Testing skill development parallels SAT mathematical competency building where specific abilities require focused development beyond general knowledge. Network testing skills include protocol analysis, performance measurement, test case design, and systematic troubleshooting requiring deliberate practice and skill refinement. Candidates should develop analytical skills, procedural discipline, and documentation capabilities supporting professional testing activities. Comprehensive skill development ensures testing professionals possess necessary competencies for effective network validation work.

Implementing Audiovisual Testing Infrastructure

Modern networks increasingly carry multimedia traffic requiring testing infrastructure addressing audiovisual protocols, quality of service, and real-time transmission characteristics. Audiovisual testing expertise enables validation of voice, video, and multimedia applications operating over ATM networks. Testing professionals must understand multimedia protocols, quality metrics specific to audiovisual applications, and specialized testing approaches for real-time traffic. Audiovisual testing represents a specialized domain within network testing requiring additional knowledge beyond basic protocol testing.

Audiovisual expertise validated through AVIXA certification programs demonstrates specialized multimedia testing knowledge applicable to ATM networks carrying audiovisual traffic. Multimedia testing requires understanding quality of service mechanisms, latency sensitivity, and bandwidth requirements specific to audiovisual applications. Testers must evaluate subjective quality metrics, measure objective performance indicators, and validate multimedia application performance over tested networks. Audiovisual testing expertise enables comprehensive validation of networks supporting multimedia applications.

Deploying Video Surveillance and IP Camera Networks

Network testing extends to specialized applications like video surveillance systems operating over IP networks requiring testing approaches addressing video transmission, storage, and quality validation. Surveillance network testing validates infrastructure supporting security cameras, video management systems, and recording infrastructure. Testing professionals supporting surveillance deployments must understand video protocols, bandwidth requirements, and quality metrics specific to surveillance applications. Surveillance network testing represents specialized application requiring domain-specific knowledge beyond general network testing.

Surveillance expertise demonstrated through Axis Communications certifications reveals specialized knowledge applicable to testing surveillance network infrastructure. Surveillance network testing addresses video quality, motion detection performance, storage system validation, and management platform functionality. Testers must evaluate video clarity, frame rates, recording reliability, and retrieval capabilities ensuring surveillance systems meet security requirements. Surveillance testing represents specialized domain where network testing intersects with physical security applications.

Administering Windows Server Testing Environments

Testing laboratories often utilize Windows Server infrastructure for test management, result storage, and testing tool hosting requiring server administration competencies. Windows Server knowledge enables testers to establish testing infrastructure, manage testing environments, and maintain laboratory systems supporting testing activities. Server administration skills complement testing expertise enabling self-sufficient testing professionals capable of managing complete testing environments. Windows Server competency represents valuable skill for testing professionals establishing and maintaining testing laboratories.

Server administration expertise validated through Windows Server fundamentals supports testing laboratory management requirements. Testing laboratories require file servers storing testing documentation, database servers managing test results, and application servers hosting testing tools. Testers with server administration skills can establish comprehensive testing environments, maintain laboratory infrastructure, and troubleshoot server issues affecting testing activities. Server administration complements testing expertise creating well-rounded professionals capable of comprehensive testing environment management.

Managing Windows-Based Testing Tools and Applications

Many network testing tools operate on Windows platforms requiring Windows administration knowledge for tool installation, configuration, and troubleshooting. Windows expertise enables testers to manage testing applications, configure testing software, and resolve Windows-related issues affecting testing tools. Windows competency ensures testing professionals can effectively utilize Windows-based testing tools without requiring separate IT support for tool management. Windows knowledge represents practical skill for testing professionals using Windows-based testing applications.

Windows platform expertise validated through Windows certification programs supports testing tool management on Windows systems. Testing tools including protocol analyzers, traffic generators, and network simulators often operate on Windows requiring installation, configuration, and maintenance. Testers must configure Windows systems appropriately for testing tools, troubleshoot Windows issues affecting tool operation, and maintain Windows-based testing infrastructure. Windows expertise enables self-sufficient testing professionals managing complete Windows-based testing environments.

Designing Secure Network Architectures for Testing

Network architecture expertise enables testers to understand network designs, identify critical paths requiring testing, and design testing strategies addressing architectural considerations. Architecture knowledge helps testers prioritize testing activities, identify potential failure points, and develop comprehensive testing covering critical network elements. ATM test certification validates understanding of network architecture principles applicable to testing strategy development. Architectural knowledge distinguishes strategic testers from technicians executing predefined tests without understanding broader network context.

Architecture expertise demonstrated through Cisco architecture certifications reveals design knowledge applicable to testing strategy development. Network architects must understand traffic flows, redundancy mechanisms, and failure scenarios informing comprehensive testing strategies. Testers with architecture knowledge can design more effective testing programs addressing critical network elements and potential failure modes. Architecture expertise elevates testing from procedural execution to strategic validation addressing comprehensive network design considerations.

Implementing Wireless Network Testing and Validation

Wireless networks present unique testing challenges including radio frequency characteristics, mobility management, and interference effects requiring specialized testing approaches. Wireless testing expertise enables validation of wireless network performance, coverage, and capacity. Testing professionals supporting wireless deployments must understand wireless protocols, RF testing equipment, and wireless-specific performance metrics. Wireless testing represents specialized domain requiring additional knowledge beyond wired network testing expertise.

Wireless expertise validated through Cisco wireless certifications demonstrates specialized wireless knowledge applicable to wireless network testing. Wireless testing addresses coverage area validation, throughput measurement, roaming performance, and interference analysis requiring specialized testing equipment and methodologies. Testers must understand wireless-specific issues including multipath, interference, and signal strength variations affecting wireless performance. Wireless testing expertise enables comprehensive validation of wireless infrastructure supporting mobile connectivity requirements.

Validating Data Center Network Infrastructure

Data center networks demand rigorous testing validating high-performance infrastructure supporting mission-critical applications. Data center testing addresses switching fabric performance, redundancy validation, and failure recovery testing ensuring infrastructure meets uptime and performance requirements. Testing professionals supporting data center deployments must understand data center technologies, high-availability architectures, and performance requirements specific to data center environments. Data center testing represents demanding specialization requiring expertise with high-performance networking technologies.

Data center expertise demonstrated through Cisco data center certifications reveals specialized data center knowledge applicable to infrastructure testing. Data center testing validates switching performance, storage network functionality, virtualization infrastructure, and disaster recovery mechanisms. Testers must evaluate latency-sensitive applications, validate redundancy mechanisms, and test failover procedures ensuring data center networks meet stringent performance and availability requirements. Data center testing requires specialized expertise addressing unique data center networking technologies and requirements.

Testing Unified Communications and Collaboration Platforms

Unified communications platforms integrating voice, video, messaging, and collaboration tools require comprehensive testing validating integrated functionality and quality. UC testing addresses call quality, video performance, messaging reliability, and collaboration tool functionality. Testing professionals supporting UC deployments must understand unified communications protocols, quality metrics, and integrated application testing. UC testing represents specialized domain combining traditional voice testing with modern collaboration platform validation.

Unified communications expertise validated through Cisco collaboration certifications demonstrates specialized UC knowledge applicable to collaboration platform testing. UC testing validates voice quality, video conferencing performance, instant messaging reliability, and application integration ensuring unified communications platforms meet business requirements. Testers must understand subjective quality metrics, measure objective performance indicators, and validate integrated functionality across diverse communication modalities. UC testing requires comprehensive expertise spanning multiple communication technologies integrated into unified platforms.

Implementing IoT Network Testing and Device Validation

Internet of Things deployments create unique testing challenges including massive device counts, diverse device types, and specialized IoT protocols requiring adapted testing approaches. IoT testing validates device connectivity, protocol compliance, and network capacity supporting large-scale IoT deployments. Testing professionals supporting IoT initiatives must understand IoT protocols, device management platforms, and scalability testing for massive device populations. IoT testing represents emerging specialization as organizations deploy IoT solutions requiring network infrastructure validation.

IoT expertise demonstrated through Cisco IoT certifications reveals specialized IoT knowledge applicable to IoT network testing. IoT testing addresses device onboarding, protocol validation, security testing, and capacity validation ensuring networks support IoT deployment requirements. Testers must validate device authentication, data transmission, management platform functionality, and network scalability supporting potentially thousands of IoT devices. IoT testing requires specialized expertise addressing unique IoT networking challenges and requirements.

Designing Advanced Network Architectures for Complex Scenarios

Expert-level architecture expertise enables testing professionals to understand sophisticated network designs, identify complex testing requirements, and develop comprehensive testing strategies for advanced implementations. Advanced architecture knowledge helps testers address multi-domain networks, complex routing scenarios, and sophisticated quality of service implementations requiring comprehensive testing approaches. Expert architecture understanding distinguishes senior testing professionals capable of addressing complex enterprise network testing requirements.

Advanced architecture expertise validated through Cisco design certifications demonstrates expert-level design knowledge applicable to complex testing scenarios. Advanced networks incorporating multiple technologies, sophisticated redundancy, and complex routing require comprehensive testing strategies addressing intricate network behaviors. Testers with advanced architecture knowledge can develop sophisticated testing approaches validating complex network implementations. Expert architecture knowledge represents advanced competency for senior testing professionals addressing enterprise-scale network validation.

Implementing Advanced Collaboration Architecture Testing

Sophisticated collaboration architectures incorporating multiple sites, diverse communication modalities, and complex integration require advanced testing approaches validating integrated functionality. Advanced collaboration testing addresses multi-site deployments, federated environments, and complex integration scenarios beyond basic collaboration testing. Testing professionals supporting advanced collaboration deployments must understand sophisticated collaboration architectures, federation protocols, and complex integration testing methodologies.

Advanced collaboration expertise demonstrated through advanced collaboration certifications validates sophisticated collaboration knowledge applicable to complex deployment testing. Advanced collaboration testing validates federated environments, multi-vendor interoperability, complex call routing, and sophisticated quality of service implementations. Testers must address complex scenarios including disaster recovery, geographic distribution, and sophisticated integration with business applications. Advanced collaboration testing requires expert-level expertise addressing sophisticated collaboration implementations.

Validating Enterprise Routing Infrastructure

Enterprise routing infrastructure forms network foundation requiring comprehensive testing validating routing protocols, convergence behavior, and failover performance. Routing testing addresses protocol functionality, convergence timing, and failure recovery ensuring routing infrastructure meets enterprise requirements. Testing professionals supporting routing infrastructure must understand routing protocols, routing design principles, and routing-specific testing methodologies. Routing testing represents core networking competency for infrastructure testing professionals.

Routing expertise validated through enterprise routing certifications demonstrates comprehensive routing knowledge applicable to routing infrastructure testing. Routing testing validates protocol operation, route advertisement, convergence performance, and failure recovery mechanisms. Testers must evaluate routing behavior under normal and failure conditions, measure convergence timing, and validate routing policy implementation. Routing testing expertise enables comprehensive routing infrastructure validation supporting enterprise network deployments.

Testing Service Provider Network Infrastructure

Service provider networks present unique testing challenges including massive scale, diverse customer requirements, and stringent performance requirements. Service provider testing validates infrastructure supporting thousands of customers, multiple service types, and guaranteed service level agreements. Testing professionals supporting service providers must understand service provider technologies, quality of service mechanisms, and large-scale testing methodologies. Service provider testing represents specialized domain addressing telecommunications carrier requirements.

Service provider expertise demonstrated through CCIE service provider certifications validates specialized carrier network knowledge applicable to service provider testing. Service provider testing addresses routing infrastructure, MPLS implementations, quality of service mechanisms, and customer service validation. Testers must evaluate large-scale performance, validate service level agreements, and test diverse service offerings. Service provider testing requires specialized expertise addressing telecommunications carrier networking requirements.

Implementing Advanced Security Testing Methodologies

Security testing represents critical validation activity ensuring network security controls function appropriately protecting against threats. Advanced security testing addresses firewall functionality, intrusion prevention, encryption implementation, and access control validation. Testing professionals conducting security testing must understand security technologies, attack methodologies, and security-specific testing approaches. Security testing represents specialized domain requiring security expertise beyond general network testing knowledge.

Security testing expertise validated through advanced security certifications demonstrates specialized security knowledge applicable to security infrastructure testing. Security testing validates security control functionality, tests vulnerability to known attacks, and verifies security policy implementation. Testers must understand attack techniques, security control operation, and security testing methodologies ensuring comprehensive security validation. Security testing requires specialized security expertise addressing threat protection and security control validation.

Validating Advanced Security Infrastructure

Advanced security infrastructure testing requires expert-level security knowledge validating sophisticated security architectures protecting enterprise networks. Expert security testing addresses multi-layered security, advanced threat protection, and complex security policy implementation. Testing professionals conducting advanced security validation must possess deep security expertise, understand sophisticated threats, and implement comprehensive security testing programs. Advanced security testing represents pinnacle security testing specialization requiring extensive security knowledge and experience.

Expert security testing expertise validated through CCIE security certifications demonstrates comprehensive security knowledge applicable to advanced security testing. Advanced security testing validates complex security architectures, tests resistance to sophisticated attacks, and verifies integrated security control operation. Testers must design comprehensive security testing programs, understand advanced attack methodologies, and validate sophisticated security implementations. Expert security testing requires extensive security expertise addressing enterprise-level security infrastructure validation.

Implementing Enterprise Wireless Solutions Testing

Enterprise wireless solutions incorporating large-scale deployments, sophisticated management, and advanced features require comprehensive testing validating wireless infrastructure at scale. Enterprise wireless testing addresses controller functionality, access point management, roaming performance, and quality of service for wireless environments. Testing professionals supporting enterprise wireless must understand wireless controllers, management platforms, and enterprise-scale wireless testing methodologies. Enterprise wireless testing represents advanced specialization addressing large-scale wireless deployments.

Enterprise wireless expertise demonstrated through advanced wireless certifications validates sophisticated wireless knowledge applicable to enterprise wireless testing. Enterprise wireless testing validates controller functionality, access point provisioning, wireless redundancy, and large-scale wireless performance. Testers must evaluate wireless management platforms, test roaming across multiple access points, and validate quality of service for wireless applications. Enterprise wireless testing requires advanced wireless expertise addressing large-scale wireless infrastructure validation.

Validating Network Programmability and Automation

Network programmability enables automated testing, configuration management, and orchestrated validation activities improving testing efficiency and coverage. Programmability testing validates automation scripts, API functionality, and orchestration platforms supporting automated network operations. Testing professionals working with programmable networks must understand programming concepts, automation frameworks, and API testing methodologies. Network programmability represents emerging competency as networks become increasingly software-defined and automated.

Network programmability expertise validated through programmability certifications demonstrates automation knowledge applicable to automated testing development. Programmability testing validates API functionality, tests automation scripts, and verifies orchestration platforms supporting network automation. Testers must understand programming languages, automation frameworks, and API testing methodologies enabling automated validation development. Network programmability expertise enables next-generation testing approaches leveraging automation and orchestration.

Implementing Service Provider Core Network Testing

Service provider core networks require specialized testing validating massive-scale routing, MPLS infrastructure, and carrier-grade reliability. Core network testing addresses routing protocols at scale, MPLS functionality, and traffic engineering mechanisms. Testing professionals supporting service provider cores must understand service provider technologies, large-scale routing, and carrier testing requirements. Core network testing represents specialized service provider domain requiring telecommunications carrier expertise.

Service provider core expertise demonstrated through core network certifications validates carrier network knowledge applicable to core infrastructure testing. Core network testing validates routing at scale, MPLS operation, traffic engineering, and carrier-grade high availability. Testers must evaluate massive routing tables, test MPLS functionality, and validate traffic engineering mechanisms. Core network testing requires specialized carrier networking expertise addressing telecommunications core infrastructure.

Validating Unified Communications Architecture

Unified communications architecture testing validates sophisticated UC implementations incorporating voice, video, messaging, and collaboration across distributed environments. UC architecture testing addresses call routing, media quality, redundancy mechanisms, and integrated functionality. Testing professionals conducting UC architecture validation must understand UC design principles, sophisticated call routing, and integrated UC testing methodologies. UC architecture testing represents advanced collaboration specialization requiring comprehensive UC expertise.

UC architecture expertise validated through UC architecture certifications demonstrates sophisticated UC knowledge applicable to UC architecture testing. UC architecture testing validates call routing logic, media quality across diverse scenarios, failover functionality, and integrated UC features. Testers must evaluate complex call flows, validate redundancy mechanisms, and test integrated collaboration capabilities. UC architecture testing requires expert UC knowledge addressing sophisticated UC implementations.

Implementing Contact Center Testing and Validation

Contact center solutions require specialized testing validating call routing, queue management, agent functionality, and customer experience. Contact center testing addresses automatic call distribution, interactive voice response, call recording, and reporting functionality. Testing professionals supporting contact center deployments must understand contact center technologies, customer experience metrics, and contact center testing methodologies. Contact center testing represents specialized domain addressing customer service infrastructure validation.

Contact center expertise demonstrated through contact center certifications validates contact center knowledge applicable to contact center testing. Contact center testing validates call routing algorithms, IVR functionality, agent desktop operation, and reporting accuracy. Testers must evaluate customer experience, test call routing under various scenarios, and validate integration with backend systems. Contact center testing requires specialized contact center expertise addressing customer service platform validation.

Validating Enterprise Video Solutions

Enterprise video solutions incorporating telepresence, video conferencing, and video content delivery require comprehensive testing validating video quality and functionality. Video solution testing addresses video quality metrics, infrastructure capacity, and integrated video features. Testing professionals supporting video deployments must understand video technologies, quality metrics, and video-specific testing approaches. Video solution testing represents specialized multimedia domain requiring video technology expertise.

Video solution expertise validated through enterprise video certifications demonstrates video technology knowledge applicable to video solution testing. Video testing validates video quality under diverse conditions, tests infrastructure capacity, and verifies integrated video features. Testers must evaluate subjective video quality, measure objective quality metrics, and validate video infrastructure components. Video solution testing requires specialized video expertise addressing enterprise video deployment validation.

Implementing Security Operations Center Infrastructure Testing

Security operations center infrastructure requires testing validating security monitoring tools, incident response platforms, and integrated security operations. SOC infrastructure testing addresses security information and event management, threat intelligence integration, and security orchestration functionality. Testing professionals supporting SOC deployments must understand security operations, security monitoring technologies, and SOC testing methodologies. SOC infrastructure testing represents specialized security operations domain.

SOC infrastructure expertise demonstrated through SOC architecture certifications validates security operations knowledge applicable to SOC infrastructure testing. SOC testing validates SIEM functionality, threat intelligence integration, security orchestration, and incident response workflows. Testers must evaluate security monitoring capabilities, test incident response procedures, and validate integrated security operations platforms. SOC infrastructure testing requires specialized security operations expertise addressing security monitoring infrastructure validation.

Validating Advanced Wireless Solutions

Advanced wireless solutions incorporating sophisticated features, high-density deployments, and specialized wireless technologies require expert-level wireless testing. Advanced wireless testing addresses location services, high-density access points, specialized wireless protocols, and sophisticated wireless features. Testing professionals conducting advanced wireless validation must possess expert wireless knowledge, understand specialized wireless technologies, and implement comprehensive wireless testing programs. Advanced wireless testing represents pinnacle wireless specialization.

Advanced wireless expertise validated through advanced wireless certifications demonstrates expert wireless knowledge applicable to sophisticated wireless testing. Advanced wireless testing validates location-based services, high-density wireless performance, specialized wireless protocols, and advanced wireless features. Testers must evaluate sophisticated wireless scenarios, test high-density deployments, and validate specialized wireless functionality. Advanced wireless testing requires expert wireless expertise addressing sophisticated wireless implementations.

Implementing Advanced Routing and Services Testing

Advanced routing and services testing validates sophisticated routing implementations incorporating complex policies, advanced protocols, and integrated services. Advanced routing testing addresses route manipulation, policy routing, multicast protocols, and integrated routing services. Testing professionals conducting advanced routing validation must understand sophisticated routing concepts, complex routing scenarios, and advanced routing testing methodologies. Advanced routing testing represents expert-level routing specialization.

Advanced routing expertise demonstrated through advanced routing certifications validates expert routing knowledge applicable to sophisticated routing testing. Advanced routing testing validates complex routing policies, advanced protocol features, multicast functionality, and integrated routing services. Testers must evaluate sophisticated routing scenarios, test complex routing policies, and validate advanced routing implementations. Advanced routing testing requires expert routing expertise addressing sophisticated routing infrastructure validation.

Validating Software-Defined Network Infrastructure

Software-defined networking introduces programmable network infrastructure requiring testing approaches validating SDN controllers, network virtualization, and automated network provisioning. SDN testing addresses controller functionality, network programmability, and orchestration platforms. Testing professionals supporting SDN deployments must understand SDN concepts, controller technologies, and SDN-specific testing methodologies. SDN testing represents emerging domain as networks become increasingly software-defined.

SDN expertise validated through SDN certifications demonstrates software-defined networking knowledge applicable to SDN infrastructure testing. SDN testing validates controller functionality, network virtualization, automated provisioning, and SDN application integration. Testers must evaluate controller operation, test network programmability, and validate orchestration platforms. SDN testing requires specialized SDN expertise addressing software-defined network infrastructure validation.

Implementing Software Testing Foundations

Software testing principles apply to network testing providing methodologies for systematic validation, test case design, and quality assurance. Software testing foundations enable structured testing approaches, comprehensive test coverage, and systematic defect identification. Testing professionals with software testing knowledge can apply proven testing methodologies to network validation activities. Software testing foundations represent valuable cross-domain knowledge enhancing network testing effectiveness.

Software testing expertise validated through ISTQB foundation certifications demonstrates testing methodology knowledge applicable to network testing. Software testing principles including test design techniques, equivalence partitioning, and boundary value analysis apply to network test case development. Testers can apply software testing methodologies to network validation creating more comprehensive and systematic testing programs. Software testing foundations provide valuable methodological knowledge enhancing network testing professional competency.

Applying Current Testing Methodologies and Standards

Testing methodologies evolve incorporating new approaches, updated standards, and current best practices requiring testers to maintain knowledge currency. Current testing standards provide latest methodological guidance, updated terminology, and contemporary testing approaches. Testing professionals should maintain familiarity with current testing standards ensuring testing activities reflect current best practices and industry standards. Current methodology knowledge demonstrates professional currency and commitment to testing excellence.

Current testing expertise validated through updated ISTQB certifications demonstrates knowledge of current testing methodologies. Current testing standards incorporate agile testing approaches, automation considerations, and contemporary testing practices. Testers should understand current methodologies, apply updated testing approaches, and maintain testing knowledge currency. Current methodology expertise ensures testing activities reflect contemporary best practices and industry standards.

Implementing Established Testing Standards

Established testing standards provide proven methodological frameworks, standardized terminology, and widely-recognized testing approaches. Testing standards enable consistent testing practices, facilitate communication among testing professionals, and provide quality benchmarks for testing activities. Testing professionals should understand established testing standards applying standardized methodologies to network validation activities. Standard methodology knowledge demonstrates professional competency and methodological rigor.

Established testing standards validated through 2018 ISTQB certifications demonstrate recognized testing methodology expertise. Established standards provide proven testing approaches, standardized test design techniques, and recognized quality criteria. Testers should apply standard methodologies, utilize established test design techniques, and follow recognized testing practices. Standard methodology knowledge provides solid foundation for professional testing activities.

Integrating IT Service Management with Testing Activities

IT service management frameworks including ITIL provide structured approaches to IT service delivery applicable to testing service offerings. ITIL knowledge enables testing professionals to align testing activities with service management processes, integrate testing with change management, and position testing within ITSM frameworks. Service management knowledge distinguishes testing professionals who understand broader IT service context from those focusing narrowly on technical testing activities. ITSM integration represents professional maturity demonstrating understanding of testing within organizational service delivery.

ITSM expertise validated through ITIL foundation certifications demonstrates service management knowledge applicable to testing service delivery. ITIL frameworks provide context for testing activities, guide testing process integration with service management, and position testing as service supporting organizational objectives. Testers should understand service management principles, integrate testing with ITSM processes, and position testing within service delivery frameworks. ITSM knowledge elevates testing from purely technical activity to strategic service supporting organizational success.

Conclusion

ATM test certification represents specialized credential validating comprehensive network testing expertise encompassing protocol knowledge, testing methodologies, instrumentation skills, and systematic validation approaches essential for network testing professionals. Certification achievement requires thorough preparation combining theoretical study of ATM protocols, practical experience with testing equipment, and development of testing methodologies applicable to network infrastructure validation. Successful candidates demonstrate deep understanding of ATM protocols, proficiency with testing tools, and ability to design, execute, and document comprehensive testing programs supporting network deployment and operations. Certification validates professional competency distinguishing qualified testing specialists from general network professionals lacking specialized testing expertise.

Career value from ATM test certification extends beyond credential achievement to encompass knowledge acquisition, skill development, and professional credibility supporting career advancement in network testing specializations. Testing professionals command strong demand as organizations require rigorous validation before deploying network infrastructure ensuring networks meet performance, reliability, and quality requirements. Certified testing professionals demonstrate validated expertise, commitment to professional standards, and proven competency providing employers confidence in testing capabilities. Certification enhances career prospects through improved employment opportunities, advancement potential, and compensation as certified testing professionals command premium salaries reflecting specialized expertise validated through credentialing.

Professional development planning should integrate ATM test certification within a broader career strategy considering specialization interests, market demands, and long-term career objectives. Network testing offers numerous specialization opportunities including protocol testing, performance testing, security testing, and emerging domains like SDN testing each requiring different knowledge and skills. Strategic professionals evaluate which specializations align with career interests and market opportunities selecting certifications and skill development supporting chosen specialization directions. Career success in testing requires combining certifications with practical experience, continuous learning, and possibly complementary credentials in related domains creating comprehensive professional capabilities.

Certification preparation effectiveness determines both examination success and professional competency development requiring comprehensive approaches combining official study materials, hands-on practice, and practical testing experience. Quality preparation develops genuine expertise rather than mere examination passing ensuring certified professionals possess competencies certifications intend to validate. Effective preparation incorporates multiple learning approaches including protocol study, equipment practice, methodology learning, and practice testing addressing comprehensive certification requirements. Adequate preparation investment proves essential with rushed preparation risking inadequate knowledge development while systematic preparation ensures thorough competency acquisition.

Technology evolution requires certified testing professionals to maintain knowledge currency through continuing education, recertification, and ongoing learning ensuring testing expertise remains relevant as network technologies and testing approaches evolve. Network technologies continuously introduce new protocols, updated standards, and novel architectures requiring testing professionals to adapt methodologies and update knowledge. Testing tools and methodologies similarly evolve incorporating automation, programmability, and advanced analytics requiring testing professionals to maintain capability currency. Commitment to continuous learning distinguishes successful testing careers from those becoming obsolete through knowledge stagnation.

Financial investment in certification preparation including examination fees, study materials, training courses, testing equipment access, and opportunity costs requires cost-benefit analysis ensuring certification investments provide appropriate returns. Quality preparation resources including official documentation, reputable training, and hands-on equipment access improve preparation effectiveness supporting first-attempt success reducing overall costs. Candidates should budget realistically for comprehensive preparation recognizing adequate resource investment proves cost-effective through improved success rates and genuine competency development supporting professional effectiveness.

Examination success requires combining subject expertise with effective test-taking strategies including time management, question interpretation, and systematic answer approaches. Certification examinations test both theoretical knowledge and practical application requiring candidates to demonstrate genuine understanding applicable to real-world testing scenarios. Practice examinations under realistic conditions develop testing skills while revealing knowledge gaps requiring additional study before actual examination attempts. Understanding examination formats and requirements enables strategic preparation maximizing performance during certification examinations.

Professional community engagement enhances both certification preparation and ongoing career development through peer learning, knowledge sharing, and professional networking. Testing communities including professional associations, online forums, and user groups connect testing professionals facilitating experience exchange, problem-solving, and career development. Active participation develops professional visibility, establishes expertise reputation, and creates advancement opportunities through connections with experienced professionals and potential employers providing long-term career value.

Career progression for testing professionals includes both technical advancement toward expert-level specializations and potential transitions into management, consulting, or architecture roles. Senior testing positions require deep technical expertise while management paths emphasize leadership, strategy, and organizational contributions. Career planning should consider personal strengths, interests, and opportunities ensuring professional development aligns with career aspirations. Understanding career options helps professionals make informed certification and development decisions supporting intended career trajectories.

Ultimately, ATM test certification success requires comprehensive preparation, strategic career planning, practical skill development, and sustained professional commitment throughout testing careers. Certified testing professionals who combine credentials with hands-on experience, continuous learning, complementary skills, and professional engagement position themselves for rewarding careers in network testing supporting critical infrastructure validation ensuring networks meet organizational requirements. Testing expertise provides a stable specialized career foundation while remaining dynamic requiring continuous adaptation to evolving technologies, methodologies, and industry requirements. Success demands dedication to professional excellence, strategic planning, and persistent effort developing comprehensive capabilities distinguishing exceptional testing professionals from those with limited expertise or commitment to testing specialization.

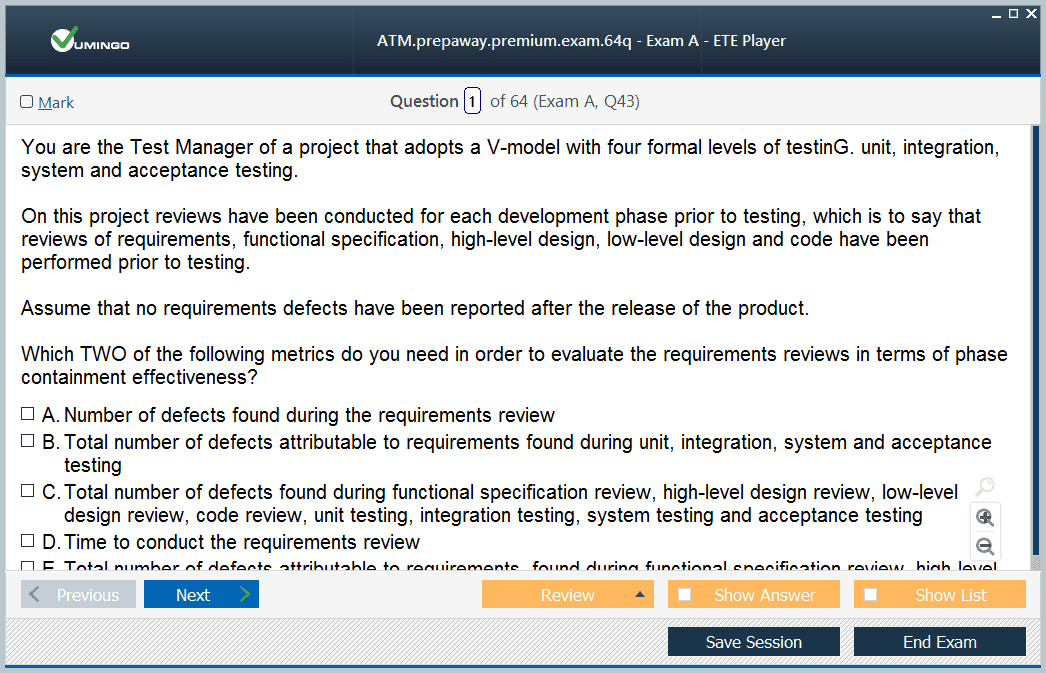

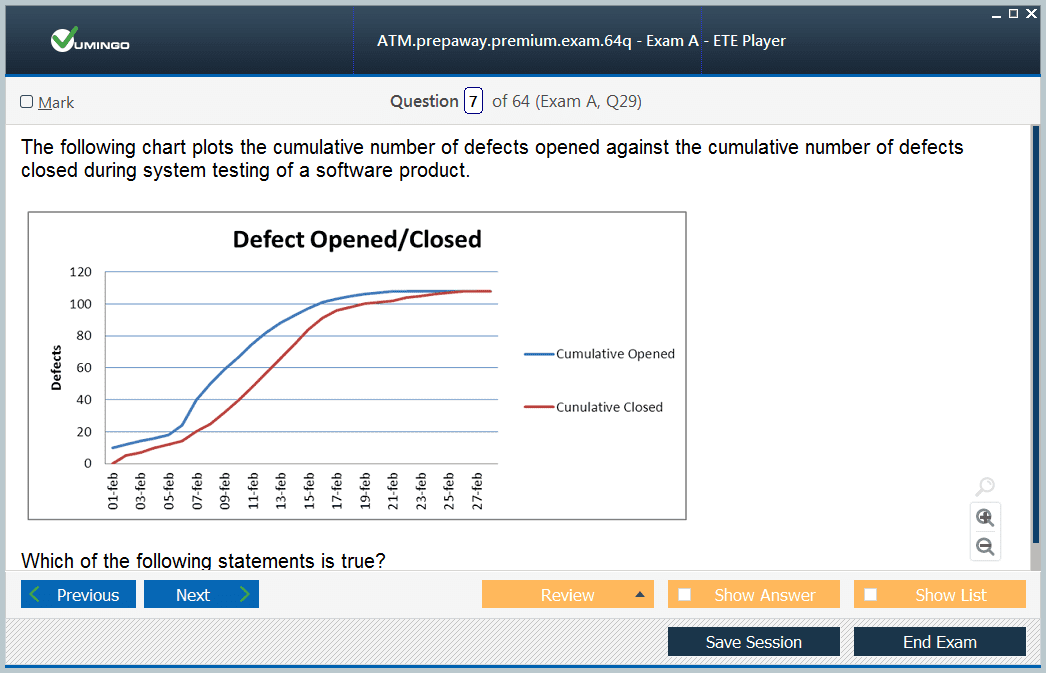

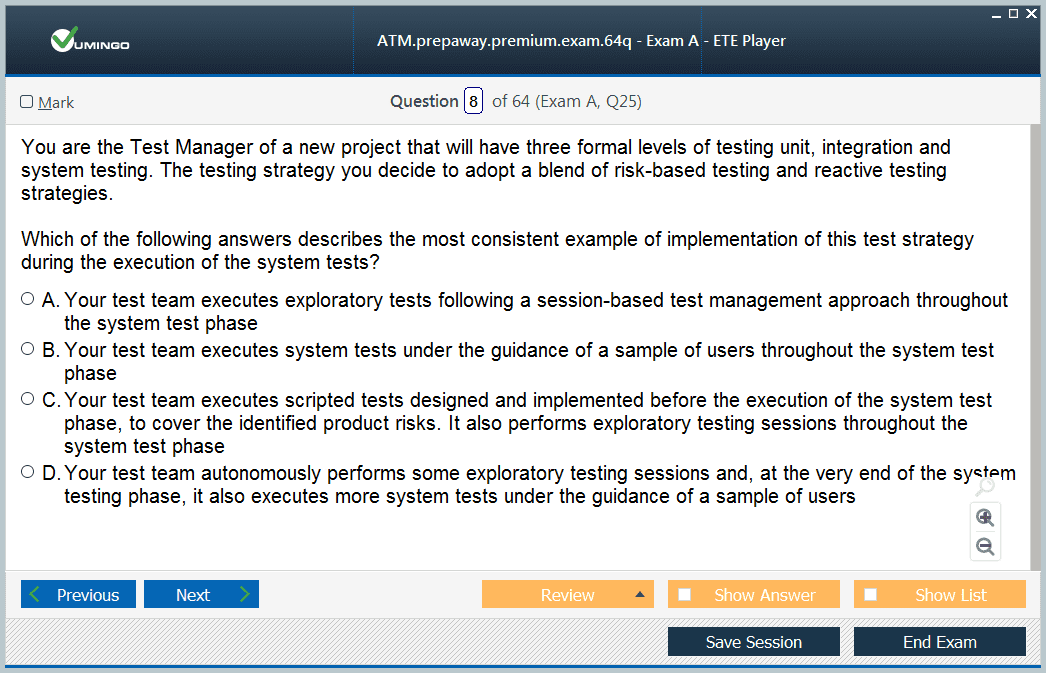

ISTQB ATM practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass ATM Advanced Test Manager certification exam dumps & practice test questions and answers are to help students.

- CTFL v4.0 - Certified Tester Foundation Level (CTFL) v4.0

- CT-AI - ISTQB Certified Tester - AI Testing

- CTAL-TAE - Certified Tester Advanced Level Test Automation Engineering

- CTAL-TM - ISTQB - Certified Tester Advanced Level, Test Manager v3.0

- CTAL-TA - Certified Tester Advanced Level - Test Analyst V3.1

- CT-TAE - Certified Tester Test Automation Engineer

- ATA - Advanced Test Analyst

Purchase ATM Exam Training Products Individually

Why customers love us?

What do our customers say?

The resources provided for the ISTQB certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the ATM test and passed with ease.

Studying for the ISTQB certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the ATM exam on my first try!

I was impressed with the quality of the ATM preparation materials for the ISTQB certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The ATM materials for the ISTQB certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the ATM exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my ISTQB certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for ATM. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the ATM stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my ATM certification exam. The support and guidance provided were top-notch. I couldn't have obtained my ISTQB certification without these amazing tools!

The materials provided for the ATM were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed ATM successfully. It was a game-changer for my career in IT!