- Home

- FINRA Certifications

- Series 63 Uniform Securities State Law Examination Dumps

Pass FINRA Series 63 Exam in First Attempt Guaranteed!

Get 100% Latest Exam Questions, Accurate & Verified Answers to Pass the Actual Exam!

30 Days Free Updates, Instant Download!

Series 63 Premium File

- Premium File 251 Questions & Answers. Last Update: Feb 26, 2026

Whats Included:

- Latest Questions

- 100% Accurate Answers

- Fast Exam Updates

Last Week Results!

All FINRA Series 63 certification exam dumps, study guide, training courses are Prepared by industry experts. PrepAway's ETE files povide the Series 63 Uniform Securities State Law Examination practice test questions and answers & exam dumps, study guide and training courses help you study and pass hassle-free!

Mastering the FINRA Series 63 Exam: Preparation Tips and Techniques

The FINRA Series 63 exam is a critical step for professionals pursuing careers in the securities industry. It is designed to ensure that individuals engaging in the sale of securities have a solid understanding of the legal and regulatory framework governing these activities. The exam emphasizes state securities laws, ethical practices, and professional responsibilities, making it essential for anyone seeking to operate as a licensed securities representative. It evaluates the ability to apply knowledge of securities regulations in practical situations and ensures candidates are equipped to provide competent guidance to clients.

Structure and Content of the Series 63 Exam

The exam is composed of multiple-choice questions designed to test both knowledge and application skills. Candidates are required to answer a set number of questions correctly to pass. The exam focuses on the principles of state securities acts, ethical standards in financial dealings, and compliance with regulatory requirements. It is constructed to assess not just theoretical understanding but also the practical application of regulations in client interactions, which reflects the real-world responsibilities of licensed professionals.

The content of the Series 63 exam covers federal and state securities laws, rules and regulations applicable to broker-dealers and investment advisors, and standards of ethical conduct. Candidates are tested on their ability to recognize and respond to situations involving fraud, misrepresentation, and conflicts of interest. Understanding the scope of prohibited activities, disclosure requirements, and proper handling of client funds is also crucial. The exam ensures that candidates are prepared to protect investors and operate within the legal framework of the financial industry.

Purpose and Importance of the Series 63 Exam

The primary objective of the Series 63 exam is to confirm that candidates possess the foundational knowledge necessary to conduct securities transactions in compliance with regulatory standards. Passing the exam demonstrates competency in understanding the obligations associated with selling securities and protecting clients from unethical practices. It also ensures that representatives are aware of the legal ramifications of their actions and the responsibilities inherent in advising clients on financial matters. The Series 63 serves as a prerequisite for many positions in the investment industry, making it a necessary credential for career advancement.

The exam is particularly focused on ensuring professionals can navigate state-specific regulations and provide suitable recommendations based on client profiles. Candidates must demonstrate awareness of the ethical responsibilities involved in soliciting, recommending, and executing securities transactions. This emphasis on ethical practice helps maintain the integrity of the financial markets and ensures that licensed representatives act in the best interest of their clients.

Scope of Securities Covered by the Series 63 Exam

The Series 63 exam encompasses a range of securities products, each with distinct characteristics and regulatory considerations. Corporate securities, such as common and preferred stocks, corporate bonds, and government-issued securities, are included. Candidates are expected to understand the features, risks, and suitability of these instruments for different investor profiles.

Investment company products, including mutual funds, unit investment trusts, and exchange-traded funds, are also a significant focus. Candidates must comprehend the structure, investment objectives, fee structures, and redemption processes for these products. Additionally, variable contracts such as variable annuities and variable life insurance are part of the curriculum, requiring knowledge of both investment and insurance components and their tax implications. Mastery of these securities ensures that candidates can provide informed advice and select suitable investment options for clients.

The Role and Significance of the Series 63 License

Obtaining the Series 63 license indicates that a professional has met the regulatory requirements necessary to sell securities legally. It validates the candidate’s understanding of the laws and ethical standards governing securities transactions. The license is often a mandatory credential for financial advisory roles, and it underlines the professional’s ability to adhere to compliance standards and act responsibly in handling client investments. By holding the Series 63 license, individuals demonstrate that they are capable of navigating both state and federal regulatory landscapes and applying this knowledge effectively in their professional practice.

The license also plays a role in career mobility, as it allows individuals to pursue positions that require state registration. It supports ethical practice by ensuring that representatives understand prohibited practices, disclosure requirements, and proper conduct in managing client relationships. Holding the license communicates credibility to employers and clients and positions candidates for greater responsibility in financial advisory and securities sales roles.

Benefits of Passing the Series 63 Exam

Successfully passing the Series 63 exam provides multiple advantages for professionals in the financial sector. It opens opportunities for a range of positions, including financial advisors, stockbrokers, investment representatives, and other roles involving the sale of securities. Professionals with this license often experience increased earning potential due to the expanded scope of responsibilities they are qualified to handle.

In addition to career advancement, the Series 63 license ensures compliance with regulatory requirements. Many positions mandate the license to satisfy state registration laws, and passing the exam equips candidates with the knowledge needed to safeguard investor interests. Understanding ethical standards and regulatory compliance reduces the risk of engaging in practices that could lead to penalties or legal action. The license provides a foundation for continued professional development and specialization in areas such as retirement planning, estate planning, and investment management.

Regulatory Requirements and Eligibility for the Series 63 License

Obtaining the Series 63 license involves meeting several regulatory and procedural requirements. Candidates must satisfy eligibility criteria, which typically include age restrictions, background checks, and the absence of disqualifying criminal history. Completion of a regulatory training program that covers exam topics is often required to ensure candidates are familiar with the material.

After preparation, candidates must pass the Series 63 exam, demonstrating sufficient knowledge of securities laws, ethical standards, and state regulations. Payment of applicable fees completes the licensing process. Successfully navigating these steps ensures that licensed professionals are well-prepared to operate responsibly and in compliance with regulatory expectations.

Creating an Effective Study Plan

A structured study plan is essential for preparing for the Series 63 exam. Candidates should begin by assessing their knowledge to identify strengths and areas requiring additional focus. Self-assessment techniques include taking practice questions, creating flashcards, and teaching concepts to others to reinforce understanding. Visual aids, such as concept maps, can help illustrate the relationships between different regulatory requirements and investment products.

Developing a study schedule involves setting realistic goals, allocating regular study sessions, and prioritizing topics that require the most attention. Effective time management strategies, such as focused study intervals and scheduled breaks, help maintain concentration and prevent burnout. Candidates should also minimize distractions and create a conducive learning environment to optimize retention and comprehension.

Gathering Study Materials

To prepare thoroughly, candidates must gather comprehensive and authoritative study resources. Official guides cover all key topics and provide detailed explanations of laws, regulations, and ethical standards. Supplementary materials, including practice questions and mock exams, allow candidates to simulate the testing environment and assess readiness. Additional textbooks and reference materials can offer deeper insights into complex topics, while online resources such as tutorials and forums provide alternative explanations and support collaborative learning.

Enhancing Learning and Exam Performance

Active engagement with study materials, rather than passive reading, enhances understanding and memory retention. Techniques such as answering practice questions, participating in study groups, and explaining concepts to others help reinforce knowledge. Regularly reviewing practice exams enables candidates to identify patterns in mistakes, focus on weak areas, and track improvement over time.

Simulating exam conditions through timed mock tests helps candidates develop familiarity with the pressure and pacing of the actual exam. Analyzing performance on these tests provides actionable insights into time management, accuracy, and comprehension, allowing candidates to adjust their preparation strategies accordingly.

Exam Day Strategies

Effective preparation extends to the day of the exam. Candidates should ensure they are well-rested and maintain a healthy routine leading up to the exam. Arriving early, bringing required identification, and setting up in a quiet, comfortable environment help reduce stress. Pacing through questions, maintaining focus, and strategically managing time are crucial for completing the exam successfully. Practicing relaxation techniques can help manage anxiety and improve concentration during the test.

Career Opportunities and Advancement

Passing the Series 63 exam unlocks numerous career opportunities within the financial industry. Entry-level positions may include roles as junior financial advisors or securities sales representatives, where professionals gain practical experience in client interactions, portfolio management, and investment analysis.

Mid-level roles include senior financial advisors or specialists focusing on specific investment areas such as retirement planning or estate management. Advanced career paths encompass leadership positions, compliance management, investment management for high-net-worth clients, and advisory roles requiring advanced expertise. The license provides a foundation for long-term professional growth, credibility, and the ability to offer informed, compliant guidance to clients.

The Series 63 exam is a pivotal step for professionals pursuing a career in the securities industry. It requires a thorough understanding of state regulations, ethical standards, and the practical application of regulatory knowledge to client situations. Careful preparation through structured study plans, active engagement with study materials, and regular practice enhances the likelihood of success. Achieving the Series 63 license validates technical competence, opens a wide range of career opportunities, and establishes a foundation for ethical and responsible practice in the financial industry.

Mastering the Knowledge Base for the Series 63 Exam

The Series 63 exam requires a strong command of securities regulations, state laws, and ethical practices. Candidates preparing for it must recognize that it is not only about memorizing terms or definitions but about understanding how regulations function in real-world financial scenarios. The exam ensures that professionals can responsibly guide clients, remain compliant with applicable laws, and recognize activities that could pose risks to investors. This means that the preparation process must balance knowledge acquisition with practical application.

A candidate should develop clarity on the framework of state securities acts, particularly the Uniform Securities Act, and the rules that govern the registration of broker-dealers, agents, and securities. Knowing when securities are exempt from registration, how administrators oversee regulatory compliance, and the differences between federal and state jurisdiction is vital. The exam places emphasis on these nuances, requiring careful study of distinctions that can appear minor but hold significant regulatory weight.

Ethical Standards and Responsibilities

One of the most crucial elements tested in the Series 63 exam is ethics. This is because financial professionals handle the trust, investments, and often the life savings of their clients. The exam evaluates whether candidates are aware of conflicts of interest, fraudulent practices, and obligations for full and fair disclosure. By examining these areas, regulators ensure that individuals entering the profession are not only competent but also capable of acting with integrity.

The exam explores responsibilities such as suitability, where professionals must ensure that the securities recommended align with a client’s goals, financial status, and risk tolerance. It also highlights fiduciary principles, which require advisors to put the client’s interests before their own. Questions may test a candidate’s ability to recognize actions that appear acceptable on the surface but may, in practice, disadvantage the client. Preparing for this component requires not just rote memorization but an understanding of how ethical conduct is applied in complex client situations.

Preparing a Focused Study Framework

To succeed on the Series 63 exam, candidates need a deliberate and structured approach. While the exam is relatively brief compared to others in the securities field, its scope is specialized, requiring deep understanding rather than superficial familiarity. A focused framework should include daily review sessions, targeted practice of weaker areas, and consistent exposure to regulatory language to reduce confusion during the exam.

Breaking down preparation into smaller, manageable sections helps prevent being overwhelmed. For example, one week can be devoted to mastering the definitions and terms used in securities regulations, while another can focus entirely on exemptions and registration requirements. This segmented approach ensures that all content is thoroughly studied while allowing sufficient time for review and practice exams before the test date.

Importance of Practice and Simulation

A key factor in preparing for the Series 63 exam is practicing with simulated questions. These practice sets allow candidates to familiarize themselves with the style, phrasing, and structure of the exam. Many candidates underestimate how challenging it can be to interpret questions that test not just what you know but how you apply it. Simulation under timed conditions trains candidates to manage their pace, maintain accuracy, and avoid spending too much time on individual questions.

Analyzing practice test results is as important as taking the test itself. Reviewing incorrect answers helps candidates identify patterns in their mistakes, whether they stem from misreading questions, gaps in knowledge, or weak time management. By focusing on these weaknesses, candidates can refine their preparation and enter the exam room with confidence.

Time Management and Exam Strategy

The Series 63 exam is relatively short, but this does not make it easier. The time allocated requires efficient pacing and the ability to stay composed under pressure. Candidates must develop a strategy to move steadily through questions without becoming bogged down. One effective technique is to quickly answer questions that appear straightforward, flag more difficult ones, and return to them after completing the rest of the exam.

During preparation, candidates should practice allocating time evenly across sections. This minimizes the risk of leaving questions unanswered due to poor pacing. Additionally, candidates should become comfortable with the idea of educated guessing when necessary. Since unanswered questions are automatically wrong, an informed guess based on elimination strategies can improve the overall score.

The Role of State Securities Acts

Central to the Series 63 exam is the Uniform Securities Act, which provides the foundation for much of the content tested. Candidates must understand its provisions regarding the registration of broker-dealers, investment advisers, agents, and securities. The Act outlines which securities are exempt, what constitutes unlawful practices, and the authority of state administrators in enforcing compliance.

Exam questions often test knowledge of how the Act interacts with other regulations. For instance, candidates may need to determine whether a security transaction is exempt from registration or whether an individual must be licensed under certain circumstances. These scenarios require careful analysis and a thorough grasp of the Act’s details. Understanding the language of the Act, along with its broader implications, ensures that candidates can confidently address such questions.

Client Interactions and Professional Conduct

The Series 63 exam also assesses how professionals should interact with clients. Effective client interactions are rooted in honesty, transparency, and suitability. The exam ensures that candidates understand their obligations to fully disclose risks, avoid misrepresentation, and refrain from making exaggerated claims about investment returns.

Candidates must also be prepared to recognize situations where professional conduct is compromised, such as recommending investments solely for the purpose of generating commissions or withholding important information about product risks. Mastery of these concepts ensures that candidates not only pass the exam but are prepared for the ethical challenges they will face in their careers.

Building Confidence Through Consistency

Consistent preparation is essential for building the confidence needed to pass the Series 63 exam. Sporadic study often leaves gaps in knowledge and reduces familiarity with the exam’s structure. A steady and disciplined study routine helps reinforce key concepts, retain information for longer periods, and reduce anxiety on exam day.

Creating a study journal can be helpful for tracking progress and reinforcing learning. Writing down concepts, rules, and regulations in your own words helps deepen understanding and makes it easier to recall them later. Consistency also builds the habit of approaching complex material with focus and patience, qualities that are crucial both for the exam and for professional practice in the financial industry.

Career Development After Passing the Exam

Successfully completing the Series 63 exam provides a foundation for advancing in the financial industry. It serves as proof that a professional understands the legal and ethical standards necessary for securities sales. This certification not only qualifies individuals to work in roles that require state registration but also builds credibility with clients and employers.

Professionals can use this milestone as a springboard to broaden their expertise, specialize in certain types of securities, or take on greater responsibilities within their organizations. The knowledge gained while preparing for the Series 63 exam also provides a framework for understanding more advanced financial regulations, helping professionals navigate an industry that is constantly evolving.

Long-Term Value of the Series 63 License

Holding a Series 63 license has enduring value throughout a professional’s career. It represents a commitment to ethical practice, regulatory compliance, and client protection. Employers and clients alike view the license as evidence that a professional is both knowledgeable and trustworthy. This credibility can lead to greater opportunities, client trust, and long-term career success.

Beyond professional advancement, the license also reinforces a commitment to investor protection. By holding professionals accountable to high standards of conduct, the Series 63 ensures that clients can place their trust in advisors and representatives who act with integrity. This not only benefits individual clients but also contributes to the stability and fairness of the financial markets as a whole.

The Series 63 exam is more than just a regulatory hurdle; it is a gateway to a meaningful career in the securities industry. By mastering state securities laws, ethical standards, and regulatory principles, candidates prepare themselves for both the exam and the responsibilities that follow. Effective preparation involves consistent study, strategic practice, and an emphasis on applying knowledge to real-world scenarios.

Those who pass the exam gain not only a license but also the confidence and credibility needed to succeed in the financial industry. The Series 63 sets the stage for a career built on compliance, ethical responsibility, and client trust. With focused preparation and a deep understanding of its content, candidates can approach the exam with confidence and step into the profession ready to uphold the highest standards of practice.

Core Areas of Knowledge for the Series 63 Exam

The Series 63 exam places heavy emphasis on state securities laws and their application in financial practices. Candidates must understand the Uniform Securities Act, which governs registration of securities, broker-dealers, investment advisers, and their agents. Grasping the details of registration exemptions is vital because many exam questions test whether a specific security or transaction requires registration. Candidates must be prepared to recognize these exemptions and explain the rationale behind them.

In addition to securities registration, the exam focuses on the responsibilities of broker-dealers and agents. These responsibilities include disclosing material information, avoiding fraudulent practices, and ensuring suitability of recommendations. Familiarity with how administrators enforce state laws, conduct investigations, and impose penalties is also essential. Candidates should not only memorize definitions but understand how these rules are applied in real-life client scenarios.

Ethics and Professional Standards

Ethical conduct is a recurring theme throughout the exam. Professionals in the securities industry handle sensitive client information and advise on financial decisions that impact long-term goals. The exam ensures that candidates can identify situations involving conflicts of interest, dishonesty, or misrepresentation. Understanding fiduciary duties and the principle of putting the client’s interests ahead of one’s own is essential to success.

One common focus is the concept of suitability. Candidates must know how to evaluate whether a security is appropriate for a client’s objectives, financial resources, and tolerance for risk. Another focus is fair dealing, which prohibits misleading statements or exaggerated claims. Candidates should also be prepared to recognize prohibited practices such as churning accounts, unauthorized trading, or withholding information about risks.

Strategies for Effective Preparation

Developing a clear preparation strategy is essential for passing the Series 63 exam. The material may appear straightforward, but the wording of exam questions often requires careful analysis. To avoid confusion, candidates should immerse themselves in the specific terminology of securities regulations. Reading definitions multiple times and applying them to practice questions strengthens comprehension.

A disciplined study routine improves retention and builds confidence. Breaking topics into smaller sections allows candidates to cover each thoroughly without feeling overwhelmed. For example, one study session may focus on securities registration, while another may be devoted entirely to ethical practices. Revisiting each area regularly reinforces knowledge and ensures that it is not forgotten before exam day.

Role of Practice Tests and Mock Exams

Practice tests are a crucial part of Series 63 exam preparation. They help candidates become familiar with the exam’s multiple-choice format and its often nuanced phrasing. By simulating test conditions, practice exams prepare candidates to manage time efficiently while maintaining accuracy. Candidates who regularly practice under timed conditions develop strategies for answering questions quickly and effectively.

The real value of practice exams lies in reviewing the results. By analyzing incorrect answers, candidates identify knowledge gaps and patterns in their mistakes. This allows for targeted study, focusing on areas where improvement is needed. Consistent use of practice exams helps reduce anxiety by making the actual test feel familiar.

Exam Day Readiness

Preparing for the exam extends beyond studying the material. Success also depends on being mentally and physically ready for the test environment. Candidates should approach exam day with a clear plan for managing time, staying calm, and maintaining focus. Simple steps such as ensuring proper rest the night before and practicing relaxation techniques can reduce anxiety.

During the exam, pacing is critical. Candidates should quickly answer straightforward questions and mark difficult ones for review. This prevents getting stuck and losing valuable time. Reading each question carefully is equally important, as the wording may include subtle distinctions that change the correct answer. Remaining calm and methodical throughout the test allows for steady progress and reduces the likelihood of careless mistakes.

Building Long-Term Skills Beyond the Exam

While passing the Series 63 exam is the immediate goal, the knowledge gained has long-term value in a professional career. Understanding securities laws, ethical principles, and regulatory compliance builds a foundation for interacting with clients responsibly and confidently. This foundation supports not only exam success but also daily decision-making in the workplace.

Professionals who internalize these principles gain credibility with clients and employers. They are better equipped to handle complex financial situations, resolve conflicts of interest, and navigate regulatory challenges. The skills reinforced during exam preparation, such as analyzing rules and applying them to scenarios, continue to be valuable throughout a career in the financial industry.

Advancing Professional Opportunities

Successfully passing the Series 63 exam opens opportunities in various roles across the financial sector. Professionals who hold the license demonstrate that they have met the regulatory standards required to work in securities sales. This creates pathways to positions that involve advising clients, managing accounts, and selling a broad range of securities products.

The license is not just a regulatory requirement but also a symbol of professional commitment. Employers value individuals who have demonstrated both competence and ethical awareness. Holding the Series 63 certification can help professionals distinguish themselves from others in the industry and pursue greater responsibilities over time.

Integrating Knowledge into Daily Practice

Knowledge of securities regulations is not meant to remain theoretical. In practice, it guides how professionals interact with clients and manage business operations. For example, understanding disclosure requirements ensures that clients receive complete and accurate information before making investment decisions. Recognizing prohibited practices helps professionals avoid actions that could harm clients or result in disciplinary action.

By applying Series 63 principles daily, professionals build trust with clients and ensure compliance with regulatory expectations. Over time, this consistent adherence to ethical and legal standards enhances a professional’s reputation and strengthens client relationships. It also contributes to the stability and fairness of financial markets by ensuring that investors are protected.

Lifelong Value of the Series 63 License

The Series 63 license is more than a one-time achievement. It reflects a commitment to maintaining knowledge of securities laws and upholding ethical conduct throughout a career. As financial markets evolve and regulations change, professionals must continue to apply the principles learned while preparing for the exam. This adaptability ensures that they remain effective and compliant in a dynamic industry.

The value of the license extends beyond individual careers. By ensuring that professionals meet a standard of competency and integrity, the Series 63 helps maintain investor confidence in the securities industry. This confidence is critical for the functioning of markets and the protection of investors. Professionals who uphold the responsibilities associated with the license contribute not only to their own success but also to the broader health of the financial system.

The Series 63 exam represents both a challenge and an opportunity for aspiring financial professionals. It demands thorough preparation, a clear understanding of securities regulations, and the ability to apply knowledge in practical scenarios. By focusing on ethics, state securities laws, and client responsibilities, candidates prepare themselves not only for the test but for their future roles in the industry.

Success requires a structured study plan, consistent practice, and the discipline to approach exam day with confidence. Those who achieve the license gain access to career opportunities, credibility, and the trust of clients and employers. More importantly, they gain a lasting foundation in compliance and ethics that supports professional growth over the long term. The Series 63 exam, therefore, is not simply a requirement but a gateway to a career grounded in integrity, responsibility, and opportunity.

Understanding the Significance of the Series 63 Exam

The Series 63 exam is designed to ensure that financial professionals entering the industry have a solid foundation in the rules and regulations that govern securities at the state level. Its primary focus is on protecting investors through a framework of laws that establish standards of honesty, fairness, and transparency. Passing this exam demonstrates that a candidate understands not only the letter of the law but also the spirit behind these regulations. It signifies readiness to carry out client-facing responsibilities with integrity, compliance, and awareness of the ethical expectations that shape the financial services industry.

For many professionals, the Series 63 exam is one of the first steps toward building a long-term career in securities. It complements other licensing requirements and strengthens an individual’s qualifications to interact with clients and sell a wide range of investment products. Because of its specific emphasis on state-level securities law and ethical standards, it provides essential knowledge that serves as a foundation for more advanced regulatory and product-related examinations.

Depth of Knowledge Required for Success

Candidates preparing for the exam must gain a deep understanding of the Uniform Securities Act and its implications for the securities industry. This includes knowing how securities must be registered, which transactions or instruments may qualify for exemptions, and the roles of broker-dealers and agents. Beyond the technical rules, candidates must also demonstrate their ability to apply these concepts to practical scenarios where client protection and regulatory compliance intersect.

The exam requires a thorough grasp of fiduciary duties, conflict-of-interest management, and the standards of ethical conduct expected in every client interaction. It tests the ability to recognize fraudulent activity, misrepresentation, and practices that place personal gain above client interests. These areas are not just about memorization but about understanding how rules guide behavior in real-world financial relationships.

Approaching the Exam with a Strategic Plan

Effective preparation for the Series 63 exam involves more than simply reading materials. A structured approach ensures that candidates not only retain information but can apply it under exam conditions. Candidates should begin by evaluating their current understanding of securities regulations and ethical practices. Identifying weaker areas early makes it possible to allocate study time more effectively.

Organizing a study schedule that gradually progresses from basic definitions to complex application is particularly effective. Time should be divided between reading, note-taking, and revisiting previous material to reinforce learning. Candidates should also incorporate regular review sessions, as repetition helps strengthen long-term retention. This structured method builds confidence and reduces stress as the exam date approaches.

Importance of Practice in Preparation

Practicing under exam-like conditions is critical for Series 63 preparation. The exam is time-limited, and candidates must balance accuracy with efficiency. Working through practice questions helps develop familiarity with the exam format, the phrasing of questions, and the subtle distinctions that often determine the correct answer.

Analyzing mistakes after practice sessions is just as important as answering the questions themselves. Candidates gain insight into their reasoning process, allowing them to correct misunderstandings and adjust their study focus. Over time, consistent practice develops both knowledge and test-taking strategies, enabling candidates to manage time effectively and remain calm under pressure.

Building Confidence for Exam Day

Preparation also involves cultivating the mindset needed for success. Candidates should approach the exam with the knowledge that their study plan has provided them with the tools necessary to succeed. Confidence grows from consistent practice, familiarity with the material, and readiness to apply concepts in multiple contexts.

Managing anxiety is part of this preparation. Candidates who practice relaxation techniques, maintain focus during study sessions, and enter the exam with a positive outlook are better able to concentrate on the task at hand. Pacing during the exam is equally important. Skipping difficult questions and returning to them later ensures that time is used effectively without allowing a single challenge to create unnecessary stress.

Ethical Foundations and Long-Term Professionalism

The emphasis on ethics within the Series 63 exam underscores the responsibility professionals carry once licensed. The financial services industry is built on trust, and maintaining ethical standards is crucial to building lasting client relationships. By mastering the ethical guidelines tested in the exam, candidates prepare themselves to act as trustworthy advisors who prioritize the needs of their clients above personal or firm-related gains.

Understanding ethical responsibilities does not end once the exam is completed. Throughout a career, professionals will face situations where the correct path is not always obvious. The principles emphasized in Series 63 preparation provide a compass for making decisions that align with both regulatory requirements and client interests. Upholding these standards enhances reputation and fosters confidence among clients and colleagues.

Professional Benefits of Certification

Earning the Series 63 certification opens opportunities for advancement in the financial industry. It equips professionals with the authority to engage in securities sales, interact directly with clients, and provide informed guidance on investment decisions. Employers often seek individuals who hold this license because it demonstrates not only knowledge but also a commitment to regulatory compliance and ethical practice.

The certification also lays the groundwork for continued growth. Many professionals pursue additional licenses and designations after achieving the Series 63, using the knowledge gained as a stepping stone to broader expertise. The credibility that comes with certification enhances career prospects, creates access to more diverse responsibilities, and contributes to long-term success in the industry.

Applying Knowledge in Practice

The knowledge acquired during Series 63 preparation has direct application in professional roles. For example, when recommending securities, professionals must ensure suitability based on a client’s financial profile, investment objectives, and tolerance for risk. Understanding state regulations guides the process of determining whether transactions are permissible, whether exemptions apply, and what disclosures must be provided.

In day-to-day operations, this knowledge helps professionals avoid practices that could result in penalties or loss of licensure. Whether handling client complaints, executing trades, or managing records, adherence to the principles learned through Series 63 preparation safeguards both the client and the professional. Applying these rules consistently builds habits of compliance and reinforces ethical conduct.

Lifelong Value of Mastering Series 63 Content

Although passing the exam is a milestone, the true value lies in how its content shapes professional conduct over time. The emphasis on investor protection, disclosure, and fair dealing ensures that licensed individuals uphold high standards throughout their careers. These principles remain relevant as markets evolve, regulations are updated, and new financial products are introduced.

Professionals who view the Series 63 not as a hurdle but as a foundation for their careers benefit most. By internalizing the lessons learned, they cultivate habits that promote long-term success. This includes being proactive about staying informed of regulatory changes, continuing education, and maintaining a focus on client-centered service.

The Series 63 exam serves as a gateway to meaningful opportunities in the financial industry. Its emphasis on state securities laws, ethical standards, and professional responsibilities ensures that those who pass are prepared to serve clients responsibly and effectively. Preparation requires dedication, structured study, and a disciplined approach to both knowledge and practice.

Beyond the exam, the principles gained provide guidance for a successful career. They reinforce the importance of trust, integrity, and compliance in every client interaction. Holding the Series 63 certification is not only a professional achievement but also a lasting commitment to serving the financial needs of clients within a framework of fairness and responsibility. It marks the beginning of a journey where ethical standards and regulatory knowledge remain central to professional identity and long-term success.

Integrating Series 63 Knowledge into Professional Practice

The knowledge gained from preparing for the Series 63 exam does not remain confined to the test itself but directly influences the way professionals engage with their daily responsibilities. At its core, the exam teaches the importance of recognizing the boundaries set by state securities laws, ensuring every transaction aligns with both regulatory frameworks and the best interests of the client. This alignment is essential in building trust and preventing conflicts that can erode the integrity of client relationships.

A licensed professional equipped with Series 63 knowledge is capable of making decisions that balance compliance with practical client needs. For instance, when evaluating whether an investment vehicle is suitable for a client, the professional not only considers financial objectives and risk tolerance but also ensures that every step of the process adheres to state-level requirements. This dual responsibility strengthens the ability to act in a way that protects clients while also safeguarding the professional’s reputation.

The Role of Ethics in Long-Term Success

Ethics are central to the Series 63 framework. The exam emphasizes how ethical behavior underpins all securities-related interactions, making it clear that violations of trust or misleading practices can have lasting consequences. Professionals who internalize these lessons learn to place client welfare above personal or organizational interests, a standard that defines lasting success in the financial industry.

Maintaining ethical integrity requires more than memorizing rules; it involves a mindset where transparency and fairness are non-negotiable. For example, when explaining the risks of a product to a client, a professional must be clear, thorough, and candid, even if it might slow down the sales process. Such behavior builds long-term relationships, as clients are more likely to rely on an advisor who consistently demonstrates honesty and accountability.

The Importance of Compliance in Daily Operations

Compliance is not simply a regulatory requirement but a professional discipline that shapes every decision. The Series 63 exam prepares candidates to understand the nuances of compliance, from the registration of securities to the correct handling of exemptions and disclosures. Once licensed, these insights serve as a daily guide, ensuring that every action meets the standards required by regulators.

The effectiveness of compliance depends on vigilance and consistency. A single oversight in documentation, reporting, or disclosure can result in penalties or legal consequences. Professionals who carry forward the compliance mindset developed during Series 63 preparation reduce these risks by integrating careful review and recordkeeping into their everyday routines. Over time, this approach not only prevents errors but also reinforces credibility in the eyes of clients and regulators.

Developing Analytical Skills through Exam Preparation

Studying for the Series 63 exam also strengthens analytical abilities that extend beyond the test. The exam requires candidates to interpret laws, assess client scenarios, and apply theoretical concepts to practical problems. This process enhances the ability to analyze information critically, evaluate the potential consequences of actions, and choose paths that align with ethical and regulatory standards.

These analytical skills are invaluable in professional contexts. For instance, when faced with a complex client case involving multiple investment options, the ability to assess each product against suitability requirements and state regulations allows for sound recommendations. This analytical approach fosters client confidence, as decisions are clearly supported by both logic and compliance.

Professional Growth Beyond the Certification

While passing the Series 63 exam is an important achievement, it also represents the beginning of continuous growth in the financial services industry. The certification creates opportunities for professionals to take on greater responsibilities, interact with a wider range of clients, and build a reputation as knowledgeable advisors who understand both the regulatory and ethical dimensions of their roles.

Beyond the immediate benefits, holding the Series 63 license positions professionals for additional certifications and career advancement. Each step taken after this foundation builds upon the knowledge gained, creating a progression toward deeper expertise. As responsibilities expand, the principles learned during Series 63 preparation continue to serve as a foundation for decision-making and client engagement.

Building Client Trust through Knowledge and Integrity

The Series 63 exam highlights that client trust is the cornerstone of success in the financial industry. Passing the exam signals to clients that a professional has been tested on and understands the rules that govern securities transactions. However, the true measure of value comes when this knowledge is translated into everyday actions that demonstrate care, transparency, and accountability.

Trust is earned gradually through consistent behavior. Each recommendation, disclosure, and explanation contributes to a client’s perception of professionalism. A licensed professional who consistently demonstrates alignment with Series 63 standards fosters relationships that extend beyond single transactions, often resulting in long-term client loyalty.

The Impact of Series 63 Certification on Career Development

Earning the Series 63 certification opens doors to roles that involve securities sales and advisory responsibilities. Employers value this certification because it proves a candidate’s readiness to operate within regulatory boundaries while maintaining ethical standards. As such, it enhances employability and provides a platform for broader career development.

The certification also offers personal growth, as professionals gain confidence in their ability to navigate complex regulations and handle challenging client scenarios. This confidence, combined with knowledge, creates momentum for further career achievements. With Series 63 as a foundation, professionals can expand into other areas of financial services, taking on more advanced roles while continuing to build credibility and trust.

Sustaining Knowledge through Ongoing Learning

Although passing the Series 63 exam is a milestone, professionals must recognize that the financial industry evolves continuously. Regulatory changes, new product developments, and shifts in client expectations require a commitment to lifelong learning. The discipline developed while preparing for the exam can serve as a framework for maintaining up-to-date knowledge throughout a career.

Ongoing education ensures that professionals remain effective and compliant. Regular review of updated rules, participation in training programs, and engagement with industry developments keep knowledge sharp and relevant. By committing to continued learning, professionals extend the value of their Series 63 certification and ensure that their practices remain aligned with evolving standards.

Long-Term Value of the Series 63 Exam

The Series 63 exam is more than a regulatory requirement; it is a professional foundation that shapes the mindset, skills, and values of individuals entering the securities industry. By emphasizing ethics, compliance, and investor protection, the exam prepares professionals not only to pass a test but also to carry forward principles that will guide them throughout their careers.

The lessons learned in preparation for this exam continue to influence how professionals interact with clients, handle complex scenarios, and pursue opportunities for growth. The certification serves as a testament to a commitment to fairness, responsibility, and knowledge. For those who embrace its value, the Series 63 exam is a stepping stone toward a meaningful and enduring career in the financial services industry.

Conclusion

The Series 63 exam is more than just an entry requirement into the financial industry; it is a gateway that shapes how professionals approach their roles and responsibilities. Its emphasis on ethics, compliance, and state-level regulations ensures that those who pass are not only knowledgeable but also equipped to act in ways that protect clients and maintain the integrity of the securities markets. By requiring candidates to master both legal frameworks and practical applications, the exam fosters a mindset where transparency, accountability, and investor protection are central to every decision.

Successfully earning this certification also provides a solid foundation for long-term career development. It demonstrates to employers, clients, and regulators that a professional is committed to meeting standards of competence and ethical practice. Beyond the immediate benefits of employability and career opportunities, it instills skills and principles that continue to grow in importance as one’s responsibilities expand. The ability to integrate regulatory awareness with practical financial advice becomes a key factor in building trust and sustaining client relationships over time.

Another lasting impact of the Series 63 exam is the discipline it instills in candidates. Preparing for the exam requires consistent study, critical thinking, and the ability to apply concepts to real-world scenarios. These habits carry forward into professional life, shaping the way licensed individuals manage their time, make decisions, and handle complex situations. In an industry where conditions are constantly changing, this discipline proves invaluable for staying current and effective.

In the long run, the Series 63 certification should be seen not as an endpoint but as the beginning of a professional journey. It opens the door to opportunities while setting a standard for how to approach them responsibly. For professionals dedicated to growth, integrity, and service, the principles established by this exam serve as guiding values that continue to define success well beyond the test itself.

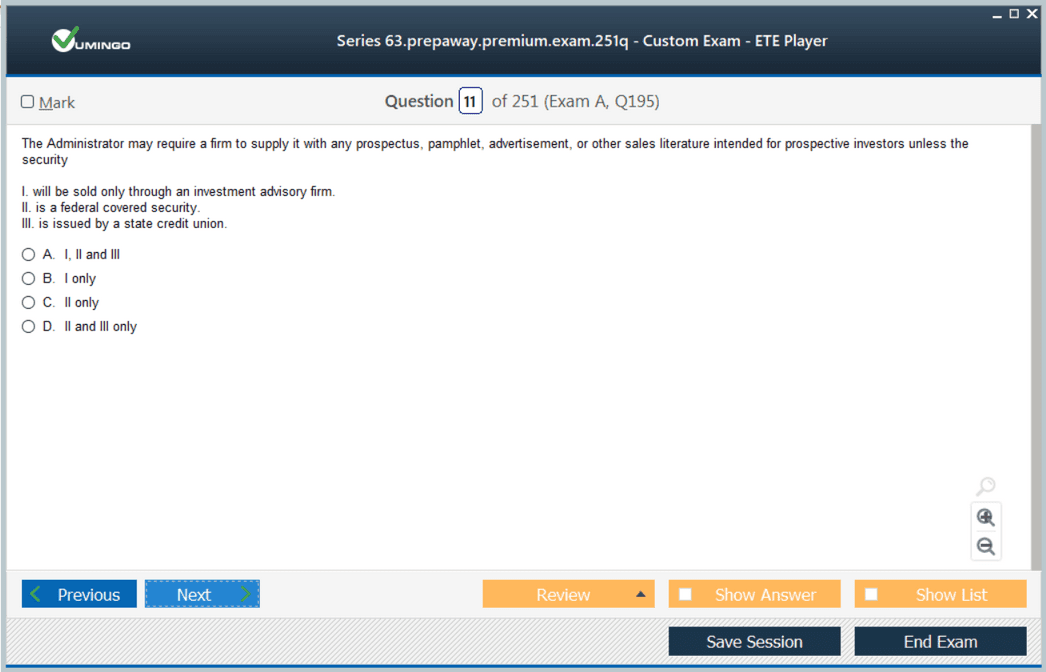

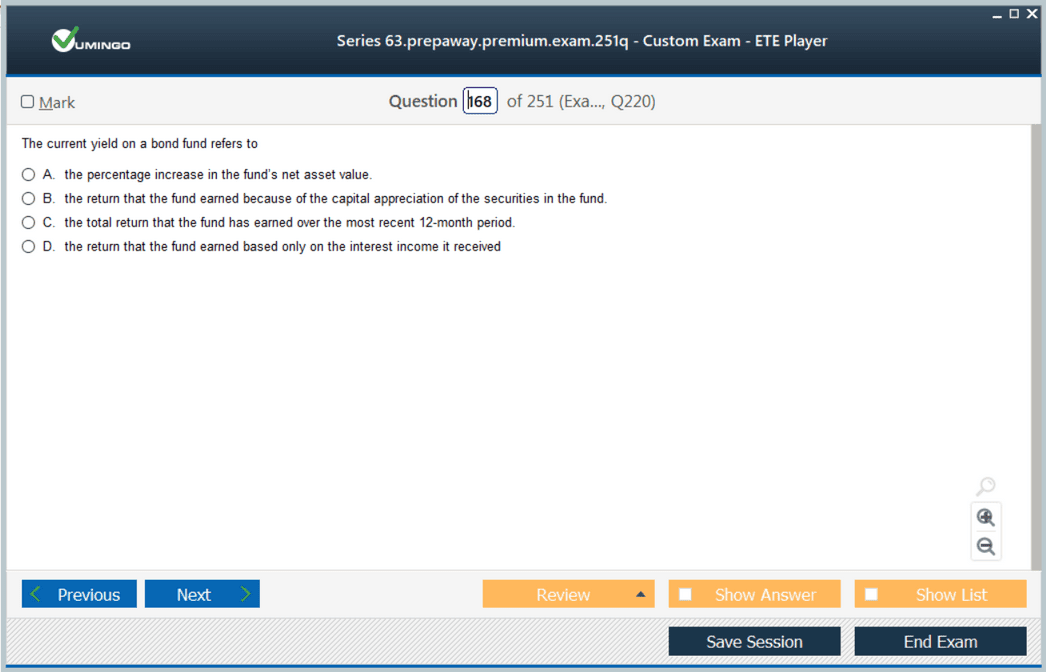

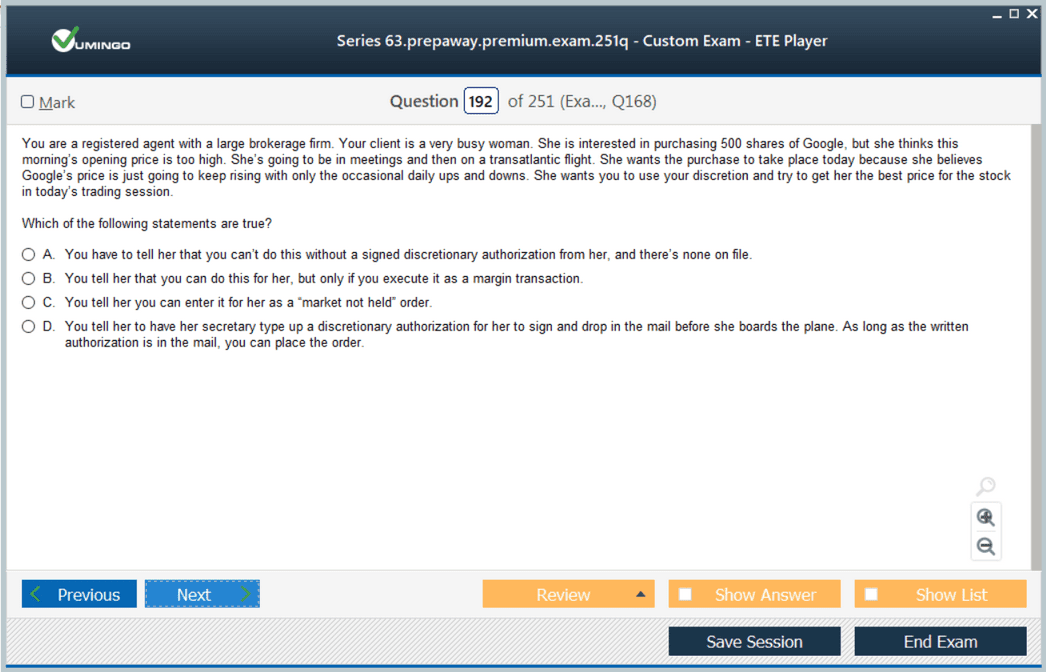

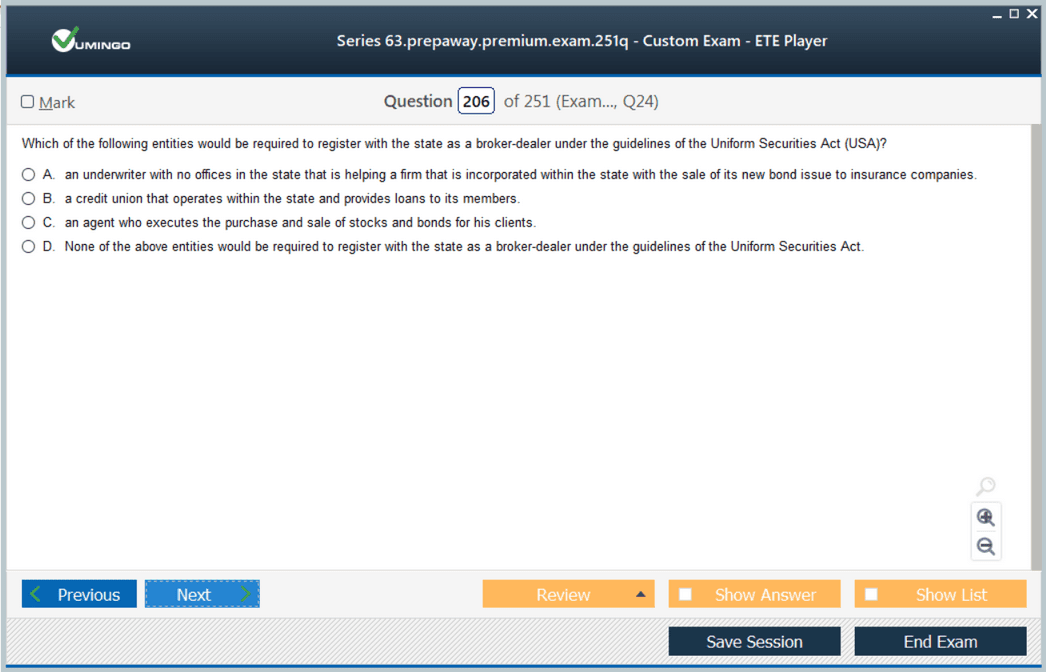

FINRA Series 63 practice test questions and answers, training course, study guide are uploaded in ETE Files format by real users. Study and Pass Series 63 Uniform Securities State Law Examination certification exam dumps & practice test questions and answers are to help students.

Why customers love us?

What do our customers say?

The resources provided for the FINRA certification exam were exceptional. The exam dumps and video courses offered clear and concise explanations of each topic. I felt thoroughly prepared for the Series 63 test and passed with ease.

Studying for the FINRA certification exam was a breeze with the comprehensive materials from this site. The detailed study guides and accurate exam dumps helped me understand every concept. I aced the Series 63 exam on my first try!

I was impressed with the quality of the Series 63 preparation materials for the FINRA certification exam. The video courses were engaging, and the study guides covered all the essential topics. These resources made a significant difference in my study routine and overall performance. I went into the exam feeling confident and well-prepared.

The Series 63 materials for the FINRA certification exam were invaluable. They provided detailed, concise explanations for each topic, helping me grasp the entire syllabus. After studying with these resources, I was able to tackle the final test questions confidently and successfully.

Thanks to the comprehensive study guides and video courses, I aced the Series 63 exam. The exam dumps were spot on and helped me understand the types of questions to expect. The certification exam was much less intimidating thanks to their excellent prep materials. So, I highly recommend their services for anyone preparing for this certification exam.

Achieving my FINRA certification was a seamless experience. The detailed study guide and practice questions ensured I was fully prepared for Series 63. The customer support was responsive and helpful throughout my journey. Highly recommend their services for anyone preparing for their certification test.

I couldn't be happier with my certification results! The study materials were comprehensive and easy to understand, making my preparation for the Series 63 stress-free. Using these resources, I was able to pass my exam on the first attempt. They are a must-have for anyone serious about advancing their career.

The practice exams were incredibly helpful in familiarizing me with the actual test format. I felt confident and well-prepared going into my Series 63 certification exam. The support and guidance provided were top-notch. I couldn't have obtained my FINRA certification without these amazing tools!

The materials provided for the Series 63 were comprehensive and very well-structured. The practice tests were particularly useful in building my confidence and understanding the exam format. After using these materials, I felt well-prepared and was able to solve all the questions on the final test with ease. Passing the certification exam was a huge relief! I feel much more competent in my role. Thank you!

The certification prep was excellent. The content was up-to-date and aligned perfectly with the exam requirements. I appreciated the clear explanations and real-world examples that made complex topics easier to grasp. I passed Series 63 successfully. It was a game-changer for my career in IT!